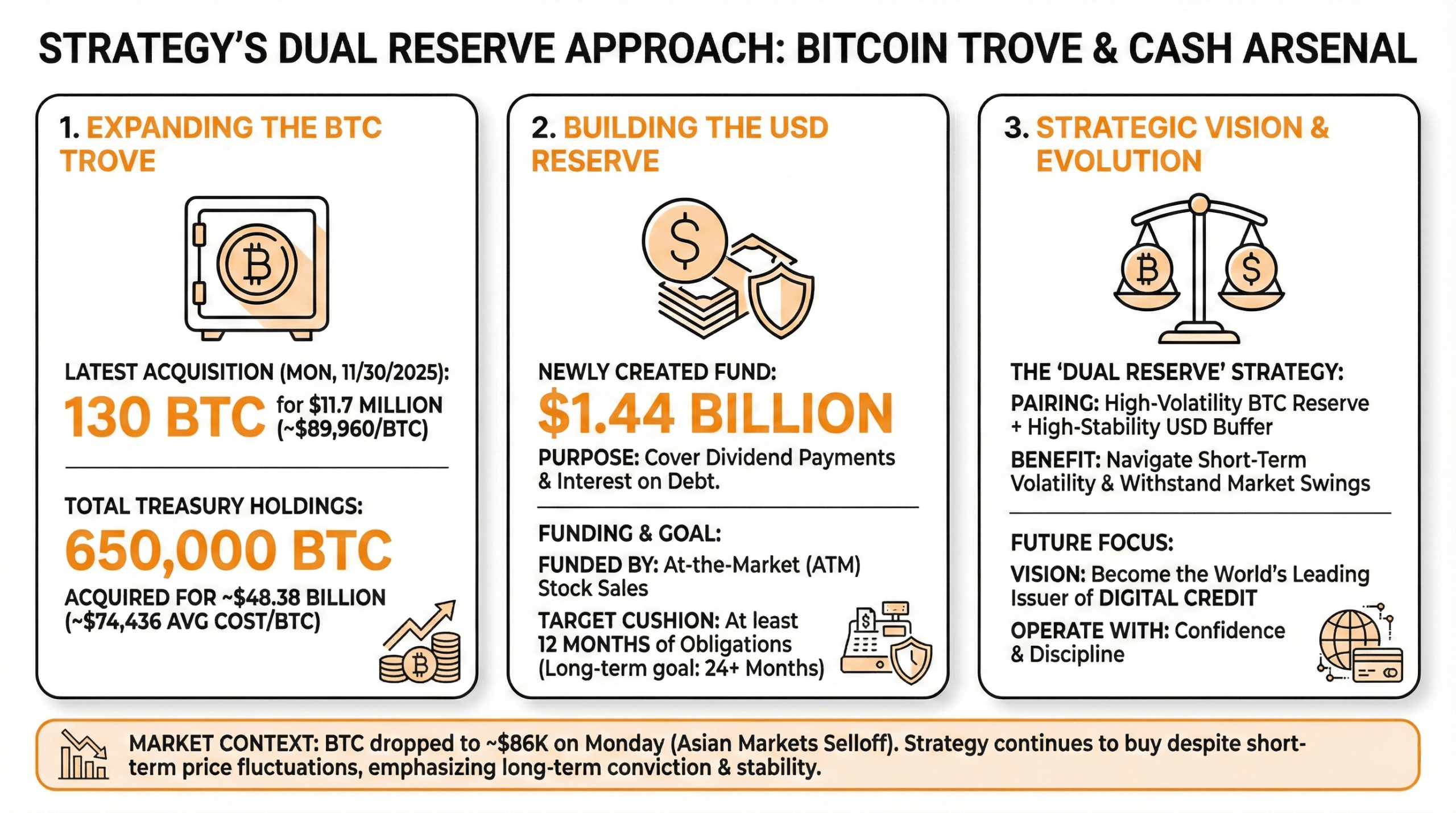

Michael Saylor, the founder of Strategy, announced his firm picked up yet another stack of bitcoin. “Strategy has acquired 130 BTC for $11.7 million at $89,960 per bitcoin,” Saylor wrote. He added that “as of 11/30/2025, we hodl 650,000 BTC acquired for ~$48.38 billion at ~$74,436 per bitcoin,” giving the company’s treasury one more unapologetically bullish flex.

Strategy also said it has created a $1.44 billion USD Reserve to help cover dividend payments on its preferred stock and interest on its outstanding debt. The fund was built through proceeds from its at-the-market (ATM) stock sales, and the company explained it plans to keep enough cash on hand to cover at least 12 months of these obligations, with a longer-term goal of extending that cushion to 24 months or more.

Strategy noted that the size and management of the reserve may shift over time depending on liquidity needs, market conditions, and other internal considerations.

“Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution, and we believe it will better position us to navigate short-term market volatility while delivering on our vision of being the world’s leading issuer of Digital Credit,” Saylor detailed in the release.

Read more: Bitcoin Drops to $86K as Asian Markets Trigger Selloff

By pairing a deep bitcoin reserve with a sizable cash buffer, Strategy signals its intent to operate with confidence and discipline, positioning itself to withstand sharp market swings while still pushing its broader mission of scaling digital credit into a global financial fixture for good. However, and once again, Strategy paid a bit more than the current going rate of $85,972 per bitcoin (8:30 a.m. EST) on Monday.

- What did Strategy buy this week?

Strategy added another 130 BTC, bringing its holdings to a massive 650,000 BTC. - Why did Strategy create a USD Reserve?

The $1.44 billion reserve is designed to cover dividend payments and interest obligations. - How was the USD Reserve funded?

Strategy built the reserve using proceeds from its at-the-market stock sales. - What is Strategy’s broader goal with these reserves?

The firm aims to bolster stability as it works toward becoming a major issuer of Digital Credit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。