Vanguard listed expansive BTC, ETH, XRP and SOL ETFs opening retail crypto access and helping drive a roughly 6% bitcoin bounce, Charles Schwab said it will expand into spot crypto trading in H1 2026, Strategy warned it might sell bitcoin to fund dividend payments if needed, Bank of America recommended a modest 1%–4% crypto allocation as a pathway for digital-asset exposure, and renewed yen carry trade dynamics rattled markets after a recent $4,000 crypto move.

Vanguard Cracks Open Crypto Access With Expansive BTC, ETH, XRP, SOL ETF Listings

Vanguard’s move to open crypto ETF access marks a pivotal expansion for millions of investors, widening… read more.

Editor’s comment: Eric Balchunas of Bloomberg attributes the 6% upwards reversal of Bitcoin’s price to the “Vanguard effect.”

Charles Schwab Plans Crypto Trading Expansion for First Half of 2026

Charles Schwab’s CEO confirms strategic move to launch spot crypto trading, signaling major expansion into… read more.

Editor’s comment: Some of the important details have yet to be announced. For example, will Schwab offer zero fee trading like it does with other products (ETFs)?

Strategy Says It Would Sell Bitcoin to Fund Dividend Payments If Needed

Strategy signaled it could tap its bitcoin stash to safeguard dividend payouts if its valuation … read more.

Editor’s comment: The number one treasury company of Bitcoin, and its biggest cheerleader cannot come out and say they’re willing to sell Bitcoin, the most pristine asset ever created.

Bank of America Sees 1%–4% Crypto Allocation Shaping New Paths in Digital-Asset Exposure

Bank of America’s new guidance urging a modest digital-asset allocation underscores how crypto is moving… read more.

Editor’s comment: Another major American tradfi bank decides to dip its toe into crypto. 2026 is looking good.

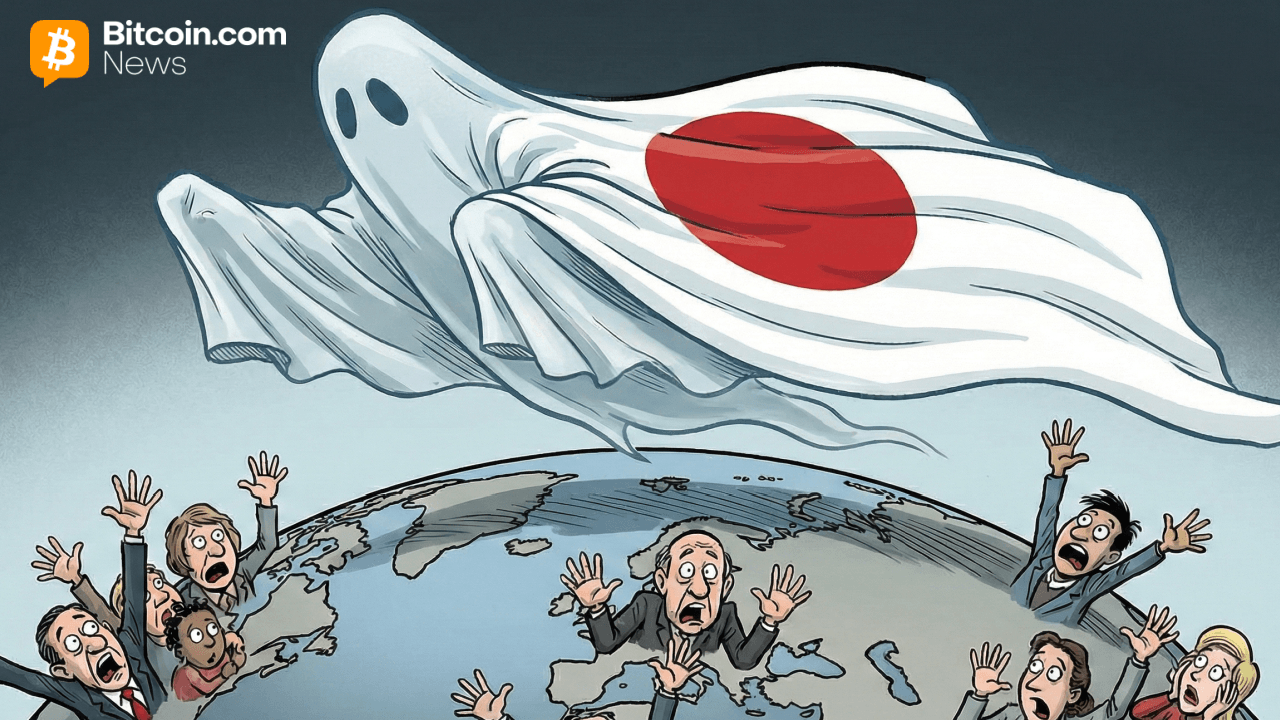

The Yen Carry Trade Explained: How Japan Spooks Crypto and Stock Markets

The so-called yen carry trade returned to the spotlight after the recent $4,000 cryptocurrency market… read more.

Editor’s comment: Like with most spooky things, upon closer examination it usually turns out to be far less scary than your initial reaction would imply.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。