Market Surge and Sudden Changes in the Second Half of 2025

In the third quarter of 2025, the cryptocurrency market experienced a rapid rebound. With the prices of mainstream assets like Bitcoin and Ethereum soaring significantly, investor sentiment and capital inflows improved noticeably, leading to active market trading. The total market capitalization of global crypto assets rose from about $3.46 trillion at the end of June to nearly $4 trillion by late September, approaching the peak of the previous bull market. Bitcoin surged to about $126,000 in early October, while net inflows into Bitcoin ETFs during the quarter reached approximately $7.8 billion, pushing Bitcoin's market cap share back up to around 64%.

However, as October began, the market underwent a dramatic shift. Over the weekend of October 10-11, the crypto market experienced an unprecedented leveraged liquidation crash: Bitcoin fell nearly 18% within five days after reaching its peak, while Ethereum and many mid- and small-cap coins plummeted by double digits, triggering panic selling and a chain reaction of forced liquidations. Approximately $19.3 billion in contract positions were liquidated within just two days, leading to a severe liquidity crisis in the market. Key indicators such as trading volume, open interest, borrowing rates, and funding rates experienced extreme volatility during this "Black Weekend," creating a chaotic trading environment.

This October crash became a watershed moment for the market in the second half of 2025. Observations afterward indicated that, following the intense fluctuations, market participants generally reduced their leverage preferences and no longer blindly chased highs; the trading share of decentralized perpetual contract platforms increased, with high-leverage funds beginning to flow into decentralized platforms like Hyperliquid; major centralized exchanges rolled out "market rescue toolkits" to stabilize user confidence. This turmoil highlighted a fact: new paradigms like Binance Alpha and Hyperliquid only eroded incremental high-risk preferences without shaking the foundations of centralized exchanges (CEX) — in an environment of significant price and sentiment fluctuations, high-risk speculative funds seek new habitats, but the vast majority of fundamental trading activities still occur within traditional centralized exchanges.

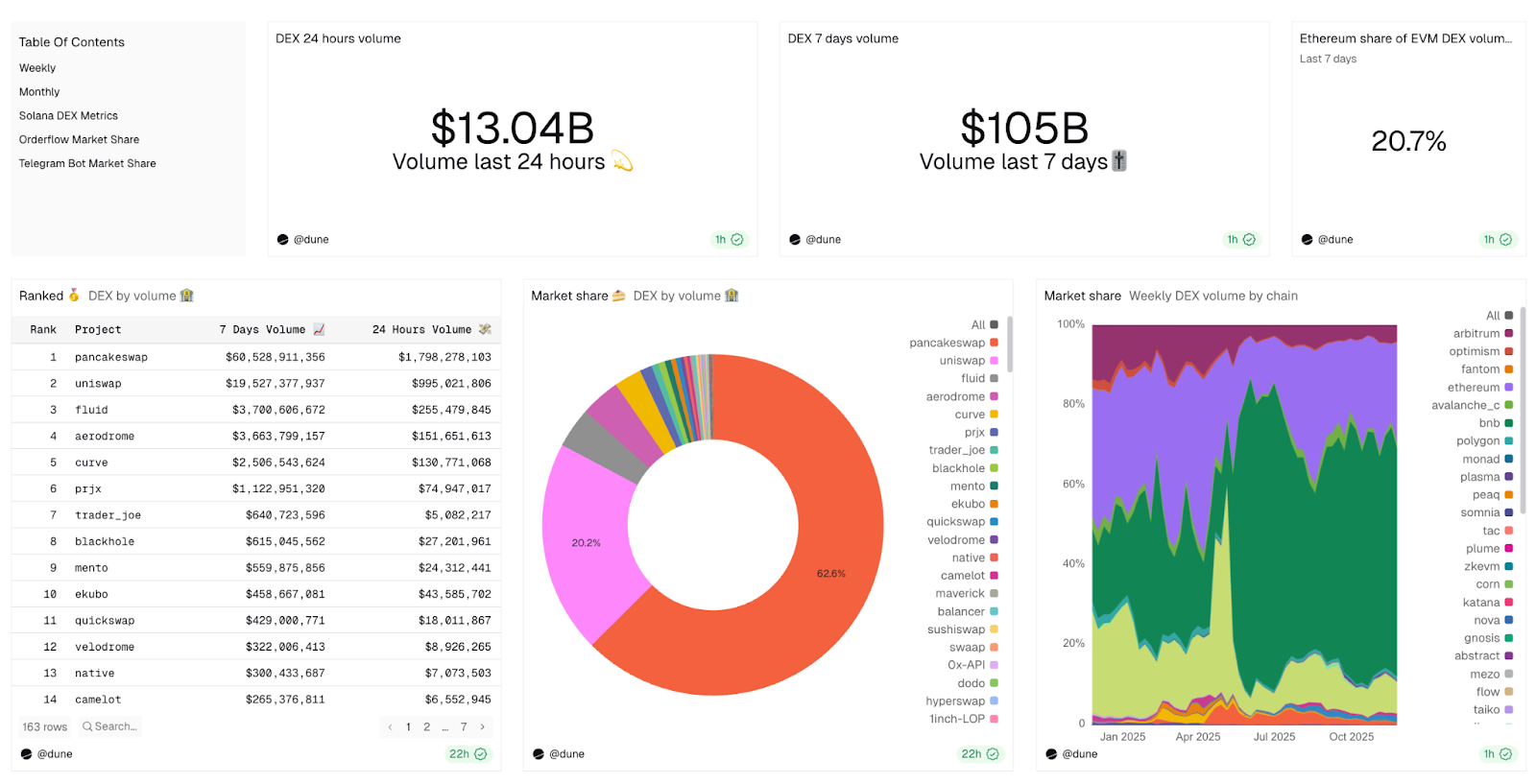

CEX vs DEX: New Trends in Trading Volume Patterns

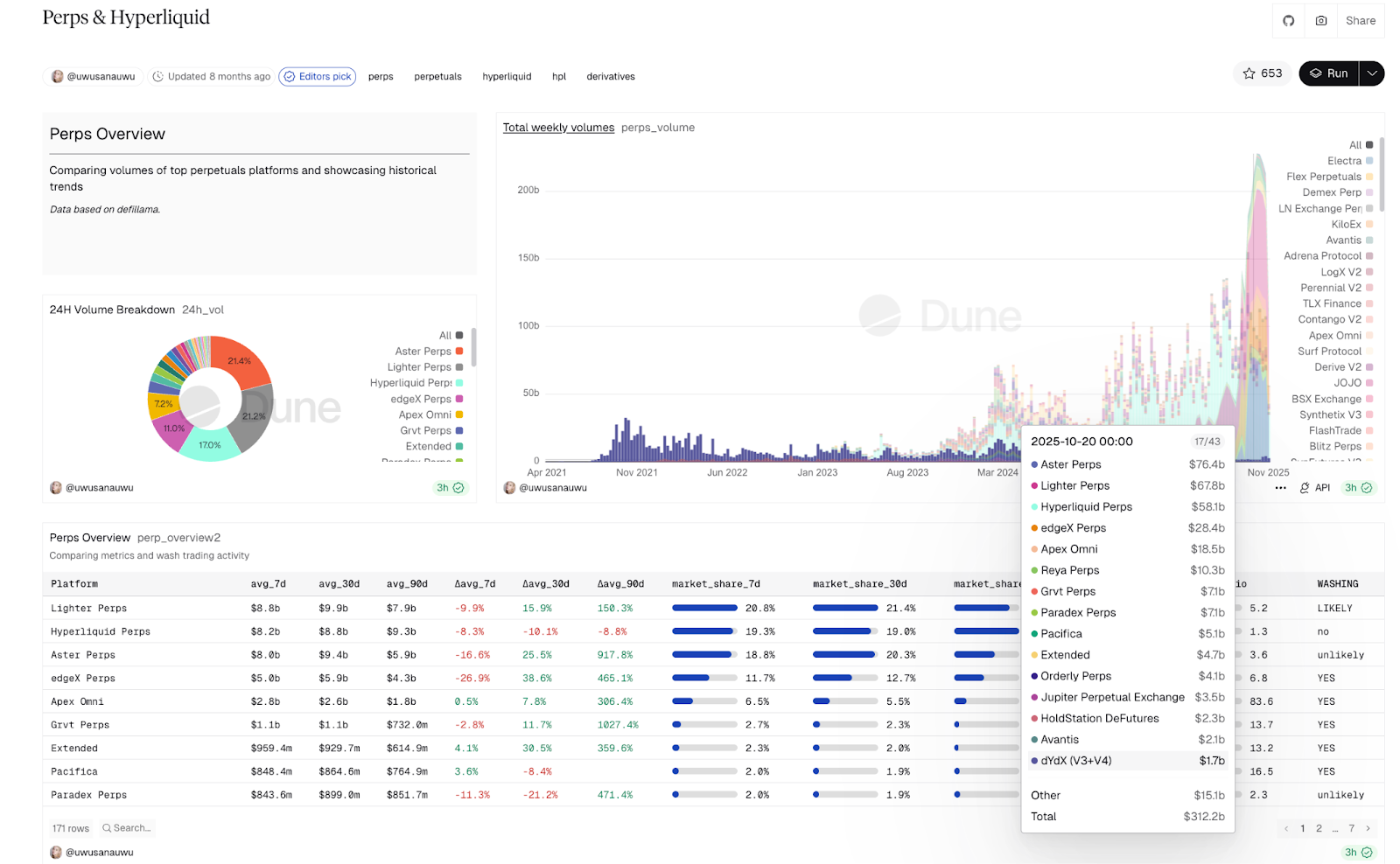

Although the resurgence of market enthusiasm in the third quarter of 2025 led to a rebound in trading volume for centralized exchanges (CEX), the rise of decentralized exchanges (DEX) was even more noteworthy. In the third quarter of 2025, decentralized perpetual contract protocols achieved approximately $1.8 trillion in trading volume, roughly 7% of the centralized derivatives trading volume during the same period (about $26 trillion).

The core of this phenomenon lies in the stratification of market sentiment: when the market is overheated, and most retail investors remain in CEX due to the convenience of fiat deposits and leverage usage, the most aggressive and highest-risk preference portion of incremental funds accelerates their flow to DEX, chasing newly issued tokens or ultra-high leverage speculation, leading to a significant diversion of marginal trading enthusiasm. Meanwhile, the 2025 surge in the tokenization of real-world assets (RWA) prompted traditional internet giants and financial institutions to accelerate their entry, making perpetual decentralized exchanges the market focus, with on-chain derivatives trading activities significantly increasing. Overall, CEX still controls the vast majority of trading activities and liquidity, but the direction of marginal funds has quietly changed: during the most frenzied phase of the bull market, DEX is rapidly eroding incremental market share at an unprecedented pace.

The "Hyperliquid" Phenomenon in the Derivatives Market

Platforms like Hyperliquid saw explosive growth in the decentralized perpetual DEX market from the end of 2024 to the first half of 2025. Hyperliquid's market share in decentralized perpetual contracts was about 56% at the end of 2024 and expanded to over 73% by the end of the first quarter of 2025; its trading volume surged simultaneously — the weekly trading volume in the fourth quarter of 2024 was about $13 billion, reaching an average of about $47 billion per week in the first half of 2025, with a peak of about $78 billion in mid-May. The users attracted to the platform are primarily traders with a strong preference for extreme leverage and privacy, including algorithmic high-frequency strategy professionals, seasoned users skeptical of centralized custody after the "FTX incident," and speculators fond of long-tail altcoin perpetual contracts — these groups originally pursued high-risk returns on centralized platforms.

Notably, even during the October crash (with over $19 billion in liquidations across the market within 24 hours), Hyperliquid maintained "zero downtime" and quickly completed liquidations (the platform's open positions accounted for about 63% of the entire market, with losses exceeding $1.2 billion), but its open interest and user participation still saw a significant decline due to panic. This indicates that while perpetual DEXs like Hyperliquid are rapidly expanding in the derivatives sub-market, their funding primarily comes from a small group with extremely high-risk preferences and is highly sensitive to extreme market conditions.

Reshuffling of Market Positions Among Major Exchanges

In the third quarter of 2025, there were some subtle changes in the rankings of major exchanges in the global market. Binance still firmly held the leading position, maintaining a market share of about 35% in quarterly trading volume, being the only platform with a stable share exceeding one-third. OKX, as a veteran exchange, consistently ranked among the top two in trading volume globally, but its market share declined in the third quarter (approximately down by 1.5 percentage points), marking the largest drop among major exchanges this quarter.

Meanwhile, Bitget achieved significant growth: its market share increased by about 0.3 percentage points in the third quarter, successfully surpassing Bybit to become the third-largest exchange by trading volume globally. Emerging platforms like Gate and BingX also showed strong momentum, with market shares increasing by approximately 1.7 and 1.1 percentage points, respectively, indicating rapid expansion of their user base and trading activity; KuCoin remained stable, with a slight increase of about 0.16 percentage points.

Among mid-sized platforms, the growth of "dark horse" LBank was particularly remarkable. Following the severe fluctuations after the October "Black Weekend," LBank's daily trading volume peaked at about $4.2 billion, accounting for nearly 4% of global spot trading. It is reported that the platform has over 20 million registered users, covering more than 160 countries, and has achieved rapid trading volume growth through aggressive market strategies. LBank is seen as one of the representatives of the "medium-sized, high-growth" tier, carving out a share of the vast long-tail market by quickly listing new coins and offering discounts.

Overall, Binance still controls the vast majority of liquidity; the second tier composed of OKX, Bybit, and Bitget competes steadily, maintaining leading positions in both spot and derivatives markets; while emerging mid-sized exchanges like LBank continuously enhance their presence through differentiated strategies (quickly listing small coins, low-fee promotions, etc.), carving out their own market space outside of mainstream giants.

Comparison of Operational Features Among Four Major Exchanges

1. Trading Scale and Market Share.

Binance: In 2025, Binance continued its strong growth momentum. In the first quarter, its spot trading volume was approximately $2.2 trillion, with market share increasing from about 38% at the beginning of the year to over 40% by the end of the first quarter; in July, the monthly spot trading volume was about $698 billion, accounting for approximately 39.8% of the global market share. In terms of derivatives, Binance remains the largest platform globally, with daily contract trading volume far exceeding its peers. In the third quarter of 2025, its open interest accounted for about 24.6% of the global total, and during the October crash, the platform's matching engine withstood the test and quickly returned to normal.

OKX: As an established exchange, OKX has a strong advantage in derivatives trading. Its daily average contract trading volume has long ranked among the industry's top, with some months' derivatives trading volumes being comparable to Binance. OKX's spot trading volume also consistently ranks among the top three globally. Although specific data is rarely publicly reported, industry rankings indicate that OKX has ranked among the top five globally every month of the year. During the market turmoil in October, OKX's platform operated smoothly without any major technical incidents.

Bitget: Bitget excels in contract trading, with an average monthly total trading volume of about $750 billion in 2025, of which approximately 90% comes from derivatives trading. The platform attracts a large number of contract users by creating a copy trading and novice contract education ecosystem. As of September 2025, about 80% of Bitget's trading volume came from institutional investors (up from about 39% at the beginning of the year), indicating a significant improvement in its market depth and professional participation. Bitget's derivatives market share remains among the top three in the industry, and its platform token BGB has a market cap of about $2.5 billion, holding a certain influence within the contract community.

LBank: As a rising "dark horse" platform in recent years, LBank's spot trading volume growth is astonishing, with daily trading reaching tens of billions of dollars, peaking over $4 billion during the volatile October period. Although its absolute size cannot compare with leading giants, LBank attracts a large number of high-risk preference speculative users by quickly listing new coins and offering high-leverage small coin contracts. It is reported that LBank has over 20 million registered users, covering more than 160 countries. The platform's positioning as a "high-leverage small coin" hub makes it highly attractive to small coin speculators, although its overall share in the global derivatives market remains relatively limited.

2. Fee Structure and Profit Model.

Binance/OKX/Bitget: All three adopt a tiered fee structure based on Maker/Taker and offer VIP rate discounts based on user trading volume or open interest. Trading fees remain the primary source of revenue for these leading platforms. Additionally, interest income from margin lending and platform token ecosystem earnings are also important profit pillars. For example, each platform issues its own tokens (BNB, OKB, BGB), providing users with rights such as fee discounts and participation in new projects, while the platforms expand revenue sources through services like Launchpad (new coin launches) and Staking. Overall, large exchanges solidify traditional fee income through deep liquidity and scale effects, supplemented by new product ecosystems to maintain profit growth.

LBank: LBank has taken a different approach in recent years. The platform frequently launches incentives such as zero trading fees for all spot transactions and 100% bonuses for contract account deposits, significantly benefiting users. For instance, users can receive about $50 in contract experience funds upon completing registration tasks, and all spot trading is fee-free during promotional periods; similarly, a 100% bonus is offered for contract account deposits. Through these measures, LBank sacrifices short-term fee income to gain market share, contrasting sharply with traditional exchanges like Binance. It can be said that LBank attracts and retains users with high benefits (fee waivers and bonuses), solidifying its influence in the high-risk speculative circle. This "counter-cyclical" marketing strategy is particularly bold during bear markets — the platform almost does not profit from user trading, instead returning saved fees and bonuses to users to cultivate user loyalty.

3. User Structure and Regional Distribution.

Binance: The user base is highly globalized, with compliance efforts advancing in several major markets (such as the U.S. and Europe). Binance has a large number of institutional and high-volume trading users, offering services such as OTC bulk trading, options, and ETFs to meet professional needs. Its ecosystem token BNB has a market cap of hundreds of billions of dollars, reflecting the platform's vast ecosystem and user stickiness.

OKX: OKX has a solid foundation in the Asian market, particularly with a broad user base in East Asia and Southeast Asia. OKX has long focused on technology development and on-chain security, attracting many professional traders and crypto technology enthusiasts. By launching Web3 products like OKX Wallet, OKX connects its centralized trading business with the DeFi world, encouraging users to participate in on-chain lending and staking using platform tokens like OKB, thereby enhancing user asset retention and stickiness.

Bitget: Bitget is quite popular in emerging markets, with a large user base in Southeast Asia, South Asia, and Latin America. Bitget excels in the copy trading community, attracting many new contract investors through strategies from well-known traders (KOLs). In recent years, the proportion of institutional clients on Bitget has rapidly increased, with about 80% of its trading volume in 2025 coming from professional institutions, indicating that the platform has gradually gained broader market recognition after initially serving mainly retail investors. Bitget's platform token BGB provides benefits to holders through regular buybacks and burn mechanisms, also offering users a channel to share in the platform's growth profits.

LBank: The main user preference is for high-volatility small coins, new projects, and high-leverage trading. This user segment is primarily distributed in emerging markets such as the Middle East, North Africa, and Southeast Asia, including global speculators seeking quick returns. They are highly sensitive to trading fees and expect the platform to quickly list popular new coins and provide substantial profit opportunities. To address these characteristics, LBank emphasizes its record of "10 years without major security incidents" and a "$100 million security fund," earning the trust of some users who are highly sensitive to security. It can be said that LBank is building a "retail-friendly high-risk coin hub" — users primarily chase opportunities for hundredfold coins and trading discounts while hoping for risk control assurances from the platform. LBank strives to establish a trust foundation among these users through long-term fulfillment of bonuses and maintaining secure operations.

Wealth Management Products, Leverage Trading, and Risk Response

1. Wealth Management and Yield Products.

Binance: Offers a wide variety of wealth management products, including "Simple Earn," structured finance, and integrates new project launches from the primary market with the Binance ecosystem through Launchpool/Launchpad. During the bull market in 2025, Binance supported liquidity mining and staking for mainstream assets like USDE, BNSOL, and WBETH, encouraging users to hold positions long-term for earnings. Notably, after the market crash in October, Binance clarified that the drop was not caused by any of its wealth management products and promised to continue strengthening product risk control.

OKX: Integrates both centralized and decentralized yield channels through the OKX Earn platform. Users can participate in traditional fixed-term/current wealth management on OKX, as well as seamlessly enter the DeFi world to earn through OKX Wallet. OKX connects its Web3 wallet with its centralized trading platform, encouraging users to utilize assets like OKB for on-chain lending and staking projects, thereby enhancing asset utilization efficiency while ensuring fund safety and increasing user stickiness.

Bitget: Bitget Earn combines robust wealth management with the advantages of a trading community, launching fixed-term wealth management products aimed at beginners, guiding users to understand advanced features like contract copy trading while obtaining fixed returns, forming a "wealth management-trading" closed loop. Bitget focuses on youthful community operations, frequently hosting trading competitions and platform token holding dividends to enhance user participation and loyalty, gradually converting wealth management users into active trading users.

LBank: LBank's wealth management feature is a combination strategy of "bonuses + leverage." The platform has launched activities like "100% deposit bonuses": for every amount deposited, the platform provides an equivalent bonus, which users can use to open leveraged contract positions without additional capital. This design allows users to "amplify market movements with bonuses," meaning that even if losses occur, the primary loss is from the bonus rather than their own funds. Additionally, LBank has long implemented a zero-fee policy for spot trading, with users viewing the saved fees as extra earnings. Official data shows that many users have achieved substantial returns by seizing opportunities from LBank's new coin listings. Overall, LBank emphasizes a user-centric approach — "returning saved fees and bonuses to users," allowing users to enjoy platform benefits even in high-risk investments, thereby establishing a differentiated competitive advantage.

2. Leverage and Contract Trading.

Centralized Exchanges: Perpetual contract trading has dominated the market in 2025, with annual contract trading volume accounting for over 78% of the total crypto market trading volume. This field is primarily controlled by leading CEXs like Binance, OKX, and Bybit — the three platforms collectively contribute to the majority of global contract liquidity (with Binance alone accounting for about a quarter of the global total). Bitget follows closely behind, ranking among the top three in certain niche markets. For the vast majority of ordinary users, centralized platforms remain the preferred choice for participating in contract trading, as these platforms offer more comprehensive risk management and custody guarantees. After the October crash, leading CEXs successively raised margin requirements, lowered maximum leverage ratios, and optimized liquidation mechanisms and risk reserves to reduce systemic risk. Overall, CEXs, leveraging brand reputation and scale effects, provide a relatively stable trading environment and risk control measures in the contract market, remaining the primary venue for most users engaging in leveraged trading.

Decentralized Platforms: In contrast, perpetual DEX platforms like Hyperliquid offer more extreme leverage (with some contracts reaching hundreds of times), looser access (no KYC identity verification required), and a wider variety of long-tail asset targets, thus attracting a group of "high-risk preference" traders. These users include professional high-frequency teams pursuing extremely high returns, seasoned players skeptical of centralized custody due to security incidents, and niche investors keen on small coin contract speculation. Perpetual DEXs execute trades and liquidations through smart contracts, reducing the trust requirement on centralized intermediaries. However, as demonstrated by the market turmoil in October 2025, high-leverage positions on decentralized platforms are also difficult to escape during extreme market conditions: although the platform itself remained stable, many user positions were forcibly liquidated amid severe fluctuations, with significant capital fleeing to safer havens in panic. This indicates that while perpetual DEXs create differentiated competition in functionality and experience compared to traditional CEXs, the high-risk user groups they serve also contract during market upheavals.

3. Response Measures After the Crisis.

Binance/OKX/Bitget: After the October 2025 crash, the aforementioned leading CEXs quickly launched a series of market stabilization measures using their risk reserve mechanisms and brand reputation. Binance announced the allocation of approximately $283 million to compensate affected users (mainly covering some stablecoin staking losses in the platform's Earn products) and publicly stated that it would strengthen risk management, raise margin requirements, and fix system vulnerabilities to prevent similar incidents in the future. OKX and Bitget focused on technical improvements and user subsidies: on one hand, they enhanced trading infrastructure and bolstered insurance fund reserves, while on the other hand, they offered fee reductions or trading rewards to loyal users, demonstrating the platform's sincerity in sharing risks with users.

LBank: As an aggressive emerging platform, LBank took a significant discount approach to rebuild user confidence. Immediately after the incident, LBank launched a series of measures including zero fees for all spot trading, 100% bonuses for contract account deposits, and a security fund of up to $100 million. The official emphasized that the platform "does not charge users any fees, but instead returns the saved fees and bonuses to users," stabilizing market sentiment and indicating the platform's solidarity with users. Although these measures reduced the platform's short-term revenue, they attracted considerable attention during the recovery period after the turbulence, bringing LBank short-term user growth and visibility. Overall, after this round of turmoil, although market volatility was sharp, most mainstream CEXs demonstrated strong resilience, with their core trading businesses not suffering disruptive impacts, and each platform took proactive measures to promptly restore user trust.

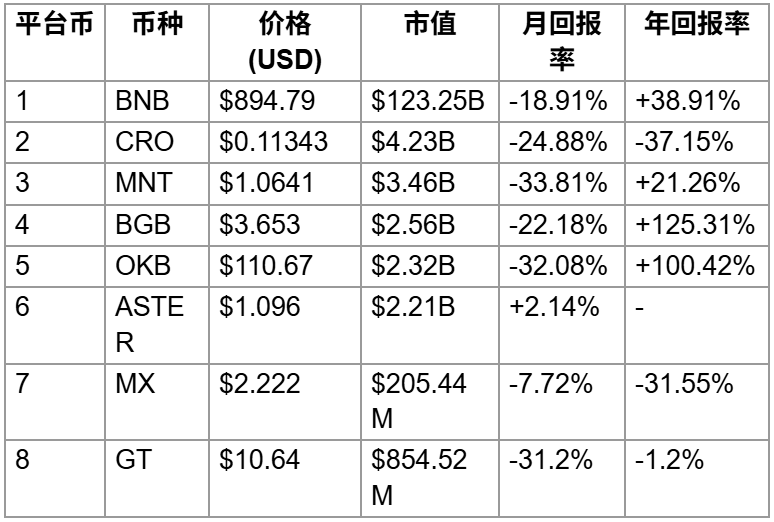

Market Performance Overview in the Last 30 Days: Most Platform Tokens Show a Downward Trend

Most exchange platform tokens have seen price declines in the last 30 days. Especially after peaking in early October, market sentiment weakened in November, leading to a general pullback in the platform token sector. For instance, the leading BNB dropped about 20% over the past month; Crypto.com's CRO fell over 30%. OKB also saw a decline of more than 30% in a single month. These declines corrected the previously rapid increases, reflecting a lack of new positive stimuli for platform tokens in the short term.

This phenomenon is related to the shift in market capital preferences — recently, Bitcoin's share has risen, with funds flowing out of high-priced exchange tokens, causing the prices of most platform tokens to drop. For example, Mantle (MNT) plummeted about 35% in the past 30 days, reflecting a decrease in investor risk appetite and a return of funds to mainstream assets like Bitcoin. Additionally, some platform tokens lack new momentum after previous positive news has been exhausted, such as OKB entering a cooling period after a one-time burn in August, with a noticeable price drop. Overall, the performance of exchange platform tokens in the past month has lagged behind the broader market, with most tokens showing negative monthly returns, needing to wait for new driving factors to emerge.

Analysis of the Reasons Behind the Trends of Each Platform Token

In response to the recent fluctuations in platform tokens, we provide a brief analysis of the underlying logic for each token based on user-provided information and market dynamics:

BNB (Binance Coin): As the platform token of a leading exchange, BNB has long benefited from Binance's vast user base and consortium support. Binance employs a continuous buyback and burn mechanism (buying back and burning BNB quarterly based on profits) along with the Binance Alpha initiative to support its price. This year, Binance has focused on expanding its on-chain applications (such as BNB Chain supporting DeFi and AI sectors), enhancing the utility of BNB. However, regulatory pressures and macro risks have caused fluctuations in BNB's upward momentum. Over the past 30 days, BNB has declined by approximately -20.8%, partly due to a technical correction after a previous rapid increase, and partly because market funds have shifted towards safer assets like Bitcoin. Overall, BNB maintains relative resilience due to its strong fundamentals, having accumulated an increase of about 28% this year, reflecting its leading position and the effectiveness of its buyback mechanism.

OKB (OKX Token): OKB's performance this year has seen an initial rise followed by a decline. On the positive side, OKX launched its self-developed Ethereum Layer 2 network "X Layer" and improved its ecosystem layout, which is one of the new application scenarios for OKB. Additionally, in August 2025, OKX officially burned a large amount of OKB in a one-time event, permanently fixing the total supply at 21 million tokens. This unprecedented concentrated burn boosted OKB's price at that time. OKB reached a high of about $258 in August. However, as the positive news was digested, the market entered a cooling period, and OKB's price significantly retreated by about 60% from its peak. In the last 30 days, OKB has continued to weaken, dropping about 33%, due to: (1) technical correction pressure after a previous large increase; (2) a shift in overall market preference towards mainstream coins, leaving platform tokens lacking new positive stimuli. Looking ahead, the long-term effects of OKB's significantly reduced supply are still in play, but in the short term, it needs to wait for the official launch of OKX's Layer 2 chain and an increase in trading volume to inject new upward momentum into OKB.

BGB (Bitget Token): BGB performed impressively in the first half of this year, at one point multiplying several times compared to its price at the end of 2022. However, recent upward momentum has weakened, which is related to its shift in functional positioning. At the beginning of September, Bitget announced a strategic partnership with the new public chain Morph, upgrading BGB to be the native gas and governance token of the Morph chain, and burning 220 million BGB in a one-time event (about 10% of the total supply). This move greatly enriched BGB's application scenarios, and after the announcement, BGB saw a slight increase of 14%. However, transitioning to a public chain token also means that BGB has shifted from primarily relying on platform buybacks and burns to an endogenous burn mechanism following on-chain activities. In the short term, this model shift has reduced market enthusiasm for BGB: before the Morph ecosystem is fully mature, BGB lacks additional positive stimuli. Therefore, in the past month, BGB's performance has been relatively weak, oscillating between $3.5 and $4, with a slight pullback. Currently, BGB shows insufficient short-term upward momentum, and its monthly performance lags behind its previous hot phase.

GT (Gate Token): GT from Gate.io is one of the earlier issued platform tokens, with relatively stable prices in its early days. However, recent operational challenges at Gate have affected GT's attractiveness. In mid-2023, rumors of a liquidity crisis at Gate surfaced, causing panic among users, but the official clarification confirmed that it had not gone bankrupt. Although the crisis was resolved, Gate's brand image and user growth suffered. Compared to leading platforms, Gate lags in product innovation and global compliance. Additionally, in a highly competitive market, funds are more inclined towards the platform tokens of leading exchanges, which has also limited GT's performance. GT surged to about $25, a historical peak, at the beginning of 2025 due to a recovery in the industry, but subsequently fell back significantly. Recently, the periodic buyback and burn of platform tokens by Gate (burning 2.1 million GT in Q3) had limited impact on the token price. Over the past 30 days, GT has dropped by 31.2%. Overall, the decline in Gate's visibility and insufficient competitiveness have made it difficult for GT to replicate its earlier stable upward trend, leading to relatively cautious investor confidence.

ASTER (Aster DEX Token): ASTER is a new decentralized perpetual contract trading platform token launched in September this year. Its product design and functionality are standard, without significant differentiation. However, ASTER gained market attention in a short time mainly because of the backing investment from one of Binance's founders. Reportedly, Aster claims to be a "Hyperliquid-style DEX on BSC," incubated by YZi Labs and supported by Binance co-founder Zhao Changpeng (CZ) with multiple public endorsements. This close relationship with Binance has led to speculative interest in ASTR upon its issuance — the price skyrocketed over 900% on the first day. Within just a week, Aster's trading volume exceeded $51.6 billion, with over 1.7 million active users, showcasing remarkable performance. However, it should be noted that ASTER's product is still in its early stages, with average functionality and user experience, and its popularity is more driven by capital backing and market speculation. After reaching a high of $2.42 in late September, the price quickly halved, currently down about 55% from its peak. In the past month, ASTER has basically consolidated, with a slight increase of about 2%. Looking ahead, unless new resources from the Binance ecosystem are introduced, ASTER's future performance will still depend on whether its product can keep pace with competitors (like Hyperliquid) and whether it can truly list on Binance for broader exposure.

MX (MEXC Token): MX is the platform token of MEXC exchange. In recent years, MEXC has shifted its focus to the global market, actively expanding its user base in emerging countries. However, compared to established giants, MEXC's international recognition and user awareness remain limited. The MX token has a small supply, and its past price has mainly been driven by the exchange's operational activities. This year, MEXC has launched a large number of new tokens and claimed outstanding liquidity performance, but these initiatives have had limited direct impact on MX. Overall, MX has a certain user base in overseas markets but lacks strong sticky ecosystem applications. Its price has steadily increased this year, but the extent of the increase has been modest, mainly reflecting the slow accumulation of platform trading volume growth. In the last 30 days, MX has dropped about 7.72%, which may be related to MEXC launching marketing activities (such as MX airdrops and new token subscriptions) during market downturns, providing some support for the token price. In the long term, if MEXC cannot enter the top tier of exchanges, MX's upward potential will be limited. Currently, MX's scale and liquidity are both relatively small, making it a high-risk niche token in investment portfolios.

Summary: In the last 30 days, exchange platform tokens have generally faced downward pressure, but the fundamental factors behind each token differ. Leading tokens (like BNB and OKB) have outperformed mid-sized and small platform tokens due to strong ecosystem support. Mid-sized platform tokens (like BGB, GT, and WOO) have shown significant divergence in performance due to operational strategies and market confidence. New platform tokens (like ASTER) have gained short-term popularity but still require fundamental support for sustained performance. For investors, it is essential to closely monitor the exchange business dynamics and changes in token economic models behind each platform token, such as buyback and burn policies, public chain and Layer 2 developments, and regulatory events.

Security and Compliance: Rebuilding User Trust

In the first half of 2025, security incidents in the crypto space remained frequent. Statistics show that asset losses due to hacking and other causes totaled nearly $2.3 billion in the first half of the year, surpassing the total for all of 2024. User concerns about the security of exchanges continue to run high. At the same time, regulatory agencies in various countries are strengthening their oversight of centralized exchanges (CEXs): requiring exchanges to publicly disclose asset reserve proofs, establish user insurance funds, undergo independent audits, and comprehensively improve risk control systems. Major regions like the U.S. and the EU have successively introduced regulatory guidelines for crypto assets — Europe plans to implement the MiCA 2.0 framework by the end of 2025, while the U.S. is also discussing clearer regulations for digital asset ETFs/brokers. In this environment, the performance of exchanges in terms of security and compliance has become an important reference indicator for users when choosing platforms.

In terms of specific measures, different exchanges have their own focuses:

Binance: As an industry leader, Binance has engaged in repeated negotiations with regulators globally in recent years and has gradually sought breakthroughs in compliance (for example, participating in Bitcoin ETF product design and reconciling with regulators in certain regions). Since 2018, Binance has established a "Secure Asset Fund for Users (SAFU)" and regularly discloses reserve asset proofs to enhance transparency. After the October storm, Binance made an exception by using its own funds to compensate users on a large scale and proactively published a system security assessment report, emphasizing that it would further strengthen technical protection and risk management — this series of measures indicates its attempt to rebuild user trust through concrete actions.

OKX: OKX is known for its technical strength and on-chain security. The platform employs a multi-signature wallet architecture and strict risk control processes. Although there have been security incidents in the past (such as a private key incident in 2018 that led to significant asset theft), OKX quickly compensated users and upgraded security measures after the incident, and no major security incidents have occurred since. OKX continues to conduct smart contract audits and system vulnerability scans, establishing a user protection fund to address black swan events; at the same time, it actively seeks licenses in multiple countries, exploring compliant operational paths. In 2025, OKX further demonstrated its ability to balance compliance and innovation by launching decentralized trading modules and on-chain custody solutions.

Bitget: In recent years, Bitget has emphasized fulfilling social responsibility and actively seeking external audits. After a large-scale liquidation event caused by severe market fluctuations in 2024, Bitget promptly utilized its platform risk reserve to compensate some users and invited a well-known cybersecurity company to conduct a comprehensive audit of the overall system. Bitget has also established its own "security fund" and claims to provide federal deposit insurance (FDIC) protection for some users' dollar deposits. Although its platform token BGB does not have the market capitalization and application influence of leading tokens like BNB, Bitget strives to maintain the value stability of its platform token through regular buybacks and burns, thereby enhancing user confidence in the platform's stable operations.

LBank: LBank highlights its "ten years without major security incidents" and "$100 million security fund" as key promotional points. In the shadow of events like the FTX collapse, LBank frequently emphasizes its long-standing stable operations and zero-incident record, promising users the safety of their funds with a substantial security reserve. Although LBank has not made significant compliance progress in the international regulatory landscape, it aims to convince users of its risk management capabilities through its solid security operation history and ongoing financial investments. For ordinary retail investors who inherently distrust CEXs, a platform that can publicly disclose its security record and establish a large security fund will undoubtedly increase its trustworthiness.

From the perspective of trust mechanisms, different types of platforms have varying appeals. Leading CEXs (like Binance) rely on scale and institutional trust — on one hand, they establish a compliant image through audits and participation in regulatory sandboxes, while on the other hand, they enhance user stickiness by expanding the ecological value of platform tokens and launching heavyweight products (like ETFs). DEXs are entirely built on technical trust: transparent smart contracts and user self-custody mechanisms allow users not to trust any centralized institution. Mid-sized CEXs (like LBank) fall somewhere in between, relying more on performance and integrity to build behavioral trust: platforms need to prove their operational stability and fulfill commitments through multiple bull and bear cycles to win the favor of ordinary users who value long-term companionship. It can be said that security and compliance have now shifted from being "marginal costs" to core considerations for users when choosing trading platforms.

The Displacement Effect of Alpha and Hyperliquid on the Market

The Token Listing Funnel Effect of Binance Alpha: Binance launched the Alpha project in 2025, significantly accelerating the speed of token listings compared to previous years. As of early July 2025, the Alpha platform has listed over 200 projects across various sectors, including AI, Meme, Layer 2, and RWA, with more than half belonging to the BNB Chain ecosystem. These projects typically first conduct airdrops or early trading on Alpha before officially listing on Binance once market interest increases. Binance has repeatedly emphasized that Alpha is the platform for the debut of new projects (for example, Yei Finance and Enso were first launched on Alpha). This process effectively creates a complete "token listing funnel": Alpha captures the maximum price increase potential for new token issuances, leaving most of the price differentials between primary and secondary markets within the Binance ecosystem, while other exchanges often only share the remaining traffic dividends later. In simple terms, Alpha attracts user attention and trading enthusiasm generated by new token listings to its platform by preemptively locking in potential tokens and establishing an internal traffic pool, greatly compressing the opportunities for other exchanges in terms of "listing dividends."

Structural Erosion of Contract Markets by Perpetual DEXs: Decentralized perpetual platforms like Hyperliquid primarily impact the contract market by diverting specific user groups. They attract not the general public but rather professional players seeking extremely high leverage and valuing anonymous self-custody. This group includes teams that typically use programmatic high-frequency trading strategies, traders who prefer self-custody due to the shadows cast by the FTX incident, and niche speculators interested in obscure altcoin contracts. When these users migrate to platforms like Hyperliquid, the corresponding trading volumes for those pairs on centralized platforms often see a significant decline. For instance, in the perpetual contract market for certain long-tail tokens, Hyperliquid has become a major trading venue. Statistics show that in the second quarter of 2025, Hyperliquid accounted for nearly 73% of DEX perpetual trading volume, highlighting its strong capital attraction. This means that for centralized exchanges like OKX, Bitget, and LBank, the users being diverted are precisely those "daring to gamble and strive" high-risk funds.

Differentiated Pressures Faced by OKX / Bitget / LBank:

OKX: As a giant in the contract field, OKX must establish a presence in on-chain derivatives, or else its high-end users may gradually be eroded by decentralized competitors. Currently, OKX has launched decentralized trading features integrated with its own public chain, OKX Chain, including on-chain perpetual contract products, to avoid losing the favor of professional traders. It is foreseeable that OKX will increase investments in areas such as stablecoin lending, cross-chain contracts, and integrating copy trading with DeFi strategies to solidify its role as a bridge between CeFi and DeFi.

Bitget: Bitget's advantage lies in its copy trading ecosystem, but some beginner users who rely on KOL strategies are also beginning to be attracted by high-yield strategies on-chain. Once they discover more aggressive leverage strategies available for copying on DEXs like Hyperliquid, they may churn. To address this, Bitget needs to extend its "copy trading + quantitative strategies" into the decentralized realm, such as launching cross-chain asset copy trading services or adding DeFi strategy pools on the platform to retain users seeking higher yield opportunities.

LBank: The most noticeable impact is on its "new tokens + long-tail contracts" business. Hyperliquid has taken away some users who demand contracts for small tokens — these users could have been important targets for LBank. However, LBank has not chosen to directly emulate the Binance Alpha model or develop its own version of Hyperliquid; instead, it continues to strengthen its positioning in the high-risk retail market. Through a high frequency of new token launches, real-time displays of "hundredfold token" achievements, and a long-term implementation of zero fees and high bonuses, LBank aims to create a "retail-friendly hub for hundredfold tokens." In other words, LBank has given up competing with Binance for absolute new token launch traffic, instead highlighting this message: "If you are passionate about hundredfold tokens and high-leverage speculation, there are the most opportunities and benefits here." This differentiated positioning allows LBank to maintain a foothold in the traffic competition and hopes to continue attracting risk capital with more user-friendly policies.

Future Outlook: The Tug of War Between CEX and DEX

Looking ahead to late 2025 and early 2026, overall market sentiment is cautiously optimistic. The potential for interest rate cuts by the Federal Reserve and expectations for further easing policies will support investor confidence, but inflationary pressures and geopolitical risks may keep volatility high. The continued inflow of ETF funds and institutional demand is expected to support major assets like Bitcoin, while the trading activity of altcoins may remain relatively moderate. It is foreseeable that under stricter compliance and transparency requirements, the trading volume of centralized exchanges will remain strong, and the market share of leading platforms across various sectors may further concentrate.

In the medium to long term, based on different macro environments and industry evolution paths, the share changes between CEX and DEX may present the following scenarios:

Scenario A (Moderate Evolution): In this scenario, although perpetual DEXs continue to develop rapidly, the regulatory environment remains relatively mild, and countries do not impose excessive restrictions on CEXs. Centralized exchanges maintain their dominant position through compliant operations and product upgrades. By 2028, DEX trading volume may rise to about 40%–45%, but CEXs will still control the majority of capital flow. Leading CEXs like Binance will welcome traditional capital entry by participating in the launch of compliant ETFs/ETNs and regulated derivatives. The Alpha model will become a regular mechanism within the ecosystem but will not completely rewrite the trading landscape.

Scenario B (Extreme Decentralization): In this scenario, decentralized perpetual platforms like Hyperliquid maintain explosive growth momentum, continuously eroding the activity of centralized platforms; at the same time, global major regulators impose increasingly stringent requirements on CEXs, significantly increasing their compliance costs and operational pressures. If DEXs capture trading volume at an exponential rate, coupled with stricter capital requirements or restrictions on CEX functions in Europe and the U.S., the overall market share of centralized exchanges may rapidly decline, ultimately leaving only a few fully compliant CEXs to survive, while most trading activities shift to on-chain protocols.

Scenario C (Regulatory-Friendly, CEX Counterattack): In this optimistic scenario, major economies like the U.S. and the EU introduce clear and friendly regulatory frameworks, and crypto assets are widely accepted by mainstream finance. CEXs are able to launch compliant ETFs, ETNs, and regulated futures contracts, allowing large-scale traditional capital to enter the market through compliant channels. Leading exchanges like Binance, with their legitimate and compliant status, will absorb this capital, further providing innovative investment opportunities for users within the BNB ecosystem through the Alpha model, thereby attracting and retaining new users. In this scenario, the overall share of CEXs will remain stable or even increase — the substantial new capital brought by compliance dividends will be sufficient to offset the diversion of DEXs from existing users.

In terms of specific platforms, the four major exchanges are expected to evolve along their respective paths over the next 2-3 years:

Binance: It is expected to gradually transition from a state of "regulatory siege" in recent years to being an "institutionalized" industry leader. In the face of regulatory pressure, Binance may integrate into the compliance systems of various regions through licensed operations by local subsidiaries and proactive cooperation with audits, while continuing to leverage its vast ecosystem advantages to solidify its user base. The Alpha project and the BNB ecosystem will serve as its dual engines for maintaining attractiveness: Alpha grants Binance a high degree of control over the traffic of emerging projects, allowing it to continuously manage market enthusiasm; BNB, as the ecological token, enhances user stickiness through fee discounts and ecological applications. With a large user base and a full industry chain layout, Binance is expected to continue holding the largest market share globally.

OKX: It will continue its investments in derivatives and Web3 infrastructure, striving to act as a bridge between centralized and decentralized worlds. OKX may expand the functionalities of its own wallet and decentralized trading platform, launching on-chain versions of contract products to stabilize its appeal to advanced users. At the same time, OKX will obtain compliance licenses in more regions globally, particularly focusing on Asia and other emerging markets, maintaining a leading position in technical strength and risk management to remain competitive in the future.

Bitget: Bitget's positioning is to delve deeply into the "contract + copy trading" vertical. Its platform token BGB will continue to serve as the core of the ecosystem, providing benefits and dividends to maintain user loyalty. Bitget may develop more innovative products based on quantitative strategies (such as cross-chain strategy copy trading and decentralized derivatives aggregation) and strengthen cooperation with professional trading institutions. As long as it can fully leverage its automated trading and community advantages within the regulatory framework, Bitget can solidify its core user base. For Bitget, continuously enhancing BGB's value and strengthening user trust will be key to maintaining competitiveness.

LBank: The future of LBank heavily depends on its ability to continue the successful model of "hundredfold tokens + benefits + safety record." If it continues to rapidly launch promising small tokens and maintain a zero-incident record on the platform during the upcoming bull market cycle, LBank is expected to maintain the fastest growth rate among mid-sized exchanges, further increasing its market share (as repeatedly proven in recent years). However, to solidify this position, LBank must consistently fulfill its safety commitments, provide attractive user incentives, and effectively safeguard user rights at critical moments. Otherwise, if user confidence is shaken, its hard-won market position may face challenges.

Finally, from the perspective of ordinary investors, when choosing an exchange, it is necessary to comprehensively consider the following aspects: First, the platform's performance during crises (whether the exchange can operate stably and ensure user asset safety during the next systemic collapse); second, whether the platform can continuously provide new opportunities (whether it keeps launching promising new projects or innovative products, allowing users to participate in future growth dividends); third, security and transparency (how the exchange's past security record is, whether reserve funds and asset proofs are sufficiently transparent and public); fourth, whether the platform is deeply bound to user interests (whether the exchange views users as long-term partners sharing profits and risks, or merely as trading counterparts and sources of traffic). After Alpha and Hyperliquid have diverted that portion of extremely high-frequency, high-leverage risk capital, the remaining CEX market places greater emphasis on security, compliance, and profit sharing. Ultimately, who can divide up this "retained land" will depend on the strategic choices of the aforementioned exchanges — and also on the choices and actions of each investor in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。