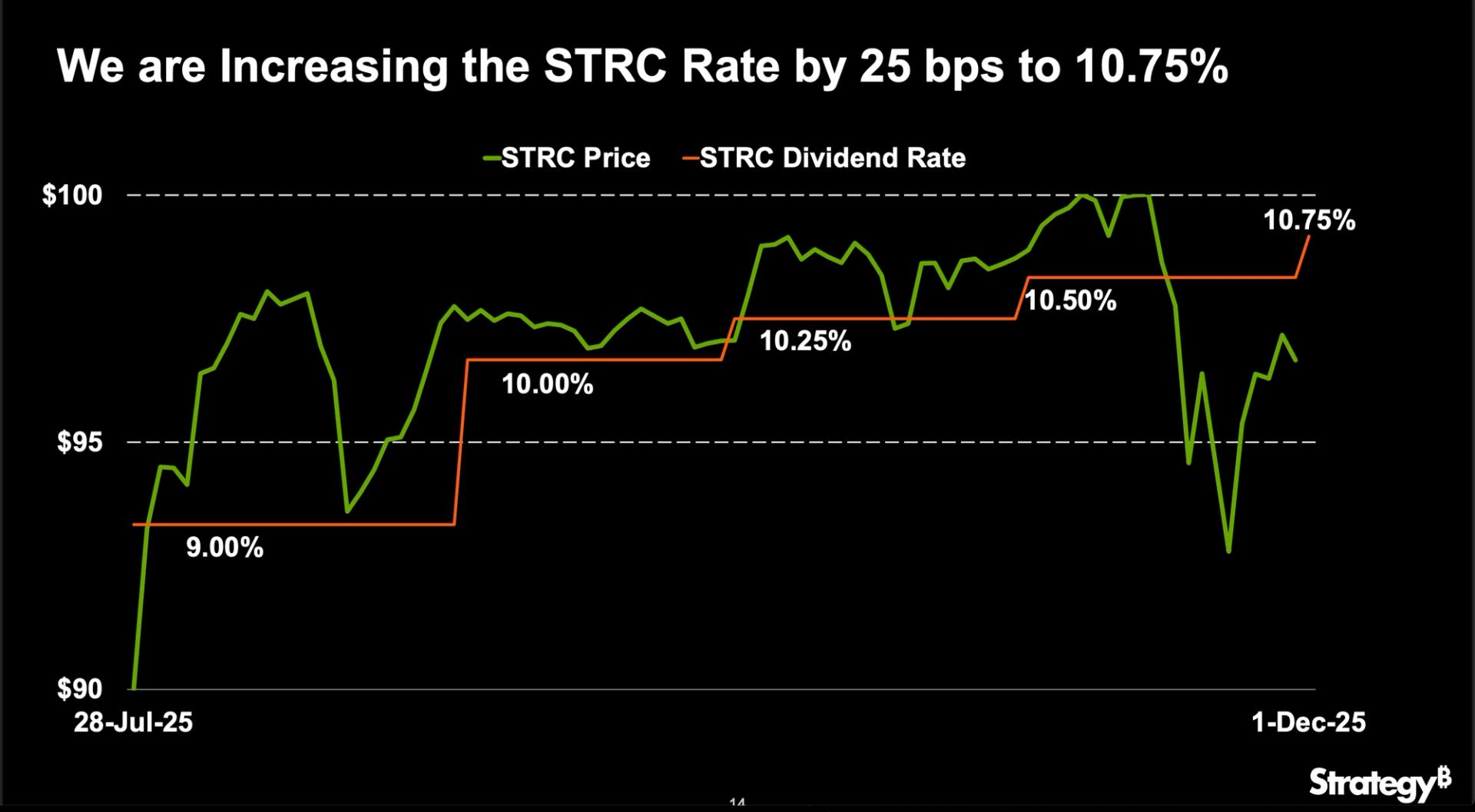

Strategy (MSTR) on Monday announced a further 25 basis point increase in the dividend rate of its STRC preferred series to 10.75%. This is the fourth increase since the IPO launch at the end of July.

One of Strategy’s perpetual preferred stocks, STRC, or "Stretch," is designed to offer short duration characteristics with high yield exposure. It currently pays a 10.75% annual dividend, distributed monthly in cash. The dividend rate is adjusted each month to encourage trading near STRC’s $100 par value and to limit price volatility.

When launched in July, STRC initially carried a 9% dividend rate at the IPO price of $90. The company then raised the dividend rate twice to 10.25%, although STRC still did not reach par. A third increase finally got the price to $100, but the tumble in the price of bitcoin and Strategy's common stock touched STRC, which at one point in the November panic fell as low as about $90, setting in motion this latest increase.

STRC was trading at $98.43 at press time.

The updated dividend rate was announced along with news of a $1.44 billion cash buffer intended to fund perpetual preferred dividends. The total annualized dividend obligation across all perpetual preferred shares is about $800 million. According to the investor presentation, the company has 74 years of dividend coverage when measured against its $59 billion bitcoin reserve. Even so, the $1.44 billion cash reserve is expected to be the primary source of near term dividend funding.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。