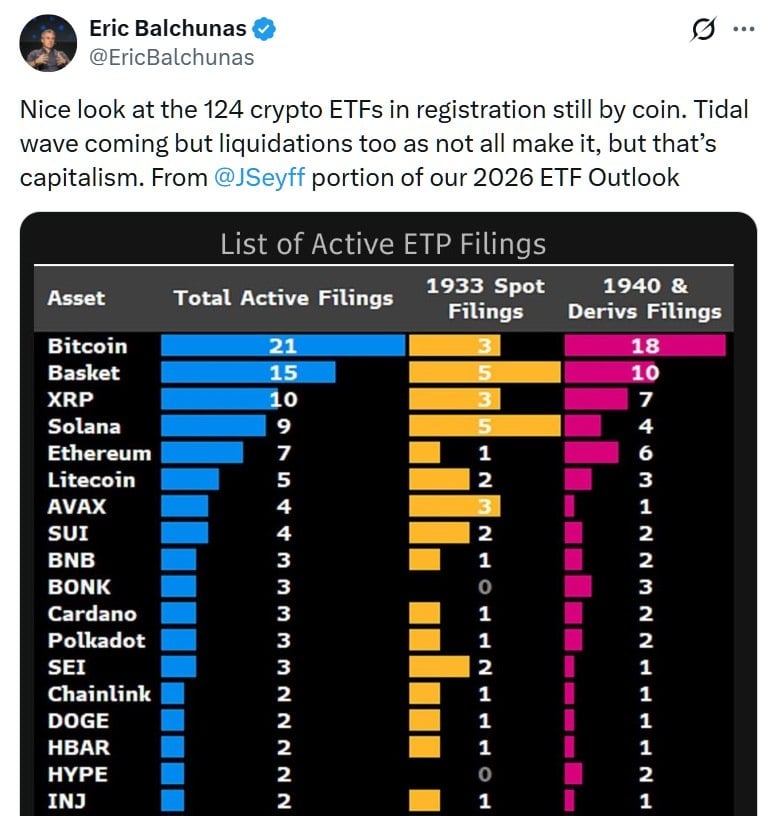

Crypto exchange-traded funds (ETFs) remain a major focus in the digital asset market as Bloomberg ETF analyst Eric Balchunas shared on social media platform X on Dec. 11, highlighting the scale of active crypto exchange-traded product (ETP) registrations. His post centered on the growing number of filings and the competitive landscape forming around them.

He said the 124 crypto ETFs still awaiting registration by coin indicate a coming surge, though he expects some to be liquidated because not all will succeed, which he described as a normal market outcome.

The accompanying data showed bitcoin ( BTC) leading with 21 filings, followed by 14 basket products, 11 XRP filings, 11 solana ( SOL) filings, 11 ethereum ( ETH) filings, and 10 litecoin ( LTC) filings, marking them as the most active categories. Additional representation for AVAX, SUI, BNB, BONK, ADA, DOT, and SEI illustrated expanding institutional exploration across mid-tier networks. The strong clustering among top assets signaled where issuers see the highest potential demand as they prepare for broader competition.

Read more: ETF Floodgates Open: XRP, SOL, LTC, HBAR, DOGE, and LINK Give Investors a Menu of Altcoin Madness

The figures also listed numerous smaller assets — including APT, ATOM, AXL, BCH, CC, CRO, DOT, ENA, LINK, MELANIA, MOG, OKB, ONDO, PENGU, TAO, UNI, and XLM — each holding a single filing as issuers test viability at the edges of the market. The analyst noted that natural market filtering is likely as approvals progress, with weaker offerings winding down while stronger ones consolidate investor interest.

The crypto ETF regulatory landscape is undergoing a significant easing, marked by the SEC’s streamlined approval process and a growing acceptance of digital assets. While some observers warn that rapid growth in crypto ETF submissions risks saturating the sector, supporters argue that increased product variety enhances transparency, strengthens market structure and supports broader adoption of bitcoin, ethereum, XRP, and other digital assets.

- What does the spike in crypto ETF registrations signal for investors?

It indicates accelerating institutional interest and a pending wave of regulated crypto investment products that could expand market liquidity and accessibility. - Which assets currently dominate pending ETF filings?

Bitcoin leads with 21 filings, followed by diversified baskets and strong interest in XRP, SOL, ETH, and LTC—showing where issuers expect the highest investor demand. - Should investors expect all 124 pending crypto ETFs to launch successfully?

No—analysts anticipate a portion will be liquidated or never reach full market traction, a normal outcome as competition intensifies. - What does the presence of mid-tier assets like AVAX, SUI, BNB, BONK, ADA, DOT, and SEI suggest?

It shows expanding institutional experimentation beyond blue-chip tokens, hinting at broader diversification opportunities in future ETF offerings.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。