Bitcoin’s latest upswing in premiums comes at an awkward moment for the broader market, which has spent the past several weeks tangled in bearish signals.

Technical charts, onchain metrics, and sentiment gauges have all painted a mood closer to caution than celebration, with analysts warning that the cycle’s earlier climb toward $126,000 may have already marked a major top. Even as bitcoin hovers near $92,000 after recovering from steeper lows, the drumbeat of calls for a possible retreat toward the $74,000 range has grown louder.

This wave of pessimism has been reinforced by fading ETF demand, weakening momentum indicators, and a streak of “Extreme Fear” sentiment readings that outlasted those seen during the FTX and LUNA debacles. Yet, amid those gloomy signals, a few pockets of strength are starting to reappear — and that’s where the premium data comes in.

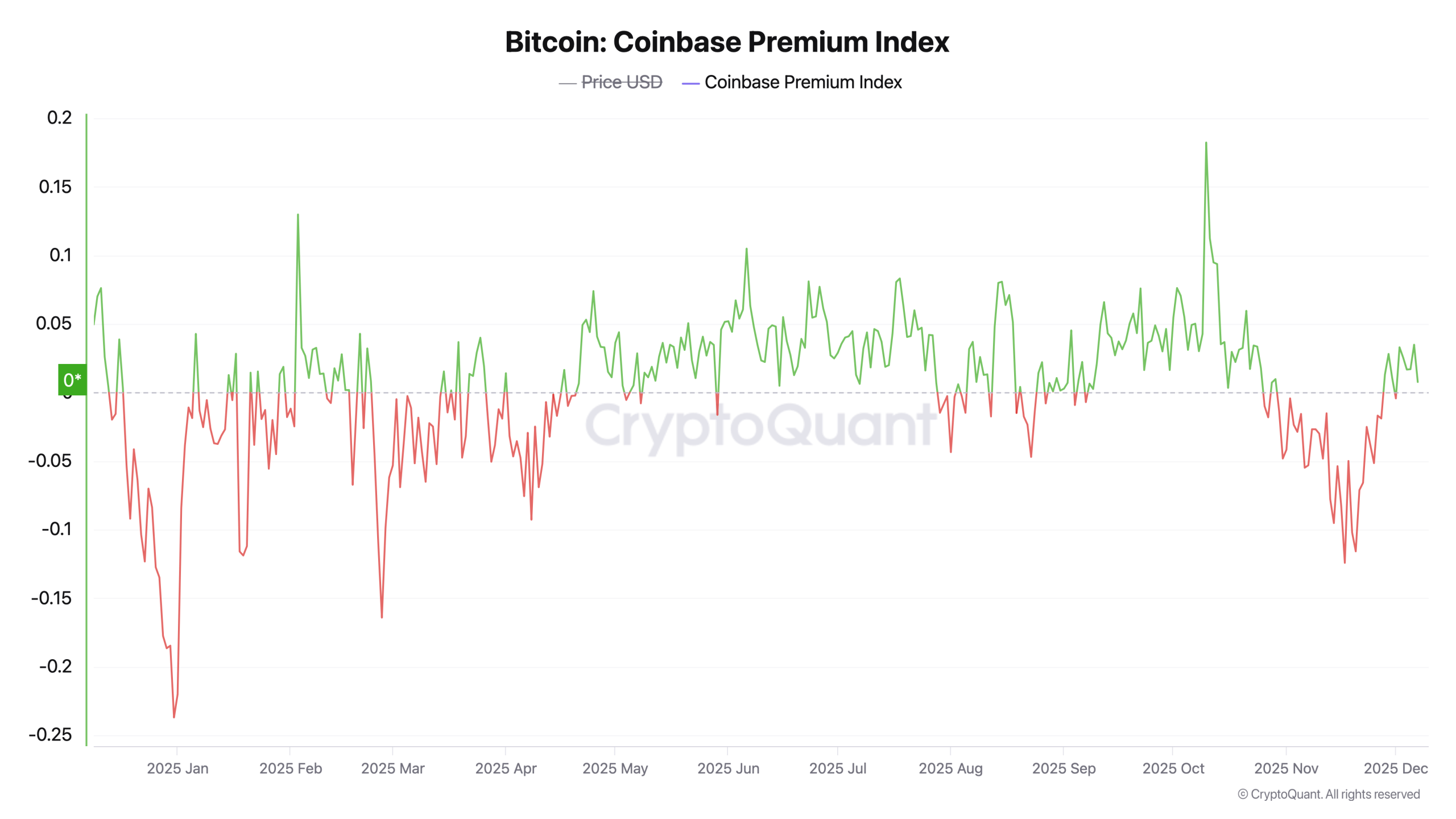

The Coinbase Premium Index on cryptoquant.com flipped positive on Nov. 28 and has stayed there, minus a brief dip into discount territory on Dec. 1. The platform’s index measures the price gap between bitcoin on Coinbase’s BTC/USD pair and Binance’s BTC/ USDT pair, presenting it as a percentage to track where pricing pressure is leaning.

A steady positive premium signals upbeat sentiment, institutional conviction, and fresh liquidity flowing into bitcoin, all of which can help propel a rally toward higher prices like $100,000 as macro factors — including Fed rate-cut expectations — tilt supportive. When combined with improving Binance liquidity, it helps smooth out fragmentation across venues and encourages greater overall market stability.

Read more: Crypto-to-Fiat Conversion at Checkout Reaches US Retailers via Oobit

Bitcoin prices have found fresh energy after sliding into the $80,000 range and briefly slipping under the $88,000 zone. Since then, the coin has lifted itself a bit higher, giving traders the sense that the bull may not have left the party just yet. Institutional money appears to be circling back as exchange-traded funds (ETFs) notch inflows again, and corporate players like Strategy continue adding BTC to their balance sheets.

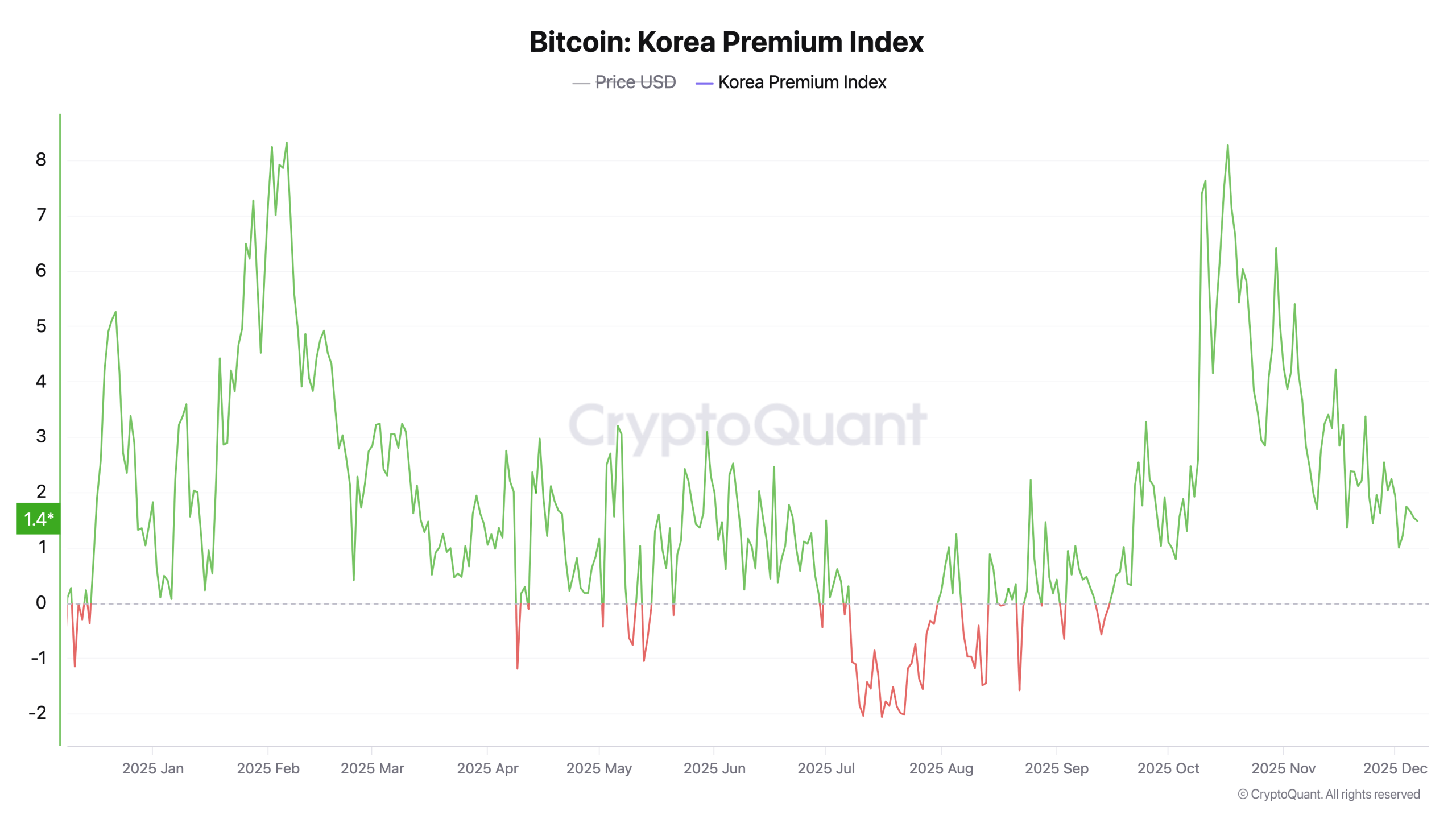

Alongside the Coinbase Premium Index, Cryptoquant’s Korea Premium Index shows BTC’s elevated pricing in the region is still intact. While the premium isn’t as lofty as mid-October., when it climbed beyond 8%, the latest reading puts bitcoin in South Korea at 1.4% higher. Exchange figures from local platforms such as Upbit and Bithumb back up the analytics firm’s numbers.

A premium in South Korea also adds a bullish twist, signaling traders there are still hungry for the leading digital asset. Taken together, the renewed strength in both premium indexes, firmer liquidity on major exchanges, and a modest rebound in bitcoin’s price offer a counterweight to December’s heavy bearish tone, hinting that the market may not be as one-sided as sentiment suggests.

- What is the Coinbase Premium Index? It measures the price difference between bitcoin on Coinbase’s BTC/USD pair and Binance’s BTC/ USDT pair to identify buying pressure in U.S. markets.

- Why are South Korean bitcoin prices trading at a premium? Elevated demand on exchanges like Upbit and Bithumb often pushes regional BTC prices above global averages.

- How does a positive premium affect bitcoin’s outlook? A steady premium can signal stronger buyer interest, institutional activity, and healthier liquidity conditions.

- What bearish factors are still pressuring bitcoin? Weaker ETF inflows, cautious sentiment, and technical breakdowns continue to fuel expectations of a potential move toward lower support levels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。