In the past few days, whether short or long positions, those who followed along have likely made profits!!! Especially yesterday's long positions, which surged significantly due to the expectations of interest rate cuts ahead of the Federal Reserve's interest rate decision. On the daily chart, the price is running above the moving averages, and the MACD continues to expand, indicating a complete bullish structure. Additionally, attention should be paid to the Federal Reserve's interest rate decision in the early hours of December 11, where the probability of a 25 basis point rate cut has reached 89.4%. Coupled with the U.S. employment market data and comments from White House economic advisors regarding rate cuts, these factors have further strengthened the expectations for a rate cut.

Ethereum's trend is similar to Bitcoin's, driven by market expectations of rate cuts. After breaking through the 3400 level, it has seen a slight pullback. On the daily chart, the EMA is trending upwards, indicating a bullish trend. The K-line has shown four consecutive bullish candles, opening the Bollinger Bands, and the MACD is expanding, further supported by the market's rate cut sentiment, which keeps Ethereum's bullish trend intact.

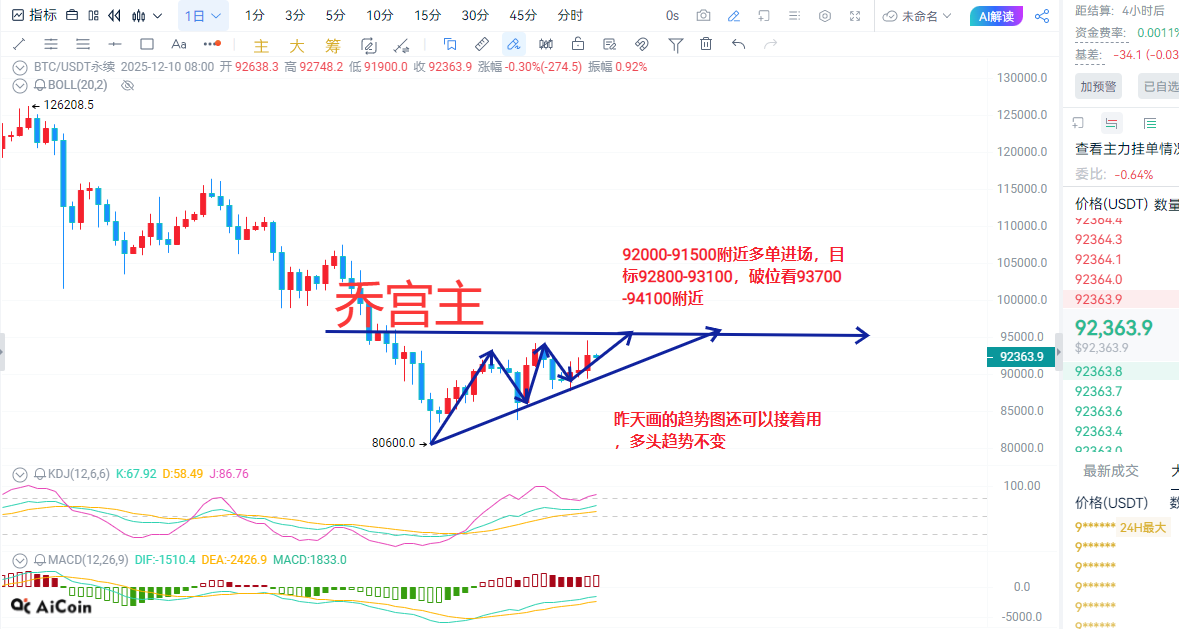

It is recommended to enter long positions around 92000-91500, with a target of 92800-93100, and if broken, look for 93700-94100.

Enter long positions around 3300-3270, with a target of 3350-3370, and if broken, look for 3430-3470.

Market conditions change rapidly, and strategies are for reference only. For specifics, please contact Q: 1284283739.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。