In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

From the private messages Lin Chao has recently received, it seems that everyone has entered a wait-and-see period; either their chips have been exhausted or their confidence has been worn down. However, Lin Chao wants to remind those who still have chips and are observing that this moment is crucial for phased and diversified positioning. Looking back at the market, after the interest rate meeting ended early yesterday morning, the market fell into a temporary state of support from positive news. The Federal Reserve's RMP will indeed inject some liquidity into the market, and today there is also good news to stimulate the market: a formal letter sent by bipartisan leaders of the U.S. Financial Services Committee to SEC Chairman Paul Atkins, urging him to expedite the official documents allowing ordinary American taxpayers to purchase other types of assets (including cryptocurrencies) in their 401(k) plans. In simple terms, both parties agree that cryptocurrency assets should be formally included in the U.S. retirement system. Once the SEC and the modification department follow the rules requested in the letter, the spot ETFs for $BTC and $ETH will naturally become compliant assets for 401(k) plans, leading to a "slow but steady" accumulation of long-term, stable retirement fund buying power. In fact, the entry of U.S. pension funds into the cryptocurrency market was proposed earlier this year; it is just that it is now gradually being implemented. Therefore, as long as the news can be rolled out one by one, the market will slowly reach a climax, which is also why Lin Chao is optimistic about the market in 2026.

Lin Chao summarizes:

My recent articles have been reminding everyone that although the market currently shows signs of building a bottom, the market often lags behind. It is crucial to control your hands and maintain patience at this time. Everyone is waiting for "a large number of policies": prosperous funds → Federal Reserve's market rescue → risk assets surge → Bitcoin forex. This system is essentially: bad news = good news. In a bull market, not only in the cryptocurrency circle but also in the stock market, it is easy to fall into this habitual thinking. However, reality is often the opposite— the first thing that truly starts with economic funds is to "hold onto your cash tightly"! It is not about rushing to invest everything, nor is it about treating the Federal Reserve's news as your lifeline. When liquidity is tightening, only those who can survive will be able to seize the next market opportunity.

Looking back at Bitcoin's data, although the turnover has decreased, it is still at previous levels. In the last 24 hours, short-term investors have been speculating that the Federal Reserve will make similar statements, so when the statements ended without more dovish comments, the short-term positive news has already landed, and the remaining concern may be the negative impact of Japan's interest rate hike. Therefore, we can see that in the last two days, investors buying below $90,000 are the main force in turnover. From the financing code structure, the current stability is still very good, and even though there have been several price declines and fluctuations, investors who are stuck at high positions and early investors are still in a wait-and-see attitude.

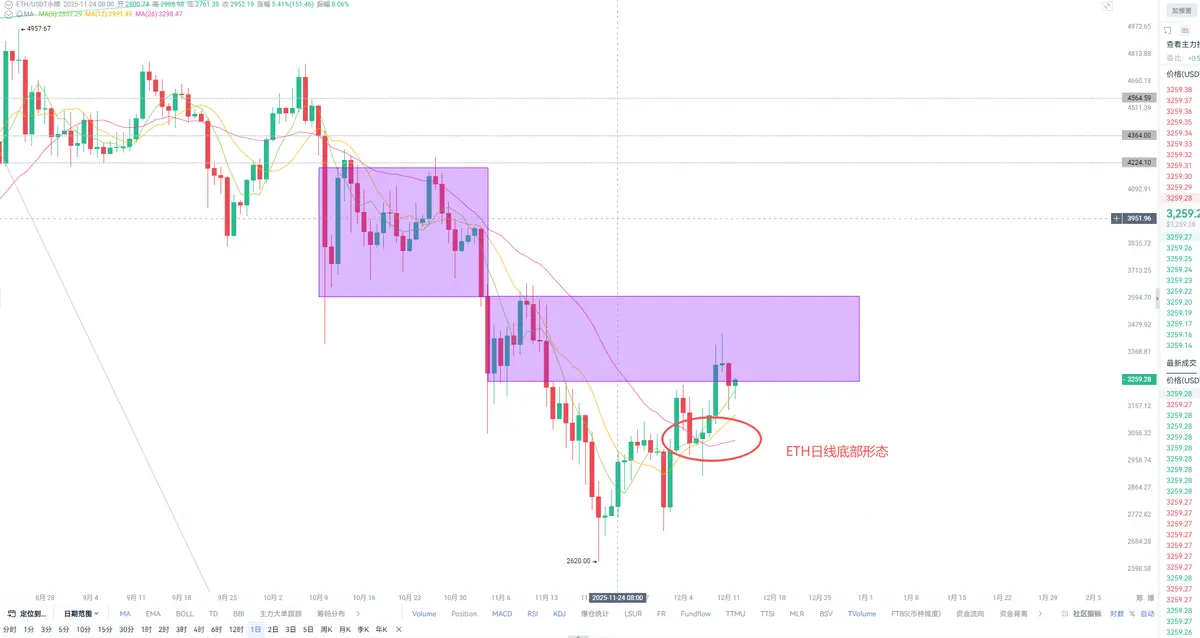

We can also see some signs from technical indicators. In fact, since the small bull market that started in March this year, ETH remains the mainstream narrative. Although we still need to look to the big brother BTC for direction, as long as the direction is clear, the momentum of ETH is still significantly stronger than any altcoin, even surpassing BTC's speed. This is probably because, compared to BTC, ETH's market is much lighter, so the entry of institutional funds will be very obvious. Secondly, the launch of ETFs has changed the market's purchasing structure, mainly driven by institutions pushing prices, so besides BTC, the most reliable ETF currently is ETH. As for other ETFs (such as SOL, XRP, etc.), it's not that no one is buying, but rather that the purchases are more exploratory. After all, for institutional funds, the history of the cryptocurrency market is still too new; they are hesitant to invest heavily in this new market but do not want to miss out on the market's wild growth. Therefore, exploratory buying occurs, and since BTC's price is too high, ETH naturally becomes everyone's first choice for investment, including retail logic. This is why we see ETH leading the charge this year.

From the sensitive daily candlestick charts, we can also see that comparing the daily trends of the two, ETH's pattern is leading BTC, especially during the bottom-building process of this phase bear market. The trading volume and moving average expansion pattern of ETH will be influenced by BTC. Lin Chao mentioned in an article a few days ago that now is suitable for laying out spot positions. As for the newly launched ETFs like SOL, XRP, etc., their performance is even more lagging; it's not that they won't rise, but they won't lead the rise. To catch the thief, catch the king first; the same goes for seizing market opportunities; you must be able to catch the leader to maximize profits. Therefore, during this rebound cycle, I recommend that everyone pay more attention to ETH's spot. Additionally, Lin Chao is also focusing on some small-cap strong coins, but to avoid suspicion, I won't discuss them in public; if anyone is interested, feel free to message Lin Chao for a discussion.

If you are feeling confused— not understanding technology, not knowing how to read charts, unsure when to enter the market, not knowing how to set stop losses, not understanding take profits, randomly increasing positions, getting stuck while trying to buy the dip, unable to hold onto profits, missing out on market opportunities… these are common problems for retail investors. Lin Chao can help you establish the correct trading mindset. A single profitable trade is worth more than a thousand words; repeatedly losing is not as good as finding the right direction. Instead of frequent operations, it is better to strike precisely, making each trade more valuable.

The success of investment depends not only on choosing good targets but also on when to buy and sell. Protecting your principal and doing proper asset allocation is essential for steady progress in the ocean of investment. Life is like a long river flowing into the sea; what determines victory or defeat is never the gains and losses of a single pass or the profits and losses of a moment, but rather planning before action and knowing when to stop to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The cryptocurrency market has risks; invest cautiously!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。