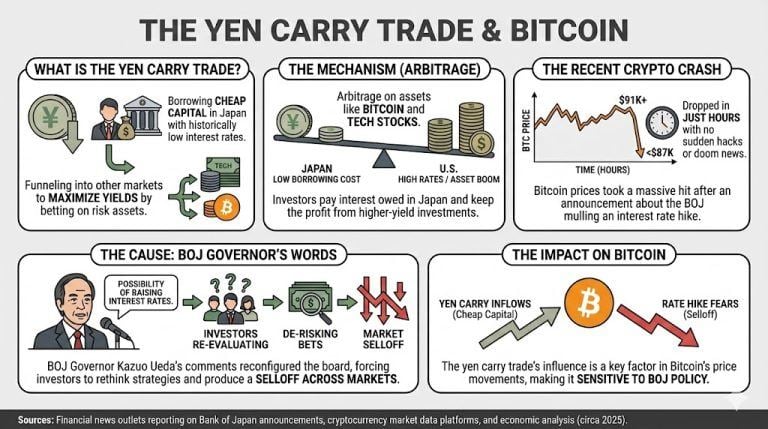

The yen carry has returned to the spotlight after the recent crypto crash, which took bitcoin prices from over $91K to less than $87K in just hours. During that time, there were no sudden hacks or doom news, just an announcement about the Bank of Japan (BOJ) mulling the possibility of raising interest rates.

BOJ Governor Kazuo Ueda could have inadvertently caused this massive drop, as his words might spell doom for the so-called yen carry trade. In a nutshell, the yen carry trade is executed by investors funneling cheap capital from Japan into other markets, seeking to maximize yields by betting on risk assets.

Read more: Bitcoin Falls off a Cliff as $91K Support Vaporizes

This is possible due to the historically low cost of borrowing money in Japan compared to interest rates in other markets, such as the U.S. This allows for an arbitrage on assets expected to boom, like bitcoin and tech stocks, which allows these investors to pay the interest owed and still come out winning.

Nonetheless, the possibility of interest rate hikes reconfigures the board and forces investors to rethink their strategies and de-risk these bets, producing a selloff across markets.

Explaining the issue, macroeconomic indexer Truflation stated:

They sell whatever assets they purchased in the US and get back into yen to pay back their loans in Japan, resulting in a cascade of US asset sales and yen purchases that drive stock prices even lower and yen prices even higher, driving more investors to exit.

This dynamic could have hit the crypto market, prompting millions in liquidations as investors sought to position before an interest rate hike.

While the decision of a rate hike is not a done deal, prediction markets like Polymarket estimate an 83% chance of a 0.25% increase in December.

Analysts will be vigilant regarding further statements from BOJ representatives, as the decision, if taken, could bring down the cryptocurrency market again on December 19, when the policy decision will be finally taken.

- What caused the recent bitcoin price drop?

The drop from over $91K to below $87K was triggered by speculation about a potential interest rate hike from the Bank of Japan. - What is the yen carry trade?

The yen carry trade involves investors borrowing at low rates in Japan and investing in higher-yielding assets, like bitcoin, globally. - How could interest rate hikes affect the markets?

Raising interest rates may force investors to de-risk, leading to sell-offs in risk assets, including cryptocurrencies and tech stocks. - What’s the current prediction for BOJ’s interest rate decision?

Prediction markets indicate an 83% chance of a 0.25% rate hike in December, with analysts closely monitoring BOJ statements for further impact.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。