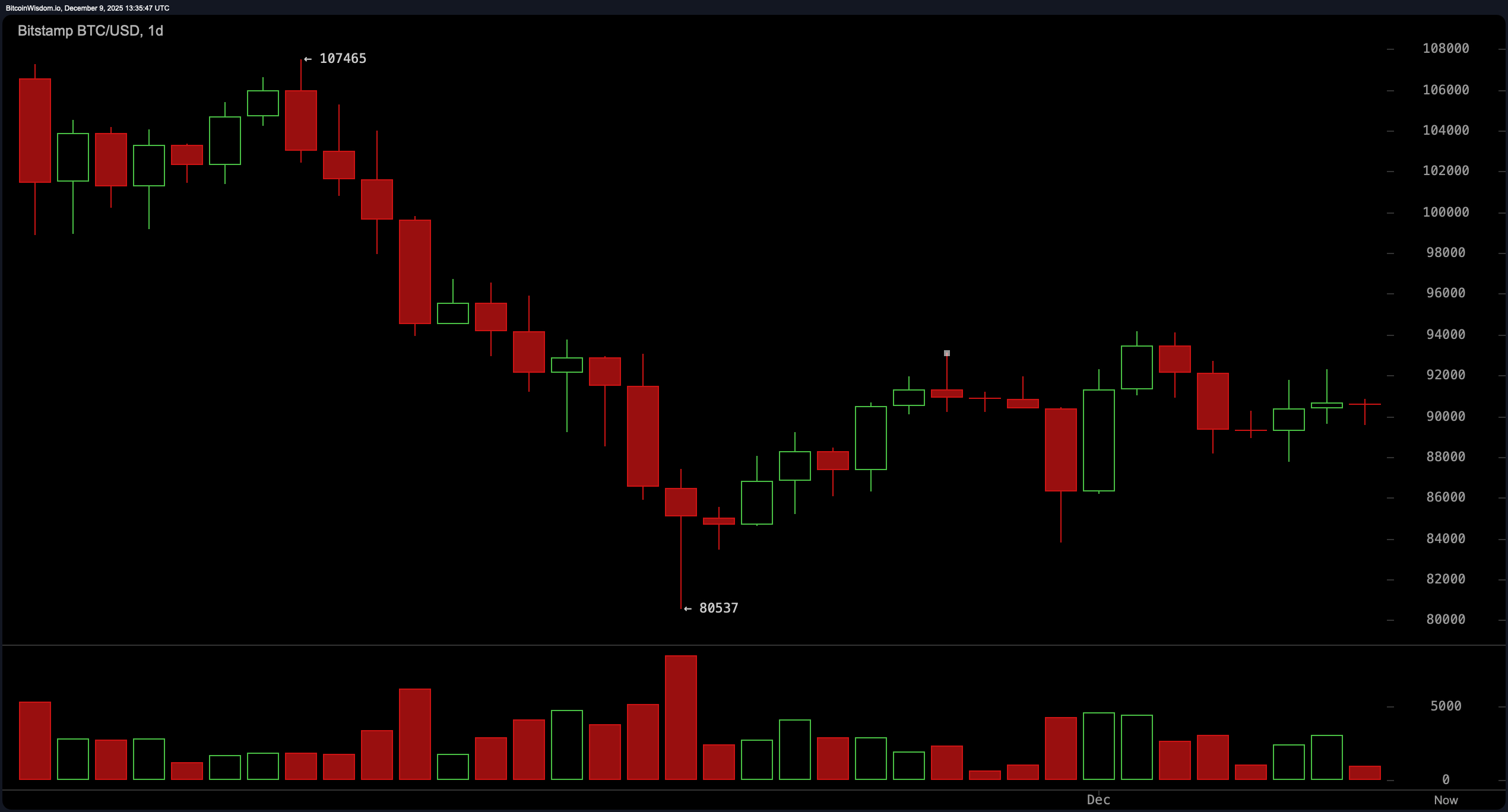

Despite the fanfare surrounding its six-figure aspirations, bitcoin’s daily chart paints a not-so-rosy macro backdrop. The asset remains in a corrective phase, licking its wounds after tumbling from a peak near $107,465 and bottoming around $80,537. Since then, a modest recovery into the low $90,000s has failed to inspire conviction.

Candles have slimmed down and volume has taken a nosedive, both classic signs of a rebound that’s barely hanging on. Resistance at the $92,500 to $94,000 level acts like a velvet rope at the club entrance, keeping the hopeful masses waiting while sellers rule the dancefloor.

The four-hour chart isn’t handing out optimism either. After a slip from $94,172 and a sharp plunge to $87,744, bitcoin clawed its way back toward $91,000—but with the energy of a dog on a treadmill. Every move upward has been met with declining momentum, capped around $91,500. A failure to hold the $89,000 floor would likely usher in a revisitation of the mid-$87,000 zone, and we’ve seen that movie before. In essence, this timeframe tells a story of attempted stabilization—without the applause.

Zooming into the one-hour chart reveals even more drama in miniature. After peaking at $92,296, bitcoin pulled back to $89,558 and is now trudging along with lower highs and fading volume. This isn’t a stage set for triumph; it’s one for short-term distribution. With resistance lurking at $91,200 and support clinging at $89,800, the price action feels like a game of Jenga—one wrong move, and it could all tumble. Until there’s a strong hourly close above $91,200 with decisive volume, upward ambitions remain just that: ambitions.

On the technical indicators front, the oscillators are collectively shrugging their shoulders. The relative strength index (RSI) reads 45, signaling neutrality. The Stochastic oscillator sits at 65, also neutral. The commodity channel index (CCI) at 39 and the average directional index (ADX) at 32 join the same neutral chorus. Meanwhile, the Awesome oscillator dips negative, and momentum, along with the moving average convergence divergence (MACD), both flash subtle hints of upward intent—but without a standing ovation.

Moving averages tell a tale of conflict. The short-term indicators—exponential moving average (EMA) 10 at $90,445 and simple moving average (SMA) 10 at $90,388—favor upward movement. But the medium and long-term figures have formed a bearish barricade. EMA 30 through EMA 200 and their simple counterparts are all lined up in a row, flashing red like a disgruntled stoplight. Unless bitcoin can shake off the weight and push past $92,500 with gusto, the technicals suggest it’s playing defense more than offense.

Bull Verdict:

If bitcoin manages to reclaim and hold above $92,500 on convincing volume, it could signal the end of the corrective phase and pave the way for a renewed push toward the $94,000 zone. The short-term moving averages offer a thin layer of optimism, and with momentum indicators like the moving average convergence divergence (MACD) and momentum showing some upward lean, there’s just enough fuel for a rally—provided buyers finally show up to the party.

Bear Verdict:

With lower highs, fading volume, and a wall of resistance between $91,200 and $92,500, bitcoin remains vulnerable to downside pressure. The macro trend is still weighed down by longer-term moving averages, and failure to hold the $89,000 support could reopen the path to $87,700—or worse, the $85,000 region. In short, unless bulls can break the cycle, bears still have the upper hand.

- What is the current bitcoin price today?

Bitcoin is trading at $90,598 as of December 9, 2025. - Is bitcoin in an uptrend or downtrend right now?

Bitcoin remains in a corrective phase with weak momentum across all timeframes. - What are the key bitcoin support and resistance levels?

Major resistance sits at $92,500–$94,000, with support near $89,000 and $87,700. - Is bitcoin showing signs of a breakout or breakdown?

A breakout requires a close above $92,500, while a drop below $89,000 signals further downside.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。