On the 1-hour chart, XRP is locked in a volatile dance between $2.05 and $2.18, with price action rejecting the upper band near $2.178. The recent bounce failed to sustain momentum, and sharp sell-off candles hint at hesitation among short-term traders. Notably, the exponential moving average (EMA) for 10 periods sits just below the current price at $2.09, while the simple moving average (SMA) for 10 periods tracks closely at $2.09—both offering minimal cushion.

Indicators such as the relative strength index (RSI) at 46.26 and the Stochastic oscillator at 30.98 suggest neither overbought nor oversold conditions, giving traders little to lean on. If XRP holds the $2.05–$2.07 support with conviction, scalpers might smell opportunity, but a weak bounce under $2.15–$2.18 could warrant tightening the seatbelt.

XRP/USD 1-hour chart via Bitfinex on Dec. 9, 2025.

Zooming out to the 4-hour chart, XRP shows subtle signs of resilience, albeit wrapped in a shroud of skepticism. The recent bounce from $1.98 to $2.17 appears to be losing steam as the price pulls back to $2.12. A minor uptrend is emerging with higher lows, suggesting a soft reversal attempt, though $2.22 remains the immediate resistance to watch. Volume spikes—those green bars that get traders’ hearts racing—reveal a surge in dip-buying behavior, possibly foreshadowing bullish intent. But don’t get too cozy; should XRP falter again at $2.22, the narrative could quickly revert to bearish déjà vu.

XRP/USD 4-hour chart via Bitfinex on Dec. 9, 2025.

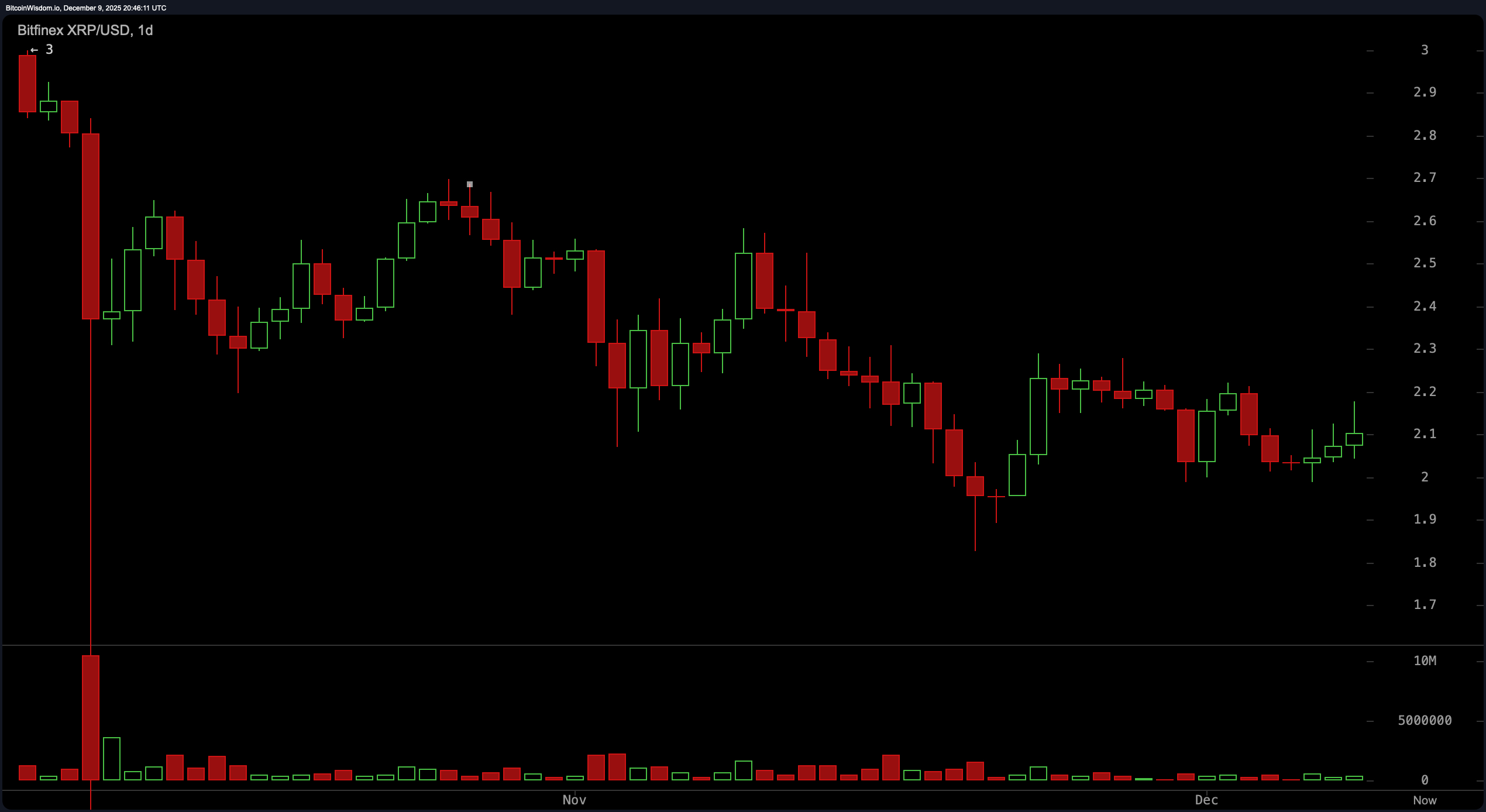

On the daily chart, XRP’s broader trend is decidedly downward, characterized by a string of lower highs and lower lows since early November. XRP continues to hug a well-established support zone near $1.90–$2.00, which has absorbed selling pressure multiple times. The volume profile on the daily shows a meaningful spike around $1.90, signaling a demand zone that traders are watching like hawks. Momentum and MACD (moving average convergence divergence) both flash mild optimism with some positive signals, while other indicators, including the average directional index (ADX) at 19.14 and commodity channel index (CCI) at 2.82, remain notably neutral. Consolidation candles around $2.10 per XRP aren’t exactly shouting breakout, but they are whispering, “watch this space.”

XRP/USD 1-day chart via Bitfinex on Dec. 9, 2025.

When it comes to moving averages (MAs), XRP’s current positioning feels like a textbook case in mixed signals. The short-term moving averages—exponential and simple over 10 and 20 periods—point to upward bias, with the EMA (10) at $2.09 and SMA (20) at $2.10. However, the longer-term averages sing a different tune, with all 30, 50, 100, and 200-period EMAs and SMAs floating above the current price, reflecting broader structural weakness. The EMA (200) at $2.47 and the SMA (200) at $2.60 are especially telling, serving as long-term resistance caps. Unless XRP can break above $2.30 with sustained volume, it risks staying stuck in this mid-$2 limbo.

To sum it up, XRP is playing a high-stakes waiting game. Price action is stuck in a short-term range, oscillators are dozing in neutral territory (aside from momentum and MACD leveling up ever so slightly), and moving averages are embroiled in a heated war between short and long-term trends. XRP traders would be wise to avoid romanticizing breakouts unless volume comes in like a wrecking ball. For now, XRP is parked at a technical crossroads—with no clear directional commitment, but with enough volatility to keep everyone on their toes.

Bull Verdict:

If XRP can maintain support above $2.05 and gather momentum past $2.22 with conviction, the technical indicators may shift decisively in its favor. Short-term moving averages are already aligned with upward price pressure, and a clean break above $2.30 could spark renewed market enthusiasm. In that case, XRP might just be coiling for a move that breaks the current downtrend’s grip and reclaims higher ground.

Bear Verdict:

XRP’s failure to surpass resistance at $2.22, coupled with a heavy overhead from long-term moving averages, casts a long shadow over any bullish aspirations. The medium-term trend remains in decline, and with daily structure still printing lower highs, any bounce could turn out to be a mirage. Unless buying volume steps in dramatically, XRP risks slipping back toward the $1.90 zone—and potentially beyond.

- What is the current XRP price?

XRP is trading at $2.11 as of December 9, 2025. - What key level should XRP watchers monitor?

The $2.22 resistance level is critical for any short-term breakout. - Where is XRP’s strongest support right now?

XRP has firm support between $1.90 and $2.00 based on recent price action. - Is XRP trending up or down?

XRP remains in a medium-term downtrend despite short-term bounces.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。