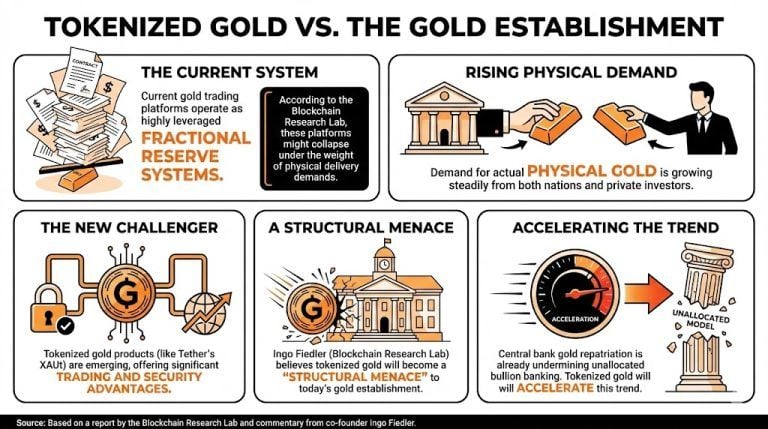

A recent report by the Blockchain Research Lab, a German nonprofit that researches the uses of blockchain for the benefit of society, has pondered the impact of the rise of tokenized gold on the current system.

According to Ingo Fiedler, co-founder of the lab, as the demand for physical gold grows from both nations and private investors, the current gold trading platforms, which work as a highly leveraged fractional reserve system, might collapse under the weight of physical delivery.

While geopolitical elements can also unwind this crisis, Fiedler believes that tokenized gold can become a structural menace to today’s gold establishment, as it will undoubtedly shift more investors due to its trading and security advantages.

Fiedler stated:

Over the past years, central bank accumulation and repatriation have steadily undermined the foundation of the unallocated model of bullion banking. The advent of tokenised gold products like Tether’s XAUt will accelerate this trend.

Read more: Schiff Doubles Down on Bitcoin Criticism, Pushes Tokenized Gold as Blockchain’s True Asset

Fiedler’s take on the future of gold markets is a classic example of how blockchain can become part of a better-designed system to support real-world assets (RWA), and how substitution can lead to the collapse of the legacy platforms.

While Fiedler’s analyses might seem far-fetched to some, as the numbers moved in London, New York, and Shanghai are humongous, and tokenized gold is still in its initial stages, the advantages of tokenization are undeniable.

“History teaches that leveraged fragile systems rarely unwind gently. As Hemingway describes bankruptcies and Bitcoiners understand intuitively: gradually, then suddenly,” he concluded.

Financial analysts predict that tokenization will take over the finance world by storm, and gold is no exception, but given the levels of leverage in gold markets, the outcome of this shift could be disastrous.

What does the recent Blockchain Research Lab report discuss?

The report examines how the rise of tokenized gold could impact traditional gold trading systems, which are based on fractional reserves.What are the potential consequences of increased demand for physical gold?

Increased demand may cause current gold trading platforms to struggle with physical delivery, potentially leading to a collapse of the existing system.How might tokenized gold affect the traditional gold market?

Ingo Fiedler believes tokenized gold, like Tether’s XAUt, could undermine traditional bullion banking by shifting investor preferences toward its transparency and security benefits.What are the future predictions for tokenization in finance?

Analysts foresee that the tokenization of assets will revolutionize finance, but the transition in gold markets could be problematic due to high levels of leverage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。