The new week opened with a split narrative across crypto ETFs, one where bitcoin stumbled, yet ether and XRP found the momentum that eluded the market leader. Trading desks saw brisk activity, and while the sentiment was hardly bearish across the board, bitcoin ETFs’ pullback set the week off on a cautious footing.

Bitcoin ETFs recorded a $60.48 million outflow, ending the day firmly in the red despite a healthy inflow from Blackrock’s IBIT. IBIT absorbed $28.76 million, but the strength there was overshadowed by a wave of exits: $44.03 million drained from Grayscale’s GBTC, $39.44 million left Fidelity’s FBTC, and another $5.76 million flowed out of Vaneck’s HODL. Even with $3.14 billion traded on the day, the category couldn’t regain its footing as total net assets settled at $118.50 billion.

Ether ETFs, in contrast, started the week on the offensive. The group posted a $35.49 million inflow, driven entirely by two funds. Blackrock’s ETHA led with a $23.66 million addition, while Grayscale’s Ether Mini Trust contributed another $11.83 million, reinforcing the renewed investor interest that has been building around ETH. Total value traded hit $1.34 billion, pushing net assets up to $19.61 billion.

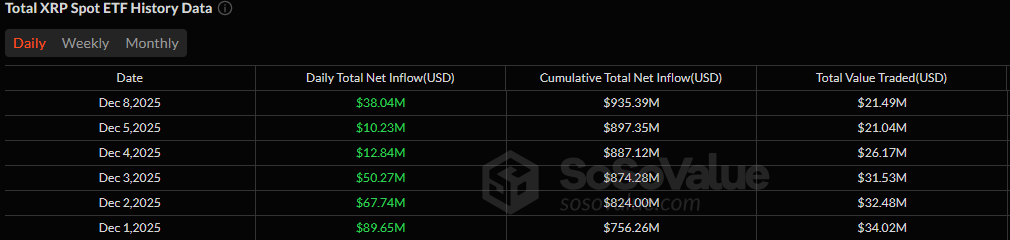

XRP ETFs’ inflow streak reached its 16th day.

XRP ETFs delivered one of the day’s standout performances with a $38.04 million inflow, another strong showing for a category that has quietly stacked gains week after week. Franklin’s XRPZ dominated with $31.70 million, followed by $4.20 million into Bitwise’s XRP, $1.33 million into Canary’s XRPC, and $810K into Grayscale’s GXRP. Total trading volume reached $21.49 million, while net assets held steady at $923.71 million.

Read more: ETF Flows Recap: Red Week for Bitcoin and Ether, Green for Solana and XRP

Solana ETFs logged a small but steady positive, recording a $1.18 million inflow, entirely from Fidelity’s FSOL. Trading was relatively light at $22.22 million, with net assets unchanged at $890.11 million.

FAQ 📊

- Why did Bitcoin ETFs start the week in the red?

Bitcoin ETFs saw $60 million in outflows as major issuers faced sizable withdrawals. - Which crypto ETF categories recorded inflows?

Ether, XRP, and solana ETFs all posted positive inflows to kick off the week. - What drove the strong inflows into XRP ETFs?

Franklin’s XRPZ led the category with over $31 million in new capital entering the fund. - How did Ether ETFs perform compared to Bitcoin?

Ether ETFs posted a $35 million inflow, signaling improving sentiment around ETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。