The recent lift in bitcoin prices has handed BTC miners a much-needed gulp of fresh air after weeks of pinched revenue. At the tail end of November, on the final day, hashprice scraped the bottom at $36.35 per petahash per second (PH/s), according to figures from hashrateindex.com.

In simple terms, hashprice is the sticker price for a single petahash of computational muscle — basically what a miner expects to pull in for all that output. Just a few days later, on Dec. 1, hashprice was still slumped at $35.85 per petahash. The latest price pop over the past day flipped the script, with miners pulling in about $39.79 per PH/s as hashprice inched its way back toward the $40 zone.

Bitcoin hashprice over the last 30 days.

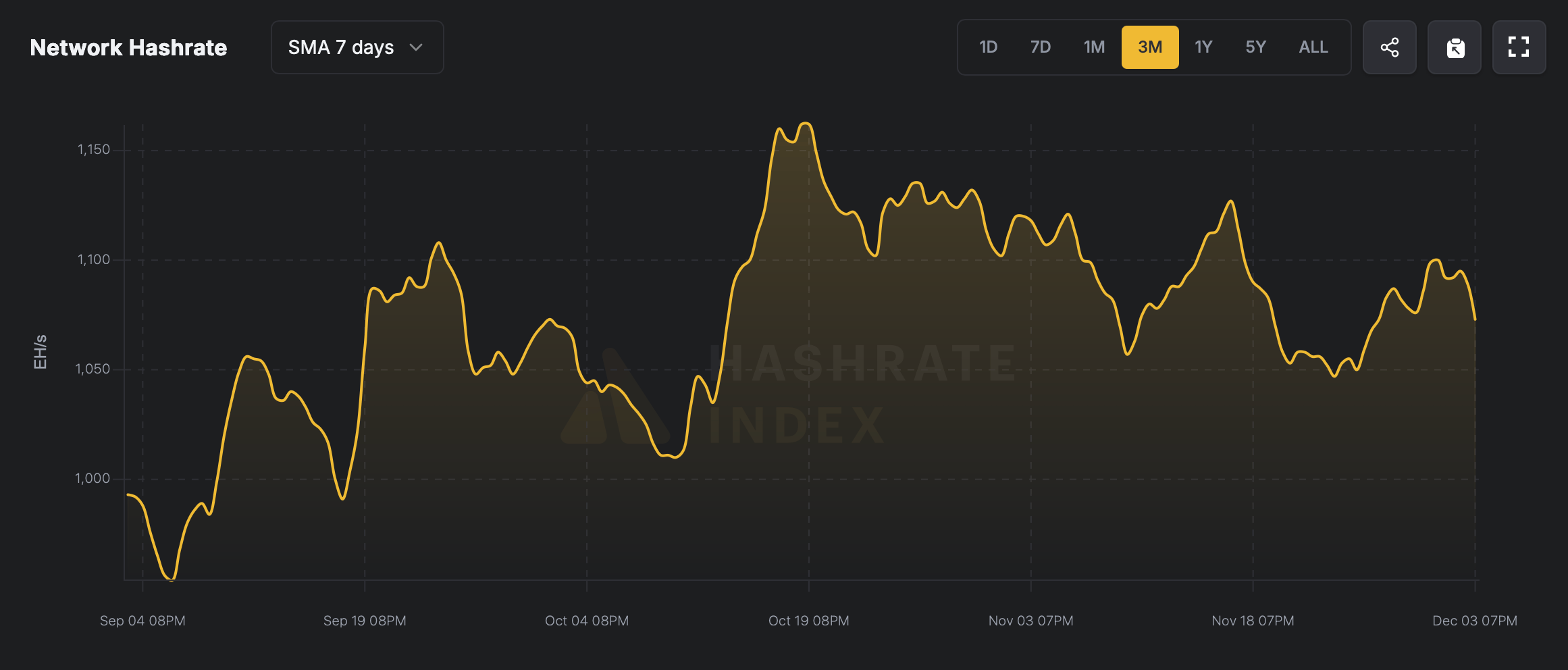

Despite the dips in daily revenue, Bitcoin’s overall hashrate has stayed rock-solid above the 1 zettahash per second (ZH/s) mark for quite a while — and it hasn’t slipped below that threshold in what seems like ages. Because of that stability, block intervals have stayed relatively indifferent as well, and the difficulty adjustment expected on Dec. 11 may not bring much in the way of relief.

Right now, miners still have roughly half of the 2,016-block difficulty epoch ahead of them, so things could shift, but current estimates point to a mild 1.34% dip. Block intervals are running a touch slower than the ten-minute target, and on Wednesday, the average clocked in at about 10 minutes and 8 seconds. If revenue improves, block times could pick up pace alongside a rising hashrate, and the difficulty epoch’s estimate could easily shift with it.

Bitcoin hashrate over the last three months.

At today’s hashprice levels, the metric is still 7.98% below where it stood 30 days ago. On top of that, November ranked as the fourth-weakest month for miner revenue in 2025. Miners have been able to navigate the squeeze in different ways, and being publicly listed has offered a serious advantage. Those outside the private realm leaned heavily on debt financing this year to fortify their warchests, with many steering deeper into artificial intelligence (AI) and high-performance computing (HPC) services.

Read more: Charles Schwab Plans Crypto Trading Expansion for First Half of 2026

AI and HPC have kept many bitcoin mining operations fortified by pumping in an extra stream of revenue. Lastly, bitcoin mining rigs keep leveling up, with manufacturers pushing the limits of application-specific integrated circuit (ASIC) performance. Today’s machines are cranking out half a petahash (1,000 terahash per second) or more, and full 1 PH/s units are already lining up on the horizon.

Altogether, the sector is wobbling through tight margins with a mix of grit, innovation, and borrowed oxygen, but miners can never stand still. With steadier hashprice, diversified revenue streams, and next-gen ASIC horsepower, miners have been riding a streak of plain old luck.

- What is hashprice?

Hashprice measures how much revenue a miner earns for each petahash (or TH/s or EH/s) of computational power. - Why did miner revenue dip recently?

Revenue cooled as bitcoin prices softened and hashprice slipped to some of its lowest levels of the year. - How are miners staying afloat?

Many miners have leaned on debt financing, AI services, and high-performance computing (HPC) to pad their income. - Are mining machines getting more efficient?

Yes — all year manufacturers have been rolling out stronger ASIC rigs, with half-petahash units now common and 1 PH/s models on the horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。