Just recently, Ethereum rolled out its Fusaka upgrade, which dramatically expanded the network’s data and gas capacity (think higher block gas limits and far larger blob space), allowing each block to haul more call data and rollup blobs.

The Fusaka upgrade reshaped layer two (L2) fees and, by extension, offered a helping hand to onchain (L1) gas costs as well. Onchain fees on Ethereum are impressively low — dipping under a single gwei, according to etherscan.io’s gas tracker.

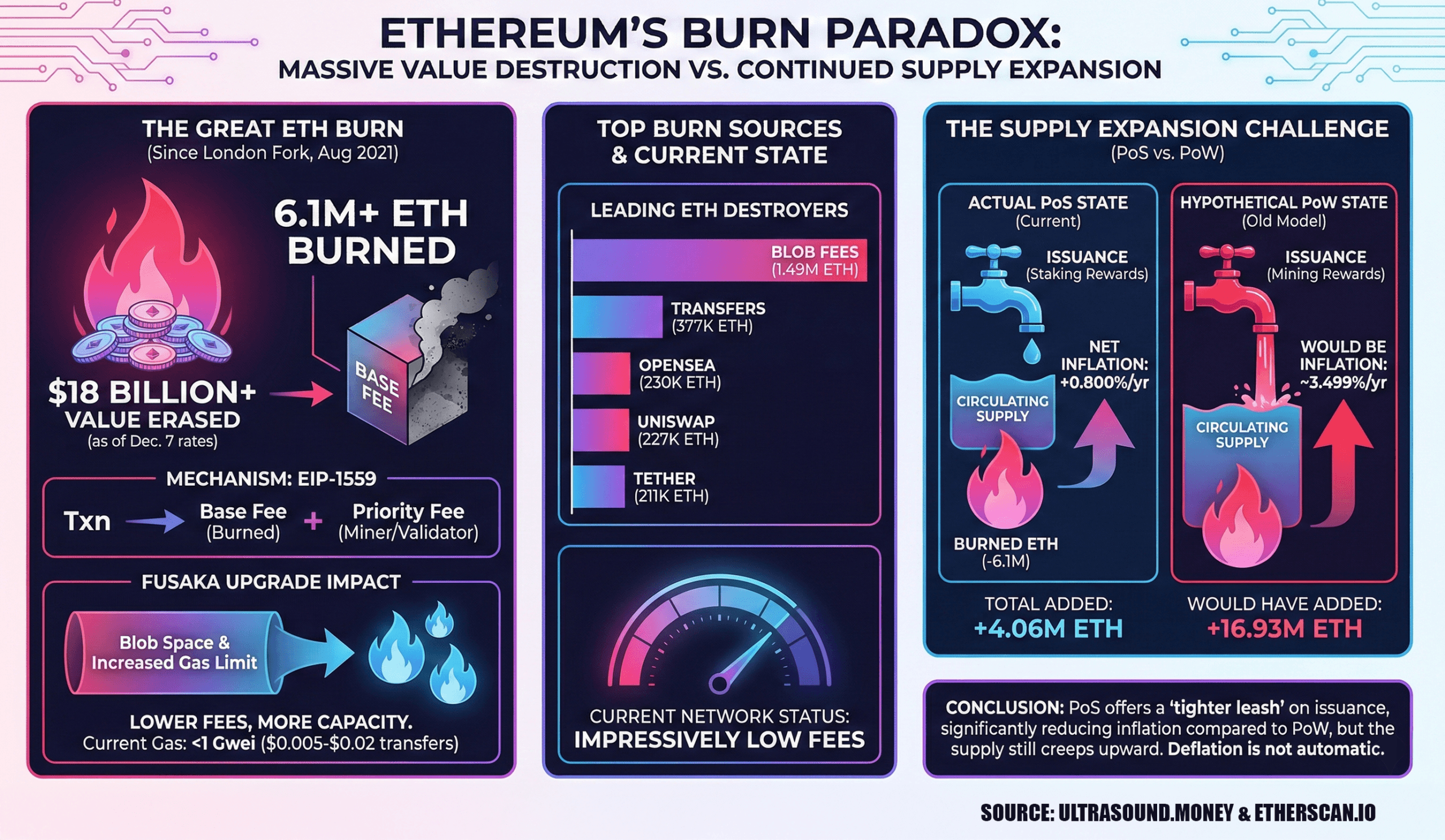

At 11 a.m. Eastern time on Dec. 7, a low-priority fee hovered near 0.305 gwei, while a high-priority fee clocked in around 0.326 gwei. That places transfer costs somewhere between $0.005 and $0.02 on Sunday, while smart contract moves like swaps, NFT sales, or bridging run anywhere from $0.14 to $0.50 per action.

When the London hard fork arrived in August 2021, it brought EIP-1559 with it—a full makeover of Ethereum’s transaction fee mechanics that introduced a dynamic base fee, automatically burned and gone for good with every block.

The fork landed 4 years, 4 months, and 2 days ago (leap year quirks included), and since then, 6.1 million ETH valued at $18 billion has been erased from circulation. Metrics from ultrasound.money reveal that blob fees have taken the crown as the biggest ETH burner, wiping out 1,492,094 ETH on their own.

Traditional ether transfers follow with 377,388 ETH torched, while the non-fungible token (NFT) marketplace Opensea is responsible for 230,051.12 ETH reduced to digital ashes. The decentralized exchange (DEX) Uniswap v2 isn’t far behind, with 227,337.27 ETH burned, and tether ( USDT) usage clocks in with 211,342.55 ETH eliminated. Closing out the top five, Uniswap v1 has erased an additional 153,585.62 ETH since 2021.

Read more: No Santa Rally? Bitcoin Derivatives Markets Hint at a Cold December

Despite the 6.1 million ETH burned, stats over the past four years still show the network running inflationary at 0.800% per year. Since the London hard fork, roughly 4,065,657 ETH have been added to the supply. Under the proof-of-stake (PoS) model, issuance has eased compared with what it would be under proof-of-work (PoW). If Ethereum were still operating on PoW system, simulated data shows the annual inflation rate would sit at 3.499%, and a hefty 16,931,820 ETH would have been added to circulation.

While PoS is keeping issuance on a tighter leash, Ethereum’s supply still creeps slowly upward, reminding everyone that deflationary dreams aren’t automatic. Despite this, the network has come a long way since the London hard fork, cutting potential inflation dramatically compared with its old PoW days.

- What triggered Ethereum’s massive burn totals?

Ethereum’s burn activity stems from EIP-1559, which destroys the dynamic base fee in every block. - How much ETH has been burned since the London hard fork?

More than 6 million ETH valued at roughly $18 billion have been removed from circulation. - Did the Fusaka upgrade affect Ethereum fees?

Yes, Fusaka expanded block capacity, mostly helping L2 transaction costs. - Is Ethereum deflationary after all this burning?

No, the network remains slightly inflationary despite the significant amount of ETH destroyed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。