Original Title: CLOB Lending: Markets Don't Need Curators

Original Author: @0xJaehaerys, Gelora Research

Original Translation: EeeVee, SpecialistXBT, BlockBeats

Editor's Note: After the successive collapses of Stream Finance and USDX, the DeFi community is undergoing a painful disillusionment. The "Curator" model introduced by protocols like Morpho and Euler was intended to address liquidity fragmentation, but inadvertently reintroduced the moral hazard of "humans" back onto the chain. The author of this article points out that current lending protocols mistakenly bundle "risk definition" with "order matching." By drawing on the order book model from traditional finance, this article constructs a new paradigm that does not require curators and is automatically routed by algorithms.

The Evolutionary Logic of Lending Markets

Looking back at the evolution of on-chain trading can provide us with insights into understanding the lending market.

Constant function AMMs (like Uniswap) solved a fundamental problem: how to create a market without active market makers? The answer is to use invariant functions to preset the "shape" of liquidity. Liquidity providers agree in advance on a set of strategies, which are automatically executed by the protocol.

This works well in trading because the transactions are relatively simple: buyers and sellers meet at a certain price. But lending is much more complex. A loan involves multiple dimensions:

- Interest rate

- Type of collateral

- Loan-to-value ratio (LTV)

- Term (fixed vs. floating)

- Liquidation mechanism

The matching of loans needs to satisfy all the constraints of the above dimensions simultaneously.

Early DeFi lending directly adopted solutions similar to AMMs. Protocols like Compound and Aave preset interest rate curves, allowing lenders to join a shared liquidity pool. This enables the lending market to operate even without active lenders.

However, this analogy has a fatal flaw. In DEX trading, the shape of the constant function curve affects execution quality (slippage, depth); in lending, the shape of the interest rate curve directly determines risk. When all lenders share a pool, they also share the risk of all collateral accepted by the pool. Lenders cannot express their willingness to take on only specific risks.

In trading, the order book solves this problem: it allows market makers to define their own "curve shapes." Each market maker quotes at their comfortable price, and the order book aggregates these quotes into a unified market, but each market maker still controls their own risk exposure.

Can lending adopt the same approach? A project called Avon attempts to answer this question.

The Problem of Liquidity Fragmentation

To give lenders control, the first attempt in DeFi was market isolation.

Protocols like Morpho Blue and Euler allow anyone to create lending markets with specific parameters: designated collateral, borrowed assets, fixed liquidation LTV, and interest rate curves. Lenders deposit into markets that align with their risk preferences. A bad debt in one market will never affect another market.

This is perfect for lenders, as they achieve the risk isolation they desire.

But for borrowers, this creates fragmentation.

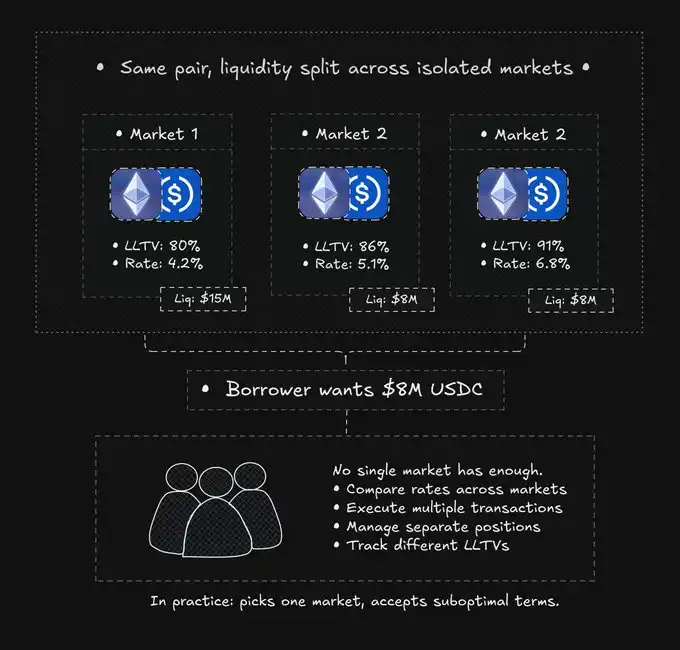

Taking ETH-USDC lending as an example, there could be a dozen different markets:

Market B: $3 million liquidity, 86% LTV, 5.1% interest rate

Market C: $2 million liquidity, 91% LTV, 6.8% interest rate

… and 9 other markets with lower liquidity

A user wanting to borrow $8 million cannot satisfy their needs from a single market. They must manually compare prices, execute multiple transactions, manage fragmented positions, and track different liquidation thresholds. The theoretically optimal solution requires splitting the loan across more than four markets.

In reality, no one does this. Borrowers typically only choose one market. Funds are underutilized in fragmented pools.

Market risk isolation solves the problem for lenders but creates problems for borrowers.

Limitations of the Curator Vault

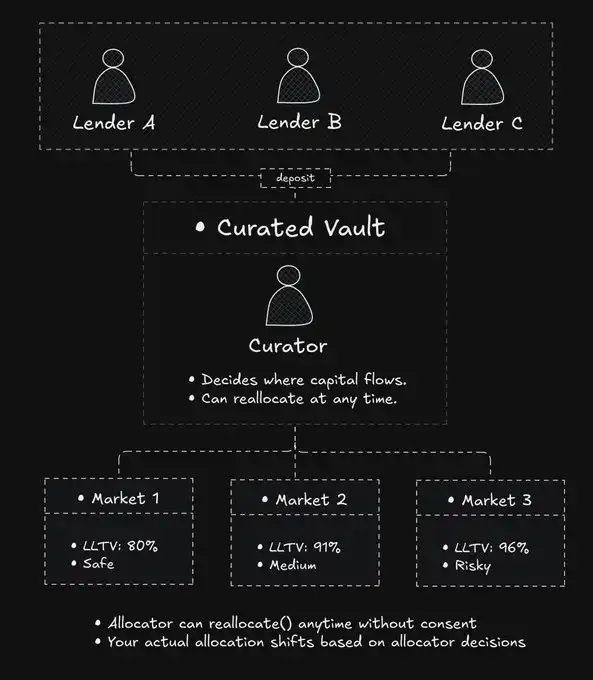

The curator vault model attempts to bridge this gap.

The idea is that professional curators manage the flow of funds. Lenders deposit into the vault, and curators allocate funds to various underlying markets, optimizing returns and managing risks. Borrowers still face fragmented markets, but at least lenders do not have to manually adjust their positions.

This helps lenders who want to "take it easy," but it reintroduces something that DeFi originally aimed to eliminate: discretion.

Curators decide which markets receive funds and can reallocate at any time. Lenders' risk exposure changes with the curator's decisions, which are unpredictable and uncontrollable. As one Twitter user put it: "Curators are PvPing with borrowers, but borrowers don't even know they're being harvested."

This asymmetry is reflected not only in strategy but also in the accuracy of the underlying interface. Morpho's UI sometimes shows "there is $3 million available liquidity," but in practice, low-interest funds are scarce, with most funds in high-interest ranges.

When liquidity coordination relies on human decisions, transparency suffers.

Fund allocators adjust market liquidity according to their schedules rather than the immediate demands of the market. The vault attempts to solve borrowers' fragmentation issues through "rebalancing," but rebalancing incurs gas fees, relies on the curator's willingness, and is often delayed. Borrowers still face suboptimal interest rates.

Separating Risk from Matching

Lending protocols confuse two distinctly different modules.

User's definition of risk: Different lenders have varying views on collateral quality and leverage.

The method by which protocols match loans: This is mechanical. It does not require users' subjective judgments, only efficient routing.

The fund pool model bundles the two, causing lenders to lose control.

The isolated pool model separates risk definition but abandons matching, forcing borrowers to manually seek the optimal path.

The curator vault model reintroduces matching through the role of curators but introduces a trust assumption regarding curators.

Can matching be automated without introducing discretion (human intervention)?

The order book in the trading domain achieves this. Market makers define quotes, the order book aggregates depth, and matching is deterministic (best price first). No one decides where orders go; the mechanism determines everything.

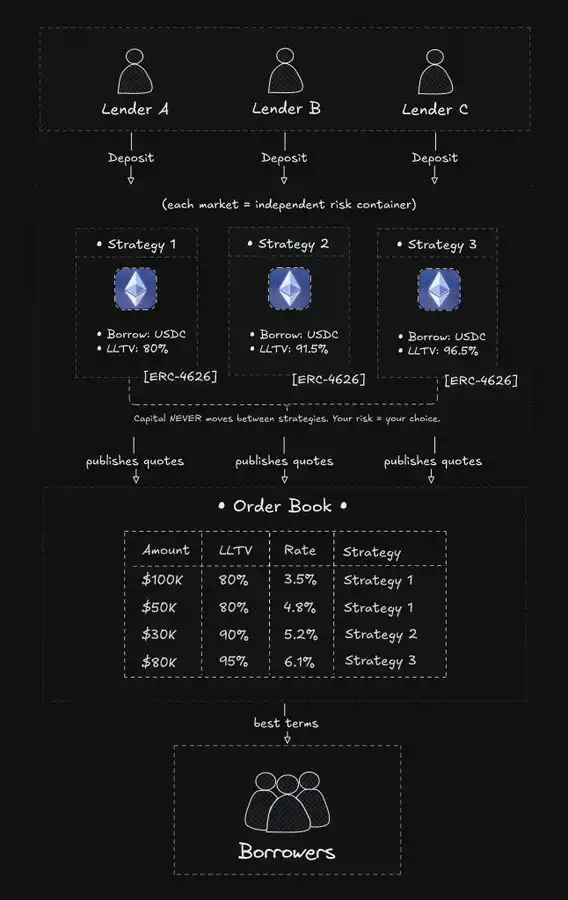

CLOB lending applies the same principles to the credit market:

Lenders define risk through isolated strategies.

Strategies publish quotes to a shared order book.

Borrowers interact with unified liquidity.

Matching occurs automatically without curator intervention.

Risk remains with the lenders, and coordination becomes mechanical. No part of the process requires trust in a third party.

Two-Tier Architecture

Avon achieves order book lending through two unique tiers.

Strategy Layer

A "strategy" is an isolated lending market with fixed parameters.

Strategy creators define the following parameters: collateral/borrowed asset, liquidation LTV, interest rate curve, oracle, liquidation mechanism.

Once deployed, the shape of the interest rate curve cannot be changed. Lenders know the rules exactly before depositing.

Funds never move between different strategies.

If you deposit into Strategy A, your money stays in Strategy A until you withdraw. No curators, no rebalancing, no sudden changes in risk exposure.

While there are still people (strategy managers) setting parameters, they are fundamentally different from curators: curators are fund allocators (deciding where the money goes), while strategy managers are true risk managers (defining rules but not moving money), as seen in Aave DAO. The decision-making power regarding fund allocation always remains with the lenders.

How does the system adapt to market changes? Through competition, not parameter modification. If risk-free interest rates soar, this forces old strategies to be eliminated (funds flow out) and new strategies to be created (funds flow in). "Discretion" shifts from "where should the funds go" (curator decision) to "which strategy should I choose" (lender decision).

Matching Layer

Strategies do not directly serve borrowers but publish quotes to the shared order book.

The order book aggregates quotes from all strategies into a unified view. Borrowers see the combined depth of all strategies that accept their collateral.

When a borrower places an order, the matching engine will:

- Filter quotes by compatibility (collateral type, LTV requirements).

- Sort by interest rate.

- Execute starting from the cheapest.

Settle in an atomic transaction.

If a strategy can fulfill the entire order, it does so in full; if not, the order is automatically split across multiple strategies. Borrowers only perceive a single transaction.

Important Note: The order book only reads the status of strategies and cannot modify it. It is solely responsible for coordinating access and has no authority to allocate capital.

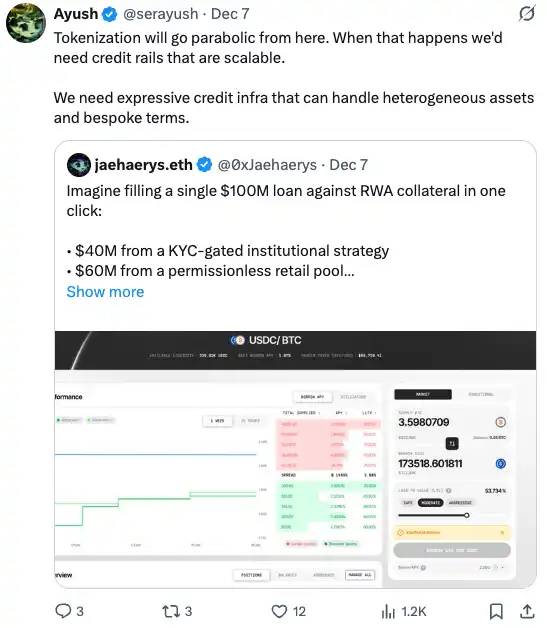

The Gospel of RWA

DeFi has faced structural contradictions in institutional adoption: compliance requirements isolate, but isolation stifles liquidity.

Aave Arc attempted a "walled garden" model, where compliant participants have their own pools. The result is shallow liquidity and interest rate discrepancies. Aave Horizon tried a "semi-open" model (RWA issuers require KYC, but lending is permissionless), which is progress, but institutional borrowers still cannot access Aave's main pool of $32 billion in liquidity. Some projects have explored permissioned rollups. KYC processes are completed at the infrastructure level. This approach is suitable for certain use cases but leads to fragmentation of liquidity at the network layer. Compliant users on Chain A cannot access liquidity on Chain B.

The order book model provides a third way.

The strategy layer can implement any access control (KYC, geographic restrictions, accredited investor checks). The matching engine is only responsible for matching.

If a compliant strategy and a permissionless strategy both offer compatible terms, they can simultaneously fill the same loan.

Imagine a corporate treasury collateralizing tokenized government bonds to borrow $100 million:

$30 million from a strategy requiring institutional KYC (pension fund LP)

$20 million from a strategy requiring accredited investor certification (family office LP)

$50 million from a completely permissionless strategy (retail LP)

Funds are never mixed at the source, institutions remain compliant, but liquidity is unified globally. This breaks the deadlock of "compliance equals isolation."

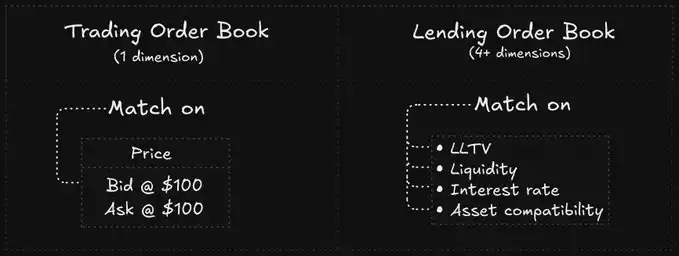

The Mechanism of Multi-Dimensional Matching

The order book matches on a single dimension: price. The highest bid matches the lowest ask.

The lending order book must match on multiple dimensions simultaneously:

- Interest Rate: Must be below the borrower's acceptable upper limit.

- LTV: The borrower's collateral ratio must meet the strategy requirements.

- Asset Compatibility: Currency matching.

- Liquidity: The market must have sufficient liquidity.

Borrowers can match more strategies by providing more collateral (lower LTV) or accepting higher interest rates. The engine will find the cheapest path within this constraint space.

For large borrowers, one point to note is that in Aave, $1 billion in liquidity is a single fund pool. In order book lending, however, $1 billion may be spread across hundreds of strategies. A $100 million loan will quickly consume the entire order book, starting from the cheapest strategy and gradually filling up to the most expensive strategy. Slippage is evident.

Pool-based systems also experience slippage, but it manifests differently: a surge in utilization will push up interest rates. The difference lies in transparency. In the order book, slippage is visible in advance. In a pool, slippage only becomes apparent after the trade is executed.

Floating Rates and Repricing

DeFi lending uses floating rates. As utilization changes, interest rates also change.

This brings about a synchronization challenge: if the strategy's utilization changes but the quotes on the order book are not updated, borrowers will transact at incorrect prices.

Solution: Continuous repricing.

Once the strategy state changes, new quotes are immediately published to the order book. This requires extremely high infrastructure performance:

- Very fast block times.

- Very low transaction costs.

- Atomic state reading.

This is also why Avon chose to build on MegaETH. On the Ethereum mainnet, this architecture is unfeasible due to high gas fees.

Existing Frictions:

If market interest rates fluctuate but the strategy's fixed curve does not adapt, a "Dead Zone" may occur—borrowers find the rates too high to borrow, and lenders earn no yield. In Aave, the curve adjusts automatically, while in the CLOB model, lenders must manually withdraw and migrate to new strategies. This is the price paid for gaining control.

Multi-Strategy Position Management

When a loan is filled by multiple strategies, the borrower effectively holds multi-strategy positions.

Although it appears as a single loan on the interface, the underlying components are independent:

- Independent Interest Rates: The interest rate of Component A may rise due to increased utilization of Strategy A, while Component B remains unchanged.

- Independent Health Ratios: When the price of the asset drops, components with stricter LTV limits will be liquidated first. You won't face a total liquidation at once but will experience a series of partial liquidations, akin to being "eroded."

To simplify the experience, Avon offers unified position management (one-click collateral addition, automatic weighted allocation) and one-click refinancing features (automatically borrowing new to pay off old through flash loans, always locking in the market's optimal interest rate).

Conclusion

DeFi lending has gone through several stages:

- Pooled Protocols: Provided depth for borrowers but stripped control from lenders.

- Isolated Markets: Gave control back to lenders but fragmented the borrowing experience.

- Vaults: Attempted to bridge the two but introduced the risk of human decision-making.

CLOB Lending: Decouples the above models. The power to define risk returns to lenders, with matching achieved through the order book engine.

This design principle is clear: when matching can be implemented through code, human intervention is no longer needed. The market can self-regulate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。