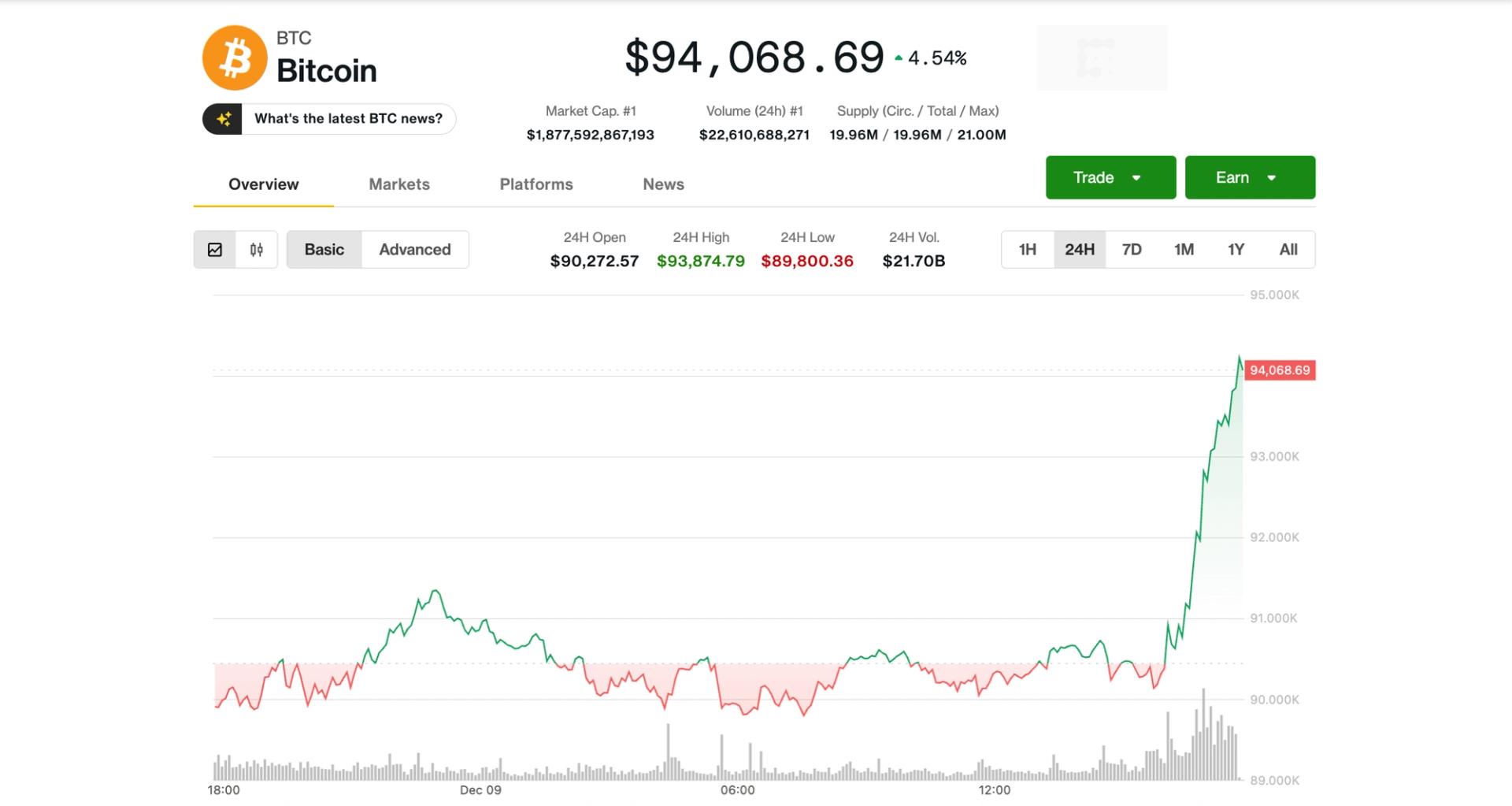

What started as a slow U.S. morning on crypto markets has taken a quick turn, with bitcoin re-taking the $94,000 level.

Hovering just above $90,000 earlier in the day, the largest crypto surged back to $94,000 minutes after 16:00 UTC, gaining more than $3,000 in less than an hour and up 4% over the past 24 hours.

Ethereum's ether jumped 5% during the same period, while native tokens of and Chainlink climbed even more.

The action went down while silver climbed to fresh record highs above $60 per ounce.

While broader equity markets remained flat, crypto stocks followed bitcoin's advance. Digital asset investment firm Galaxy (GLXY) and bitcoin miner CleanSpark (CLSK) led with gains of more than 10%, while Coinbase (COIN), Strategy (MSTR) and BitMine (BMNR) were up 4%-6%.

While there was no single obvious catalyst for the quick move higher, BTC for weeks has been mostly selling off alongside the open of U.S. markets. Today's change of pattern could point to seller exhaustion.

Vetle Lunde, lead analyst at K33 Research, pointed to "deeply defensive" positioning on crypto derivatives markets with investors concerned about further weakness, and crowded positioning possibly contributing to the quick snapback.

Further signs of bear market capitulation also emerged on Tuesday with Standard Chartered bull Geoff Kendrick slashing his outlook for the price of bitcoin for the next several years.

The Coinbase bitcoin premium, which shows the BTC spot price difference on U.S.-centric exchange Coinbase and offshore exchange Binance, has also turned positive over the past few days, signaling U.S. investor demand making a comeback.

The Federal Reserve is expected to lower benchmark interest rates by 25 basis points at its two-day meeting concluding on Wednesday. While the rate cut is largely anticipated by market participants, looser financial conditions with a resilient U.S. economy could help bolster risk appetite on markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。