“ Bitcoin will fail. Because it is a lie,” writes Mike Brock, a former executive at Jack Dorsey’s bitcoin firm, Block. His comments have caused an uproar on social media at a time when the cryptocurrency appears to be in the early stages of a recovery and maybe even on the path to a year-end rally.

But Brock isn’t just another skeptic; he’s an insider, or at least he used to be. He knows how the sausage is made. He started his career at Block as a software engineer, developing Square Cash, a popular remittance application that would later morph into Cash App. The application recently made headlines after launching a feature that allows its 58 million users to pay in bitcoin without having to own the cryptocurrency.

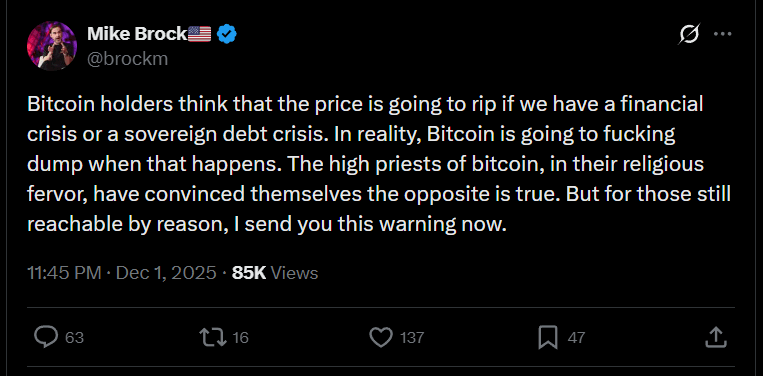

(Brock posted a dire warning about the future of bitcoin on Monday evening / Mike Brock on X)

The California resident rose through the ranks, eventually becoming CEO of TBD, a developer-focused division within Block. But then something shifted. After TBD was mysteriously shuttered in November 2024, Brock abandoned his corporate ambitions, ending his eleven-year career at the company.

“I walked away from everything I’d built,” he writes. “The recruiters stopped calling. Professional opportunities disappeared. I lost the insider status, the comfortable salary, the ability to tell myself I was one of the good guys inside the system making it better.”

Brock’s primary thesis appears to be that bitcoin has become (or always was) a tool for the elites. An asset that a secretive “corporate monarchy” is using to undermine democracy in favor of a Russian-style oligarchy. He acknowledges that many in the bitcoin community are ideologically opposed to this outcome, but they turn a blind eye to it, justifying their inaction by claiming they have good intentions, only to become “useful idiots” exploited by fascists.

“I was one of those useful idiots,” Brock explains. “Convinced my good intentions and technical competence made me different from the people using the same tools for authoritarian ends.”

Read more: Irrational Pessimism: Have Bitcoin Investors Gone Mad?

There may be some truth to Brock’s claims. Other credible executives, such as Caitlin Long, CEO of Custodia Bank, have accused shadowy whales of manipulating the cryptocurrency’s price. Institutional capital has flooded bitcoin, with firms like Blackrock now owning more of the digital asset than any other company. Vanguard and Charles Schwab, two of the largest money managers in the world, have both confirmed plans to allow bitcoin on their platforms. Surely these companies are just as much “corporate monarchs” as venture capitalist Peter Thiel, who Brock describes as the quintessential oligarch. “I no longer believe that freedom and democracy are compatible,” Thiel wrote in 2009.

(Venture capitalist Peter Thiel once wrote, “I no longer believe that freedom and democracy are compatible.” / cato-unbound.org)

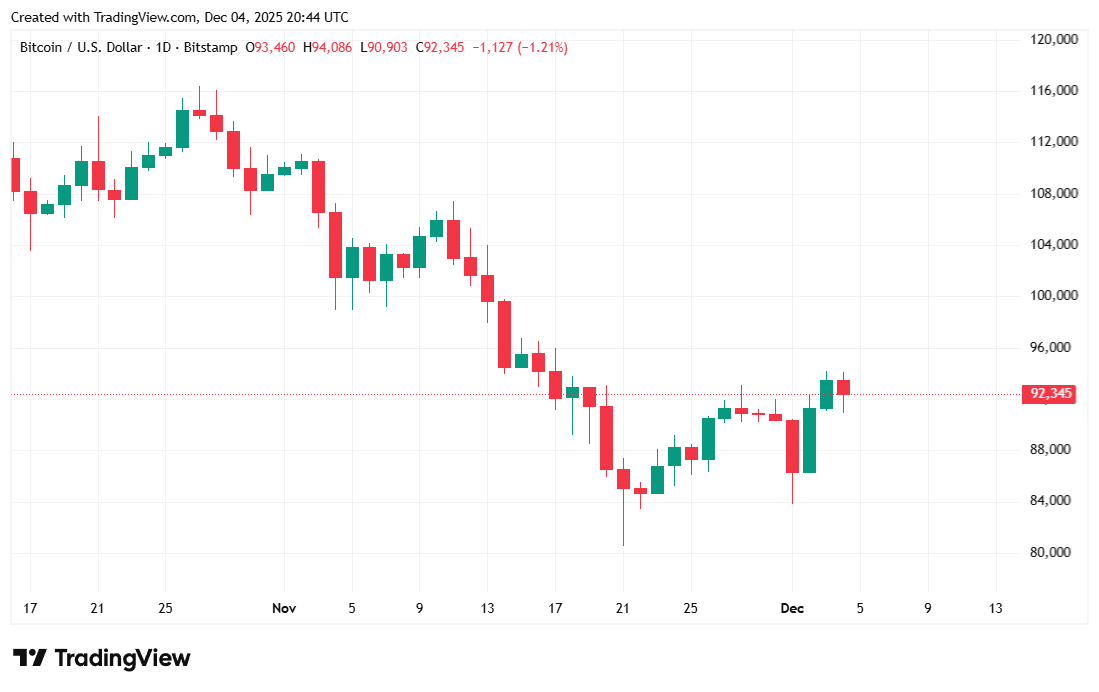

Whether Brock’s dire warning should be heeded remains unclear. But what can’t be denied is the progression of bitcoin from a niche experiment to the apple of corporate America’s eye. It topped $126K in October, crashed to $80K in November, and seems to be back on track today. How it all ends is anyone’s guess.

“ Bitcoin holders think that the price is going to rip if we have a financial crisis,” Brock said. “In reality, Bitcoin is going to f*cking dump when that happens. The high priests of bitcoin, in their religious fervor, have convinced themselves the opposite is true. But for those still reachable by reason, I send you this warning now.”

Bitcoin was trading at $92,222.31 at the time of reporting, down slightly from yesterday by roughly 1%, but still up 0.85% for the week, according to Coinmarketcap. The digital asset’s price moved between $90,976.10 and $94,060.77 over the past 24 hours.

( BTC price / Trading View)

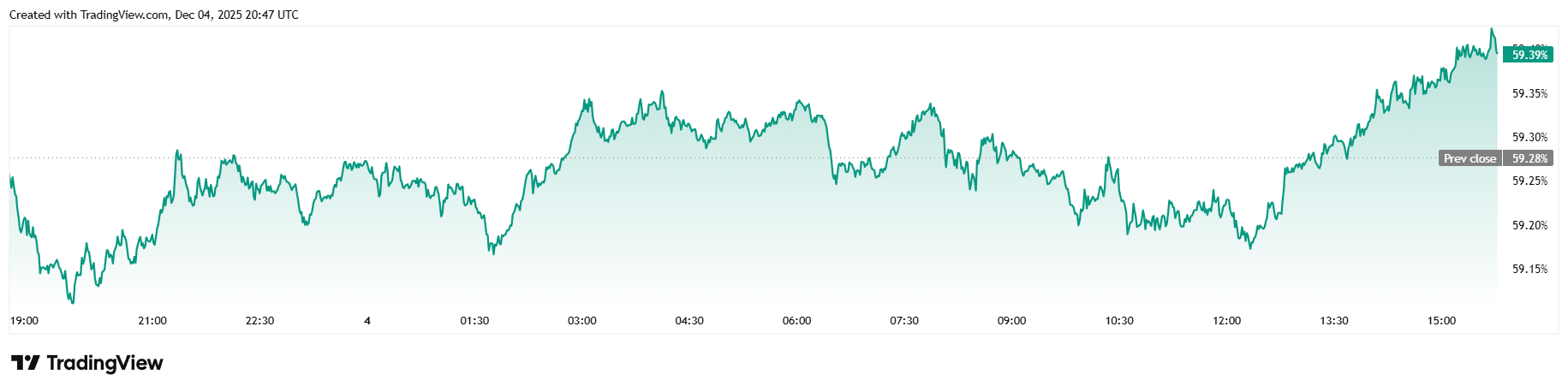

Daily trading volume fell 11.27% to $68.34 billion. Market capitalization stood at $1.93 trillion, and bitcoin dominance inched upward by 0.21% to reach 59.41%.

( BTC dominance / Trading View)

Total bitcoin futures open interest edged lower by 0.82%, to arrive at $59.52 billion, according to Coinglass data. Total liquidations were lower than yesterday but still relatively high at $108.31 million. Long investors suffered the majority of losses with $64.10 million wiped out, but short sellers weren’t too far behind, with $44.22 million in liquidated margin.

- Why are Mike Brock’s comments making waves?

Because he’s a former Block executive with insider credibility who now argues bitcoin is being co-opted by powerful elites. - What exactly is Brock warning about?

He claims a “corporate monarchy” is using bitcoin to undermine democracy and push society toward oligarchic control. - How is the crypto community reacting?

His post has sparked fierce debate, with some agreeing that elites are reshaping bitcoin and others dismissing his claims as alarmist. - Does Brock think bitcoin’s price will suffer?

Yes. He argues bitcoin would crash, not soar, during a financial crisis, contradicting a core belief held by many holders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。