Coinbase Institutional, a division of crypto exchange Coinbase (Nasdaq: COIN), explained on social media platform X on Dec. 2 why bitcoin’s price is dumping. The group noted that easier monetary conditions usually help risk assets, yet recent market action diverged from expectations.

Coinbase stated:

So why did BTC dump?

The division outlined several structural pressures weighing on bitcoin. The asset slipped beneath major bull-market support bands, signaling weakening trend strength. Options activity shifted toward bearish structures. Longtime whales sold into declining liquidity. Spot bitcoin ETFs saw significant outflows, reducing consistent buy-side demand. Digital asset traders slowed participation, tightening liquidity conditions and amplifying market swings.

The firm further noted:

With quantitative tightening ending, the Fed is back in the bond market and the drain of cash from markets may be behind us. That’s usually good for risk-on assets like crypto.

Read more: Coinbase Turns up the Heat With Worldwide Rollouts and Prime-Grade Assets

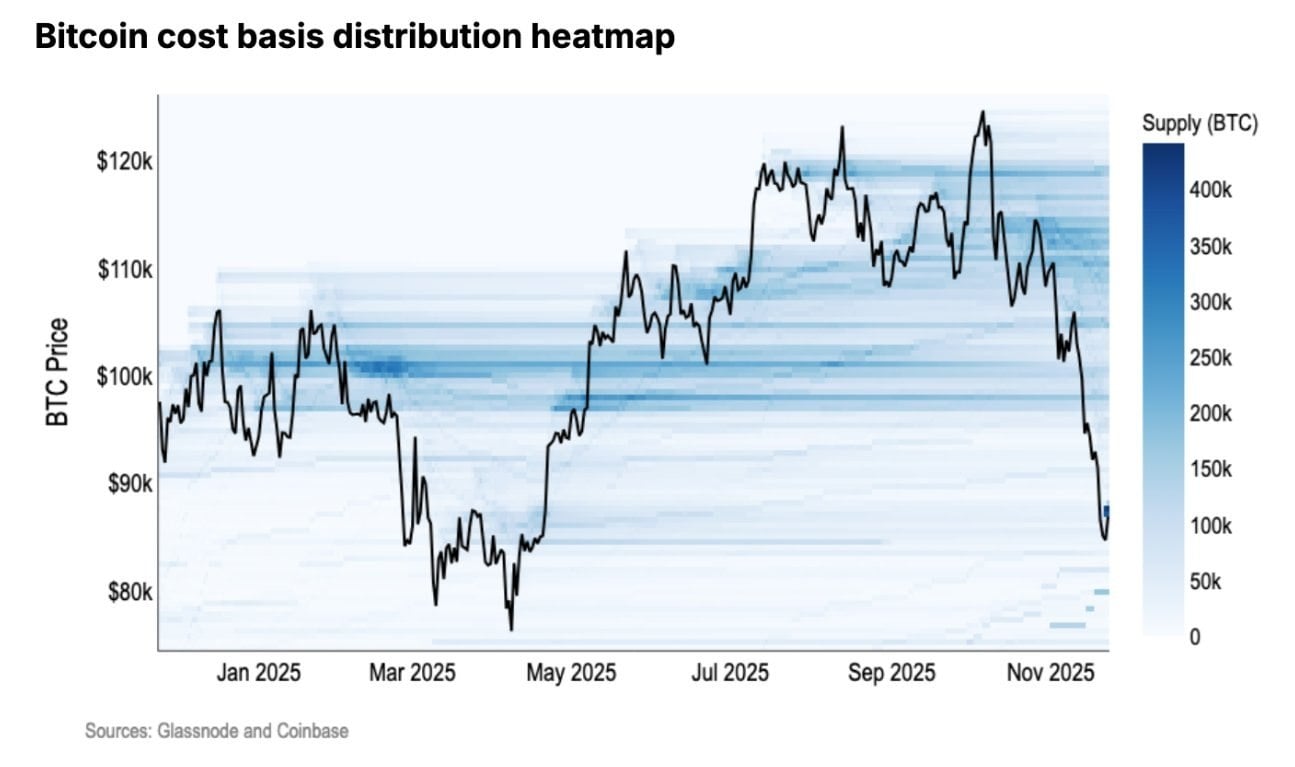

Coinbase also posted an accompanying chart showing bitcoin’s cost-basis distribution across 2025. The heatmap displays concentrated pockets of holder supply between roughly $95,000 and $110,000, with darker bands indicating heavier clusters of coins bought in those ranges. As the price fell sharply in November, the chart shows bitcoin moving below dense ownership layers, suggesting many market participants are now holding unrealized losses. The visualization also reflects thinner supply zones at lower levels, which may influence volatility as price searches for areas with stronger historical demand.

Bitcoin cost basis distribution heatmap shared by Coinbase Institutional. Source: Coinbase

The team also emphasized its tactical view, stating:

In this environment, we think higher probability setups favor breakout trades over knife-catching.

Analysts noted narrowing liquidity pockets, persistent clustering in implied volatility, and selective institutional flow patterns that influence near-term behavior. While the analysis leaned cautious, pro-crypto voices counter that bitcoin’s fixed issuance, broader international adoption, and continued institutional integration support a constructive long-run thesis. They argue that corrective phases clear excess leverage and help create more stable foundations for future appreciation as macro conditions gradually normalize.

- Why does Coinbase say bitcoin is dropping?

Coinbase points to weakening trend signals, bearish options flows, whale selling, and ETF outflows as key pressures. - What role do spot bitcoin ETF outflows play?

Coinbase notes that they reduce steady buy-side demand and hurt market stability. - How does liquidity affect bitcoin’s recent volatility?

Tight liquidity from slower trader participation and whale selling amplifies market swings. - What does Coinbase’s cost-basis chart suggest?

It shows bitcoin falling below dense ownership zones, leaving many holders at unrealized losses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。