November was originally a month full of expectations. The market had prepared early, hoping for a smooth year-end conclusion. AI concept stocks continued to lead the global risk appetite, and the crypto market was steadily floating at high levels, everything seemed to be progressing according to script.

However, the plot suddenly reversed. The U.S. government shutdown lasted a full forty-three days, key economic data was forced to halt, and the market suddenly felt blindfolded, only able to grope for direction in mid-air. Meanwhile, the statements from global central banks fluctuated repeatedly, making it impossible to grasp the rhythm. The pressure in China's real estate sector resurfaced, reigniting concerns that investors least wanted to face. Even the previously strong AI leading stocks began to show signs of fatigue in this atmosphere.

The crypto market naturally could not escape this turmoil. Bitcoin and Ethereum no longer acted like independent assets; instead, they resembled highly volatile tech stocks, experiencing sharp fluctuations with emotional swings. However, amidst this chaos, the flow of funds quietly revealed two winners. One was the RWA track, which institutions continued to increase their positions in, and the other was the suddenly surging privacy coins, which saw a fierce rise in a short time, even outpacing BTC and ETH at one point.

Now we stand at the threshold of December. How the market will move next ultimately depends on the decisions of central banks, the direction of AI regulation, and the narrative flow within the crypto industry. Whether it will lead to a year-end rebound or continue to adjust, no one can provide an absolute answer. For XT users, the most important thing this month is to maintain selectivity. Understanding the direction is more crucial than blindly chasing speed.

TL;DR Quick Summary

- November's market was fraught with incidents. The U.S. experienced a 43-day data vacuum, Powell's statements were contradictory, pressure in China's real estate sector heated up again, Japan's stance suddenly became more hawkish, and AI concept stocks faced their first real resistance.

- BTC and ETH recorded their weakest performance in over a year, resembling high-volatility tech stocks rather than being influenced by factors within the crypto industry. The decline in global risk sentiment was the main cause.

- RWA tokens continued to rise steadily under favorable regulatory conditions, while privacy coins staged one of the most rapid rebounds of 2025, briefly outperforming mainstream markets.

- December is a critical turning point. The direction of central banks, macro data, AI policies, and the rotation of funds within crypto will all impact the year-end market.

- For XT users, it is more important to focus on stable leverage, macro rhythm, and narrative choices. RWA and privacy coins are worth paying attention to, avoiding blind chasing of price increases.

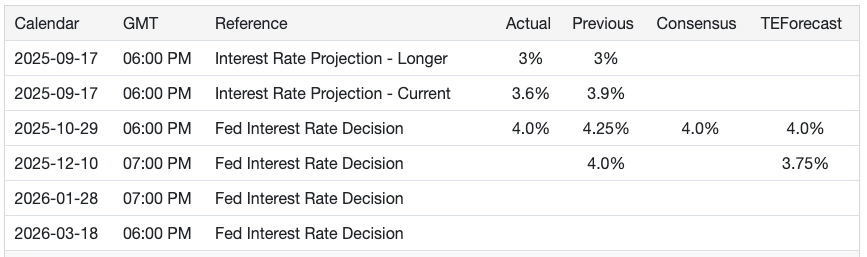

December 2025 Macro Calendar (Overview of Key Dates)

What November Taught Us: Changes in Macro Winds, AI Retreat, and Risk Sentiment

At the beginning of November, the overall market atmosphere was quite optimistic. AI concept stocks continued to be the star, still the traffic driver of the year. Bitcoin had just touched a new high of $126,000, and Ethereum was also climbing up. Everyone felt that the global switch from interest rate hikes to cuts should land smoothly, and a traditional year-end rebound was quite probable.

However, the U.S. suddenly hit the brakes.

The government shutdown left the market directionless. Key economic data was forced to pause updates, with no non-farm payrolls or CPI for a full forty-three days, and the entire set of reference indicators that the Federal Reserve usually relied on was interrupted. The Beige Book provided some vague signals, indicating that economic activity was stabilizing, with employment and consumption cooling, but without the support of hard data, the market remained anxious.

The Fed's attitude appeared more dovish on the surface, but internal thoughts were not unified.

At the end of October, rates were just lowered to 3.75% to 4%, but in November's public speeches, some officials began to hint at the possibility of further rate cuts in the short term. New York Fed President Williams even directly stated that policy could continue to be relaxed. However, looking back at the October meeting minutes, many members emphasized that inflationary pressures still existed. In the absence of data, the market continued to bet on a rate cut in December, but this confidence could be shattered at any moment.

TradingEconomics.com

TradingEconomics.com

Europe Performed Much More Steadily

Compared to the chaos in the U.S., Europe was noticeably calmer. The European Central Bank maintained a 2% deposit rate, indicating that the current position was appropriate and not to be disturbed. The situation in the UK was more nuanced. The rate decision on November 6 was a narrow 5 to 4 to hold steady, but the tight fiscal budget led the market to lean towards the possibility of opening the door to rate cuts on December 18.

Japan Was the True Wild Card

The biggest plot twist in November came from Japan. The Bank of Japan kept its rate unchanged at 0.5%, but the tone suddenly turned hawkish. Governor Ueda hinted at a possible rate hike in December due to significant wage increases and no longer low inflation levels.

At the same time, new Prime Minister Kishi Sanae introduced a stimulus policy of 21.3 trillion yen, with both fiscal and monetary sides working together. The result was that Japanese government bond yields soared to their highest level since 2008, raising concerns that Japan could become an "amplifier" of global volatility. As long as it trembles, other markets might shake along with it.

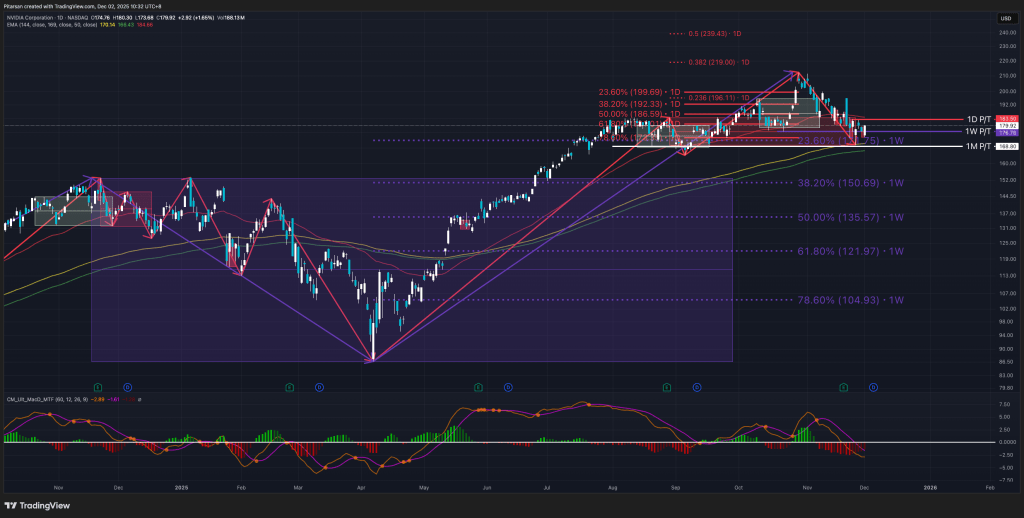

AI Stocks Finally No Longer "Riding Alone"

The most surprising aspect for the market was the AI sector. After several months of frenzied growth, November finally showed signs of fatigue. Nvidia delivered an impressive earnings report, but its stock price did not continue to surge, Palantir fell over 30% from its peak, and the Nasdaq also cooled off. These signals indicated that even the hottest narratives could encounter valuation pressures and profit-taking.

2025 NVDA Price Performance (TradingView.com)

2025 NVDA Price Performance (TradingView.com)

November's Crypto Insights: BTC, ETH, RWA, Privacy Coins, and AI, Understanding Market Sentiment with One Chart

All the macro storms in November were fully borne by the crypto market. In summary:

- The decline of BTC and ETH mainly stemmed from the macro environment, not structural issues.

- AI tokens briefly cooled down, but the underlying logic remained unchanged.

- RWA continued to see institutional accumulation, being the most stable track throughout the month.

- Privacy coins unexpectedly became a liquidity hotspot, experiencing extreme volatility but high interest.

As November began, the crypto market was in full swing. The heat of AI pushed risk appetite higher, the dollar weakened, and Bitcoin surged directly to over $110,000, with Ethereum closely following. At that time, everyone had a consistent mindset; the path to rate cuts seemed clear, and the year-end market should steadily rise.

However, macro sentiment changed abruptly, and Bitcoin and Ethereum moved like high-flying tech stocks. Throughout November, BTC retraced over 21 percentage points, dropping from over $110,000 to over $80,000. ETH also fell to just over $3,000. Various leveraged positions in the market were continuously liquidated, with the total liquidation amount exceeding $8 billion, and the market was amplified wave after wave.

In fact, there was nothing wrong with crypto itself; the core issue was the macro environment being repriced. With U.S. data interruptions, the Fed's fluctuating attitude, and the amplified pressure from China's real estate sector, AI stock prices finally weakened. Funds naturally chose to avoid risk, gold hit new highs, and BTC's movements almost completely followed the Nasdaq.

Yet amidst this chaos, the choice of funds provided another clear picture of the market.

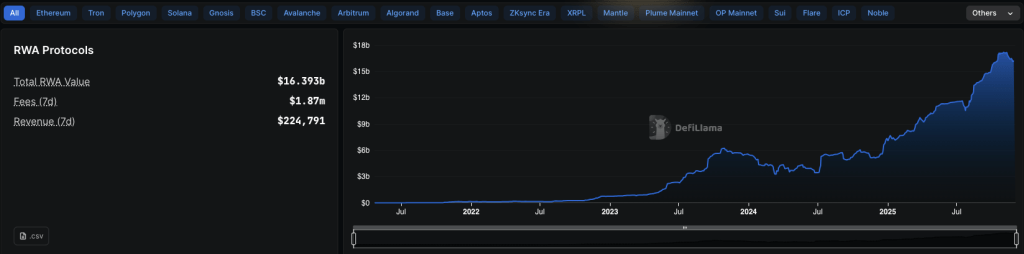

RWA: The Steadiest Line in November

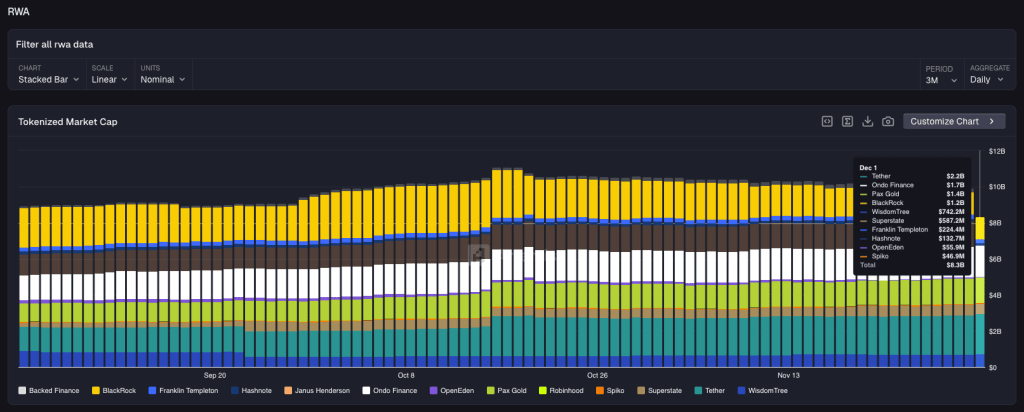

RWA was simply the "stabilizing force" of November.

RWA Project TVL (DeFiLlama)

RWA Project TVL (DeFiLlama)

The on-chain RWA market cap rose to around $36 billion, increasing by 5 percentage points month-on-month, with the number of holders also rising by over 11 percentage points. Institutions were particularly active:

- Ondo received permission for the entire European Economic Area to directly offer tokenized stocks.

- Centrifuge launched institutional tools, with the tokenization scale of credit and energy assets exceeding $1.3 billion.

- MakerDAO's Sky savings pool continued to absorb a large amount of DAI.

- Major banks in Singapore, South Korea, and Europe are advancing pilot projects for tokenized deposits and government bonds.

For investors, the logic of RWA is clear and the rhythm is steady, not overly affected by market sentiment, making it a typical fundamental track. XT also launched a RWA section.

UPAL, SZRR, GSSG, GCF, MINT, USTBL, and other trading pairs represent real assets or income-generating products, resembling "stable returns with a bit of extra upside." Compared to sentiment-driven coins, they are significantly more stable.

RWA Total Market Cap (Artemis)

RWA Total Market Cap (Artemis)

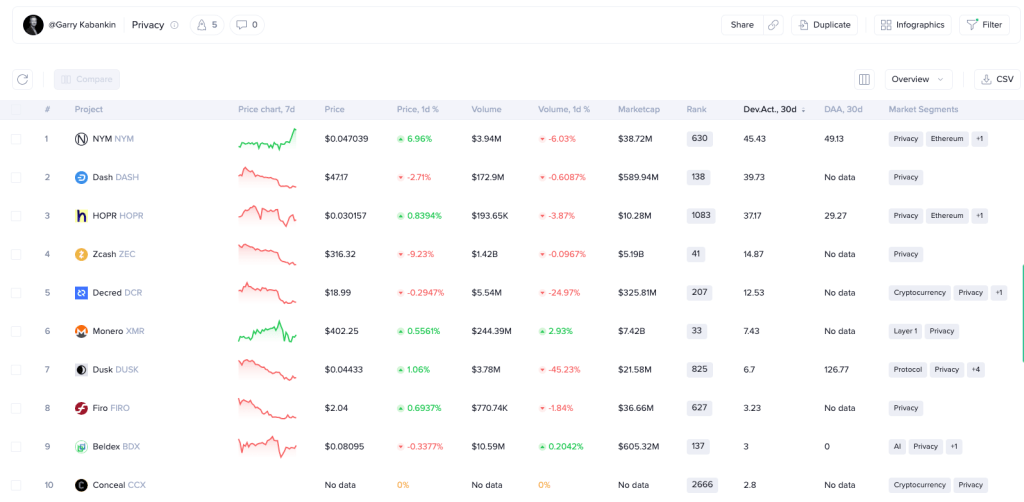

Privacy Coins: The Most Dramatic Market of November

If we were to select the most dramatic track of November, privacy coins would undoubtedly take the top spot.

Zcash has surged over seven times since the end of September. Monero and Dash have also seen triple-digit gains. At one point, six percent of the entire market's trading volume was focused on trading privacy coins.

Why did they suddenly become popular? The reasons are quite simple:

- 1. Real Usage: The usage of ZEC privacy pools has been steadily increasing, indicating genuine demand.

- 2. Narrative Fit: When BTC and ETH are underperforming, the market naturally seeks new stories, and "digital cash" quickly became the substitute star.

- 3. Macro Stimulus: With stricter global regulations and frequent news of asset freezes, privacy coins are viewed as essential assets.

Regulation remains complex. The U.S. quietly lifted sanctions on Tornado Cash contracts, but developers are still facing lawsuits. Europe plans to phase out privacy coins from the compliant market by 2027. However, the demand remains, making it difficult for the privacy sector to truly cool down.

Privacy Coin Development Activity Ranking Over the Last 30 Days (Santiment)

Privacy Coin Development Activity Ranking Over the Last 30 Days (Santiment)

AI Tokens and L2: A Brief Pause After Strength

The AI sector finally took a moment to cool off in November.

Nvidia's impressive earnings report did not lead to a price increase, Palantir dropped by 30%, and the heat in the U.S. AI market quickly diminished. The crypto market's AI tokens also experienced a synchronized adjustment:

- Slowing capital inflow

- Tokens like Bittensor (TAO), Fetch.ai (FET), Render (RNDR), and NEAR showed significant pullbacks

- Some short-term funds directly shifted from AI to trade privacy coins

However, this does not mean the AI narrative has ended. The demand for computing power, data, and AI agents continues to expand. The only change is that AI tokens are increasingly tied to the sentiment of AI stocks, leading to more synchronized volatility.

BTC and ETH: Key Positions in December

Although November was brutal, the medium to long-term logic remains intact.

- The U.S. spot Bitcoin ETF has been established, which is a long-term influx of capital.

- The political environment in the U.S. is more favorable compared to previous cycles.

- The Ethereum Dencun upgrade is progressing, and there may be a spot ETF in 2026.

Institutions are generally focused on the $75,000 to $80,000 range for BTC and the $2,800 level for ETH as support. If the Federal Reserve signals a dovish stance in December, coupled with a weakening CPI, a year-end rebound is entirely possible. However, if Japan suddenly raises interest rates or if China faces another crisis, the market may not have hit the bottom.

How the December market will unfold: Possible Paths and XT Trading Guide

The December market remains full of suspense. Macro factors, AI, BTC and ETH, RWA, and privacy coins are all in motion; this month could either reverse or continue to decline.

If the strong route is taken:

- The Federal Reserve cuts rates by 25 basis points and expresses confidence in falling inflation.

- The Bank of England follows suit, initiating its first easing of the year.

- The Bank of Japan remains steady, with no sudden rate hikes.

- No new negative developments in China's real estate sector.

Market Effect: The dollar weakens, risk premiums decrease, and BTC and ETH are likely to see a year-end rebound, with some narrative-supported sectors following suit.

If the weak route is taken:

- The Federal Reserve adopts a hawkish tone or delays rate cuts.

- Japan suddenly tightens policy, triggering a global interest rate spike.

- China faces further issues in real estate, dampening investment sentiment.

Market Effect: Year-end risk aversion may increase, with BTC potentially being pressured down to around $75,000 and ETH possibly returning to the $2,500 range, with high-volatility sectors being the first to feel the impact.

XT Users' Trading Manual

- Keep a close eye on the FOMC, Bank of England, and Bank of Japan meeting schedules at key points.

- Maintain light positions before major events; do not stubbornly hold through volatility.

- View the $75,000 to $80,000 range for BTC and around $2,800 for ETH as a range rather than a hard line.

- Manage positions based on sector attributes: RWA is relatively stable, privacy coins are more volatile, and AI tends to follow U.S. stock sentiment.

Quick Links

- November 2025 Market Outlook: From FOMC to x402 Protocol, A Comprehensive Analysis of Global Hotspots

- XT.com and Dash Discuss: Instant Settlement, Chain Lock Mechanism, and the Path of Privacy Innovation

- How to Invest 100,000 USDT? XT's Simple Earning Strategy Helps You Achieve Stable 10%+ Passive Income

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform, now boasting over 12 million registered users, with operations covering more than 200 countries and regions, and an ecosystem traffic exceeding 40 million. The XT.COM cryptocurrency trading platform supports over 1,300 quality coins and 1,300 trading pairs, offering spot trading, margin trading, futures trading, and other diversified trading services, along with a secure and reliable RWA (Real World Assets) trading market. We adhere to the philosophy of "Exploring Crypto, Trusting Trading," committed to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。