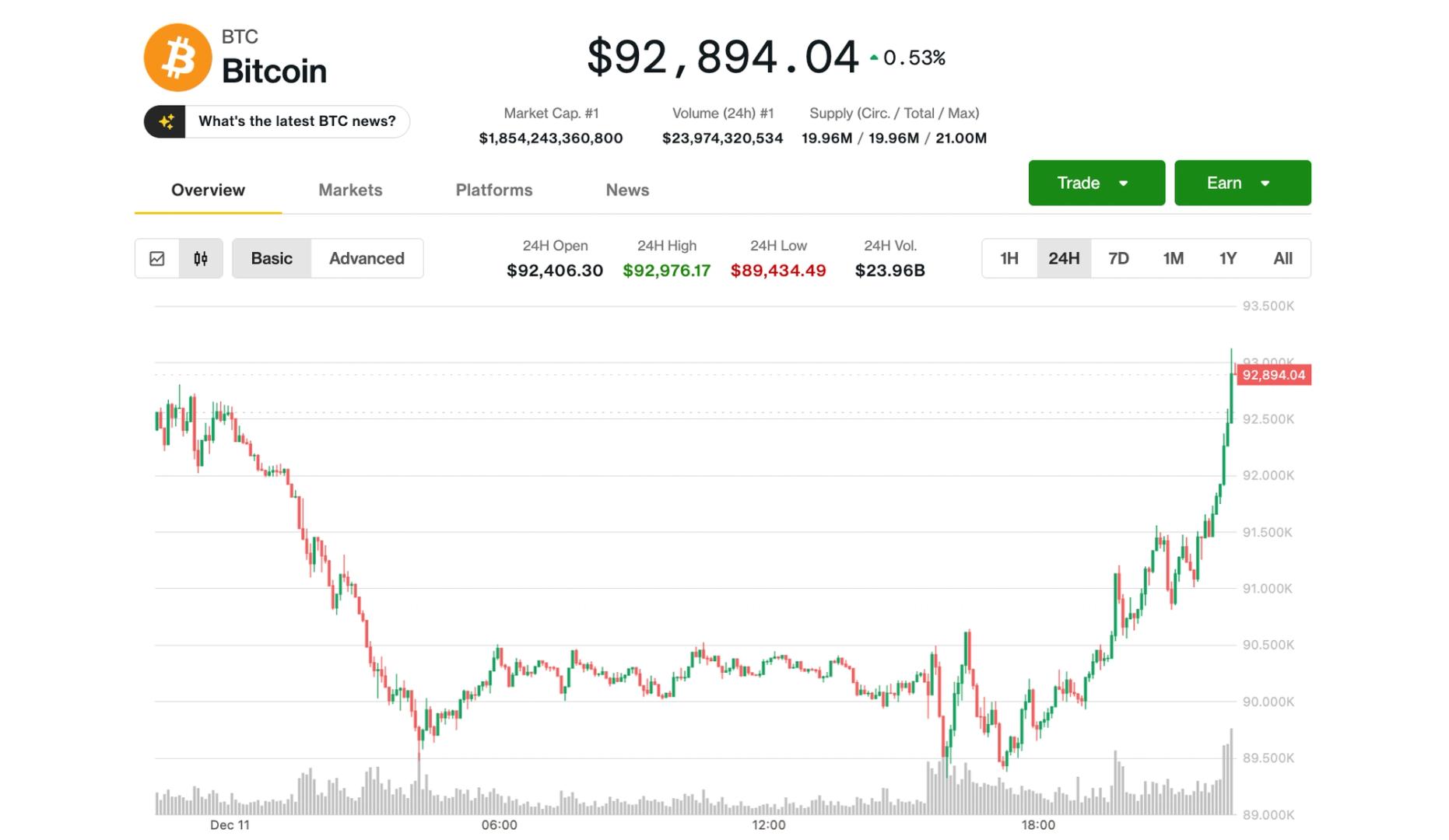

Bitcoin clawed back to $93,000 on Thursday as traders digested the Fed decision, but altcoins mostly didn't join in the bounce.

Slipping to $89,000 after the Federal Reserve’s Wednesday rate cut and a sharply lower open for U.S. stocks, bitcoin recently was trading at $93,000, up marginally over the past 24 hours.

Altcoins mostly held onto their early losses, with Cardano's ADA and Avalanche's AVAX (AVAX) leading declines, down 6%-7%. Ether was 3% lower on the day, holding above $3,200.

Bitcoin's late-day bounce came alongside similar action in U.S. stocks, with the Nasdaq managing to close down just 0.25% after being as much as 1.5% lower. The S&P 500 closed modestly in the green and the DJIA gained 1.3%..

The day's standout rally came from precious metals, with silver surging 5% to a fresh all-time high of $64 per ounce and gold climbing over 1% to near $4,300. The advance was helped by the U.S. dollar index (DXY) slipping to its weakest since mid-October.

Crypto exchange Gemini stood out among crypto stocks, gaining over 30% on news of obtaining regulatory approval to offer prediction markets in the U.S.

Crypto diverges from equities

Jasper De Maere, desk strategist at trading firm Wintermute, said Thursday’s action reinforced crypto’s growing decoupling from equities, especially around macro catalysts.

"Only 18% of the past year’s sessions have seen BTC outperform the Nasdaq on macro days," he noted. "Yesterday fit that pattern: equities rallied while crypto sold off, suggesting the rate cut was fully priced and that marginal easing is no longer providing support."

De Maere added that early signs of stagflation concerns are emerging into the first half of 2026, and markets are beginning to shift focus from Fed policy toward U.S. crypto regulation as the next major driver.

Bitcoin sell pressure waning

Analytics firm Swissblock noted the downward pressure on bitcoin is losing steam, with the market stabilizing but not yet out of the woods.

"The second selling wave is weaker than the first, and selling pressure is not intensifying," the firm said in an X post. "There are signs of stabilization... but not confirmation."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。