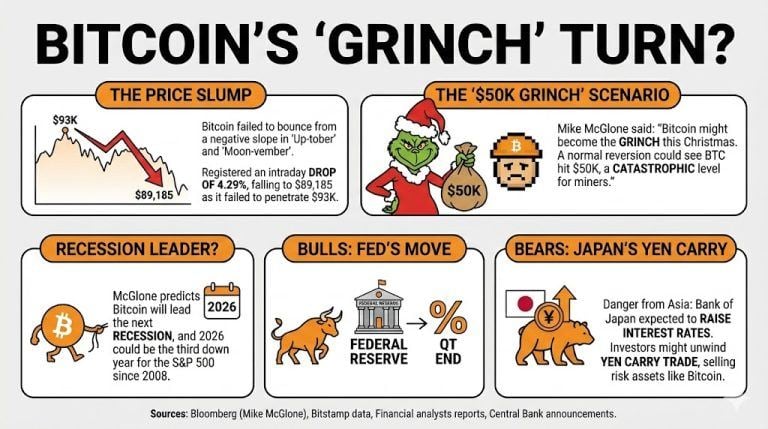

Bitcoin is inching lower after it failed to bounce from a negative slope during the last two months, Up-tober and Moon-vember, which failed to be positive for the currency.

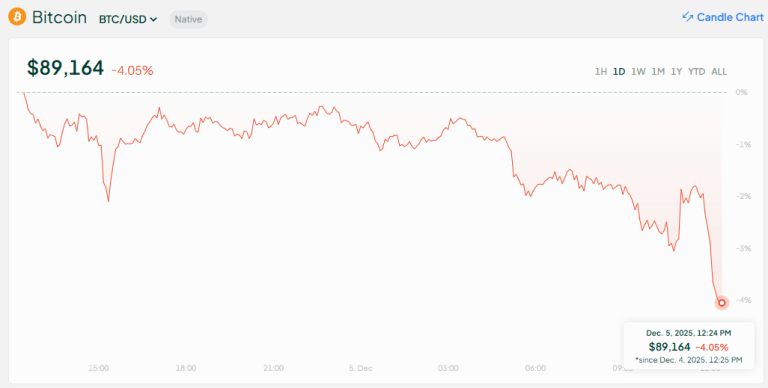

BTC registered an intraday drop of 4.29%, as it failed to generate enough interest to penetrate the $93K level on its way up. The currency price fell as low as $89,185 on Bitstamp at the time of writing, as financial analysts claim that there is still room for the downside.

Bloomberg’s Mike McGlone claims that Bitcoin might become the Grinch for this Christmas. On social media, McGlone stated that a normal reversion might get bitcoin to $50K again, a level that would be catastrophic for mining companies, potentially signaling a negative future for the whole ecosystem.

Finally, McGlone posted that Bitcoin will lead the next recession, and that 2026 will be the third down year for the S&P 500 since 2008.

While bitcoin registered record prices earlier this year, the sentiment turned bearish amid what analysts labeled a liquidity crisis, with relatively small positions causing big shifts in the cryptocurrency market.

Nonetheless, bulls and bears are having an intense fight, as there are elements supporting bitcoin’s rise while others suppress it. Among the former are the expected decision of the Federal Reserve to cut interest rates and the end of the institution’s quantitative tightening policy.

Nonetheless, danger might come from Asia, as the Bank of Japan is expected to raise interest rates in the country, with the government readied to execute one of the largest stimulus programs since the COVID pandemic.

This could accelerate bitcoin’s fall as investors unwind their yen carry trade, selling risk assets such as bitcoin to cover their loans in the country of the rising sun.

Read more: The Yen Carry Trade Explained: How Japan Spooks Crypto and Stock Markets

What recent trend is Bitcoin experiencing?

Bitcoin has registered an intraday drop of 4.29%, failing to rebound from a negative slope during “Up-tober” and “Moon-vember.”What price level did Bitcoin struggle to reach?

BTC failed to break the $93K level, falling to as low as $89,185 on Bitstamp amid a bearish market sentiment.What are analysts predicting for Bitcoin’s future?

Mike McGlone from Bloomberg suggests Bitcoin could drop to $50K, potentially leading to negative outcomes for mining companies.What external factors could impact Bitcoin prices?

Interest rate changes, particularly from the Bank of Japan, could worsen Bitcoin’s situation as investors sell risk assets to cover loans.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。