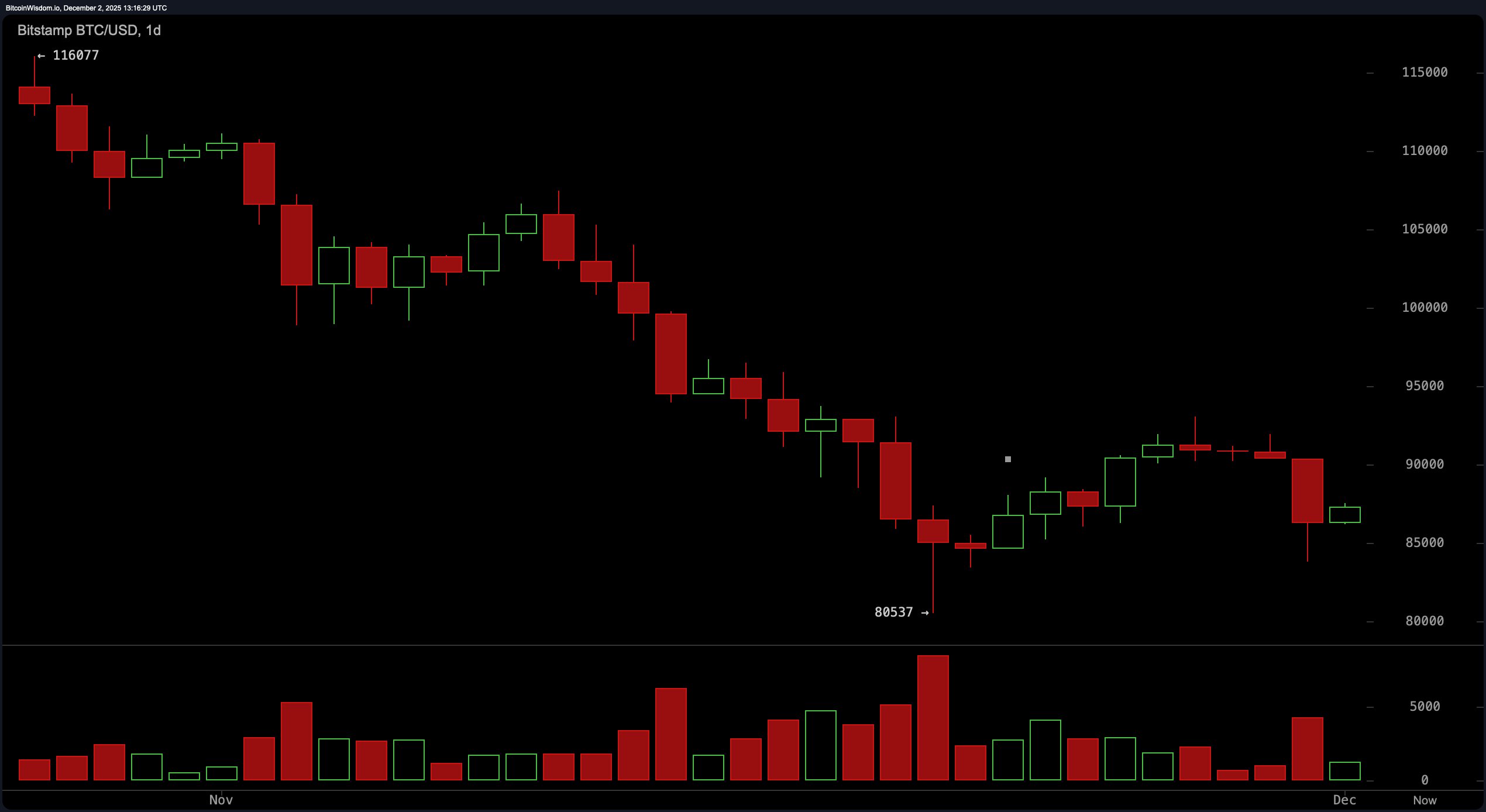

On the daily chart, bitcoin’s broader trajectory is unmistakably bearish, marching down a slope of lower highs and lower lows. November’s price action left behind a clear trail of selling pressure, culminating in a hefty red candle that signaled strong distribution near the $91,000 resistance level.

Although there was a modest bounce from support around $80,537, it failed to follow through, showing no convincing bullish reversal patterns. The increase in volume on the latest red daily candle adds weight to the idea that sellers are still running the show. With no confirmed floor yet, the risk of continuation lower remains elevated.

BTC/USD 1-day chart via Bitstamp on Dec. 2, 2025.

Shifting to the 4-hour chart, things get murkier—but not necessarily brighter. bitcoin saw a corrective rally off its $83,814 low, rising into a stiff resistance band between $88,000 and $88,500. However, the momentum behind this push has waned, with declining volume suggesting buyers are already losing enthusiasm. This bounce lacks structural conviction and reads more like a technical reprieve than a legitimate reversal. Unless the price can burst through $88,500 with volume and purpose, it’s more likely a pause in the storm than the end of one.

BTC/USD 4-hour chart via Bitstamp on Dec. 2, 2025.

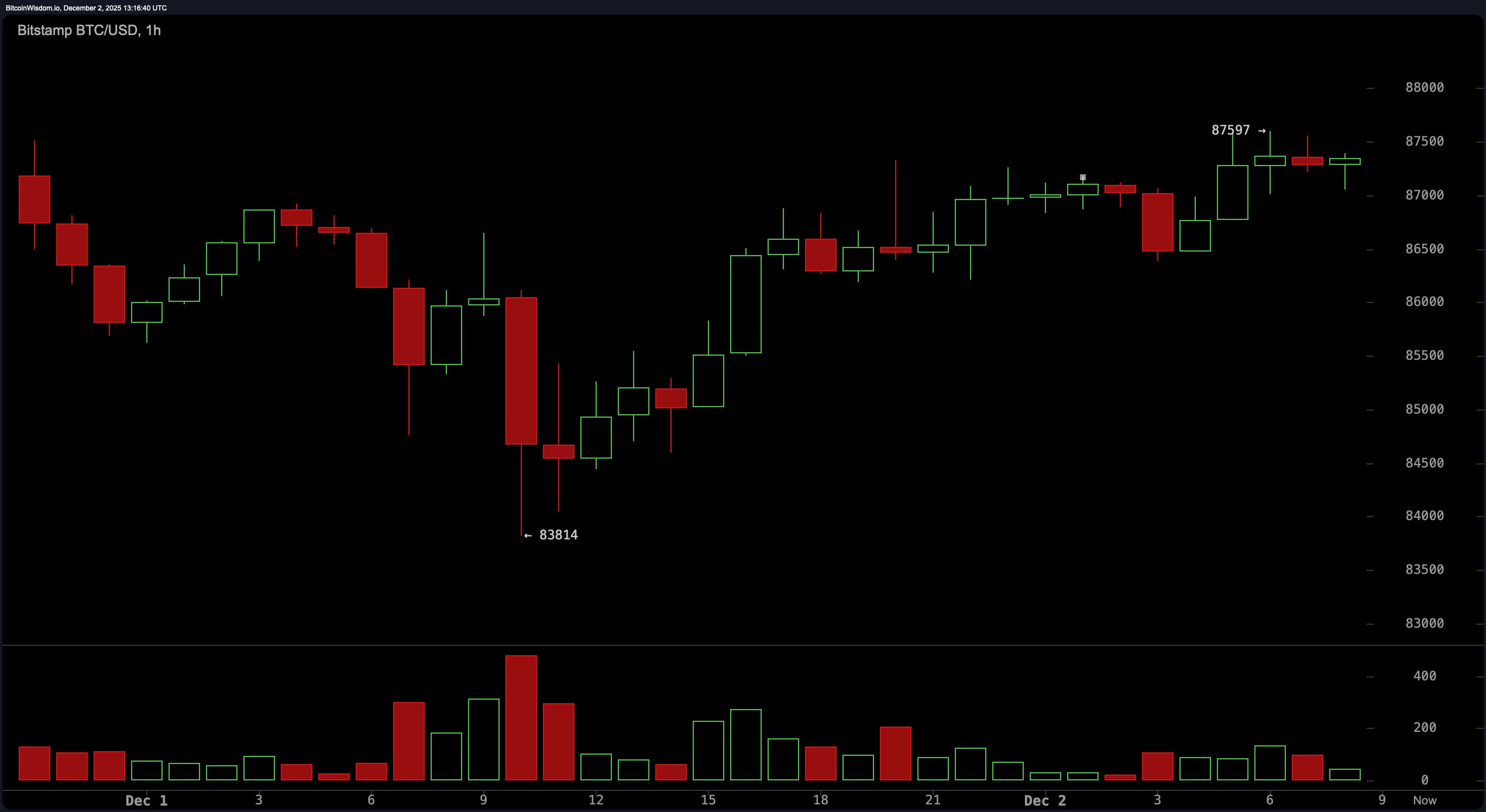

The 1-hour chart offers a flicker of bullish intrigue—albeit one that needs a health check. Since the bottom at $83,814, bitcoin has formed a series of higher highs and higher lows, a micro-uptrend in an otherwise tired market. It even poked near resistance at $87,600 before being swatted back by weak volume and tepid follow-through. If the price dips below the $86,000 level on strong volume, that would likely mark the end of this short-term recovery. Until then, it’s holding on by its fingertips, supported more by inertia than conviction.

BTC/USD 1-hour chart via Bitstamp on Dec. 2, 2025.

Oscillators are collectively shrugging their shoulders. The relative strength index (RSI) at 35, stochastic at 53, and commodity channel index (CCI) at −71 all point to neutral territory—neither oversold nor overbought, just indecisive. The average directional index (ADX) clocks in at 40, implying trend strength, while the awesome oscillator prints a dismal −7,096. Momentum, surprisingly, registers a bullish 2,481, and the moving average convergence divergence (MACD) level sits at −3,772 with a bullish bias. In short: signals are mixed, momentum is suspect, and direction remains hotly contested.

Moving averages, however, have made up their minds—and they’re all pointing south. The 10-, 20-, 30-, 50-, 100-, and 200-period exponential moving averages (EMAs) and simple moving averages (SMAs) all hover well above current price levels, flashing consistent downward pressure across every major timeframe. With the 200-period simple moving average (SMA) looming near $109,562, bitcoin has plenty of ground to cover before even teasing a major trend reversal. Until short-term bullish structures begin to break long-term trendlines, this remains a rally looking for a reason to exist—and so far, it hasn’t found one.

Bull Verdict:

For those with a glass-half-full view, bitcoin’s microstructure on the 1-hour chart offers a potential launchpad—higher highs, higher lows, and just enough momentum to flirt with another test of resistance. If volume steps up and price breaches the $88,500 barrier with authority, this could evolve into a short-term breakout attempt. Until then, any optimism is speculative and should be paired with tight risk controls.

Bear Verdict:

From the broader lens, the downtrend still wears the crown. With every major exponential moving average (EMA) and simple moving average (SMA) stacked above current price, and daily rejection candles forming with increasing volume, the path of least resistance remains downward. Unless bitcoin can reclaim key resistance levels with conviction, rallies will likely serve as nothing more than exits for the well-positioned bears.

- Where is bitcoin’s price trending now?

bitcoin remains in a broader downtrend, facing strong resistance near $88,500. - What is the key support level for bitcoin?

Current support is around $80,500, with recent bounces observed near $83,814. - Is bitcoin showing signs of recovery?

Short-term charts show a mild bounce, but momentum and volume remain weak. - What technical levels are traders watching?

Key zones include resistance at $88,500 and support between $85,500 and $86,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。