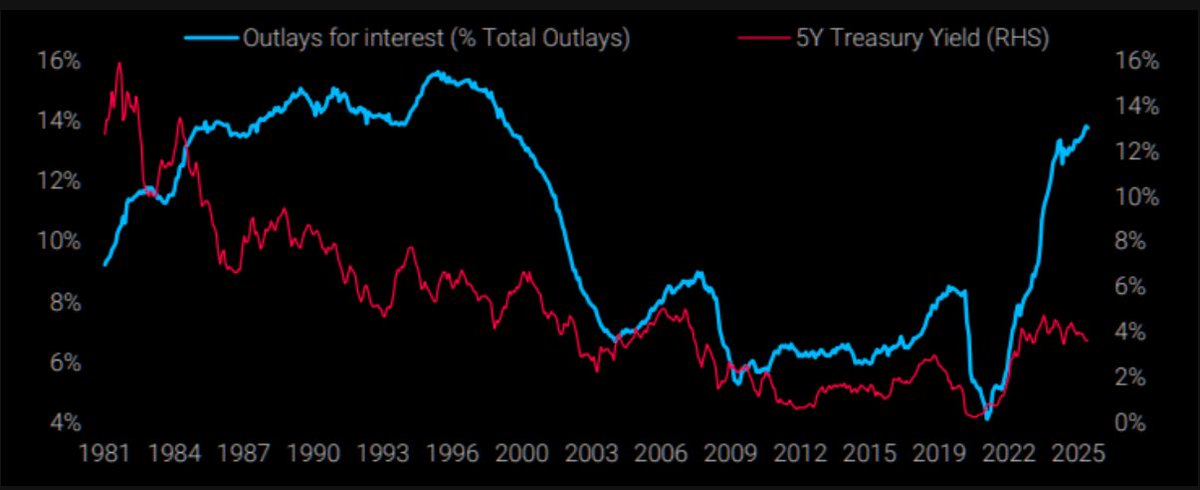

⚠️ The U.S. Treasury has entered the interest rate hostage zone —

Interest expenses now account for about 14% of federal spending, but the current yield on government bonds is only 3.7%.

If we return to the 6% levels of the 1990s? The Treasury estimates it would blow up directly.

This is the precursor to what is called Fiscal Dominance: monetary policy is no longer free and must revolve around fiscal sustainability.

The next new chairman, Hassett, advocates for rapid interest rate cuts, and those playing in the bond market on Wall Street are getting anxious.

Because in the logic of the bond market, rapid interest rate cuts only mean one thing — the Treasury can't hold up, and the Federal Reserve is preparing to concede.

Once this expectation forms, long-term interest rates will rise, and everyone will demand higher yields to compensate for potential future inflation, monetary easing, and policy uncertainty.

We may witness this particularly magical scenario:

Short-term interest rates drop,

Long-term interest rates are pulled up by the market,

Fiscal pressure not only fails to ease but becomes heavier.

We are likely facing a chaotic market lasting several years!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。