The world is bustling, all for profit; the world is bustling, all for profit! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome all friends in the crypto community to follow and like, and I refuse any market smoke screens!

The expectation of interest rate cuts has begun to be speculated upon, and I have talked about this many times, so I won't start from here today. Lao Cui would rather discuss the issue of the Federal Reserve Chair's transition with everyone. From Lao Cui's perspective, this is no less powerful than ending the balance sheet reduction; perhaps after a successful transition this time, we will welcome a completely bullish market space. As of now, the probability of Hassett (also phonetically translated as Haxit in China) being elected is basically predicted by AI to be as high as 60%. This person's philosophy strongly advocates for interest rate cuts and is also a loyal fan of Trump. Perhaps everyone will also recall that Powell was also a candidate promoted by Trump, yet he stands on the opposite side of Trump. Will this candidate follow in Powell's footsteps? Lao Cui's conclusion is that it is highly unlikely. Powell's first term was indeed promoted by Trump, but at that time, Trump did not expect to win against Hillary. Therefore, promoting Powell was a last resort, a situation where there were no great generals in Shu.

After being promoted, Powell chose to align with Wall Street to secure his reappointment, which led to Trump being unable to advance his strategies after taking office. His early resignation can also be seen as a push from Trump, making reappointment impossible. The early resignation has given both sides enough face, and Trump almost holds the majority of the voting rights within the Federal Reserve's structure. At the same time, Hassett's appointment issue should not be too difficult; one can recall the situation when Trump was elected, where both the Senate and House of Representatives were almost entirely Republican victories. Legislative and executive powers were firmly in Trump's hands, and he indeed has the ability to appoint a new Federal Reserve leader; it is just a matter of timing after the initiation. Hassett's relationship with Trump is more like Li Wei and Yongzheng, pointing where to strike. The current Trump is completely different from his first term, and the measures for interest rate cuts will almost be implemented simultaneously. Hassett has previously claimed that if he is elected, the interest rate cuts in 2026 may remain at 150-200 basis points.

Of course, in the previous paragraph, 150-200 basis points is considered a luxury and is unlikely to result in such an outcome. This is also to express loyalty, speaking against his conscience, more for the sake of votes. The most likely change resulting from his appointment is the interest rate cuts at the beginning of the year; at least the interest rate cuts in early 2026 will remain around 50 basis points, and combined with balance sheet expansion, the amount of funds released will be extremely large. This also means that perhaps the cryptocurrency market will show a different trend in early 2026, very likely reaching new highs. The transition will likely be completed by mid-month, and once this event is confirmed, after waiting for Japan's interest rate hike, everyone can start bottom-fishing in anticipation of favorable timing. The only possibility that could threaten bullish users is the interest rate hike in Japan; this interest rate hike will indeed make Japan uncomfortable, with the main purpose being to stop capital outflows and eliminate specific inflation. However, this operation somewhat betrays national interests and is also a last resort.

Many friends tend to overlook Japan's role; in the cryptocurrency space, Asian giants are basically looking at Japan and South Korea. As long as they have a significant outflow of funds, the impact on their domestic economy is quite substantial, and an interest rate hike is also highly likely to occur. Here, I want to clarify a logic: Japan's previous interest rate cuts have almost reached the threshold of zero interest rates. At that time, many enterprises and institutions borrowed yen to purchase Japanese government bonds or gold stocks, cryptocurrencies, and other high-yield markets. This is also the reason why Japan's government bond yields reached a short-term new high, and the current interest rate hike will cause all previous investments to withdraw, which may affect the pricing in the cryptocurrency market. Interest rate hikes and cuts are primarily focused on economic cycles; at this stage, it is impossible to determine how much capital has flowed from Japan into the cryptocurrency market. After the interest rate hike, these funds will likely show a phenomenon of returning.

Therefore, if you have strong confidence in the cryptocurrency market, it is best to wait until after this round of Japan's interest rate hike before choosing to enter the cryptocurrency market. It is still somewhat difficult to directly initiate a bull market in the cryptocurrency space. The 19th will be the decision day for Japan's interest rate hike, and before that, the first thing that will erupt is the expectation of interest rate cuts in the U.S. and subsequent speculation, combined with the transition of the Federal Reserve. This wave of growth will likely be affected by the interest rate hike, so do not easily short before that; I emphasized multiple times yesterday that if you want to enter contracts, you can only go long. As a result, after waking up, all the short positions were trapped. Everyone needs to strengthen their faith and verify themselves. Let's start verifying our short-term speculation: gold has reached a historical new high, breaking through $4200 per ounce, with an intraday increase of 0.23%. This is the power of interest rate cut expectations. The holdings of Bitcoin by listed and private companies have increased to 1.08 million coins, and the giants are still striving to bottom-fish. White House official Hassett: The Federal Reserve still has ample room to cut interest rates, laying the foundation for future direction.

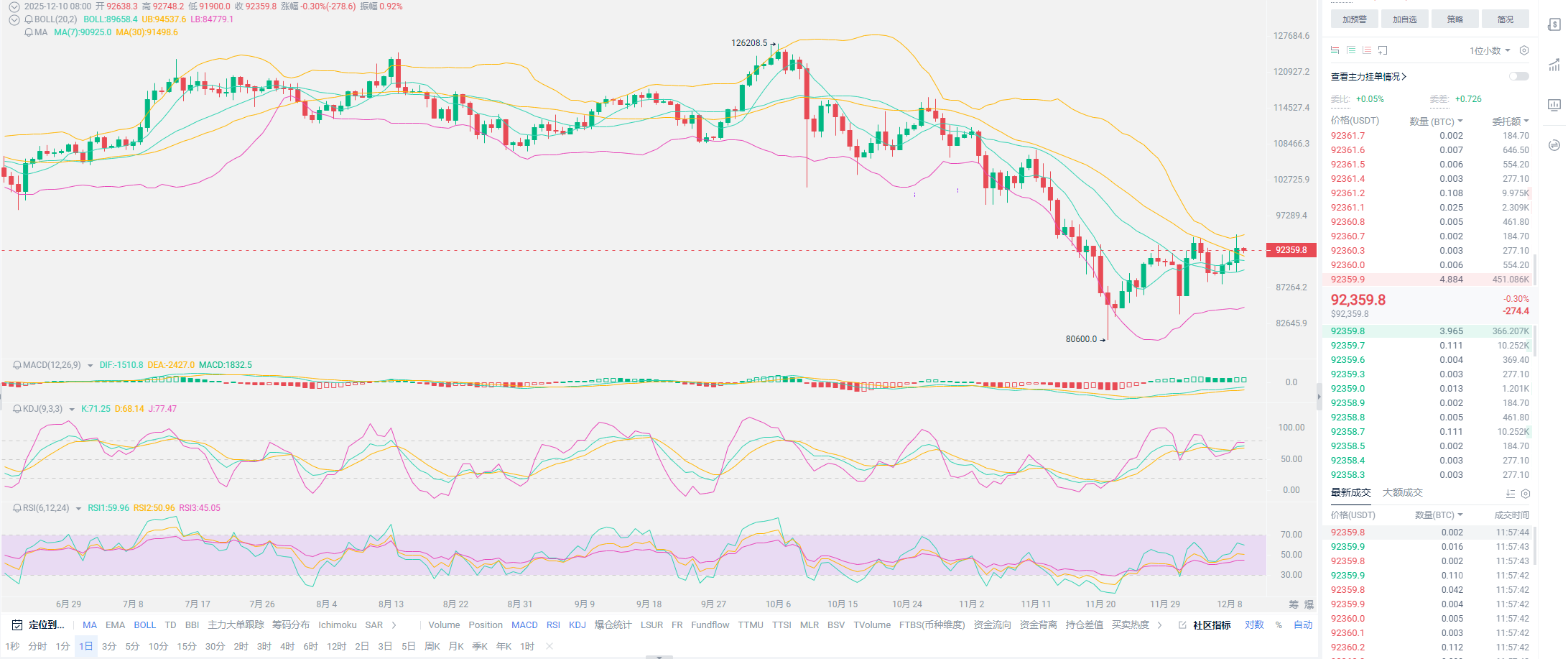

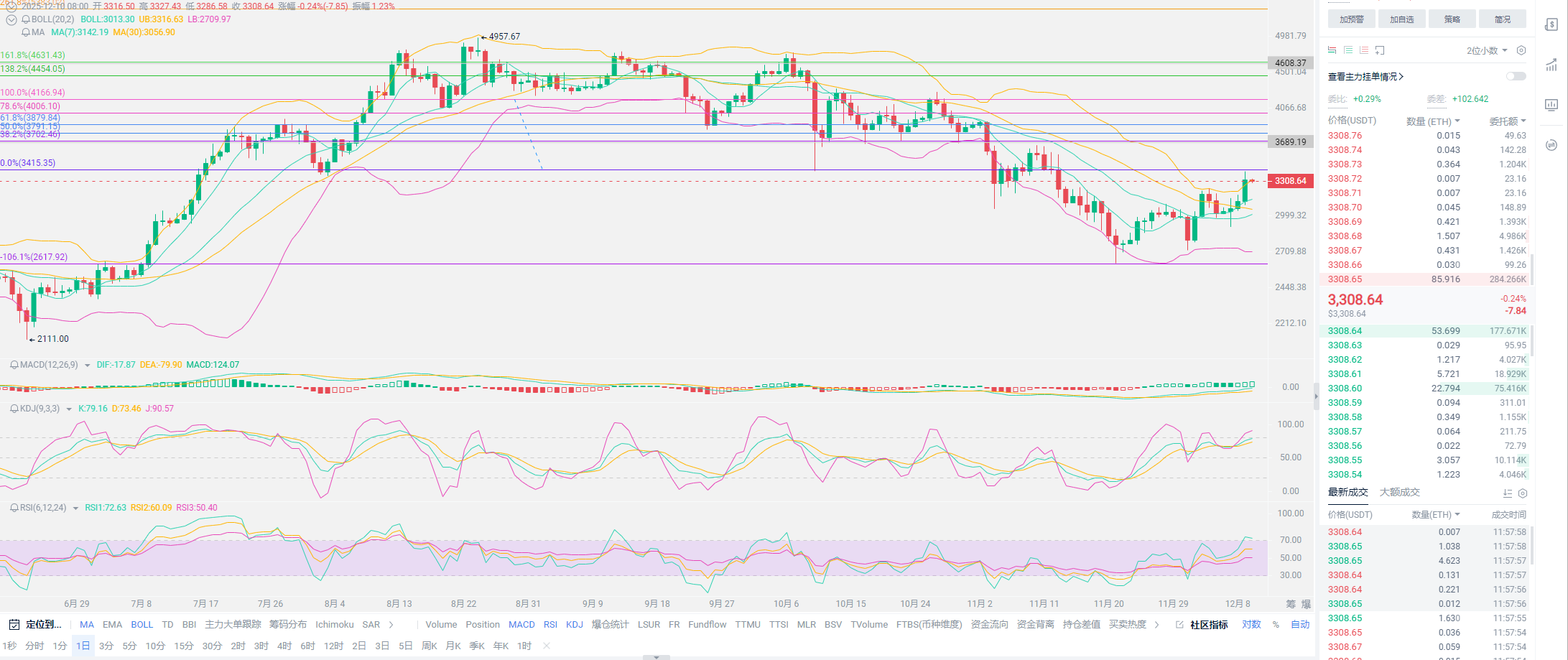

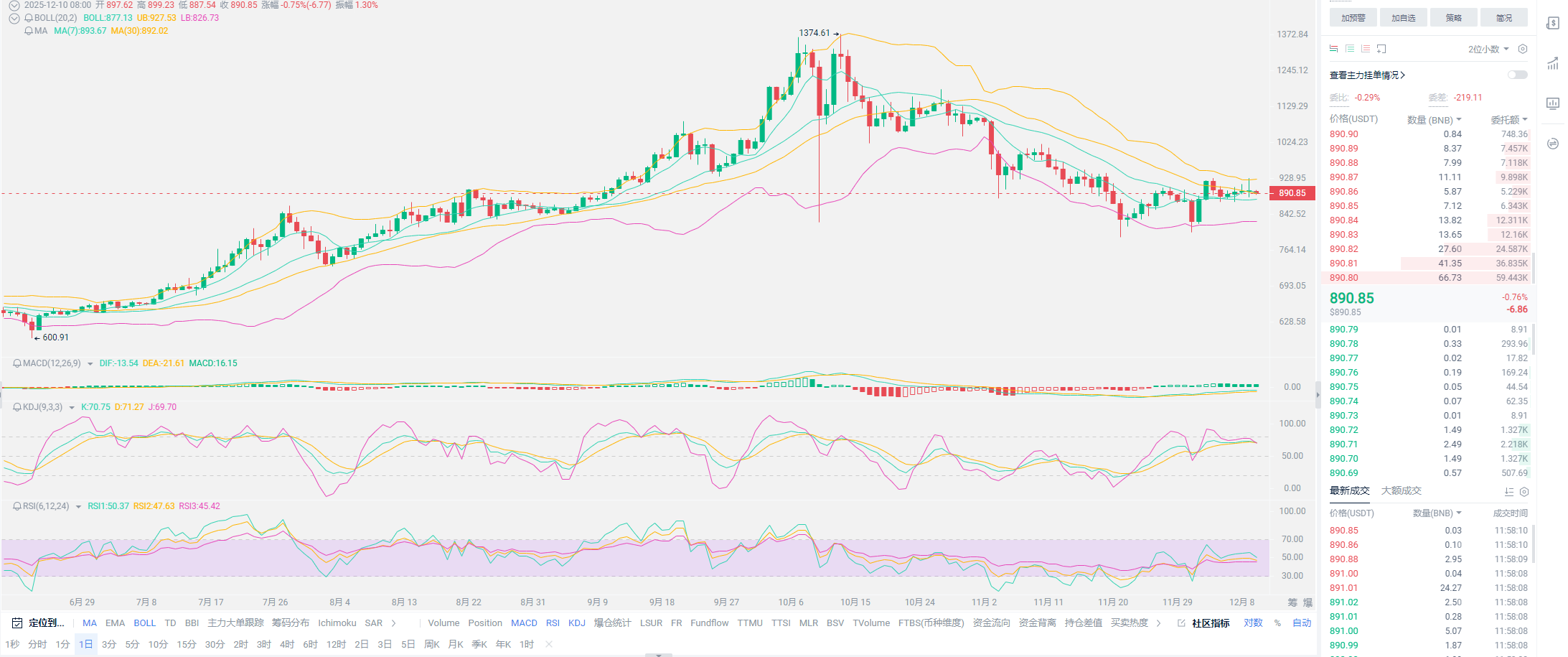

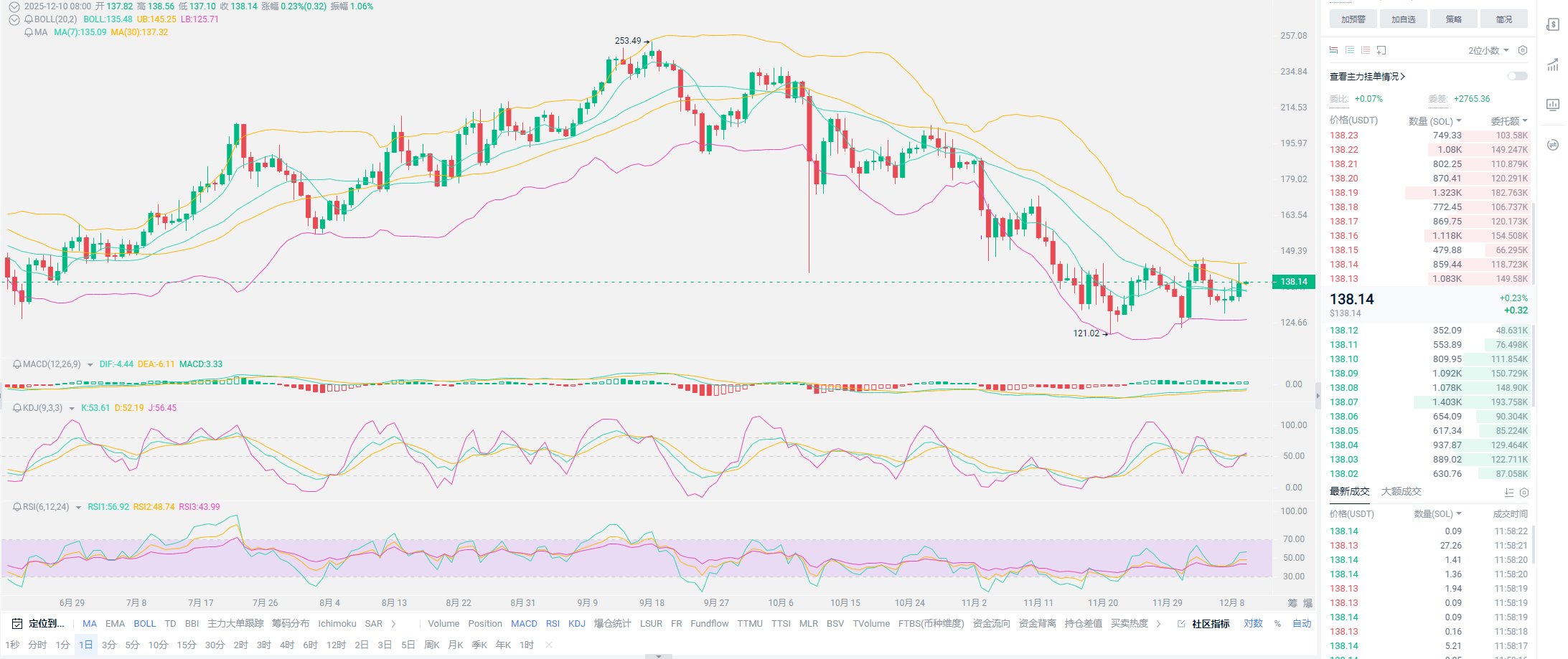

Lao Cui's summary: Recently, I don't want to talk too much about the market trends; the overall trend is consistent with our previous estimates. If you have deep losses in your spot holdings, especially in coins like SOL that Lao Cui previously recommended, many friends joined midway, and most are currently in a state of loss. Such positions should be prepared for at least half a year. At the same time, Lao Cui suggests that you can stake a portion, as the returns are much higher than many markets. I won't strongly promote it; it depends on personal willingness. Choose a staking period of about 1-3 months; by then, the market may perform better. Try to select products that can be redeemed within 72 hours for flexibility. For contract users, do not ignore the trapped short positions; make some operations, especially since the interest rate cuts will start at 3 a.m. on the 11th. It might even break upward; if you can exit at a low position, do so, and try to lock in losses as much as possible, using a larger position to go long and recover losses. If there are users who do not understand the operations, please keep in touch with Lao Cui.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on individual pieces or positions, aiming for the ultimate victory in chess. The novice, however, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。