Written by: Yokiiiya

Today, while chatting with a friend, he posed an interesting question: "If Crypto × Fintech really creates gains in the next 10 years, who will be the biggest winners? In other words, which companies will be the 'Mag7' in this field?"

Revolut, Robinhood, Coinbase, Stripe… these are obviously the first names that come to mind. Over the past decade, they have proven their ability to reinvent certain parts of traditional finance.

But as we talked, I suddenly realized that my previous thinking framework had a flaw. I was always asking — "What parts of traditional finance have not been redone?" This logic is essentially still looking for blanks on an old map.

But the real question should be: Which companies are not digitizing old finance but are creating an entirely new financial market?

In this framework, one name is almost a given — Polymarket. Not because it has risen quickly, nor because it has been frequently cited by the media recently, but because what it does is completely different: it does not transform banks or payments; it transforms the "event" itself. It turns events into assets and probabilities into prices.

Coincidentally, prediction markets have seen a resurgence in popularity over the past year. So we naturally ask another more important question: Why will prediction markets suddenly become "one of the most worthy research tracks" in 2024–2025? And in this revival, what paths do Polymarket, Kalshi, and Opinion each represent?

II. Why Will Prediction Markets Heat Up Again in 2024–2025?

If we only use "U.S. elections" and "celebrity events" to explain this wave of popularity, it actually doesn't hold water. There have been countless hot topics in recent years, but prediction markets have never risen this high. This time is different. There are several deeper structural changes behind it.

1) AI Makes "Probabilities" Important Again

In the past, the answers given by large models were judgment statements; now, more and more scenarios are starting to output probabilities. Predicting CP, predicting interest rate cuts, predicting corporate events, predicting policy directions — once probabilities appear, a natural demand arises: probabilities need prices, and prices need markets. Thus, prediction markets have become a part of the AI workflow for the first time, rather than just a "speculative tool." The impact of this will far exceed the discussions we see today.

2) It Has Been Treated by the Media as a "Real-Time Sentiment Indicator"

In the past year, one change has been very obvious: more and more mainstream media outlets have started to cite Polymarket. Why? Because it is faster than polls and more transparent than expert judgments. Media citations → user growth → market depth improvement is a simple but effective flywheel. The reason prediction markets were not large enough in the past was that they had not entered mainstream narratives; now they have.

3) High Event Density, but the Market Lacks "Corresponding Tools"

In the world of 2024–2025, the information density is higher than at any time in the past decade: elections, geopolitics, macro policies, technology regulations, corporate events (especially AI). The problem is that these events have significant impacts, but there are no corresponding financial tools to trade.

You can buy gold, buy U.S. stocks, buy government bonds, but you cannot buy: "the probability change of the Federal Reserve cutting interest rates in December," "whether a certain CEO will leave this quarter," or "whether a certain regulation will be implemented." Prediction markets just happen to fill this gap. Essentially, it creates a new type of asset: event assets.

4) Regulatory Attitudes Have Undergone Small but Important Changes

The CFTC once penalized Polymarket, but at the same time, Kalshi obtained a CFTC license. This sends a very realistic signal: part of the prediction market can be allowed, and part can take a compliant route; the gray area is starting to be divided. For institutional investors, "uncertainty being reduced" is a growth signal.

5) User Structure Has Changed

In the past: dominated by entertainment users, liquidity was dispersed, and the product resembled an "information application." This wave is clearly different: there are more institutional accounts, professional players making indicator predictions are entering, and funds using it for hedging are increasing. As the user structure upgrades from "bystanders" to "traders," the quality of the market will undergo a qualitative change.

Summary

Prediction markets did not suddenly become popular. They are the result of the combined structural uplift formed by AI demand, media citations, macro environment promotion, changes in user structure, and gradually clarifying regulatory boundaries. This wave is not driven by short-term events. It is more like prediction markets have finally gained "use cases of the times."

III. Three Completely Different Paths: Polymarket, Kalshi, Opinion

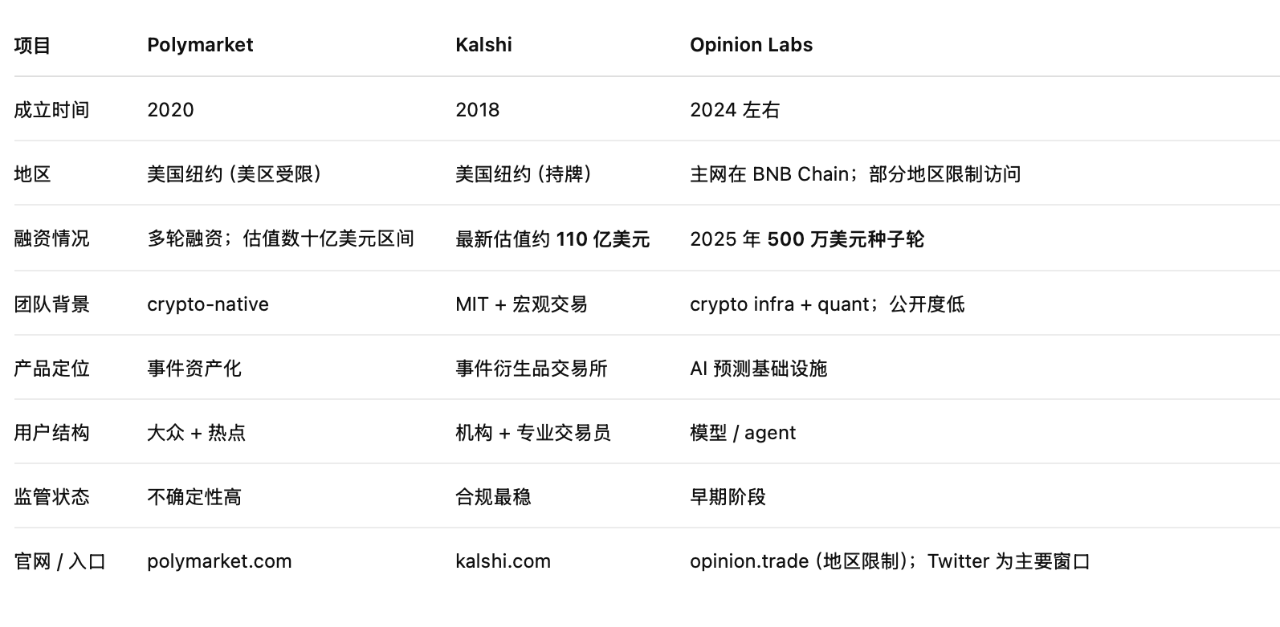

Although all three companies are engaged in prediction markets, their routes are completely different. They are not solving the same problem and are not facing the same type of users. By looking at them together, we can see the potential layered structure of this track in the future.

1) Polymarket: Turning Events into Assets

Polymarket's route is very straightforward: turning events into assets and probabilities into prices. It is not a traditional "prediction tool," but more like a real-time event price screen. The higher the social attention, the greater the event density, and the more frequently it is cited by the media, the faster its market response. The low understanding threshold for users and strong emotional drive are the reasons for its rapid growth. Its advantage is speed; its challenge is regulation. In a nutshell: the entry point for event assetization.

2) Kalshi: A Regulated Event Derivatives Exchange

Kalshi takes the most financialized route. It deals with event contracts that can be defined by regulation and captured by models: CPI, unemployment rates, yield rates, FOMC, etc. It attracts a different type of user: macro traders, hedge funds, quantitative teams. This determines that its trading structure is more stable and scalable than Polymarket.

The political market you see on Kalshi does not mean it is the same type of product as Polymarket — politics is just one of the regulated event categories and does not carry the growth logic. In a nutshell: an event derivatives exchange, the financial infrastructure of prediction markets.

3) Opinion Labs: The Model Consensus Layer in the AI Era

Opinion takes a third route, not targeting public trading nor serving institutional traders. It attempts to establish a "probability consensus layer" for AI models: allowing probabilities outputted by different models to be aggregated, cited, and ultimately priced by the market. Its target users are not people, but models. It is not about "letting users bet," but "providing models with a readable, tradable probability interface."

This path has a longer time scale and is more forward-looking. Compared to the first two, Opinion is clearly in the earliest development stage.

It already has a trading interface (opinion.trade), but it will impose access restrictions in regions like the U.S. and China, leading to inconsistent access experiences in different network environments. There is little public information, and its main external touchpoint remains Twitter. The underlying structure is still rapidly iterating, and branding and the official website are not priorities.

This is not an "immature website experience," but a typical state of an early infrastructure project: first, get the underlying mechanisms running, then gradually move towards external stabilization.

In a nutshell: Opinion already has a product, but it is still in a very early stage, more like a foundational building block of the future AI ecosystem rather than a competitor in the current user scale race.

Polymarket, Kalshi, and Opinion all seem to be engaged in prediction markets, but their directions, product structures, compliance paths, and future positions are completely different: Polymarket captures "attention and emotion." Kalshi captures "risk and pricing models." Opinion captures "AI's understanding of the future."

They correspond to three layers of prediction markets: the public layer, the financial layer, and the model layer. It is precisely because these three paths have emerged simultaneously that this round of prediction markets is not like the past — it is not a single product that suddenly became popular, but a market that is taking shape.

IV. An Observation on This Track: AI is Creating Noise, Web3 is Distinguishing Noise

I do not want to draw a conclusion about "what the future will look like" for prediction markets, as I have not deeply researched this track. However, over the past year, across different projects and product forms, I have repeatedly seen one thing: the combination of AI and Web3 is happening faster than we imagined, and the direction is very clear.

The capability of AI lies in "generation" — generating text, generating judgments, generating predictions. But as the content it generates increases, a new problem becomes increasingly apparent: AI is creating noise. Judgments, explanations, probabilities, inferences — each is growing exponentially. More information → more noise → higher costs.

The role of Web3, precisely after the noise: Web3 distinguishes noise. What it provides is not "content," but: immutable, settlement-ready, verifiable, aligned incentives, and capable of forming prices.

The combination of these two will gradually become natural in financial markets:

AI is responsible for generating views of the future;

Web3 is responsible for putting these views into the market, allowing them to undergo price, time, and incentive testing.

Prediction markets are just a very intuitive example. They turn "AI-generated probabilities" into "prices usable in finance." From this perspective, it is more like an interface rather than an application. I am not sure what this track will ultimately look like, but what I can see is: AI is making the future more ambiguous, while Web3 is making the future more verifiable. And in financial markets, these two will naturally need each other.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。