Rebound or Reversal: What is the Reason for Institutions Starting to Build Positions? (Part One)

Since the speech by Williams on the Friday of the week before last, investor sentiment has begun to warm up, which once again proves that the Federal Reserve's monetary management is the main narrative in the current market. As long as the expectations for a rate cut in December are not broken and the dot plot does not show a significant hawkish shift, the market will naturally maintain a relatively optimistic range. In fact, this also indicates that under the premise of no systemic issues in the macro environment, the core focus of investors is no longer the individual data points themselves, but whether the Federal Reserve is willing to hinder the rise of inflation by triggering an economic downturn.

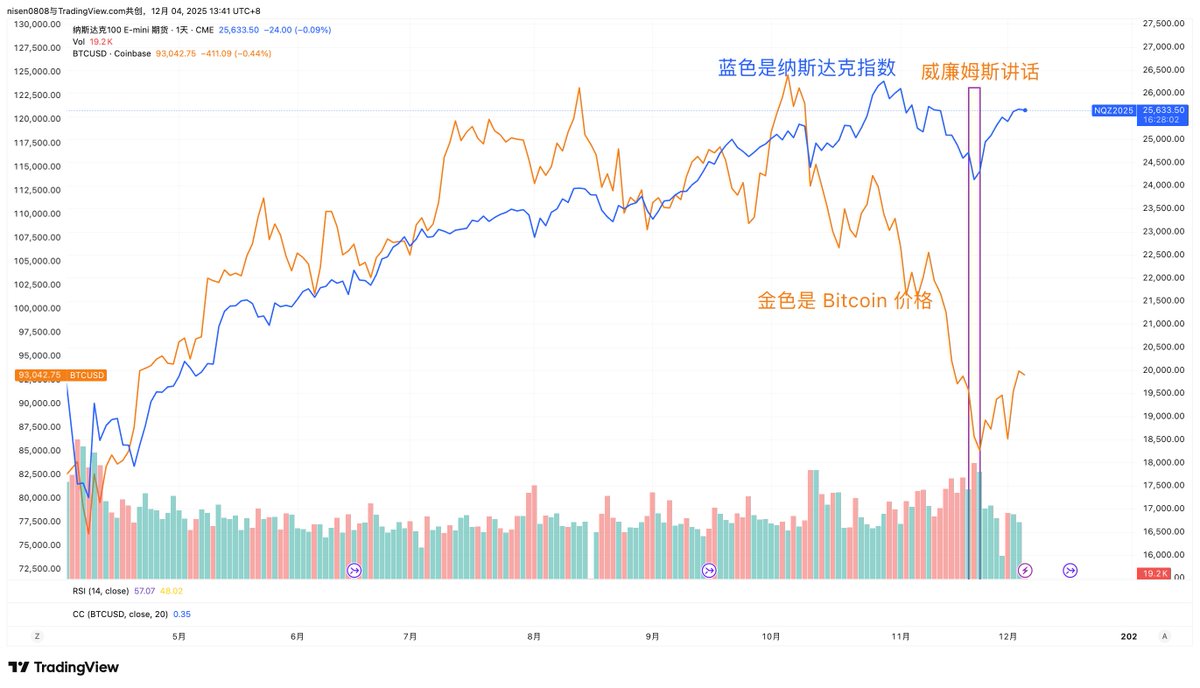

Figure 1: Williams' Speech Drives Risk Markets to Stop Declining and Rebound

The reason Williams' speech was able to stabilize the market immediately is not because the content was particularly dovish, but because it sent a very clear signal that the Federal Reserve has realized that the tightening of financial conditions has exceeded expectations and needs to communicate to avoid unnecessary market deleveraging. In the current window of slowing growth but not yet in recession, and inflation declining but not yet at the bottom, changes in policy stance will be magnified by the market as a directional guide.

Therefore, even if the fundamental data still has noise, as long as monetary policy does not deviate from a loose path, funds will tend to buy expectations, wait for confirmation, and then find reasons for self-complacency. This is also the reason why risk assets have been able to quickly recover in recent days, even showing active buying, as the market's trading rhythm is shifting from risk aversion to waiting, and then from waiting to tentative position building.

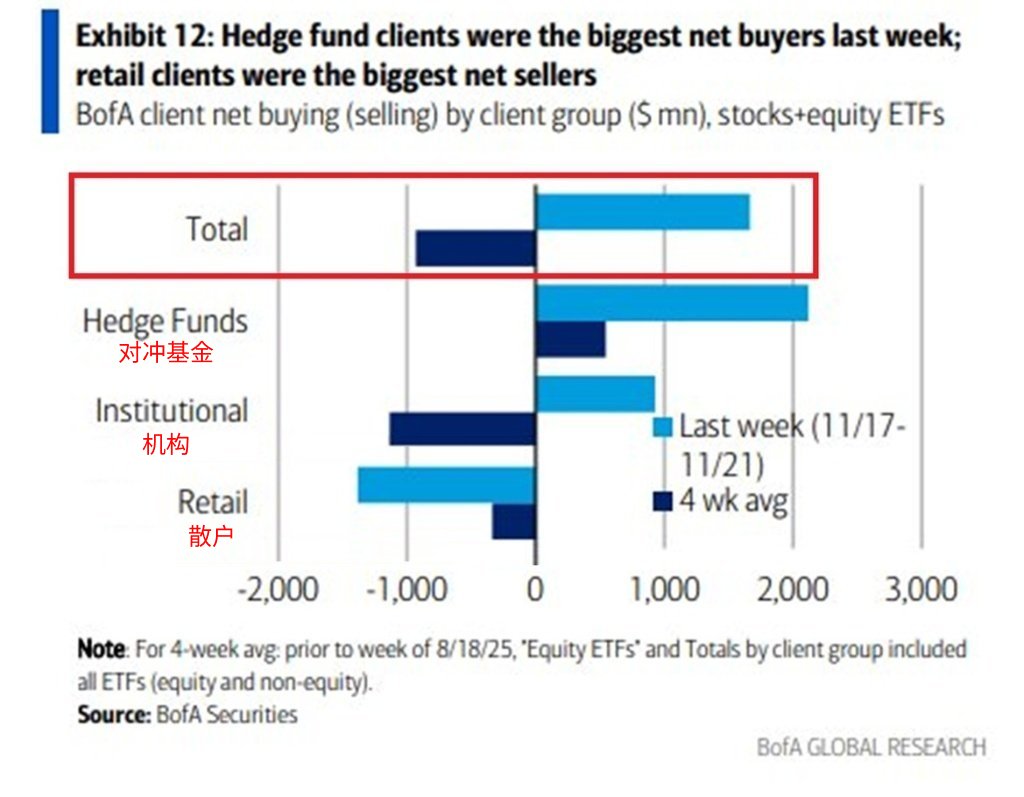

Figure 2: Hedge Funds and Institutions Start Positioning in the Third Week of November

During the week, I have shown a lot of data to inform everyone about the current market situation. Overall, although retail investors have been the largest supporters of the U.S. stock market in the past two years, data from November shows a trend of surrender among retail investors. Meanwhile, hedge funds, which have been short and experiencing net outflows since 2025, have shown significant inflows starting in November. If the outflow of retail investors may be due to the upcoming Thanksgiving and Black Friday, then the institutions' bottom-fishing may be a judgment on the cyclical bottom market.

Why do I say this?

Figure 3: Since the Start of the Rate Hike Cycle in 2022, Only Retail Investors Have Been Buying.

Because since 2022, the Federal Reserve has entered a new round of monetary policy cycle, starting a strategy of high interest rates to reduce inflation. High interest rates often lead to a decrease in liquidity, so my judgment is that institutions and hedge funds are unwilling to increase their investments in risk markets during periods of high interest rates, instead choosing to focus on risk aversion. Therefore, we can see that from 2022 to 2024, professional funds have almost all been net outflows. Even when the market rebounds, they only reduce positions at high points, always unwilling to bear higher risk exposure against the backdrop of tightening liquidity.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。