Author: JW, Techub News

The start of 2026 is colder than expected. It was originally thought that we had endured a long period of decline, and spring was within reach; instead, reality presents a sudden "chill of spring."

It is like scrolling through the boasts of "Builders" on Twitter, only to turn around and see them quietly changing their status to "Open to work" on LinkedIn.

Recent news has shown that even Jack Dorsey, the Bitcoin fundamentalist and founder of Block, formerly known as Square, cannot hold out. According to Bloomberg, Block is initiating a layoff plan to cut 10% of its workforce. Even if you are a giant in the payments sector, holding a printing machine like Cash App, you still have to slash jobs in the name of "efficiency improvement."

What does the entire industry look like now? Exchanges are laying off staff due to compliance costs, NFT platforms are laying off due to lack of trading volume, and GameFi project teams are directly disbanding as tokens hit zero. This is not just a winter for the crypto industry; it is a "cutting fat and building muscle" trend occurring across the global tech landscape.

However, amidst this wave of layoffs, there is an exception; one company is not only not laying off but is instead aggressively hiring and even "spreading funds" wildly.

That's right, it is Tether.

This is the Tether that was once under the scrutiny of the SEC, fined by the New York Attorney General, and called out by countless bears that it would "explode." According to Cointelegraph, they are planning to expand their staff to 450 people.

You might laugh: 450 people? Even after layoffs, Binance has a few thousand people, and Coinbase also has several thousand.

But you have to look at the efficiency. Tether manages over a hundred billion dollars in assets with just a few hundred people, and they have just extended their reach to 140 investment projects across traditional fields.

While everyone else is competing to death in the stagnant Web3 market, Tether has quietly moved its earnings to Web2 and even more traditional "old world" sectors.

In this article, we will explore what game Tether, which cloaks itself in the guise of Web3, is playing?

The most profitable business requires not many people

First, we must acknowledge a fact that is despairing for all Web3 entrepreneurs: Tether is running the best business in the industry and even the world.

While you are still desperately writing code, running operations, managing airdrops, and防 hacking, Tether only needs to do one thing: accept dollars, issue USDT, and then use the dollars to buy U.S. Treasury bonds.

In the past few years of high interest rates maintained by the Federal Reserve, Tether has literally been rolling in money. They don’t need to deal with complex liquidity algorithms like Uniswap, nor do they need to maintain a large node network like Ethereum. Their business model is shockingly simple: "profit from interest spread."

This is known as the "seigniorage."

This is why they have fewer employees. Because the act of printing money does not require many people.

But the question arises, what to do after making money?

Looking back at the last bull market, most Web3 projects (including some top exchanges) usually followed a path after making money: extravagance, buying mansions, naming stadiums (the lessons from FTX Arena are vivid in mind), or madly reinvesting in poor quality assets within their ecosystem, engaging in a spiraled game of stepping on the left foot and the right. We know how that ends; when the tide goes out, we see who was swimming naked.

But Tether's executives, especially after Paolo Ardoino, the tech geek, became CEO, have shown an extremely terrifying mentality similar to "old money thinking."

Tether has not reinvested profits back into high-risk crypto assets (or the proportion is very small); instead, they have operated like a sovereign wealth fund. They are acutely aware that the moat for USDT does not rely on technology (issuing ERC-20 tokens has no thresholds) but on credit endorsement and risk resistance capabilities.

In the stablecoin arena, it may appear to be a technical competition, but fundamentally it is a trust competition. Who can redeem during extreme conditions, who can withstand regulatory storms, and who can avoid bank runs during a black swan event, that is the true threshold. Over the past few years, Tether has experienced numerous "death sentences," each time being confronted by the market with real redemptions and reissuances. To some extent, their credit is not built on audit reports, but rather through rounds of pressure testing from bank runs. This harsh market selection, in itself, serves as a form of alternative endorsement.

If you closely examine the financial reports and news from the past two years, you will discover that Tether is undergoing a thrilling "transition from virtual to real."

The money earned has not been squandered

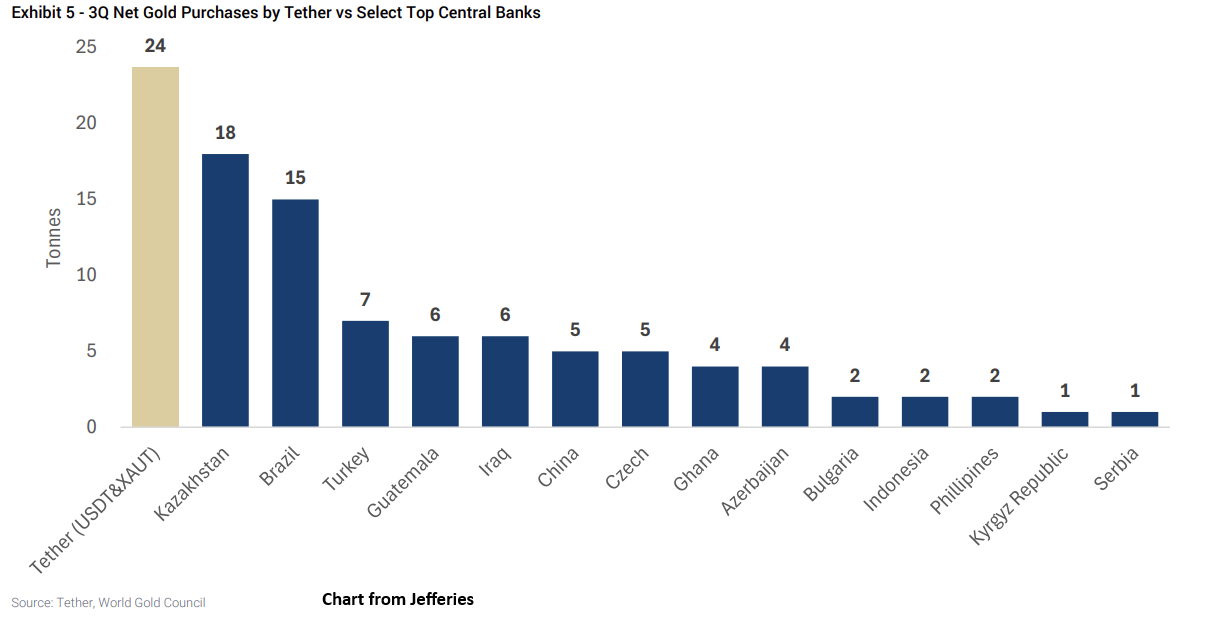

The latest data is simply shocking. According to investment bank Jefferies' report, as of January 2026, Tether's gold reserves had surpassed 23 billion dollars. Converting this, they hold 148 tons of physical gold. This volume places them among the top 30 gold holders in the world.

Source: Wall Street Watch

Do you think they are competing with the crypto whales? No, they are competing with nations.

Tether's gold reserves now exceed those of sovereign countries like Australia, the UAE, and Qatar. In just a few short months from Q4 2025 to January 2026, they purchased 32 tons of gold. This buying speed is only second to the central banks of Poland and Brazil globally.

This is the most "forward-thinking" move in Tether's risk management.

Everyone is worried about the decline of dollar hegemony and the liquidity crisis of U.S. Treasuries. As an issuer of a dollar stablecoin, Tether is essentially a shadow bank of the dollar. If the dollar sneezes, USDT catches a cold.

To hedge against this greatest "systemic risk," Tether has chosen humanity's only hard currency: "gold." While other stablecoins are currently fighting over compliance evidence for "100% dollar reserves," Tether has quietly replaced its base reserve with gold. This means that even if something significant happens at the U.S. Treasury tomorrow, or if the dollar credit system collapses, Tether still has 148 tons of heavy gold bars on hand.

This is not just a coin issuance company; this is clearly a "digital Federal Reserve" with insider knowledge.

This shift in asset allocation has changed Tether's risk exposure structure. In the past, the market's biggest doubt about it focused on the "quality of dollar assets"; now, the question has transformed into "what kind of diversified asset portfolio it is constructing." When a stablecoin issuer begins to allocate gold like a central bank and diversify investments like a sovereign fund, its role has quietly shifted. It is no longer just a liquidity tool on the blockchain but an invisible node in the real financial system.

This also explains why Tether's narrative increasingly downplays "crypto ideals" while strengthening "asset safety" and "long-term robustness." In a rapidly evolving narrative industry, it chooses to stand on the side of time. Everyone is an innovator in a bull market; only balance sheets matter in a bear market. Tether traded the imagination gained in the bull market for certainty in the bear market.

140 projects, from neuroscience to fun farms

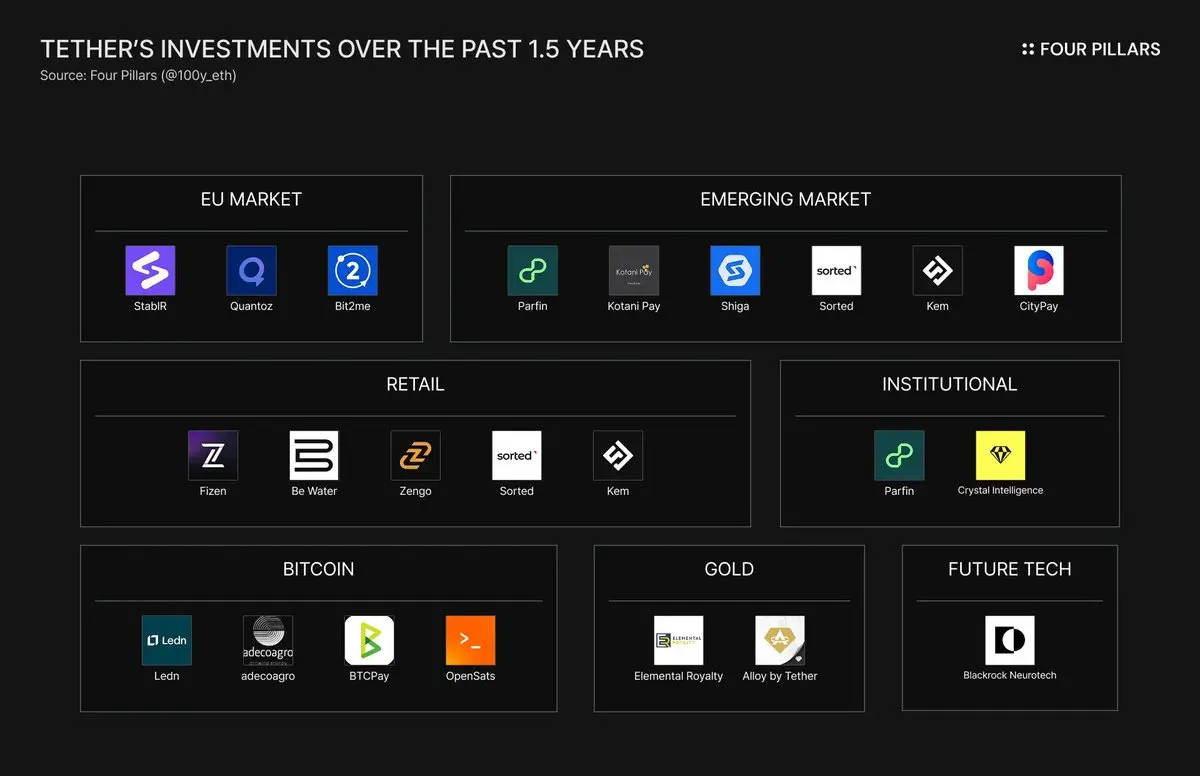

If hoarding gold is defense, then investing in 140 traditional projects is Tether's full-on offense.

Flipping through Tether's investment landscape might seem chaotic at first glance, but upon closer inspection, it is immensely thought-provoking. They are not just buying assets; they are investing in "essentials for human survival" for the future.

Unlike other crypto funds that are keen to invest in tokens and protocols, Tether has spread its profits into computing power, energy, agriculture, healthcare, and other tangible fields, building a vast resource empire:

First, monopolizing computing power and energy, becoming the "landlord" of the AI era. Tether heavily invested in computing power infrastructure over the past two years; not only did they mine using geothermal energy in Uruguay and El Salvador, but they also entered the AI computing rental market by investing in Northern Data. The logic is very hardcore: the narrative of Web3 may cool, but the demand for computing power and electricity driven by AI will be a rigid need for the next decade. Holding funds (USDT) and computing power (GPU), Tether is becoming the fundamental infrastructure service provider of the digital age.

Second, betting on biotechnology, hedging against singular industry risks. Little known is that Tether actually invested in brain-computer interface company Blackrock Neurotech. To traditional venture capitalists, this looks like a layout for the next era; to Tether, it is a transformation of the copper-smelling "stablecoin profits" into "tech capital" that benefits humanity. This not only wins them a reputation but also breaks their asset allocation out of the financial cycle.

Third, laying out in agriculture and land, returning to the most fundamental hedging. Tether has begun to buy land and invest in modern agriculture. This may sound the least "sexy" but is the most stable. When the digital bubble bursts, food and land will always be hard currencies. This allocation logic is being executed entirely according to the "doomsday survival" script.

Additionally, they are continuously infiltrating offline traffic portals through investments in the Georgian payment system and sponsoring European football clubs. All these layouts indicate that Tether intends for USDT to permeate the capillaries of the real world, just like water and electricity.

Tether's "Web2ification" Survival Philosophy

Returning to the initial question of the article: why is Block laying off while Tether is hiring?

Because Block is still playing the "growth game" of Web2. Once growth slows down, it needs to cut costs and improve efficiency. Meanwhile, Tether plays the "resource game."

Tether's expansion is not aimed at developing more advanced DApps, nor creating Layer 3 solutions. The 450 people they are hiring are most likely not writing Solidity code; they are handling compliance, government relations, asset management, and geopolitical maneuvering. This is precisely why Tether can endure multiple bull and bear cycles and outlast countless competitors.

They are extremely "Web2ified," even "traditional." In a Web3 filled with air and bubbles, Tether is the dealer who took the hardest chips (dollars), then turned and walked out of the casino, going next door to buy buildings, land, gold bars, and power plants. When others in the casino are fighting each other as their chips hit zero or frantically flee as regulators burst in, Tether is sitting in a tall building across the casino, sipping coffee, watching it all.

This represents an extreme rationality, even tinged with a certain coldness. Many criticize Tether for its lack of transparency, claiming it operates like a black box. But from a business strategy perspective, one cannot help but admire Paolo Ardoino and his team. They have not been misled by the grand narratives of Web3. They know that crypto must genuinely become "water" and "electricity," part of the real world, to survive. Therefore, when seeing Block laying off and various institutions downsizing, don't just be anxious. Look at what Tether is doing.

It is telling you a fundamental truth: it is not hard to fly up in the wind; what is difficult is whether you truly grasp the roots that grow in the ground when the wind stops. Tether has grasped gold, computing power, and land.

This may be the ultimate form of a Web3 company: using decentralized technology to earn excess profits, then controlling the means of production in the real world in the most centralized way.

It sounds a bit cyberpunk and somewhat dystopian, but that is likely the reality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。