Gold and metals market financial analyst Jesse Columbo believes that a major market move might be brewing, and that gold could reach record prices once again.

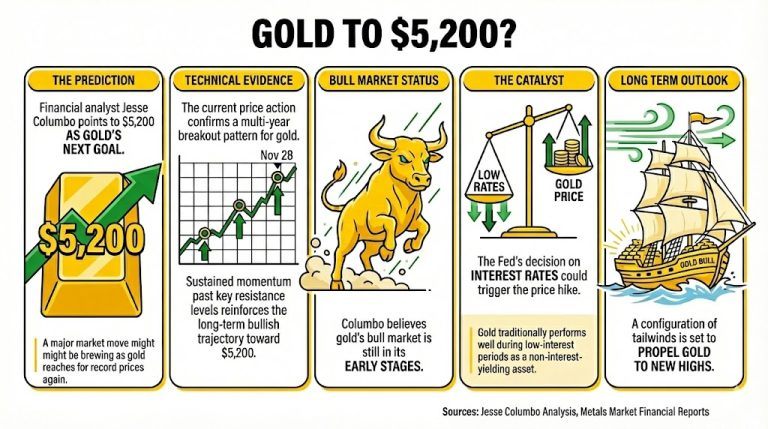

In a recent analysis on the state of the gold market, Columbo pointed out $5,200 as gold’s next goal, having already registered several all-time high prices this year.

Columbo states that the recent price breakout that gold experienced on November 28 is part of the evidence leading to this new price goal. He explained that this move is the third of its kind happening this year, and that if prices follow their previous behavior, it could reach this number.

Nonetheless, Columbo is even more bullish about gold long-term, as he believes there is a configuration of tailwinds that will propel gold to new highs, having recently explained that gold’s bull market is still in its early stages.

The Fed’s long-awaited decision on interest rates might also become another catalyst for a hypothetical price hike, as gold traditionally performs well during low-interest periods as a non-interest-yielding asset.

The expectation of a quarter-point rate cut is widespread, meaning that if the Federal Reserve fails to deliver, prices might decrease temporarily.

Read more: Fed Could Give Gold a Launchpad With Upcoming Cut

Phillip Streible, chief metal strategist at Chicago’s Blue Line Futures, pondered on this outcome. Talking to Sputnik, he stated:

The overwhelming expectation for December is that there will be another Fed rate cut. If that doesn’t happen, be prepared for downside that could even exclude December as a winning month.

Even so, most firms predict gold will keep rising in 2026 and beyond, as central banks and investors are expected to maintain growing demand for the metal as an inflation and uncertainty hedge with no clear substitute.

What does financial analyst Jesse Columbo predict for gold prices?

Columbo believes gold could reach $5,200 as it aims for record highs, having already achieved several all-time highs this year.What recent evidence supports Columbo’s price forecast?

He cites a significant price breakout on November 28 as part of a trend, noting it’s the third breakout of the year.What factors could influence gold prices in the near future?

The Federal Reserve’s potential interest rate cut is expected to boost gold, as it traditionally performs well during low-interest periods.What are long-term expectations for gold beyond 2026?

Analysts generally predict rising gold prices, driven by sustained demand from central banks and investors as a hedge against inflation and uncertainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。