For the first time in more than six years, three members of the Federal Open Market Committee (FOMC) officially disagreed with Wednesday’s interest rate reduction, exposing increasing tensions within the elite group. And now the Fed’s own polling of its top brass, a chart dubbed “the dot plot” reveals that 2026 may only see a single rate cut, a scenario that may have spooked bearish traders, sending bitcoin below $90K on Thursday morning.

Read more: The Fed Just Cut Rates, How Will BTC React?

The central bank held rates steady for most of the year, despite calls for aggressive cuts by the Trump administration. Softer-than-normal employment eventually caused the Fed to lower the policy rate three times in 2025, with Wednesday’s reduction being the final one of the year. But not everyone was on board with a third cut. Austan Goolsbee and Jeffrey Schmid, Fed presidents for the Chicago and Kansas City branches respectively, voted to hold rates. Recent Trump appointee Stephen Miran wanted a 50-basis-point reduction.

“You just have people who have strong views,” said Fed Chairman Jerome Powell at Wednesday’s official press conference. “Nine out of twelve supported it, so fairly broad support. But it’s not like the normal situation where everyone agrees on the direction and what to do.”

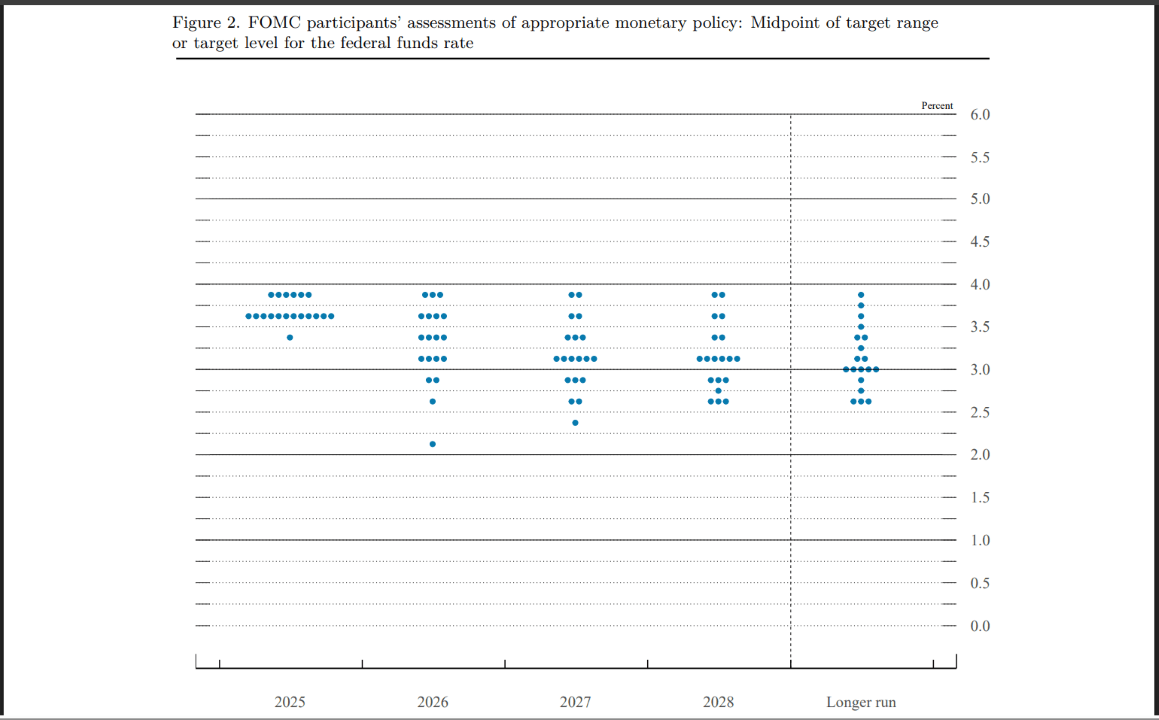

(The quarterly “dot plot” chart shows interest rate projections by 19 Fed officials / Federal Reserve)

The “strong views” Powell referenced also found their way into the dot plot, a quarterly chart showing interest rate projections by each of the twelve FOMC members and the seven Federal Reserve Bank presidents. According to the chart, the median interest rate range projected by the Fed’s top officials is 3.25-3.50%. Powell confirmed the exact number during his press conference: 3.4%. This means many in the group expect a single 25-basis-point cut in 2026, which isn’t good news for risk-on assets such as bitcoin. The current interest rate range after Wednesday’s reduction is 3.50-3.75%.

“In our summary of economic projections, FOMC participants wrote down their individual assessments,” Powell said. “The median participant projects that the appropriate level of the federal funds rate will be 3.4% at the end of 2026.”

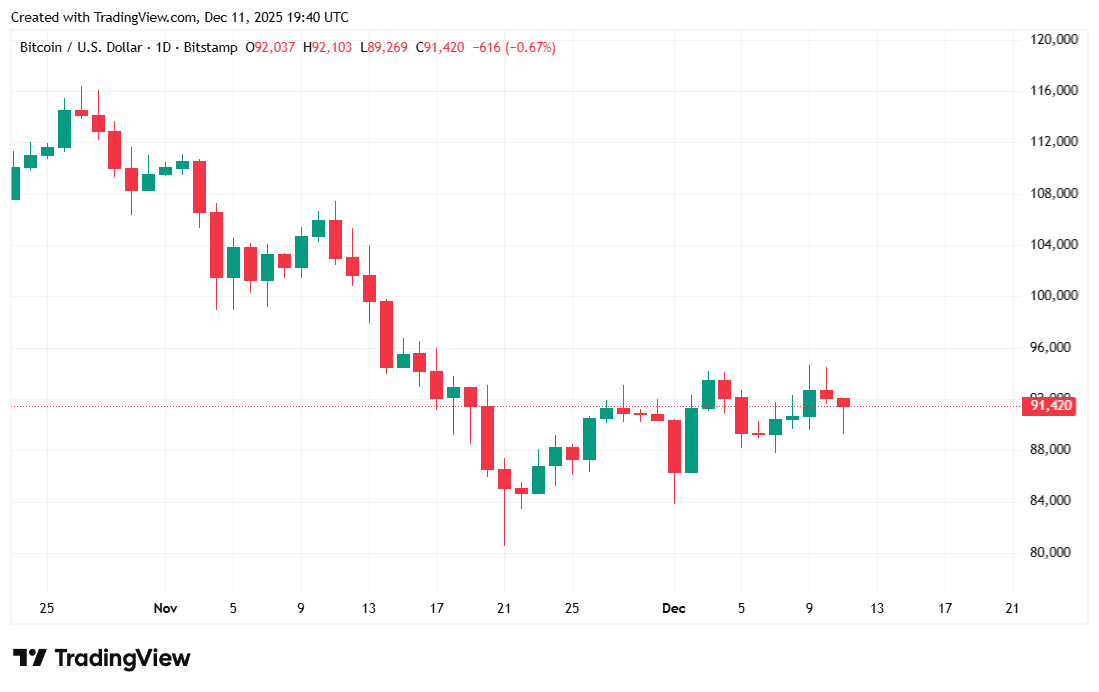

Bitcoin was priced at $91,346.75 at the time of reporting, down 1.82% over 24 hours and lower by 0.43% for the week, according to Coinmarketcap data. The cryptocurrency traded as low as $89,335.30 on Thursday and climbed as high as $94,477.16.

( BTC price / Trading View)

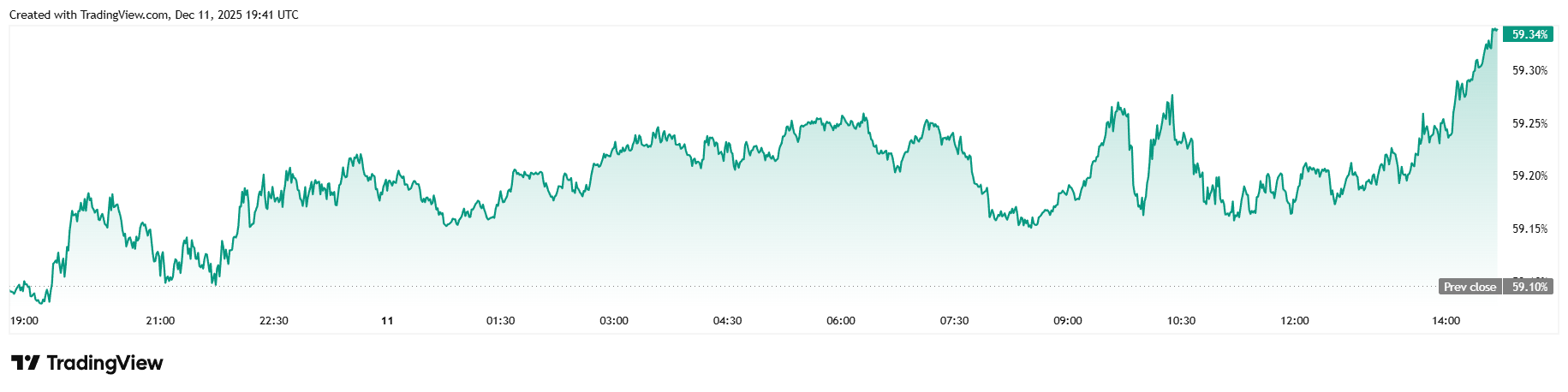

Daily trading volume rose 13.56% to reach $65.64 billion. Market capitalization fell to $1.82 trillion, but bitcoin dominance increased by 0.45% to reach 59.34%.

( BTC dominance / Trading View)

Total bitcoin futures open interest remained mostly flat, much like yesterday, inching upward by 0.20% to reach $59.74 billion, according to Coinglass data. Thursday’s liquidations nearly doubled, reaching a total of $180.23 million. Long investors once again suffered most of the losses with $131.81 million in liquidated margin. The remaining $48.42 million was attributable to overzealous short sellers.

- Why did bitcoin fall after the Fed’s decision?

Traders were spooked by new Fed projections showing only one potential rate cut in 2026. - What changed inside the Federal Reserve?

Three FOMC members dissented on the latest cut, highlighting growing internal division. - How does the 2026 dot plot affect crypto?

A hawkish outlook suggests tighter financial conditions ahead, weighing on risk assets like BTC. - What interest rate does the Fed now expect for 2026?

The median projection is 3.4%, implying barely any easing from today’s 3.50–3.75% range.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。