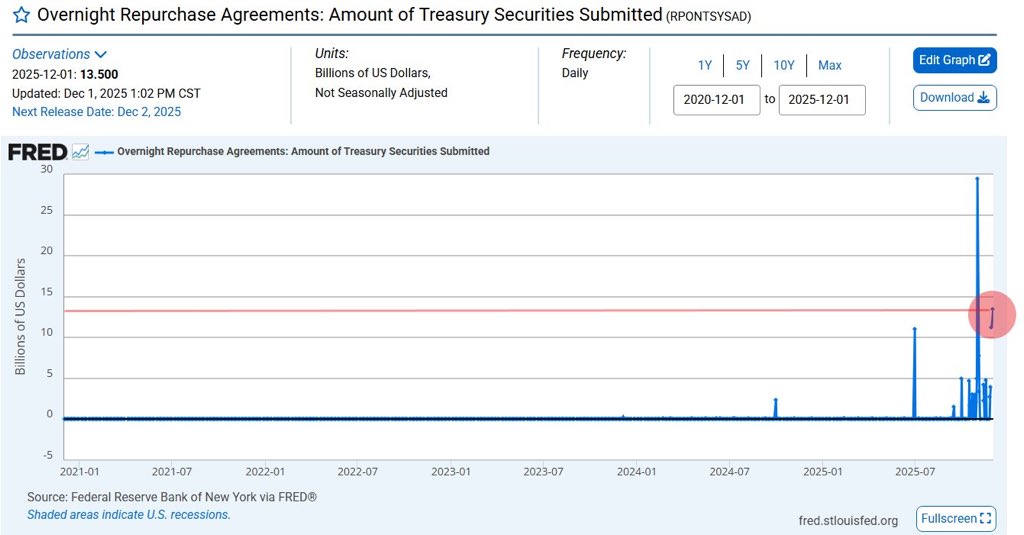

As soon as the market landed, an upward sentiment emerged, as today is indeed the day the Federal Reserve officially ends its balance sheet reduction. During the day, the Federal Reserve injected $13.5 billion into the banking system through overnight repos, marking the second-largest single-day liquidity injection since the COVID-19 pandemic.

However, this type of overnight repo is not easing; rather, it is a response to the system being drained too quickly, forcing the Federal Reserve to step in with a "liquidity injection," which is a one-time, passive liquidity replenishment. The core variable that truly determines whether the short end remains tight is that the SLR itself has not been relaxed. Banks still cannot expand their balance sheets, cannot absorb U.S. Treasuries on a large scale, and cannot withstand the impact of fiscal replenishment.

Overall, this round of upward movement is more of a sentiment reaction to the end of balance sheet reduction, rather than an improvement in system liquidity due to the $13.5 billion in repo funds. Whether the short-end dollar can truly ease depends not on overnight repos, but on whether the SLR will be adjusted. If the SLR continues to maintain its current hard constraints, then this passive liquidity injection will repeatedly occur, and the market will oscillate between being drained and being replenished, without forming a sustained easing of funds.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。