The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

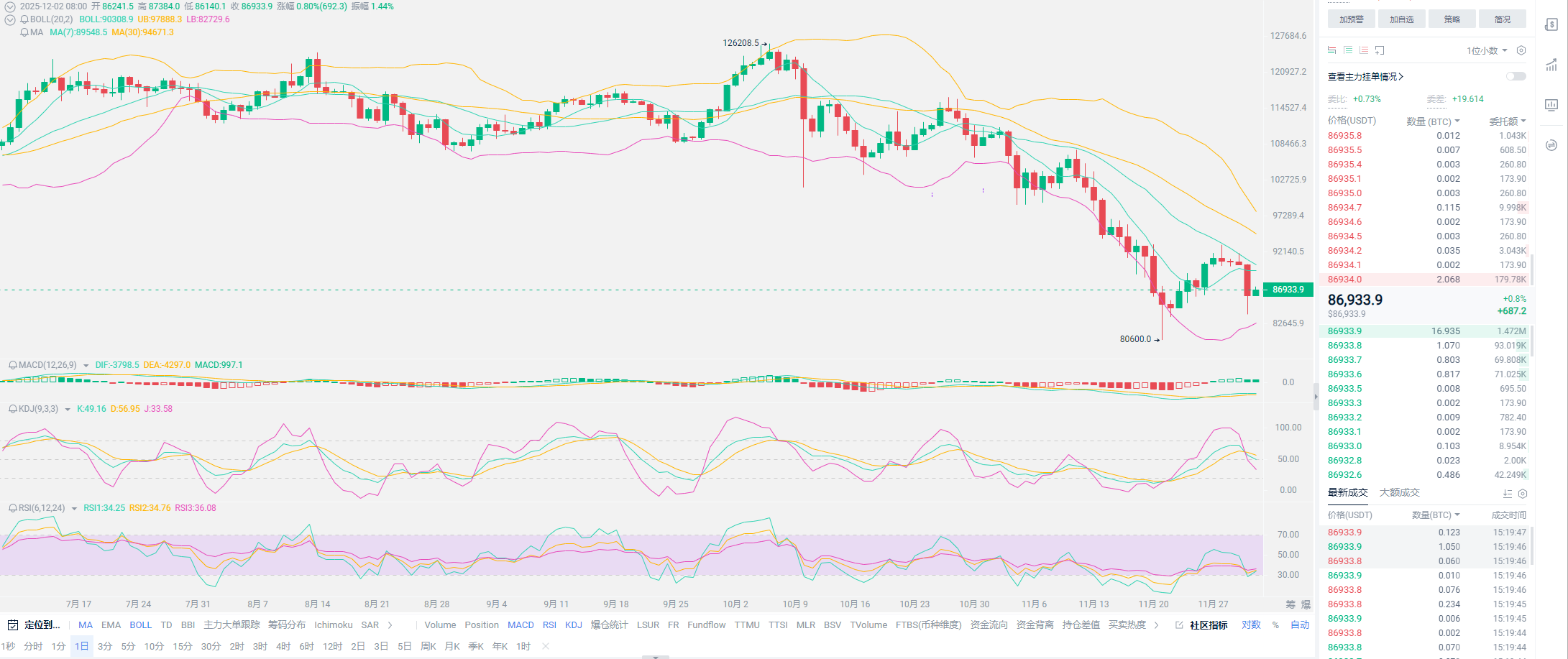

The market continues to decline, and Lao Cui has recently been unable to concentrate on the trend; often considering risk issues more. Considering mainland users, it is indeed based on the sharing status. Therefore, platform parties and U merchants should not come to Lao Cui anymore, as Lao Cui indeed has no intention of cooperating with you. More users are now more concerned about the monetization issue. Lao Cui cannot express this view, but can only say one thing: if the scale is not large, there is no need to worry; if it exceeds the scope, legal avenues need to be considered. The definition of scale is not Lao Cui's personal will. If everyone has practical issues, it is best to communicate directly with Lao Cui. The current stage of risk is indeed very high, and perhaps Lao Cui will update irregularly in the future, so it won't be so frequent. The market will still exist; existence is reasonable. Personal trading is not a big problem, as long as everyone does not have crooked thoughts, technology is still innocent. Returning to the trend, yesterday was still revolving around the bearish trend, and the residual heat has not cooled down.

This also has historical references. It is obvious that this decline is not as rapid as on May 19, thanks to the previous clean-up, which resulted in not much inventory in the domestic market. There is no need for everyone to overestimate themselves; facing the intensity of this strategy, the influence in the domestic market will only decrease. Most friends do not understand what Lao Cui mentioned in yesterday's article, that the non-intervention in the domestic market is a long-term positive message for digital currency. This view was mentioned by Lao Cui earlier, and from a realistic perspective, it can be clearly observed that the Americans are in the stage of acquiring chips. In other words, your selling is what the Americans want to see. The previous view is that any bull market must start with chips highly concentrated in the hands of the controllers. When the chips rush towards BlackRock, American pensions, and even giants like Coinbase, they all converge in the American market. When there is enough scale, pulling the market up is naturally the only choice.

This short-term suppression is definitely painful for the market, and the outflow from the domestic market severely tests the ability of the market makers to take over. The short-term trend has almost become a foregone conclusion, and it may only have a chance to turn around after experiencing the Fed's interest rate cuts. Under this market fluctuation, there will be a wave of contracts, and most users who communicate with Lao Cui end up with losses. The reasons for the losses, from Lao Cui's perspective, are simply three stages, which I will briefly organize and discuss with everyone today. Most contract users will experience stage successes, stage failures, and choices after calming down. To put it simply, last year, Lao Cui was in great form, predicting a hundred thousand Bitcoin at the beginning of the year, and the target exceeded expectations, which became the initial point for many users to believe in Lao Cui. It was also discussed earlier that the start to the end of the last bull market, in Lao Cui's eyes, was not a prophecy but something that would definitely happen.

In the face of this market situation, as long as you go long, everyone can profit, but you must be clear that this success is due to external factors, not yourself; circumstances create heroes. At the same time, from July to December this year, there have also been stage failures. For example, the speculation on interest rate cuts, always thinking that a peak will appear only after the cuts, resulting in missing every wave of peaks, leading to losses. Facing such failures, if you started paying attention to Lao Cui this year, you would have suffered particularly severe losses. But at the same time, if you have been continuously following, the overall should still be preserved at around 3-5 times profit. Whether in profit or loss, it exists in stages; this is the greatest value Lao Cui can offer you. Losses can be reduced, and profits can be expanded. One point I often emphasize is that after making a profit, you must consider the potential for future losses. The depth of this pullback was not within Lao Cui's expectations, and the current price has already lost the principal, and Lao Cui is the same.

If you still choose to believe, I hope everyone can follow through to the end. Whether it is continuous success or continuous failure, it is a stage process, and ultimately it will return to rationality. The factors causing this result are also very simple, which is the anchoring effect that Lao Cui mentioned. Most friends will be more or less influenced by this, and so is Lao Cui. For example, in this pullback, more friends will set the depth of the pullback near the starting point of the last bull market, which is around 73,000. When you have this anchoring point, you will naturally feel that being bearish is the only choice. Then this wave of decline to 80,000 and the subsequent pullback to 93,000 will naturally lead to a complete loss of this round of rebound, resulting in losses. Even if there are no losses, the current stage is still in a holding position. Overcoming this mentality is extremely difficult, and Lao Cui does not expect to completely overcome it with everyone. At this stage, Lao Cui still cannot do it, so in the face of this mentality, Lao Cui's only solution is to lower psychological expectations.

Taking the example from the beginning of the year, when it reached a new high of 120,000, everyone was touting that this year it would reach the 180,000-200,000 range. When everyone was believing, that was the time you needed to be vigilant. You must control your emotions, so Lao Cui gave the range of 130,000-150,000. Up to now, this lowest position of 130,000 has not been reached, but it does not mean much to Lao Cui. Plans can never keep up with changes, and you must have a mindset of accepting reality. This acceptance must come from the heart. When stage failures begin to extend, you must learn to accept reality. Holding onto the mindset of recovering losses will only take you further away. This is similar to relationships; often, couples who can remarry after divorce have gone through a period of time to consider, completely calm down, and be able to make changes, which gives them the possibility of profit. The shorter the time, the more contact between the two will only cause confusion in the relationship, becoming irretrievable, so take more time to review.

Lao Cui summarizes: In a downward state, losses are considerable, coupled with domestic restrictions, Lao Cui will also consider many issues: risks, markets, returns, and future developments. At this stage, I see no hope, taking a pause is also an explanation to myself. Even if I update, it will only be about the trend. The short-term trend is still dominated by bearish behavior, especially emphasizing one currency, SOL, which is facing some difficulties in this decline and showing signs of bottoming out. Those with positions can prepare to add a bit; Lao Cui has also re-entered. Yesterday, I already talked about the future trend, so I won't go into too much detail today. Talking about short-term issues, currently, the bears are the main force, and reversal signals are continuously appearing; therefore, Lao Cui's definition will not revolve around short positions. In December, Lao Cui sees a rebound. The trend after interest rate cuts will be reassessed. Based on the current situation, it is difficult to create new lows. Even if new lows appear, Lao Cui does not recommend you to chase short positions. The profit from short positions in Bitcoin can only be kept within 2,000 points, and be prepared for a possible reversal at any time; spot trading is the way to go. Risk issues are what platforms and U merchants need to consider; individual investors should not overthink.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; experts can see five, seven, or even ten steps ahead, while those with lower skills can only see two or three steps. The skilled consider the overall situation, strategize the big picture, and do not focus on individual pieces or positions, aiming for the final victory. The less skilled, however, will fight for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。