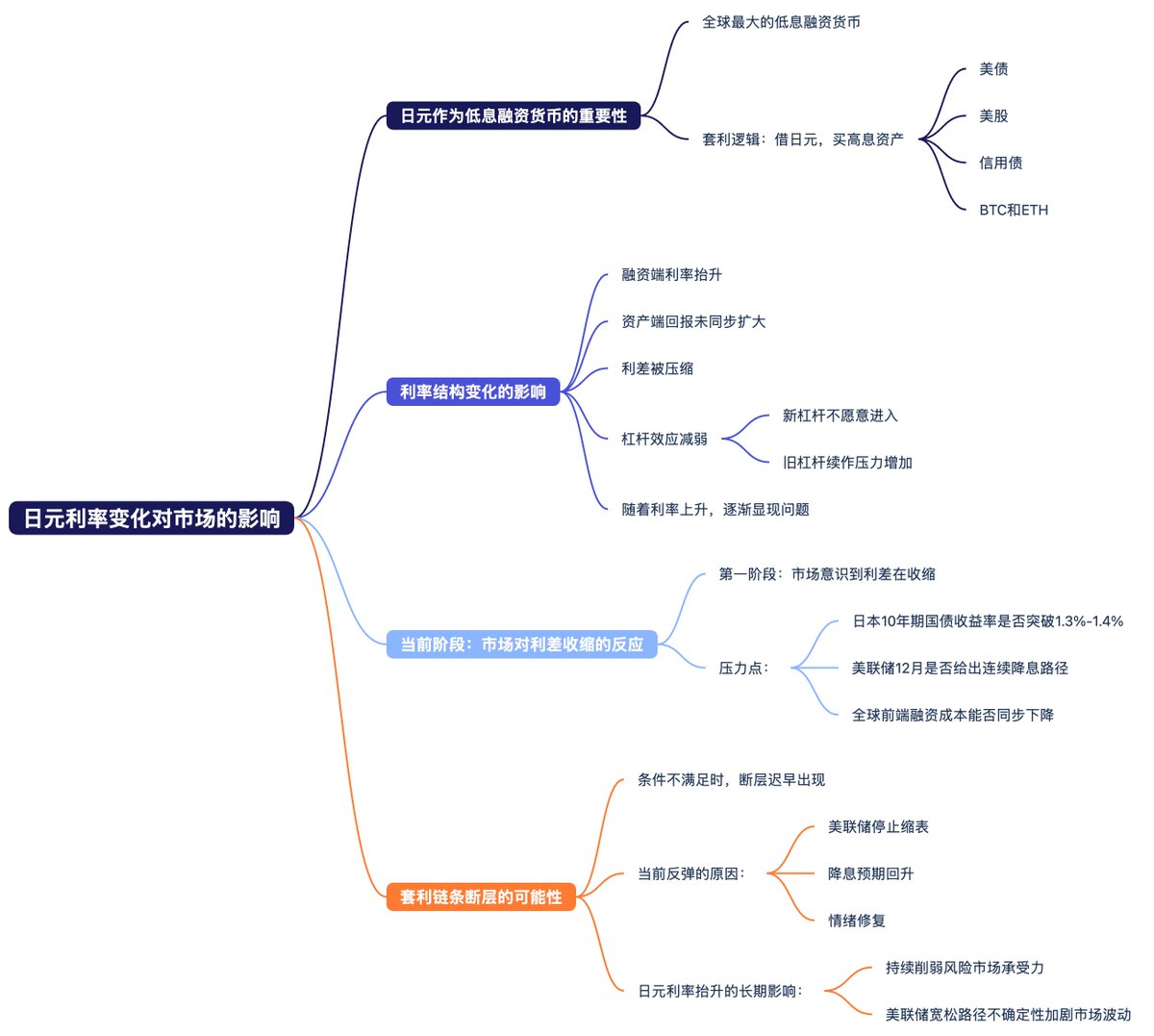

Of course, this market is not smooth sailing. The increase in Japan's real interest rates hangs over the risk market like the sword of Damocles. However, the impact has not been significant so far. Starting Monday, there was a sudden rise in Japan's 10-year interest rates, breaking through a nearly 17-year historical high, and by Thursday, it continued to rise, now surpassing an 18-year historical high. Although Japan has not announced an immediate interest rate hike, the increase in real interest rates is essentially equivalent to a substantial rate hike.

More critically, the yen, as the world's largest low-interest financing currency, means that this change in interest rate structure will essentially squeeze the arbitrage opportunities built over the past decade based on "borrowing yen to buy high-yield assets." Beneficiaries of this chain include U.S. Treasuries, U.S. stocks, credit bonds, as well as BTC and ETH. When financing rates rise while asset returns do not expand in tandem, the interest rate spread will be compressed, making leverage less attractive. New leverage will be reluctant to enter, and the pressure on old leverage during renewal will also increase, likely becoming more pronounced as interest rates rise.

Currently, we are still in the first phase, where the market realizes that the interest rate spread is shrinking. The real pressure point will depend on whether Japan's 10-year rate can continue to push into the sensitive range of 1.3% to 1.4%, whether the Federal Reserve will provide a continuous rate cut path in December, and whether global front-end financing costs can synchronize downwards. If these three conditions are not met, the fracture in the arbitrage chain will eventually appear. The current rebound is more about the market's emotional repair due to the Federal Reserve's cessation of balance sheet reduction and the recovery of rate cut expectations, rather than a successful hedge against Japanese interest rates. The rise in yen interest rates will not change the market overnight, but it will continue to weaken the risk market's resilience. As long as the Federal Reserve's easing path is not fully determined, this variable will continuously and repeatedly affect the market.

In simpler terms, it used to be that someone could lend you money interest-free to invest in U.S. Treasuries with an annualized return of 4%, and every penny of profit was yours. But now, the person lending you money wants you to pay interest. Initially, the interest is only 1%. Although you are unhappy, you still have a 3% return. However, this interest will gradually increase, and when it exceeds 3%, although you are still making money, you will start to worry that rising interest rates will render your efforts futile. Therefore, you might choose to sell the U.S. Treasuries to repay the loan. I believe no one would want to earn a 4% return while paying over 4% in interest, which reflects the current situation of Japanese interest rates.

This is also why I believe we are still in a rebound phase. The current rise in the risk market is largely due to the Federal Reserve ending balance sheet reduction and injecting some liquidity. However, if the SLR has not been completely lifted, and we have not fully escaped the risk of economic recession, it is difficult to say we have entered a reversal cycle. However, it is evident that due to the emergence of some expectations and easing windows, institutions and hedge funds have begun to build positions.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。