Some trading days feel like a reset button has been pushed, and Friday, Dec. 5, delivered exactly that. After a choppy stretch of outflows, the crypto ETF market found its footing again, led by a renewed wave of capital into bitcoin products and by continued strength in solana and XRP funds. Ether, however, faced another day of turbulence.

Bitcoin ETFs closed the session with a $54.79 million inflow, reversing the previous day’s weakness and marking a measured return of investor confidence. The day’s strength came primarily from Ark & 21Shares’ ARKB, which pulled in $42.79 million, while Fidelity’s FBTC followed with a solid $27.29 million.

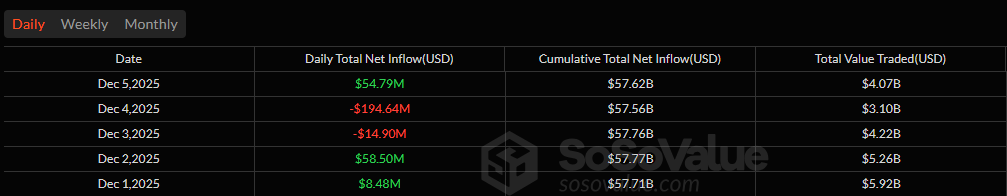

Mixed trading week for bitcoin ETFs with three days of inflows and two days of outflows.

Vaneck’s HODL added $11.39 million, Bitwise’s BITB contributed $4.86 million, and even Wisdomtree’s BTCW, usually quiet, added $947.22K. The lone drag came from Blackrock’s IBIT, which posted a $32.49 million outflow, but it wasn’t nearly enough to tip the day into the red. With $4.07 billion in total trading volume and net assets at $117.11 billion, bitcoin ETFs ended the week in a steadier position.

Ether ETFs weren’t as fortunate. The category logged a $75.21 million outflow, entirely driven by Blackrock’s ETHA, which shouldered the full departure. No other ether ETF recorded movement, leaving the day decisively negative despite steady trading volumes of $1.77 billion. Even so, net assets remained healthy at $18.94 billion, underscoring that the market hasn’t lost faith, just momentum.

Solana ETFs, meanwhile, continued to show resilience with a $15.68 million inflow. Bitwise’s BSOL led with $12.18 million, while Fidelity’s FSOL added $3.49 million, keeping the week firmly green for the SOL ecosystem. Total trading reached $27.28 million, and net assets held at $877.62 million.

Read more: Bitcoin and Ether Post Combined $236 Million Outflow as Solana Stays Green

Rounding out the day, XRP ETFs enjoyed another $10.23 million inflow, spreading across Canary’s XRPC ($4.97 million), Bitwise’s XRP ($2.27 million), Franklin’s XRPZ ($2.20 million), and Grayscale’s GXRP ($785.40K). Though still the smallest of the major crypto ETF sectors, XRP continues to carve out meaningful traction.

FAQ📊

- Why did Bitcoin ETFs see inflows?

Bitcoin ETFs gained $54.79 million as investor confidence returned after recent outflows. - What caused Ether ETFs to record outflows?

Ether ETFs saw a $75.21 million outflow driven entirely by Blackrock’s ETHA. - Why are Solana ETFs gaining traction?

Solana funds added $15.68 million as demand for alternative crypto exposure increased. - How did XRP ETFs perform?

XRP ETFs brought in $10.23 million, showing steadily rising interest despite their smaller size.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。