Written by: Jack, Mars Finance

Last night, Bitcoin once again became the focus of attention, with its price strongly returning to the $94,000 mark. This breakthrough movement has sparked widespread discussion in the market: does this signify the beginning of a new bull market, or is it just a brief technical rebound?

As of the time of writing, Bitcoin's price has retreated to around $92,000. Despite the strong price performance last night, the trading volume data did not fully support the upward trend.

Key Resistance Levels and Market Sentiment Ahead of the FOMC Meeting

After experiencing a brief structural weakness on December 3, Bitcoin struggled to maintain a stable daily closing price above $93,000.

With the approach of an important macroeconomic event—the Federal Open Market Committee (FOMC) meeting—most market participants chose to remain on the sidelines, leading to several days of price consolidation.

This stalemate was broken on December 5, when Bitcoin's price successfully broke through $93,500, forming the high point needed for a short-term bullish trend recovery.

From a technical analysis perspective, on the four-hour chart, Bitcoin not only completely filled the fair value gap between $87,500 and $90,000 but also showed a strong buying intention. The effectiveness of this breakout is particularly significant against the backdrop of macro events that may trigger volatility.

A confirmed "cup and handle" pattern was observed on the four-hour chart, suggesting that if Bitcoin can break through $96,000, the next target could point to $104,000. At the same time, an "inverted head and shoulders" pattern is also taking shape, and these two bullish patterns together enhance bullish confidence.

Market analysts generally believe that $94,000 is a key psychological level, coinciding with a downward trend line resistance. The criteria for determining whether the trend can continue are very clear: if Bitcoin's daily closing price can stabilize above $96,000, it will be seen as a strong bullish reversal signal; conversely, if it fails at this resistance level, it may quickly retreat to the $88,000-$89,000 range.

More broadly, the $95,000 area is viewed as the "main battlefield" for both bulls and bears. A successful breakout of this area could open up space for the price to test the $99,000 to $107,000 range; however, if the breakout fails, the pullback could be deeper, potentially retesting the $85,000 support, and in extreme cases, further probing down to $76,000.

Contradictory Signals in Liquidity and Market Participation

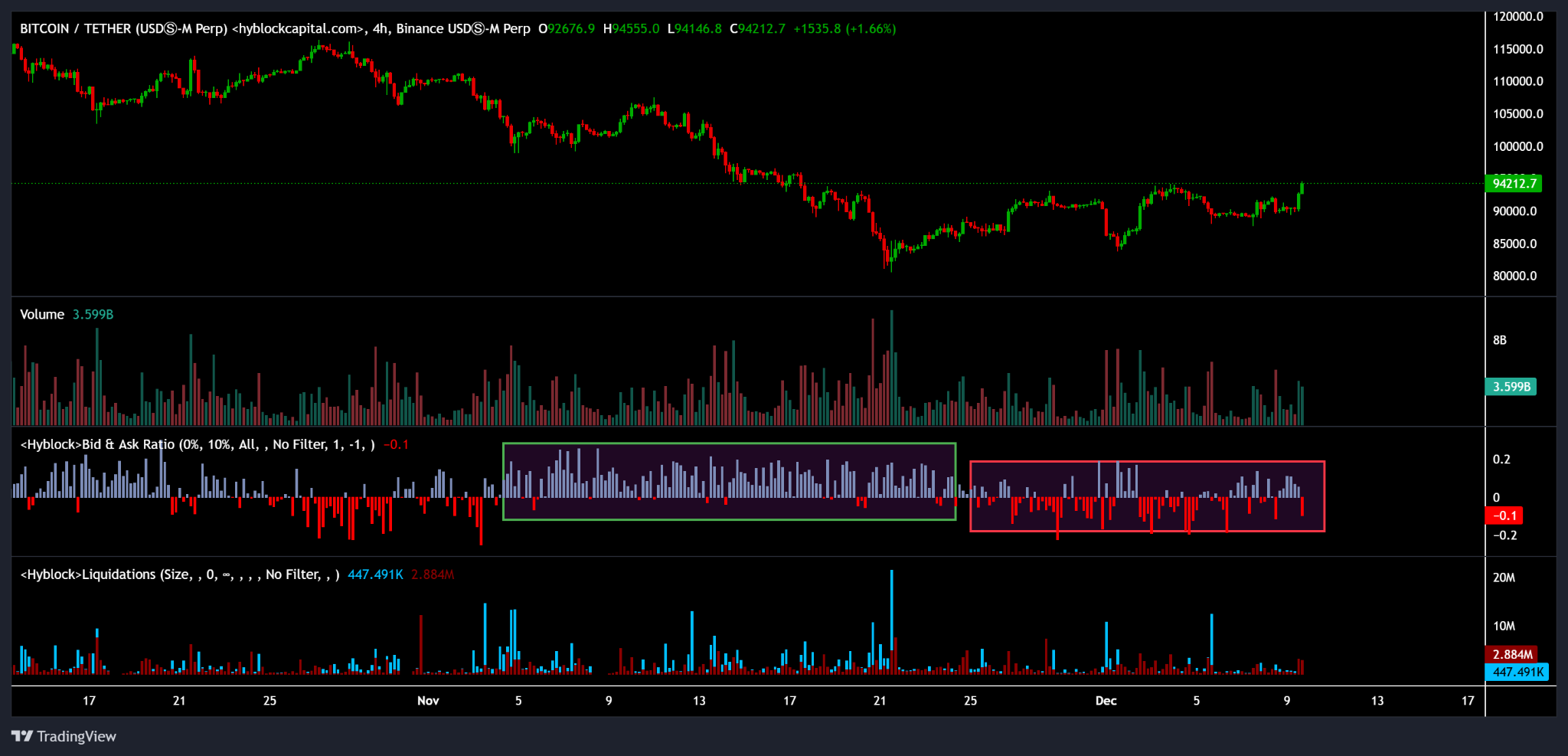

Bitcoin's preference-sell ratio and liquidation data analysis. Source: Hyblock

Despite the encouraging price movement, market liquidity indicators have not fully validated the upward trend. The buy-sell ratio of Bitcoin remains at a relatively low and unstable level.

Unlike the strong buying support seen during the drop from $100,000 to $80,000 in November, the current rebound has not seen the same level of buying support. This indicates that the recent rise is primarily driven by price movements rather than solid new demand. Exchange premium data also presents a complex picture.

The South Korean premium index (often an important indicator of retail sentiment) has significantly cooled. Previously, the South Korean market often saw premium trading during rebounds, but this enthusiasm has now waned, approaching flat or slightly negative values, indicating that retail speculators have not yet entered the market on a large scale.

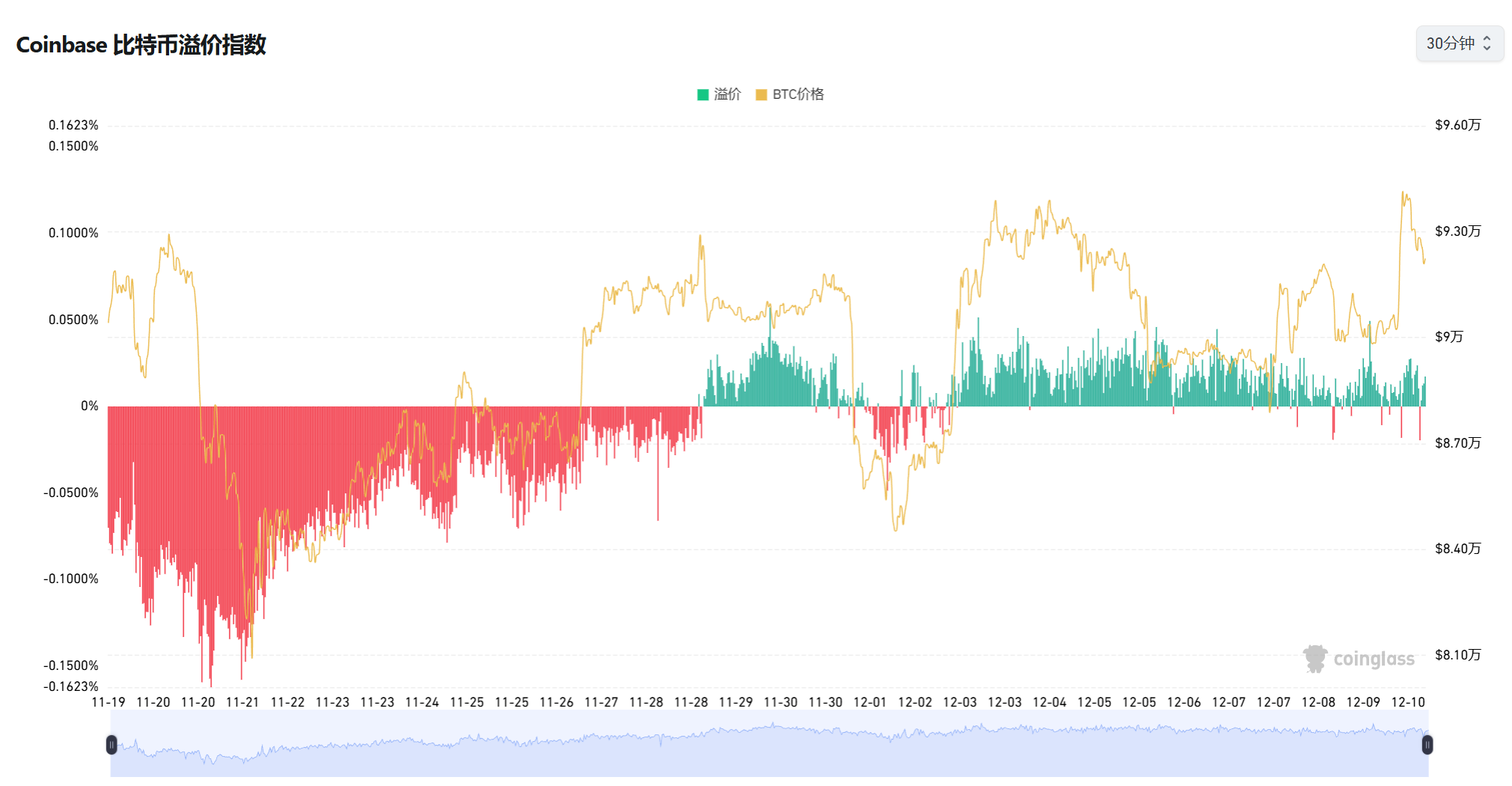

Meanwhile, the Coinbase Premium Index (representing U.S. institutional demand) has turned positive again.

Historical data shows that moderate positive readings often appear during early trend reversals and spot accumulation phases. This regional disparity complicates the market outlook.

On-chain data provides further insights. The number of "whale" addresses holding at least 100 BTC has reached a new high for 2025, and large transfers have also peaked in three months. This typically indicates that "smart money" is accumulating positions rather than short-term speculators dominating the market. The average cost of short-term holders is approaching $90,000, forming a psychological support level.

Market Risks and Potential Challenges

Although the outlook seems optimistic, several risk factors cannot be ignored. The Federal Reserve's monetary policy direction remains a key macro factor influencing Bitcoin's price movements.

Ahead of the FOMC meeting, the market generally expects a possible 25 basis point rate cut.

Historical data indicates that in six FOMC meetings this year, five coincided with Bitcoin price corrections.

From a technical indicator perspective, Bitcoin's Relative Strength Index (RSI) has entered the overbought zone (>70), with the 200-day moving average around $96,216 forming strong resistance.

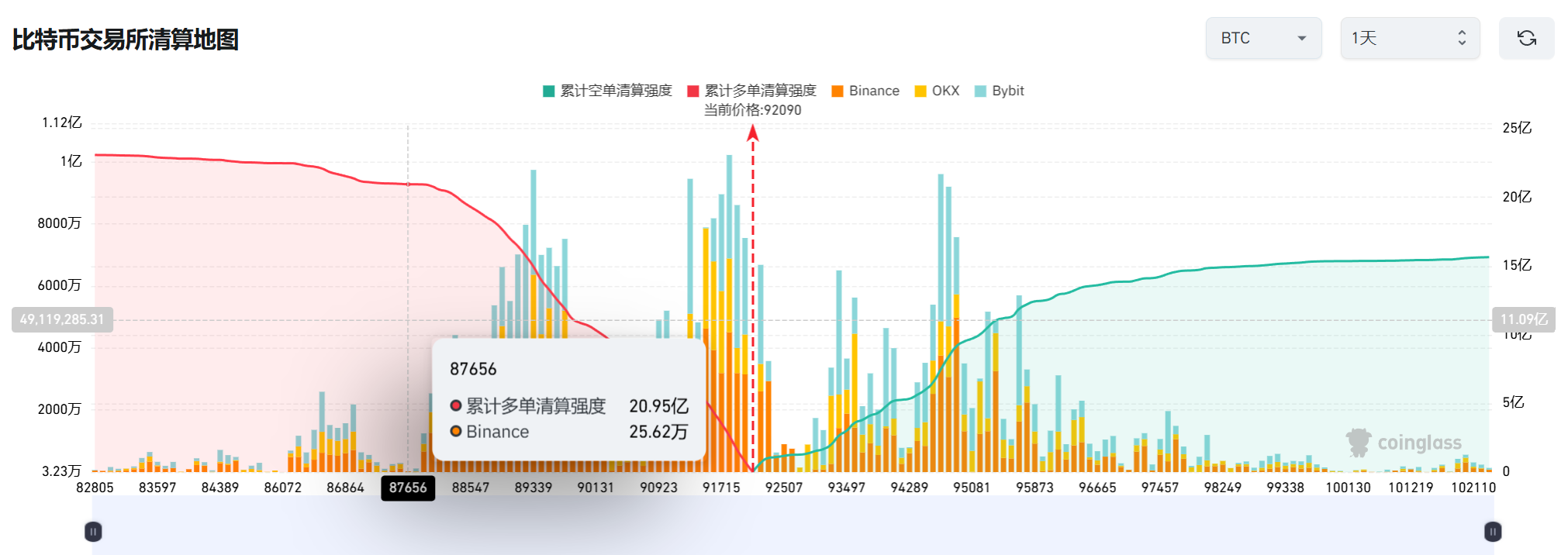

Additionally, leverage risk is particularly prominent. Coinglass data shows that if the price falls below $87,000, it could trigger over $2.1 billion in cascading liquidations.

This high-leverage environment makes the market more susceptible to sharp fluctuations.

Conclusion

Bitcoin's return to $94,000 undoubtedly injects new optimism into the market, but whether the bull market has truly restarted still requires more evidence. The current market is at a resonance point of bullish technical signals and favorable macro conditions, but is constrained by key resistance levels and liquidity concerns.

Investors should closely monitor the breakout situation at $96,000 and the Federal Reserve's policy direction, as these factors are more important than any single candlestick pattern. In an environment where volatility may intensify, position management and risk control are more crucial than pursuing short-term gains.

The Bitcoin market has entered a new era of complex pricing driven by ETF fund flows, leverage cycles, stablecoin liquidity, holder structure, and macro liquidity. Understanding the interrelationships of these signals will be key to navigating the future market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。