Written by: Prathik Desai

Translated by: Luffy, Foresight News

In the first two weeks of October 2025, Bitcoin spot ETFs attracted inflows of $3.2 billion and $2.7 billion, setting records for the highest and fifth highest weekly net inflows in 2025.

Prior to this, Bitcoin ETFs were expected to achieve a record of "no consecutive weeks of outflows" in the second half of 2025.

However, the most severe cryptocurrency liquidation event in history unexpectedly occurred. This event, which saw $19 billion in assets evaporate, still leaves the crypto market feeling uneasy.

Weekly net inflows and net asset value of Bitcoin spot ETFs in October and November

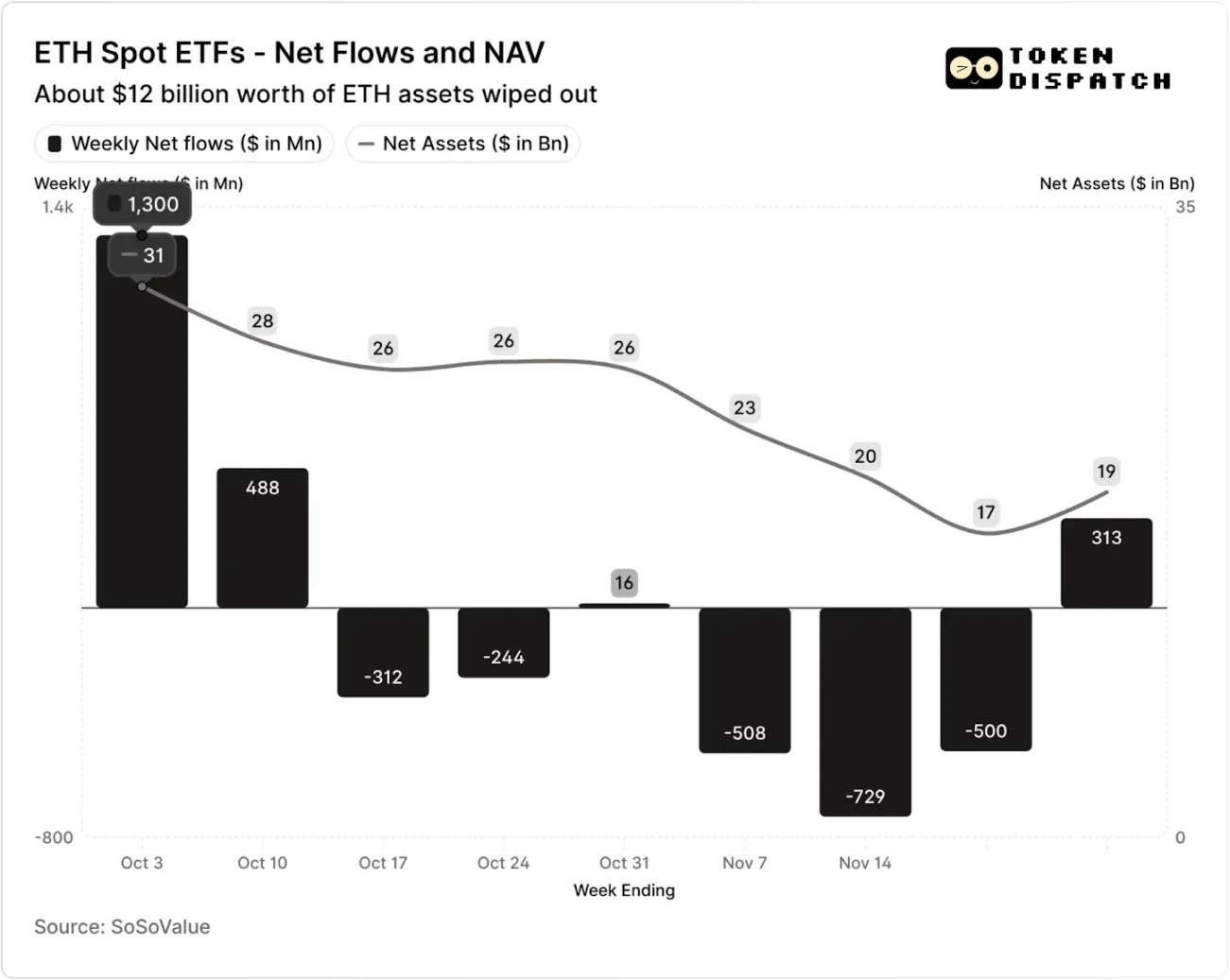

Weekly net inflows and net asset value of Ethereum spot ETFs in October and November

In the seven weeks following the liquidation event, Bitcoin and Ethereum ETFs experienced outflows in five of those weeks, totaling over $5 billion and $2 billion, respectively.

As of the week of November 21, the net asset value (NAV) managed by Bitcoin ETF issuers shrank from approximately $164.5 billion to $110.1 billion; the NAV of Ethereum ETFs nearly halved, dropping from $30.6 billion to $16.9 billion. This decline was partly due to the price drops of Bitcoin and Ethereum themselves, as well as some tokens being redeemed. In less than two months, the combined NAV of Bitcoin and Ethereum ETFs evaporated by about one-third.

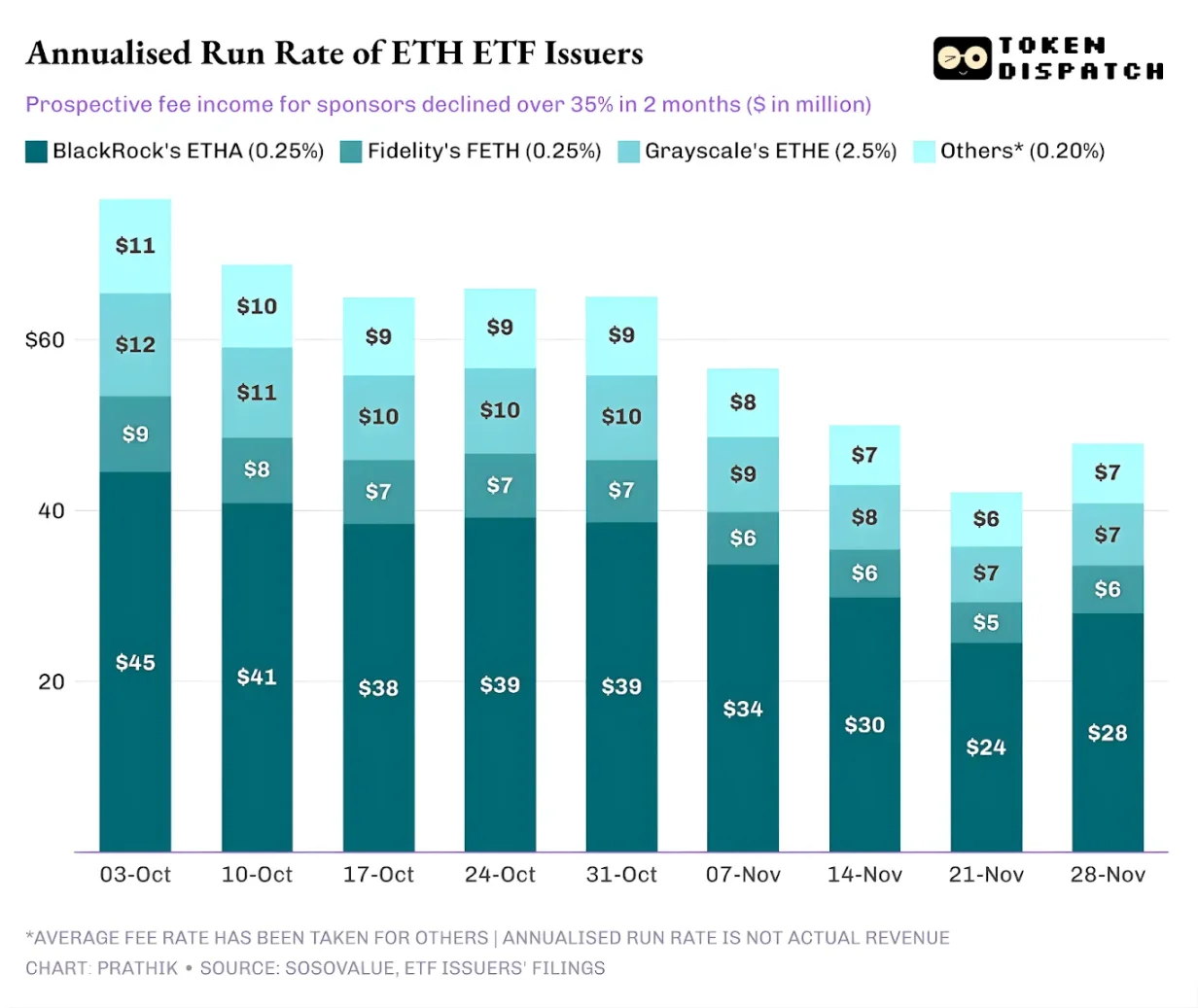

The retreat in fund flows reflects not only investor sentiment but also directly impacts the fee income of ETF issuers.

Bitcoin and Ethereum spot ETFs are "cash cows" for issuers like BlackRock, Fidelity, Grayscale, and Bitwise. Each fund charges fees based on the size of the assets held, typically disclosed as an annual fee rate, but actually calculated based on daily net asset value.

Every day, trust funds holding Bitcoin or Ethereum shares sell part of their holdings to pay for fees and other operating expenses. For issuers, this means their annual revenue is approximately equal to the assets under management (AUM) multiplied by the fee rate; for holders, this results in the gradual dilution of the number of tokens they hold over time.

The fee rates for ETF issuers range from 0.15% to 2.50%.

Redemptions or outflows do not directly cause issuers to profit or incur losses, but outflows lead to a reduction in the total assets managed by the issuer, thereby decreasing the asset base on which fees can be charged.

On October 3, the total assets managed by Bitcoin and Ethereum ETF issuers reached $195 billion, and combined with the aforementioned fee levels, their fee pool was quite substantial. However, by November 21, the remaining asset size of these products was only about $127 billion.

If we calculate the annualized fee income based on weekend asset management sizes, over the past two months, the potential income from Bitcoin ETFs has dropped by more than 25%; the impact on Ethereum ETF issuers has been even greater, with annualized revenue declining by 35% over the past nine weeks.

The Larger the Issuance Scale, the Worse the Decline

From the perspective of individual issuers, the fund flows reveal three slightly different trends.

For BlackRock, its business characteristics are a coexistence of "scale effects" and "cyclical fluctuations." Its IBIT and ETHA have become the default choices for mainstream investors to allocate Bitcoin and Ethereum through ETFs. This allows the world's largest asset management firm to charge a fee of 0.25% based on a large asset base, especially when asset sizes hit record levels in early October, resulting in substantial earnings. However, this also means that when large holders choose to reduce risk in November, IBIT and ETHA become the most direct targets for selling.

The data supports this: the annualized fee income from BlackRock's Bitcoin and Ethereum ETFs has declined by 28% and 38%, respectively, both exceeding the industry average declines of 25% and 35%.

Fidelity's situation is similar to BlackRock's, but on a smaller scale. Its FBTC and FETH funds also followed the rhythm of "inflows followed by outflows," with the market enthusiasm in October ultimately replaced by outflows in November.

Grayscale's story is more about "historical legacy issues." Once upon a time, GBTC and ETHE were the only scaled channels for many U.S. investors to allocate Bitcoin and Ethereum through brokerage accounts. However, as institutions like BlackRock and Fidelity have taken the lead in the market, Grayscale's monopoly position has vanished. Compounding the issue is the high fee structure of its early products, which has led to continuous outflow pressure over the past two years.

The market performance in October and November also confirms this tendency among investors: when the market is good, funds shift to lower-fee products; when the market weakens, holdings are cut across the board.

The fee rates of Grayscale's early crypto products are 6-10 times that of low-cost ETFs. Although high fees can boost revenue figures, the high expense ratios continue to drive away investors, shrinking the asset base from which they can earn fees. The remaining funds are often constrained by friction costs such as taxes, investment directives, and operational processes, rather than being a result of active choices by investors; and every outflow serves as a reminder to the market: once better options are available, more holders will abandon high-fee products.

These ETF data reveal several key characteristics of the current institutionalization process in cryptocurrency.

The spot ETF market in October and November indicates that the management of cryptocurrency ETFs is cyclical, just like the underlying asset market. When asset prices rise and market sentiment is positive, inflows will boost fee income; however, once the macro environment changes, funds will quickly withdraw.

While large issuing institutions have built efficient "fee channels" on Bitcoin and Ethereum assets, the volatility in October and November proves that these channels are also vulnerable to market cycles. For issuers, the core issue is how to retain assets amid a new round of market shocks and avoid significant fluctuations in fee income due to changes in macro trends.

Although issuers cannot prevent investors from redeeming shares during a sell-off, income-generating products can help mitigate downside risks to some extent.

Covered call option ETFs can provide investors with premium income (Note: A covered call option is an options investment strategy where investors sell a corresponding number of call option contracts while holding the underlying asset. By collecting premiums, this strategy aims to enhance holding returns or hedge some risks.), offsetting part of the price decline of the underlying assets; staking products are also a viable direction. However, these products must first pass regulatory scrutiny before being officially launched in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。