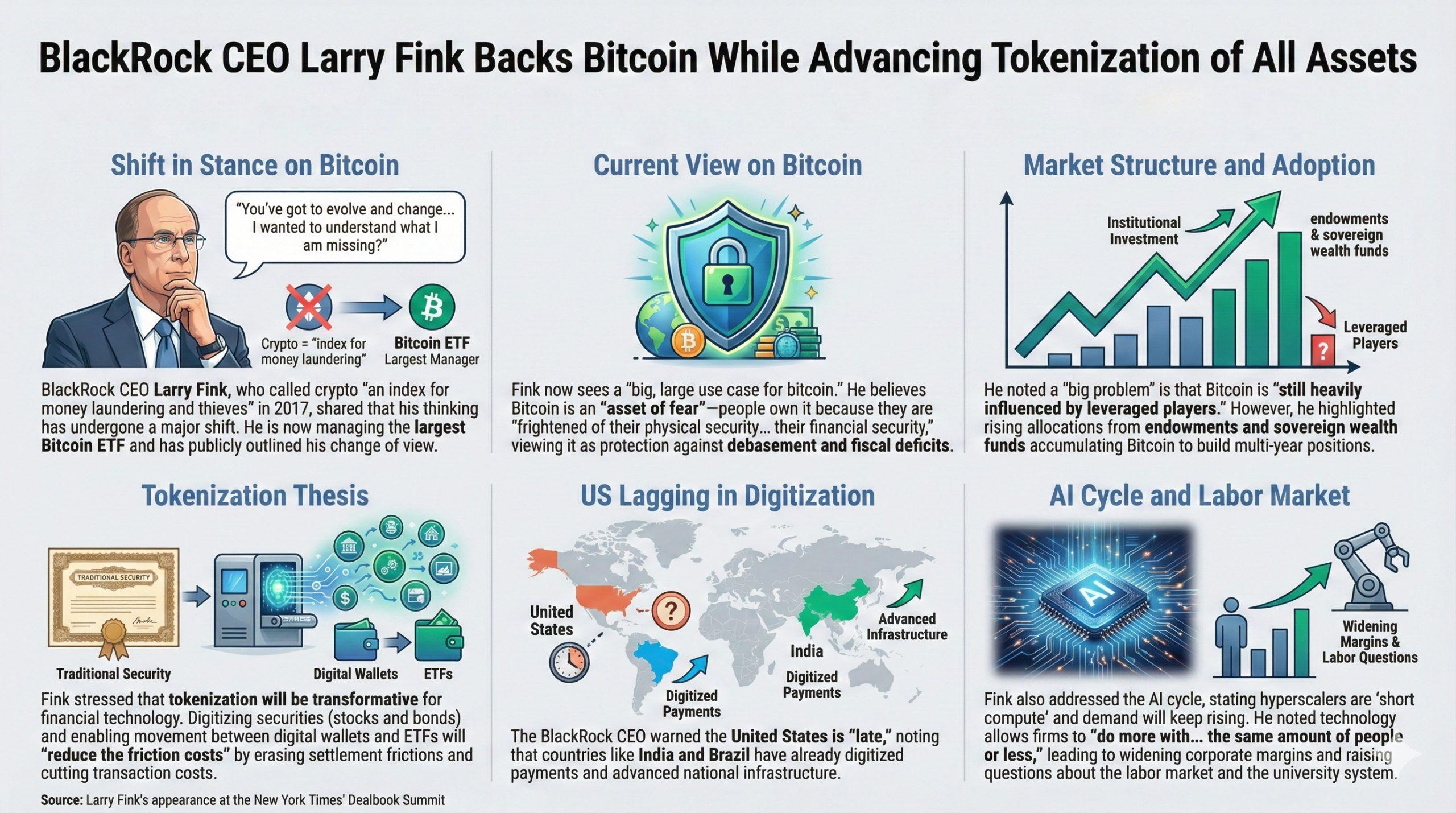

Blackrock CEO Larry Fink shared last week at the New York Times’ Dealbook Summit that his thinking about bitcoin has undergone a major shift since he labeled the crypto “an index for money laundering and thieves” in 2017. Blackrock, the world’s largest asset manager, now manages the largest bitcoin exchange-traded fund (ETF), and Fink used his appearance to outline how his views changed and how he sees tokenization transforming global markets.

Explaining why he changed his mind about BTC, Fink stated: “You’ve got to evolve and change… I actually took it upon myself to visit and talk to a lot of people who were advocates of it. I wanted to understand what I am missing?” Noting that his earlier remarks were aimed at bitcoin specifically, not crypto in general, the Blackrock chief executive detailed:

I see a big, large use case for bitcoin and I still do today.

He said his role exposes him to thousands of clients and policymakers, which pushes him to reassess assumptions. He emphasized: “ Bitcoin is an asset of fear… You own bitcoin because you’re frightened of your physical security… your financial security.” He argued that long-term buyers view it as protection against debasement and fiscal deficits. He also highlighted market structure issues, pointing to leverage: “The other big problem of bitcoin is it is still heavily influenced by leveraged players.” Yet, he detailed rising allocations from endowments and sovereign wealth funds accumulating bitcoin across price levels to build multi-year positions.

Read more: Blackrock CEO Larry Fink Believes Bitcoin Could Reach $700K

Fink expanded his broader thesis on financial technology, stressing that tokenization will be transformative. He said digitizing securities and enabling movement between digital wallets and ETFs will erase settlement frictions and cut transaction costs:

If we could digitize all stocks and bonds… it will reduce the friction costs.

The Blackrock CEO warned the United States is “late,” noting India and Brazil have already digitized payments and advanced national infrastructure. He also addressed the AI cycle, stating hyperscalers are “short compute” and demand will keep rising, even though investment timing may lag returns. He said corporate margins are widening because technology allows firms to “do more with… the same amount of people or less,” raising questions about the labor market and the university system. He closed by emphasizing his long-term focus: “We try to help people navigate a 30-year outcome. I don’t really care about what happens the next moment.”

- What shift did Blackrock CEO Larry Fink make regarding bitcoin?

He moved from skepticism to endorsing bitcoin as a long-term protective asset. - Why does Fink believe bitcoin demand is rising?

He says investors seek security amid fears of debasement and fiscal deficits. - How does Fink view tokenization’s impact on markets?

He argues it will cut settlement friction and transform global securities infrastructure. - What concerns did Fink raise about bitcoin market structure?

He highlighted the influence of leveraged players on bitcoin’s price behavior.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。