Bitcoin and Ether ETFs Surge as Markets Turn Fully Green

The crypto ETF market lit up green on Tuesday, Dec. 9, shaking off Monday’s caution and surging back with conviction. It was the kind of broad-based risk appetite traders hadn’t seen in weeks: steady, enthusiastic, and spread across nearly every major product.

Bitcoin ETFs roared back to life with a $151.74 million inflow, powered by a remarkable resurgence at Fidelity. Its FBTC fund absorbed $198.85 million, the largest individual influx of the day. Grayscale’s Bitcoin Mini Trust contributed another $33.79 million, followed by $17.48 million into GBTC and $16.22 million into Bitwise’s BITB.

Additional inflows rolled in across the board: $8.09 million to Franklin’s EZBC, $6.50 million to Invesco’s BTCO, and $5.26 million to Ark & 21Shares’ ARKB. Even Wisdomtree’s BTCW added nearly $1 million. The only setback came from Blackrock’s IBIT, which saw a sizeable $135.44 million outflow, but it wasn’t nearly enough to dull the day’s momentum. With $4.27 billion traded, total net assets climbed to $122.10 billion.

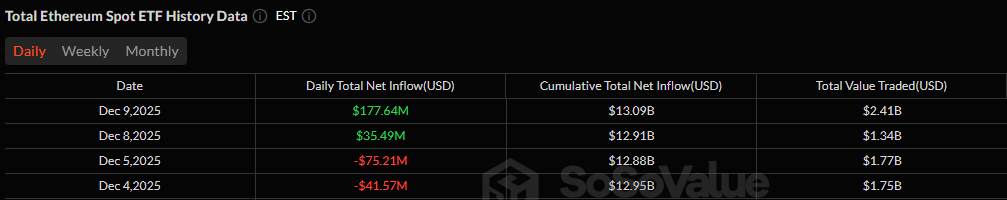

Consecutive inflow days for ether ETFs

Ether ETFs matched and even exceeded the excitement with a $177.64 million inflow spread widely across seven issuers. Fidelity’s FETH led the category with $51.47 million, while Grayscale’s Ether Mini Trust added $45.19 million and Blackrock’s ETHA contributed $35.29 million. Bitwise’s ETHW saw a strong $17.91 million inflow, joined by $14.64 million for Vaneck’s ETHV, $11.47 million for Grayscale’s ETHE, and $1.66 million for 21Shares’ TETH. Trading volumes jumped to $2.41 billion, pushing net assets up to $21.04 billion.

Solana ETFs extended the wave with $16.54 million in fresh inflows. Bitwise’s BSOL led with $7.78 million, while Grayscale’s GSOL added $5.84 million, Fidelity’s FSOL brought in $2.47 million, and Vaneck’s VSOL rounded out the activity with $456,990. Trading reached $49.51 million, and total assets climbed to $950.40 million.

Read more: Ether and XRP Surge With Strong Inflows as Bitcoin ETFs Slip

Rounding out the day’s clean sweep, XRP ETFs recorded $8.73 million in inflows, dominated by $6.08 million into Canary’s XRPC. Bitwise’s XRP added $1.42 million, and Grayscale’s GXRP collected $1.23 million, with trading activity rising to $28.63 million.

Across the board, Tuesday delivered a rare and refreshing sight: every major crypto ETF category finished in the green, fueled by broad participation, strong volume, and renewed investor confidence.

FAQ 🚀

- What triggered Tuesday’s strong crypto ETF inflows?

A broad market rebound drove investors back into bitcoin, ether, solana, and XRP funds. - Which category saw the biggest inflows?

Ether ETFs led the day with over $177 million in new capital. - How did bitcoin ETFs perform?

Bitcoin products posted $151 million in inflows despite a large outflow from IBIT. - Did all major crypto ETF sectors finish positive?

Yes. BTC, ETH, SOL, and XRP ETFs all recorded net inflows, marking a fully green day.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。