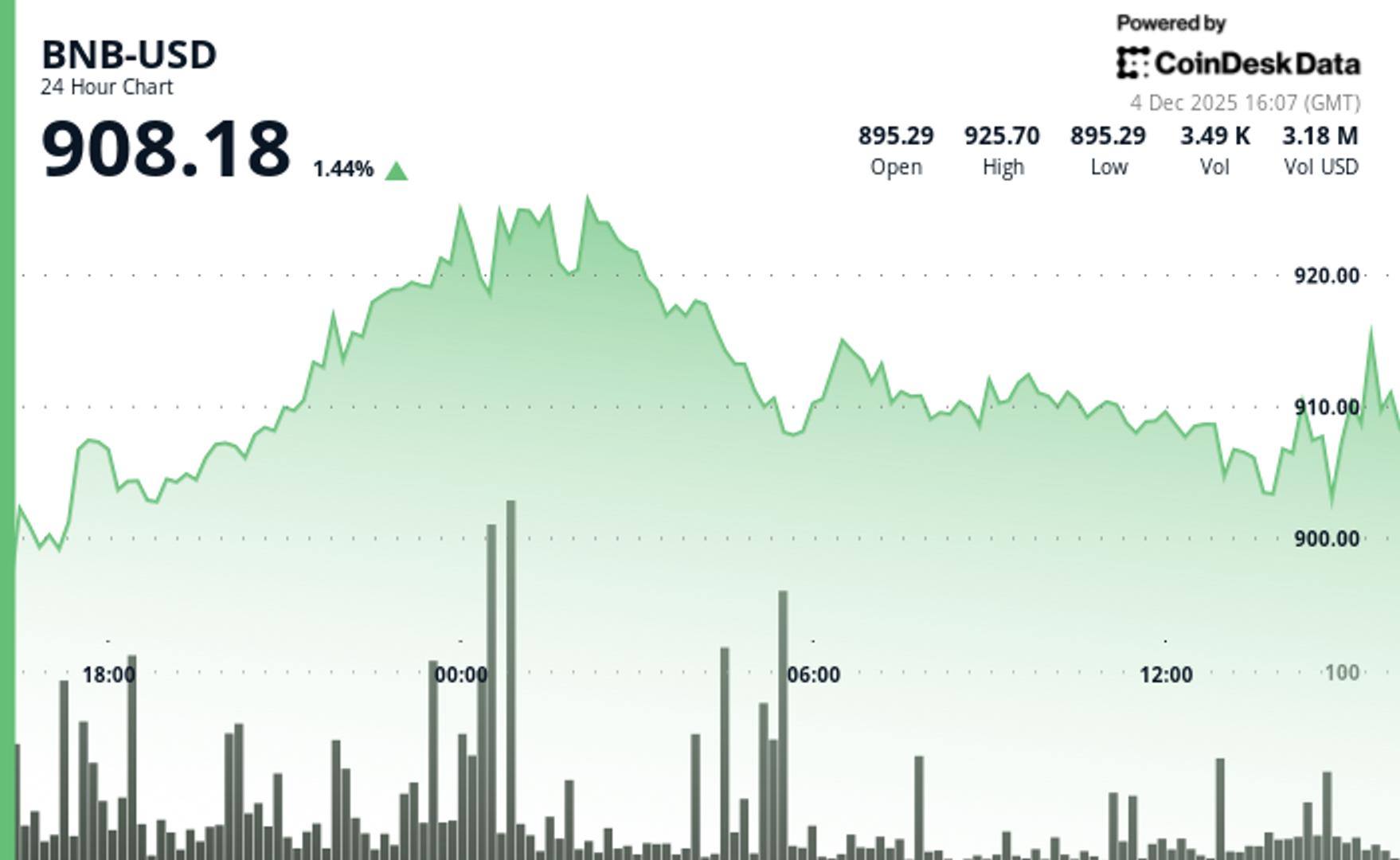

BNB rose to $908 over the last 24-hour period, up 1.44% in the period, as a surge in trading volume suggests that large investors may be accumulating the token during a consolidation phase.

Volume spiked 68% above average, peaking at 86,436 tokens in a single hour, as BNB tested a key resistance cluster between $920 and $928, according to CoinDesk Research's technical analysis data model.

The token pulled back slightly to $903 but held above its recent lows near $896, forming a sideways trading range. This pattern often signals buyers preparing for a larger move.

The uptick comes amid a broader crypto market rebound, where major assets like bitcoin and ether posted gains of 0.5% to 3.5% following positive signals from traditional finance, including looser monetary policy expectations as the Federal Reserve is now widely expected to cut interest rates this month.

BNB’s activity coincides with developments on the BNB Chain, including increased on-chain volume and the launch of new tools like predict.fun, a prediction market app tied to the Binance ecosystem.

Despite recent volatility, these projects aim to grow the utility of the chain, which continues to attract speculative and longer-term interest.

Traders are now watching the $920-$928 range closely. A breakout above this zone could push BNB toward $940 or even $1,000, though a drop below $903 might test support near $896.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。