Source: BIRN Balkan Investigative Reporting Network

Translation: BlockWeeks Blockchain Weekly

In Montenegro, cryptocurrency trading remains in a regulatory vacuum. People conduct transactions through offline cash exchanges and unverified intermediaries, evading legal oversight.

A trader posts an advertisement on social media, and both parties agree on transaction details via chat software—within just a few minutes, 70 USDT is transferred from one crypto wallet to another, while 60 euros in cash is exchanged on the busy streets of Podgorica (the capital of Montenegro). The fee is 5 euros, with no questions asked and no inquiries about the source of funds.

After the transaction is completed, both parties quickly shake hands and leave, with the trader stating he has other clients waiting for service.

This scene is a true reflection of the "gray area" of cryptocurrency in Montenegro: cryptocurrencies are exchanged for cash outside the purview of legal regulation, with undercurrents flowing.

Anonymity, Cash, and High Risk

In fact, although Montenegro has promised to establish regulatory laws for digital assets since 2020, none have been implemented to date.

While transferring funds from a bank account to a crypto trading platform is not illegal, cryptocurrencies cannot be exchanged for fiat currency through banks or registered exchange institutions.

At this point, intermediary platforms, Telegram groups, and online forums have become the main trading channels—known as "over-the-counter" (OTC) trading. Transactions are usually completed offline, with cryptocurrencies exchanged directly for cash, and no identity verification is required.

According to statistics from the blockchain forensics and crypto risk assessment platform "Global Ledger," the crypto wallet address used by BIRN reporters for this transaction processed transactions worth millions of euros between October 2024 and October 2025. The largest single incoming transaction was 440,000 euros, and the largest single outgoing transaction exceeded 500,000 euros.

Most of these transactions were conducted through well-known crypto platforms like Binance and Gate.io, with about 75% of the activity occurring on low-risk platforms. However, a quarter of the transactions were classified as medium to high risk, including dealings with "frozen funds" (assets associated with frozen or sanctioned wallets) and entities sanctioned by the U.S. Financial Crimes Enforcement Network (FinCEN). Global Ledger rated the risk level of the trader's crypto wallet as "medium."

"In Podgorica, just ask anyone who deals with cryptocurrencies—everyone has their own 'trader,'" said Ivan Jolicic, a developer of the Montenegrin digital currency Perper and a crypto expert. These traders not only come from Montenegro but also include many foreigners from Russia, Ukraine, and Turkey.

"Participants include local crypto investors as well as foreigners, especially Russians, Ukrainians, and Turks. For them, this is the only way to make a living in Montenegro," Jolicic revealed to BIRN. "They need to pay for living expenses in Montenegro, but banks are either unwilling or outright refuse to open accounts for them."

Another active crypto trader in the Balkans declined the reporter's request to exchange 70 euros for Bitcoin, stating that his trading threshold is "no less than 10,000 euros per transaction."

Russian Telegram Groups Form Trading Hubs

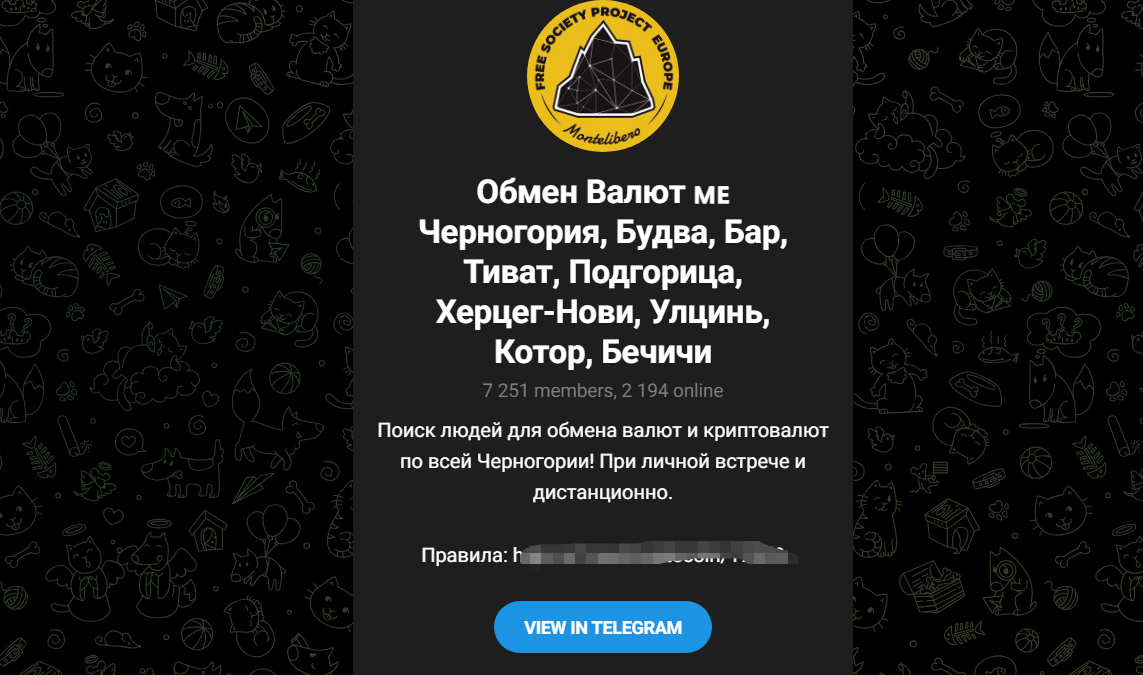

BIRN reporters discovered that several Telegram channels and online forums operate crypto exchange services in the Balkans or specifically for Montenegro. The number of group members ranges from dozens to thousands, with content including exchange amounts, exchange rates, fees, and specific transaction locations.

A Russian-language Telegram group named "Обмен Валют Montenegro" (Montenegro Currency Exchange) has over 7,000 members and specializes in direct exchanges of cryptocurrencies for cash.

The group advises users to "only trade in person in public places and take necessary precautions," but also allows transactions through online-verified traders—these traders must submit passport information for group verification to obtain a certification mark.

The group logo and administrator usernames include the "Montelibero" community symbol. This community, located near the port city of Bar in Montenegro, was established by Russians in 2021 and claims to be a "free society" based on anarcho-capitalist principles, issuing its own cryptocurrency EURMTL.

Victor Korb, a member of the Montelibero community council, denied any connection between the community and the Telegram group: "Questions about others using the Montelibero project logo should be directed to the users themselves."

Montenegro's tax authorities stated that they cannot tax such transactions due to a lack of legal basis.

"Until digital assets and their transactions are legally regulated, we cannot take any action," the Montenegrin tax office responded. "Once the legal framework is established, the tax authorities will take all measures within their jurisdiction."

Despite the slow legislative process, there has been some preliminary progress.

In February 2025, the parliament passed amendments to the "Anti-Money Laundering and Counter-Terrorism Financing Law," adding a "Register of Crypto-Asset Service Providers," which requires "Know Your Customer" (KYC) verification for every crypto transaction exceeding 1,000 euros.

The Montenegrin Capital Markets Commission (an independent securities and capital market regulatory body) has been tasked with completing the establishment of the register by mid-December 2025.

"Individuals or entities providing cash exchange services for cryptocurrencies through social media operate in an unregulated 'gray area,'" the commission stated. "If service providers are not registered and do not comply with the law, their activities may be deemed illegal—especially in cases of suspected money laundering, unauthorized provision of financial services, or evasion of regulatory measures."

However, Jolicic is skeptical about this. He believes that the registration requirements contradict the current operational logic of the gray area: "Those engaged in OTC crypto trading must register and conduct KYC verification for each client—but currently, no one is enforcing this. The law remains vague, and I believe these activities are essentially in violation of anti-money laundering regulations."

Legislative Revisions on the Horizon

BIRN previously revealed that there have been cases in Montenegro where cryptocurrencies were used to purchase real estate and vehicles, but such transactions have not been incorporated into the tax or legal system.

Due to the lack of a legal framework, authorities are even unable to accurately grasp the information regarding the crypto assets held by public officials.

In mid-2023, the European Union's executive body—the European Commission—passed the "Markets in Crypto-Assets Regulation" (MiCA), establishing a unified framework for digital asset regulation in the EU.

In September 2025, Montenegrin Prime Minister Milojko Spajic announced plans to develop digital asset laws that comply with EU standards, with the Ministry of Finance initiating public consultations on related drafts.

The proposed amendments to the "Credit Institutions Law" will define the concept of "digital assets" for the first time, allowing credit institutions to provide crypto-related services (including digital token custody, trading platform operation, and trading intermediation); the amendments to the "Tax Administration Law" will align Montenegrin law with the EU's "Directive on the Automatic Exchange of Information on Crypto Assets."

The Ministry of Finance stated that this will enable the Montenegrin tax authorities to automatically exchange digital asset information with EU member states and other countries. Crypto service providers will be required to collect and maintain user data (including accounts, transactions, and crypto income) and submit formal reports to the national service provider register.

"Regarding the taxation of digital assets, we emphasize that once the digital asset regulatory law comes into effect, the Ministry of Finance will amend tax laws to clarify the tax treatment of digital assets," the Ministry of Finance responded.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。