Six large exchanges showed outflows of nearly 40,000 BTC on the same day, according to a popular crypto trader who goes by “@DefiWimar” on X. That’s more than $3.6 billion in 24 hours. Around the same time, bitcoin nosedived from $91K to $87K, eventually bottoming out at $83,862.25 on Monday morning. Was this a “coordinated dump” as DefiWimar alleges, or just a list of innocuous transactions that are part and parcel of exchange operations?

“These are major OTC and trading venues who operate on behalf of clients,” said Matt Law, partner at Web3 accelerator Outlier Ventures. “Their clients are selling the coins and you are shooting the messenger.”

Read more: Here’s One Reason Why Bitcoin Might Rally After Thanksgiving

It’s important to point out that outflows are not necessarily sells. One X user responded to DefiWimar, suggesting the transactions are likely part of a month-end rebalancing process. But even if the outflows represent actual sell orders, the reason for selling could simply be paper hands panicking or leveraged traders getting liquidated, according to other X users who chimed in on the thread.

Bitmex co-founder Arthur Hayes chalked up bitcoin’s slide to what’s shaping up to be the second interest rate increase by Japan’s central bank since January. Kazuo Ueda, governor of the Bank of Japan (BOJ), hinted at a likely 25-basis-point hike to the country’s policy rate which currently stands at 50 basis points. The move will likely hurt so-called carry traders who take advantage of the country’s low interest rates by borrowing Japanese yen to invest in higher-return assets such as bitcoin. “$ BTC dumped cause BOJ put Dec rate hike in play [sic],” Hayes wrote on Twitter.

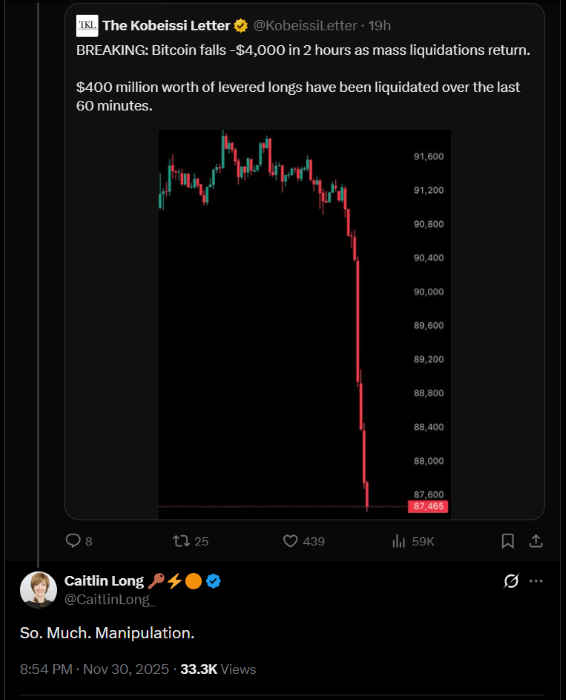

(Custodia Bank CEO Caitlin Long calls the latest bitcoin price drop “manipulation.” / Caitlin Long on X.)

But despite Hayes’s more rational macroeconomic explanation, suspicions of BTC price manipulation seem to be on the rise. And the allegations of unscrupulous whales conducting coordinated dumps are no longer restricted to tin-foil conspiracy theorists behind a Pepe avatar on X. Even credible thought leaders like Caitlin Long, CEO of crypto-focused financial institution Custodia Bank, are starting to get skeptical. “So. Much. Manipulation,” Long said, in response to a post showing bitcoin’s precipitous plunge Sunday night that has since triggered roughly $400 million in liquidations.

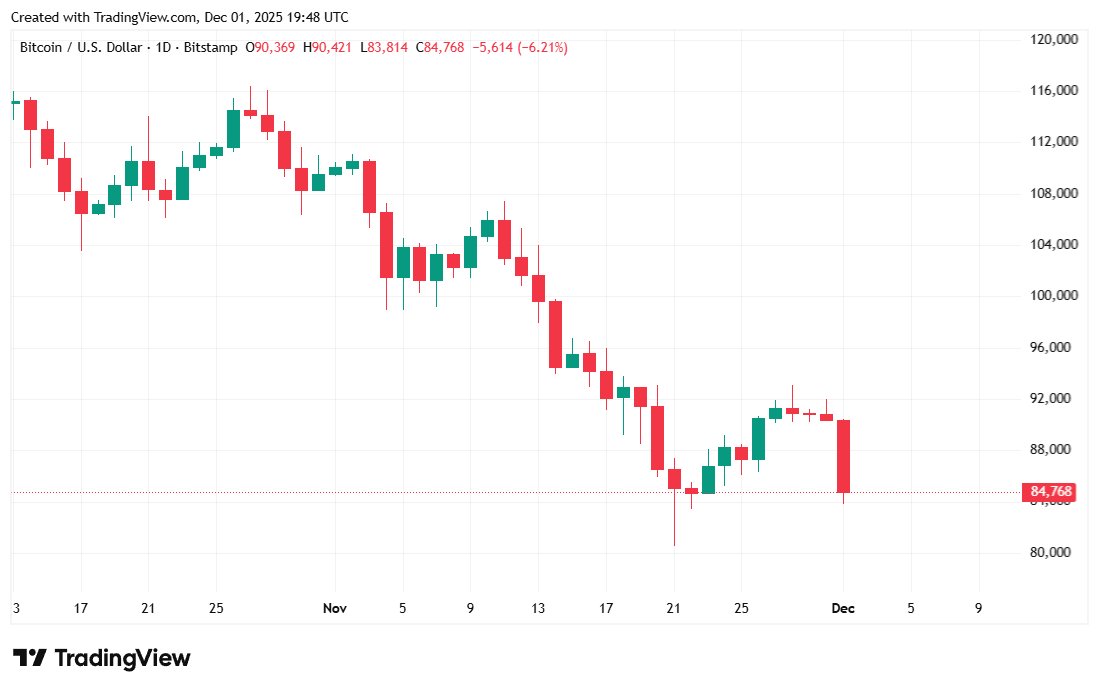

Bitcoin fell 7.12% over the last 24 hours and was trading at $84,916.12 at the time of reporting, according to Coinmarketcap. Weekly performance was more palatable, but still negative as the cryptocurrency shed 3.85% over seven days. Volatility jumped since yesterday, with BTC’s lower bound falling to $83,862.25 and its top price reaching $91,626.32 in a single 24-hour trading period.

( BTC price / Trading View)

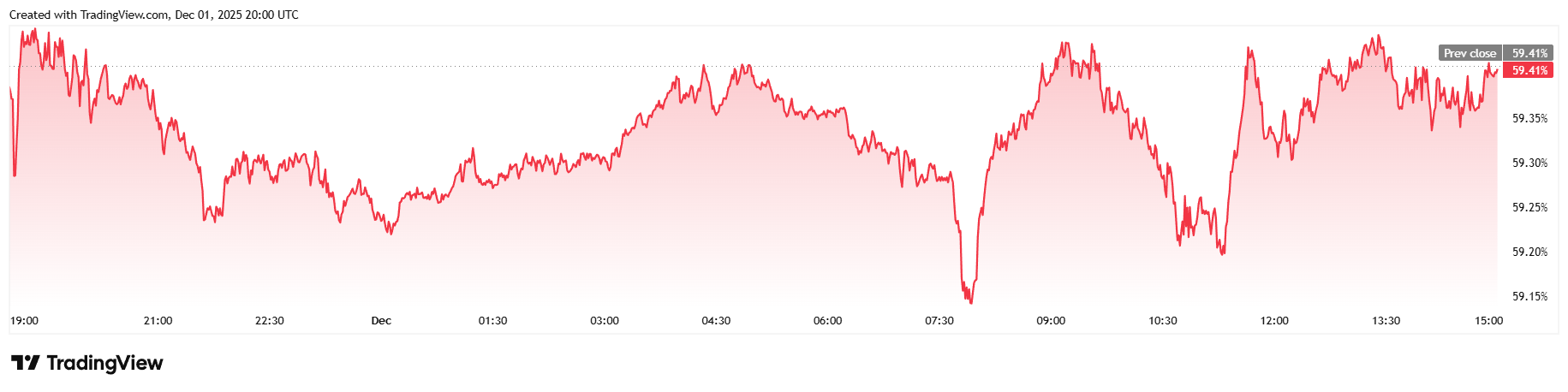

Daily trading volume ballooned 120.48% to reach $83.48 billion, mostly attributable to the Sunday-Monday sell-off. Market capitalization dropped to $1.69 trillion but bitcoin dominance was mostly flat, dipping slightly by 0.01% to reach 59.40%.

( BTC dominance / Trading View)

Total bitcoin futures open interest fell 3.94%, reaching $57.37 billion, according to Coinglass data. Liquidations quadrupled from Friday, totaling $392.55 million. Almost all losses came from bullish long investors who were caught unawares by Sunday’s price drop. Short sellers posted a much smaller $32.625 million in liquidated margin.

- Why did bitcoin suddenly drop 7%?

Some analysts point to large exchange outflows and heavy liquidations, while others cite macro pressures like Japan’s expected rate hike. - Do massive outflows automatically mean price manipulation?

Not necessarily. Many outflows are internal transfers, OTC movements, or month-end rebalancing rather than coordinated selling. - What role did the Bank of Japan play in the sell-off?

A likely BOJ rate hike threatens carry traders who borrow yen to buy risk-on assets like bitcoin, forcing rapid unwinding and adding to downward pressure. - Are credible experts concerned about manipulation?

Yes . Even well-known industry figures like Caitlin Long say recent price action “looks manipulated,” fueling growing skepticism.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。