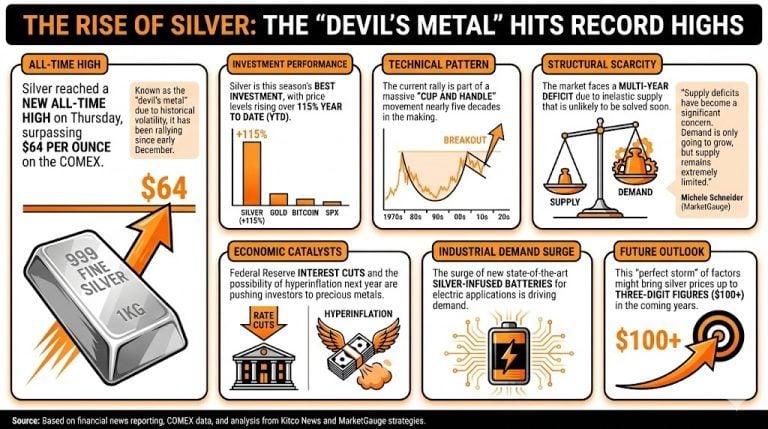

Silver, the so-called “devil’s metal” due to its historical volatility, reached a new all-time high on Thursday, surpassing $64 per ounce on the COMEX. The metal, which has been rallying since early December, has continued to rise despite being labeled as overbought several times by analysts.

Silver has become this season’s best investment, with price levels rising over 115% year to date, surpassing notable rivals such as gold, bitcoin, and the SPX index as part of a cup and handle movement that has been nearly five decades in the making, since silver became tradable on commodity markets.

Analysts have stated that this rise has its origin in several structural factors, mainly the supply scarcity, given that the silver market has been experiencing a multi-year deficit that is unlikely to be solved anytime soon due to inelastic supply.

Michele Schneider, Chief Market Strategist at MarketGauge, stated that silver should be priced even higher, as the market evolves into a scarcity-led mode.

Talking with Kitco News, she stated:

It’s amazing that silver prices are not trading a lot higher right now. Supply deficits have become a significant concern. Demand is only going to grow, but supply remains extremely limited.

The announcement of the recent Federal Reserve interest cut and the possibility of hyperinflation next year are elements that might push investors to precious metals, like gold and silver.

Finally, the increased use of silver in electric battery applications, with the surge of new state-of-the-art silver-infused batteries, configures a perfect storm that can take silver prices to three-digit figures in the coming years.

Read more: Analyst Predicts Silver Prices Could Reach $200 Driven by Demand for New EV Battery Technology

- What recent milestone did silver achieve?

Silver reached a new all-time high of over $64 per ounce on the COMEX, continuing its rally since early December. - How much has silver’s price increased this year?

Silver has risen by over 115% year-to-date, outperforming competitors like gold, Bitcoin, and the SPX index. - What factors are driving the rise in silver prices?

A prolonged supply deficit and growing demand, particularly in electric battery applications, are contributing to silver’s price surge. - How could future economic conditions impact silver further?

The recent Federal Reserve interest cut and concerns about potential hyperinflation may drive more investors toward precious metals like silver.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。