Ethereum broke through the $3,400 mark yesterday due to the favorable push from the Federal Reserve's decision, then quickly retraced.

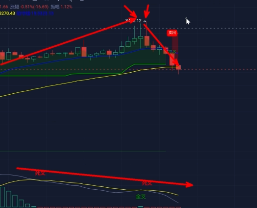

This formed a top divergence on the hourly chart. Should we buy on the dip or short at the rebound resistance level for a higher win rate?

Let's analyze the market around this theme.

Today is December 11, 2025. Last night, a favorable push quickly drove the price above $3,440, peaking at $3,446 with three spikes testing the top, then quickly retracing.

This is not just a blatant move by the market makers using favorable policies to offload their positions, enticing small investors to jump in, while they take the profits, forming a one-hour top divergence.

In this structure, the MACD indicator shows a top divergence, forming a resonance with the trend indicator, signaling a sell and close long position.

In this structure, the main strategy should be to short on the rebound. How to short?

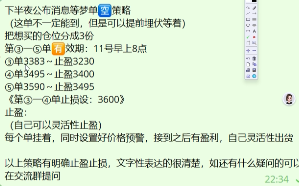

Let me show you if we made any profits last night. The results from last night show that friends entered around the average price of $3,400, with the first order placed between $3,383 and $3,495.

Although it didn't reach that point, some friends flexibly adapted their strategy based on the 5-minute trading logic and entered around $3,430, with an average price of $3,400.

For those who placed an order and went to sleep, there was still profit at $3,383.

How do we approach today's trading?

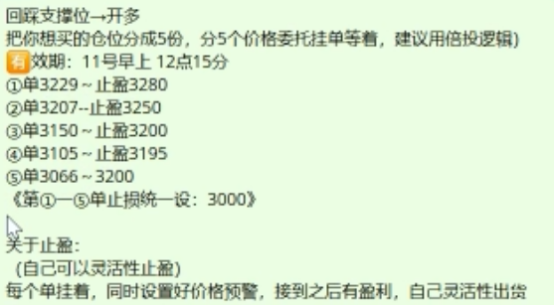

For long positions, I would place orders in batches at multiple prices between $3,229 and $3,207, setting a unified target at $3,000. It’s unlikely to reach as low as $3,000 in a short time; this is just to prevent market makers from spiking the price, which could lead to unfortunate losses. If we hadn't used this batch layout strategy last night, we could have faced significant losses, which would have been regrettable.

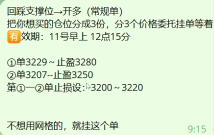

If you prefer not to place orders at so many different prices, you can refer to this strategy.

This strategy involves a conventional order with a small stop loss, placing orders at two prices: $3,229 and $3,207, with a stop loss set at $3,200 to $3,220.

These are all based on the current market conditions to determine support.

For more strategy analysis, follow the public account BTC-ETH Crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。