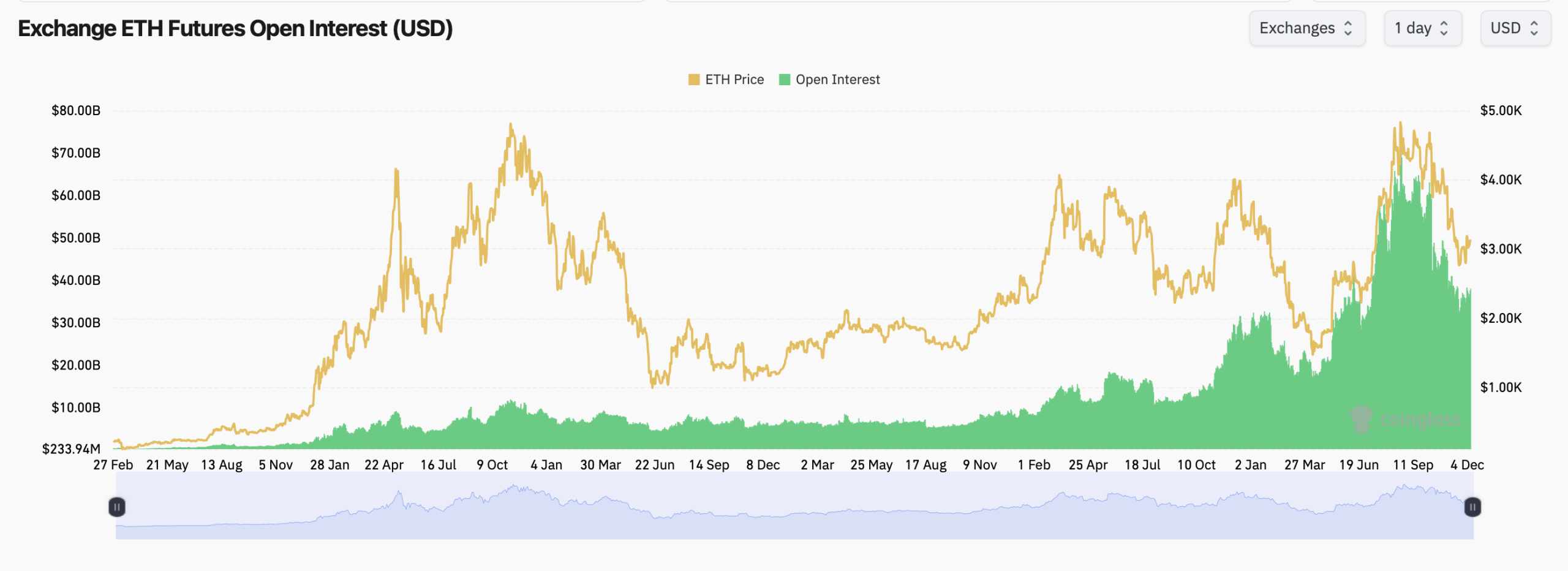

Ethereum is trading near $3,291, and futures open interest across all exchanges sits at roughly 12.24 million ETH, equal to about $38.07 billion, according to coinglass.com figures. That number is sizable on its own, but the more interesting story is how uneven the flows have been.

CME, which controls a hefty 2.02 million ETH in open interest and now accounts for about 16.5% of global futures exposure, saw light cooling in the most recent hour before posting a tiny uptick later in the session. Binance, holding an even larger 2.57 million ETH and commanding just under 21% of total open interest, followed a similar pattern, with pockets of outflows showing traders trimming risk around the edges.

Bybit and Kucoin, meanwhile, were two of the only exchanges flashing green on short-term inflows, suggesting that smaller venues may be picking up directional bettors while the majors stay cautious. The 24-hour changes tell the real story: nearly every exchange saw open interest decline, confirming that traders are de-risking into December rather than pressing their advantage.

The broader futures data reinforces this tension-fueled trend. Ethereum’s total futures open interest remains historically elevated — still stacked in the tens of billions — even after cooling from earlier peaks. When open interest stays high while price trades sideways, the market tends to behave like a coiled spring: the eventual move is rarely gentle, and December historically has a reputation for proving that point.

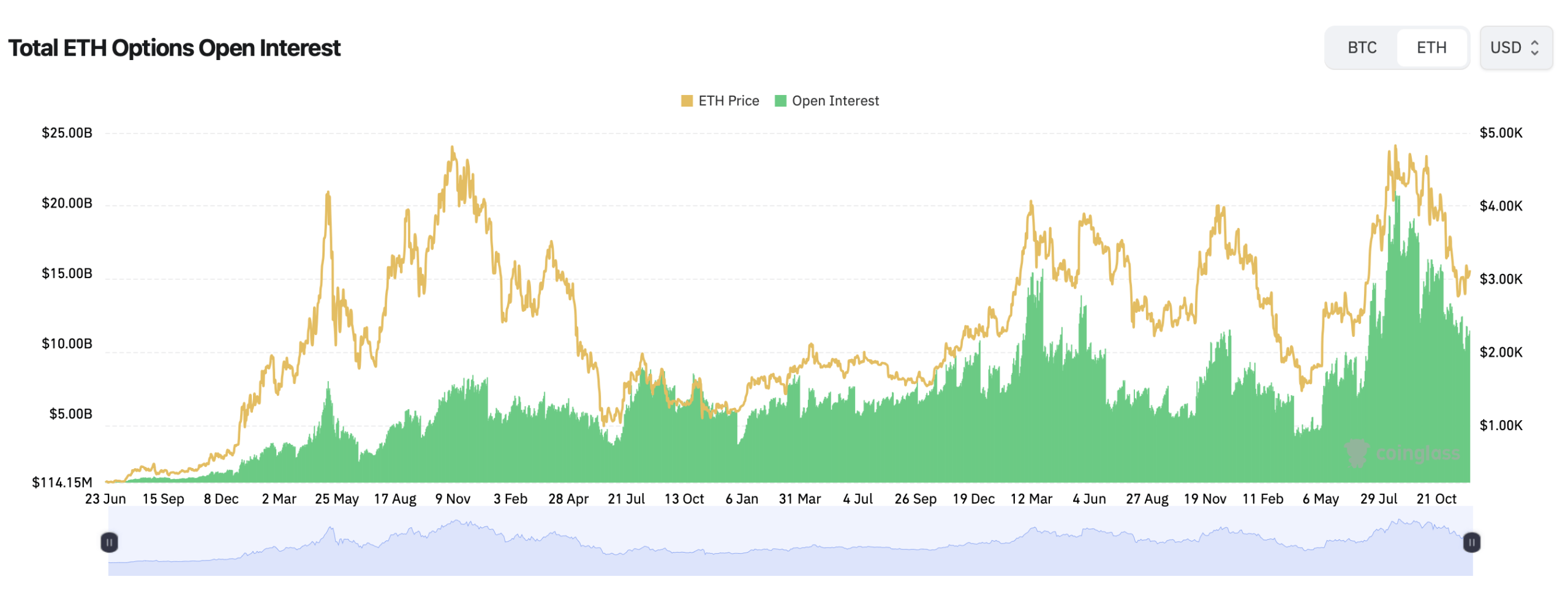

Ethereum’s options market adds another layer of intrigue. Coinglass stats indicate that open interest in calls still outweighs puts by a significant margin on Tuesday, with calls representing about 62.6% of all outstanding options while puts account for roughly 37.4%. In simple terms, this shows that more traders are betting on or protecting against upside moves than downside ones. But the volume tells a moodier story.

Over the last day, calls made up only 58% of activity while puts climbed to nearly 42%, showing traders quietly stocking up on downside protection. It’s not a shift toward panic — more like the market slipping on a seatbelt before the ride starts. On the other hand, strike activity on Deribit, the undisputed heavyweight of ether options, shows traders crowding around some ambitious price targets for late December.

Contracts tied to $6,000 hold the most open interest, followed closely by strikes at $4,000, $5,000, and even a $7,000 high note. That means traders are still willing to position for a strong upside move, even if the spot price is barely holding the $3,100 line. It’s speculative, yes, but it also reflects a market that hasn’t given up on a late-month surprise ‘Santa Rally.’

On the volume side, the busiest contracts were clustered around December expiries near the $5,100 to $5,500 range, with Bybit and Deribit sharing the bulk of activity. Tuesday’s records show these trades reflect a simple sentiment: nobody knows where ETH will land, but plenty of traders want exposure to the big swings.

Max pain levels — the prices at which option sellers theoretically benefit the most — sharpen the December outlook. On Deribit, the max pain zone hovers near the low-$3,000s for upcoming December expirations before rising into the mid-$3,000s and eventually spiking above $4,000 for early-2026 contracts. Binance follows a similar curve, although its near-term max pain levels sit slightly lower, clustering around $3,000 to $3,100 before drifting higher for later expiries.

In plain language, the options market is signaling that ethereum is more likely to gravitate toward the $3,000 to $3,300 range in the short term, even though traders continue to buy exposure to wilder price paths.

Read more: 8 AI Chatbots Deliver Wildly Different Bitcoin Price Predictions — Which One Nails Dec. 31, 2025?

Combining all of this with the broader sentiment — where analysts see a mixed December with a possible push toward $3,400, $3,800, or even higher if resistance levels break — the roadmap becomes clearer: the market has upside dreams but short-term caution. Both the futures and options data logged this week reflect a market bracing for movement but not yet committing to a clean breakout. It’s the kind of setup that makes December notorious for fakeouts, whipsaws, and the occasional holiday miracle.

Ethereum’s derivatives structure ultimately paints December as a month where traders should expect motion. The futures market is still decently large, the options market leans bullish but increasingly hedged, and max pain levels imply gravity pulling back toward the low-$3,000s before any decisive trend emerges. Traders aren’t panicking — but they’re definitely preparing for some impact this month.

- What is driving Ethereum’s derivatives volatility in December?

High open interest, shifting options activity, and concentrated max pain levels are creating conditions for sharp price moves. - Why are Ethereum traders increasing put activity?

More puts are being purchased as traders hedge against downside while still keeping upside exposure through calls. - What do current max pain levels suggest for Ethereum’s price?

Max pain clustering near $3,000 to $3,300 implies ETH may gravitate toward that range before major trend confirmation. - How does Ethereum’s futures market compare to previous months?

Futures open interest remains historically elevated, signaling heavy positioning even as traders reduce leverage short-term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。