在上一篇《以太坊 Interop 路线图》中,我们提到以太坊基金会(EF)为了改善用户体验(Improve UX),制定了三步走的互操作战略:初始化、加速与最终确定(延伸阅读《以太坊 Interop 路线图:如何解锁大规模采用的「最后一公里」》)。

如果说未来的以太坊是一个庞大的高速公路网络,那么「加速」和「最终确定」解决的是路面平整度和车速限制的问题,但在此之前,我们面临一个更基础的痛点:不同的车辆(DApp/钱包)、不同的收费站(L2/跨链桥)说着完全不同的语言。

这正是「初始化」阶段要解决的核心问题,而「Open Intents Framework(OIF)」正是这个阶段最重要的「通用语言」。

在阿根廷 Devconnect 上,尽管 EIL(以太坊互操作层)占据了大量讨论篇幅,但 OIF 作为应用层与协议层之间的关键粘合剂,其重要性丝毫不逊色,也是实现 EIL 愿景的前置条件,今天我们就来拆解一下这个听起来有些晦涩,但对用户体验至关重要的 OIF。

一、OIF 到底是什么?从「指令」到「意图」的范式转换

要理解 OIF,首先要理解 Web3 交互逻辑正在发生的一场根本性变革:从「指令」(Transaction)到「意图」(Intent)。

先从一个普通用户的真实痛点说起,假设你想把 Arbitrum 上的 USDC 换成 Base 上的 ETH,那在今天的以太坊生态,这往往意味着一场「操作马拉松」:

你需要先在钱包里手动切到 Arbitrum,授权某个跨链桥的合约,再签一笔跨链交易,然后打开另一个聚合器,最后把跨到 Base 的 USDC 换成 ETH,全程不仅要自己计算 Gas、滑点,还要时刻提防跨链时延和合约风险,是一条由「一连串技术细节」堆砌出来的繁琐步骤,而不是一条简单清晰的需求路径。

这也是传统「指令」模式在 Web3 的映射,就像你打车去机场,需要自己规划路线——「先左转,直行 500 米,上高架,下匝道……」,在链上,这则表现为用户必须手动一步步操作,譬如先跨链、再授权(Approve)、再交易(Swap),一旦某一步出错,不仅损耗 Gas,甚至可能资金受损。

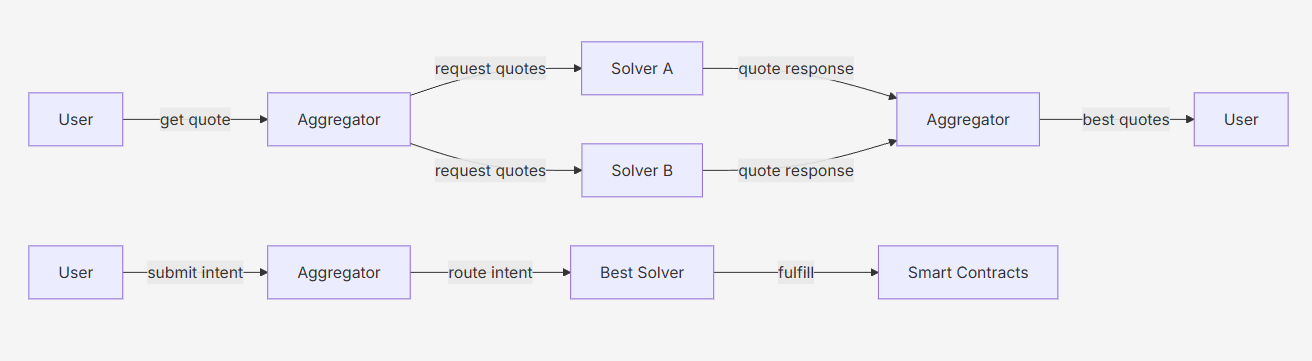

而新兴的「意图」模式则完全省略掉了中间的繁琐,你只需要告诉司机「我要去机场,愿意付 50 元」至于司机走哪条路、用什么导航,用户并不关心,只要结果达成即可,映射在链上,则表现为用户只需签署一个包含「我想用 A 链的 USDC 换 B 链的 ETH」的意图,剩下的交给专业的求解器(Solver)去执行。

既然意图这么好,为什么还需要 Open Intents Framework(OIF)?

简单来说,目前的意图市场是一片割裂的「狂野西部」,UniswapX 有自己的意图标准,CowSwap 有自己的标准,Across 也有自己的标准,求解器(Solver)需要适配几十种协议,钱包(Wallet)需要集成几十个 SDK,效率极低。

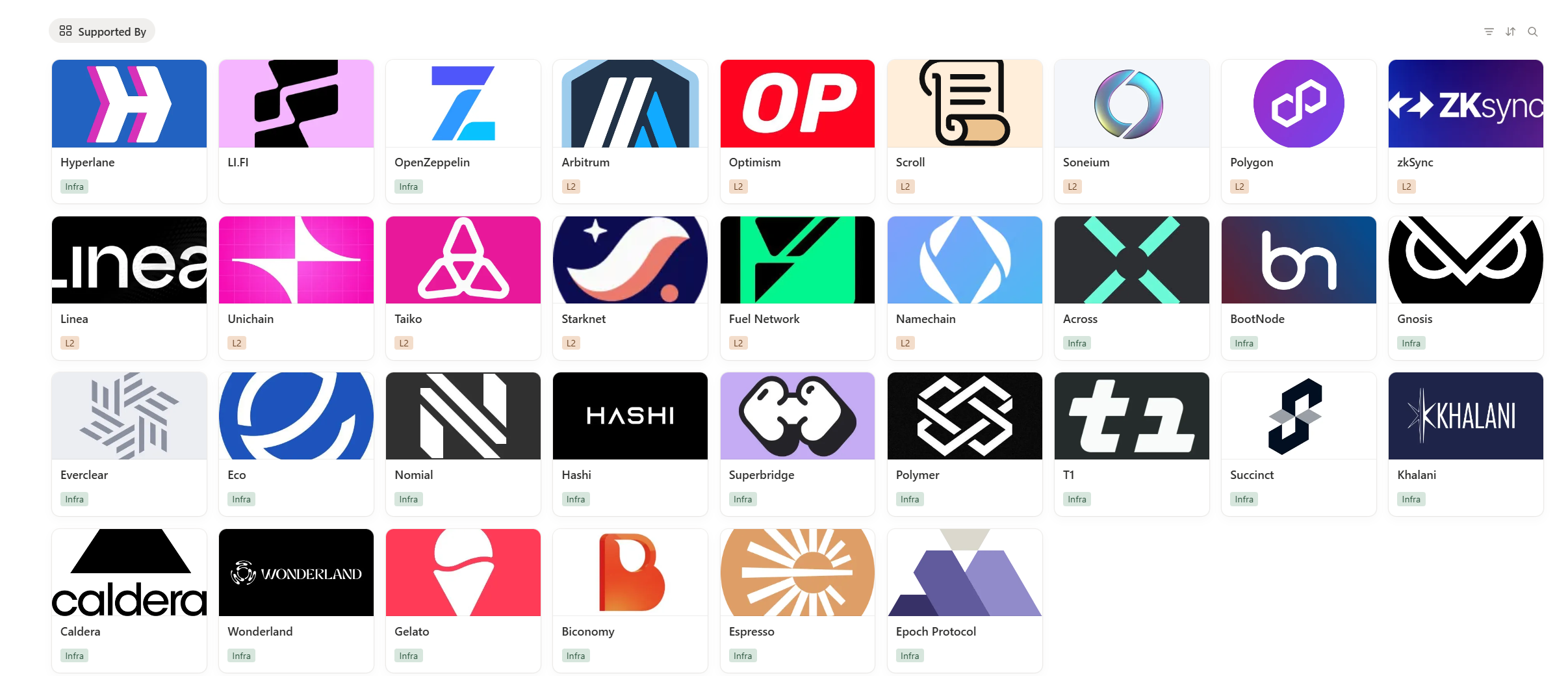

而 OIF 就是要结束这种混乱,建立一套面向整个以太坊生态的标准化「意图框架」,为钱包、桥、Rollup 和做市/solver 提供通用的协议栈——作为由以太坊基金会联合 Across、Arbitrum、Hyperlane 等头部项目共同推进的模块化意图栈,它不是一个单一的协议,而是一套通用的接口标准。

其中它规定了「意图」应该长什么样、如何验证、如何结算,从而让任何钱包、任何 DApp 和任何求解器都能在同一个频道上对话,且不仅支持多种意图交易模式,开发者还能通过 OIF 拓展新型交易模式,如跨链荷兰拍卖、订单簿撮合、自动套利等。

二、OIF 的核心价值:不只是另一个跨链聚合器

你可能会问,那 OIF 和今天的跨链聚合器有什么不同?

最本质的区别就在于标准化,说到底,今天的大部分跨链聚合器可以理解为自建一整套闭环系统——自己定义 Intent 格式、自己选桥、接路由、自己管理风控和监控,在此基础上,任何钱包、DApp 想集成,就要逐个对接每个聚合器的 API 和安全假设。

而 OIF 更像是一个中立、开源的标准件库,它一开始就被设计成「多方共建」的公共设施,而不是某个项目的私有标准:Intent 的数据格式、签名方式、拍卖/竞价逻辑都采用通用的结算与验证模块,钱包或 DApp 只需要集成一次 OIF,就可以和多个后端、多个桥、多个 solver 对接。

当前,也已有 Arbitrum、Optimism、Polygon、ZKsync、Across 等 L2、跨链桥、聚合器等以太坊头部玩家入局。

今天的以太坊生态面临的流动性破碎难题比以往要复杂地多—— L2 遍地开花,流动性碎片化,用户被迫在不同的网络间频繁切换、跨链、授权,因此从这个角度来看,OIF 的出现,不仅仅是为了让代码写起来更漂亮,它对 Web3 的大规模采用有着深远的商业和体验价值。

首先是对用户而言,在 OIF 的框架下,用户不再需要感知我在哪条链。你可以在 Optimism 上发起一笔交易,意图是购买 Arbitrum 上的某个 NFT,以前需要先跨链资产,然后等待到账,再切换网络,最后购买 NFT。

而一旦集成 OIF,像 imToken 这样的钱包就可以直接识别你的意图,然后生成标准订单,通过求解器自动垫付资金并在目标链完成购买,期间用户仅需一次签名,这就是所谓的「链抽象」体验,OIF 也正是实现这种体验的底层语法。

与此同时,对于全网流动性而言也能打破孤岛,实现全局共享。毕竟目前以太坊 L2 的流动性是割裂的,像 Uniswap 在 Base 上的流动性无法直接服务于 Arbitrum 上的用户,而通过 OIF 标准(特别是 ERC-7683),所有的意图订单可以汇聚到一个全球共享的订单簿中。

一个专业的做市商(Solver)可以同时监听所有链上的需求,哪里有需求就在哪里提供资金。这意味着流动性利用率将大幅提升,用户也能获得更优的报价。

最后对开发者与钱包来说,也意味着一次集成、处处通用,像对于 imToken 这样的钱包或 DApp 开发者而言,OIF 意味着极大的减负,开发者不再需要针对每一个跨链桥或意图协议单独开发适配器。

只要集成了 OIF 标准,就可以立刻接入整个以太坊生态的意图网络,支持所有符合该标准的求解器。

三、OIF 现在发展到哪一步了?

正如上文提到的,根据以太坊基金会的公开说明,OIF 由 EF Protocol 团队牵头,联合了 Across、Arbitrum、Hyperlane、LI.FI、OpenZeppelin、Taiko 等多家团队共同推进,并且在 2025 年陆续有更多基础设施和钱包参与讨论与测试。

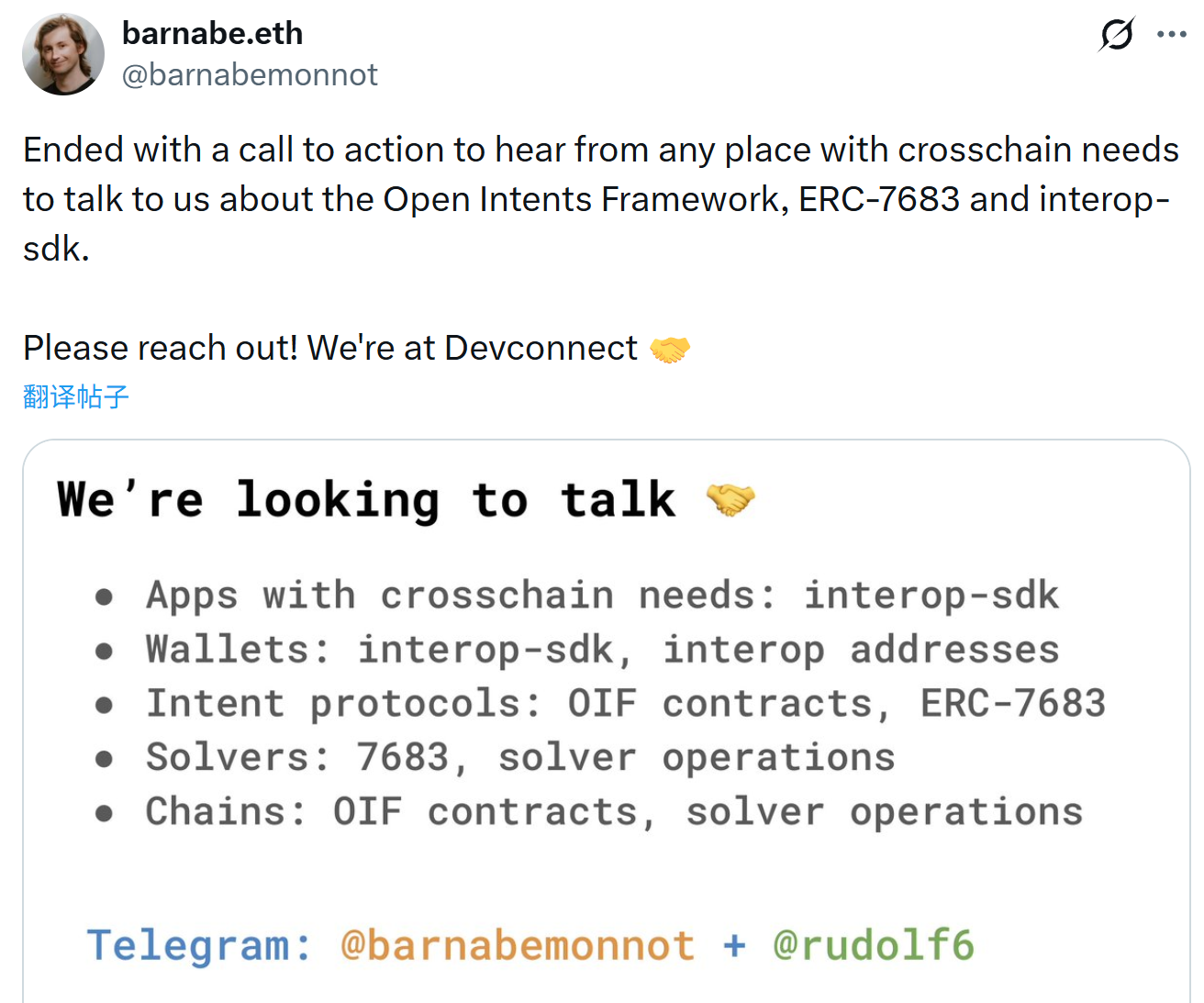

最近 Devconnect 上的聚光灯打在了很多新概念上,但 OIF 的拼图也在实打实地落地,主要体现在标准制定和生态联盟的建立上,像今年 Devconnect 的 Interop 主舞台,几乎整天都在围绕「intent、interoperability、account abstraction」展开,OIF 多次出现在相关议程和 PPT 中,被明确定位为未来多链 UX 的关键组件之一。

虽然目前还没有针对普通用户的大规模应用,但从会议密度和参与方来看,社区已经基本达成共识:未来几年的「好钱包 + 好应用」,极大概率会在 OIF 这类公共框架之上构建跨链能力。

其中就包括老生常谈的 ERC-7683,这是 OIF 目前最具体的落地成果之一,由 Uniswap Labs 和 Across Protocol 联合提出,旨在建立一个跨链意图的通用结构。

在 Devconnect 期间,围绕 ERC-7683 的讨论确实在进一步深化,越来越多的开发者、Solver 和做市商开始加大对这一标准的支持,这标志着跨链意图交易正在从私有协议走向公用设施。

其次则是配合 Interop 系列中另一条主线——Ethereum Interoperability Layer(EIL),OIF 在上层提供「意图与 UX」,EIL 在底层提供「跨 L2 的信任最小化消息通道」,两者叠加,构成了未来以太坊互操作栈的重要基础。

而以太坊基金会在其中扮演了协调者而非控制者的角色。通过 Protocol Update 等文档,EF 明确了将 OIF 作为互操作路线图的初始化阶段,这给了市场极大的信心——意图(Intent)不是昙花一现的叙事,而是以太坊官方认可的长期演进方向。

对整个以太坊生态来说,OIF 正在把「互操作」从白皮书上的概念,推进到可以被复制、被审计、被大规模集成的工程现实,也许未来你在使用钱包时,会逐步留意到一个变化:你只需要说出「想做什么」,而不必再纠结「在哪条链、用哪个桥」时——那就是 OIF 这类基础设施,在悄悄发挥作用。

至此,互操作的「初始化」拼图已现雏形。

但在 EF 的路线图中,仅仅听得懂意图还不够,还需要跑得快、跑得稳,在下一篇 Interop 系列文章中,我们将深入 Devconnect 的核心议题——EIL(以太坊互操作层),带你看看以太坊如何通过 「加速(Acceleration)」 阶段,构建一个无许可、抗审查的跨 L2 信任通道,真正实现让所有 Rollup「看起来像一条链」的终极愿景。

敬请期待。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。