Has the pressure level for Ethereum's rebound at the monthly line of over 3,400 been reached? Will it break below 3,000-3,100 next? Where should we go long? Where should we short for a higher win rate?

Today, we will analyze the market around this theme. It is December 12, 2025. Let's first take a look at Ethereum.

Last night, there was a wave of chaotic operations, with nearly 1 billion in long positions liquidated across the network. The total liquidation for both long and short positions reached 1.2 billion. The liquidation price for long positions was quite aggressive at 3,194, with a liquidation price of 3,200.

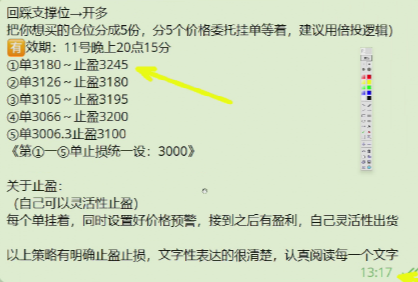

Even at 3,212, there was a liquidation price. During this collective liquidation, I called on my friends to get in around 3,180, with some entering at 3,174.

Some entered at 3,000, and others at 3,181 based on yesterday's strategy to go long at 3,180, which was called at 13:17 yesterday.

Some friends entered in real-time at 3,150, waiting for two days to finally see support at 3,180 and 3,150.

The market liquidated in the 3,180-3,200 range, while I entered long positions at this level. Would you say it was just luck, or was there some underlying logic?

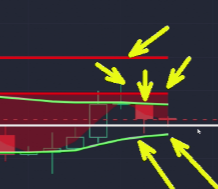

How should we operate today? First, let's look at Ethereum. Although it retraced quite a bit yesterday, it is still holding above 3,100, with the lowest retracement at 3,142, which is the defense line. The support line is at 3,140.

It hasn't broken down, but it closed with a bearish candle.

With this bearish close, we have two strategies. If it rebounds and fails to break the pressure level, we can go short.

This pressure level is at 3,383.

Another pressure level is at 3,595.

It won't reach that high in the short term because there is a pin bar here, and it also closed bearish. This pin bar and the bearish candle, along with these two lines, are pressing down. It needs to consolidate here, and we cannot rule out another false breakdown.

A false breakdown could test around 3,000. As long as the 3,000 level holds, in my opinion, it will oscillate around this range.

This range is between 3,380 and 3,400, with the high point around 3,450. Since we know the range, it becomes easier. As long as it doesn't break the high of 3,440 or 3,446 from yesterday, we should short at highs with a stop loss. Otherwise, if it breaks this high, it could reach 3,500. The third strong resistance at the monthly line is between 3,500-3,560. You can note where to go long. If we want to make a short-term long position, it's simple. If we want to go long, we can look for a pullback to 3,150.

This is the defense line at 3,150-3,180. There is a $40 range where we can gradually enter small long positions, with a stop loss placed below 3,140, at 3,130 or 3,120. If you can tolerate a larger retracement, the stop loss can be set at 3,100.

For more strategies, follow the public account BTC-ETH Crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。