More than a month has passed since the epic liquidation in the cryptocurrency industry on October 11, and the pain seems to have only now become clear. Due to a significant contraction of hot money in the market, those who still hold funds at the table are almost all participants with stronger risk awareness and more cautious strategies, which has significantly increased the difficulty of market speculation.

One question everyone is concerned about is whether the liquidity in the crypto market can return to what it was before this round.

Interestingly, at the coldest moment of retail sentiment, another type of capital has not stopped. For example, JPMorgan launched the deposit token JPM Coin for institutional clients, representing dollar deposits, multiple crypto ETFs have been approved, and crypto mining company stocks have received high ratings. For the market, this represents a structural change; previously, liquidity mainly came from retail and institutional investors willing to engage in high-frequency trading and high leverage, but now it increasingly comes from institutions and companies that need to undergo audits, include information in financial reports, and be accountable to shareholders.

Money is still coming in, but the nature of the money has changed. Perhaps the first to feel this change are not the altcoin project teams, but the centralized exchanges.

The Crossroads of CEX Differentiation: Choices of Top European Trading Platforms

In recent years, centralized exchanges have been the most mature and clear business model in the cryptocurrency industry. Listing coins, matching trades, leverage, and transaction fees—whoever has a larger asset scale, deeper liquidity, and lower fees can take the biggest slice of the cake in a bull market.

However, in the month following October 11, more and more people began to have an intuitive feeling that relying solely on listing coins and contracts may no longer support the next growth curve.

As a result, the strategic paths of mainstream CEXs have begun to show clear differentiation. Some continue to delve into high leverage and derivatives markets, strengthening the global liquidity landscape. Others are turning to the infrastructure level, laying out public chains, wallets, and clearing networks, attempting to transform themselves into the "underlying architecture of on-chain finance." A small portion has chosen to align closely with regulatory and banking systems, trying to become the standard interface between traditional finance and Web3.

In the United States, Coinbase has written its answer on the Nasdaq listing and the Base public chain. In Asia, Binance has built a complete ecological closed loop with BNB and BSC. In Europe, there is a platform answering in a completely different way: Bitpanda, and the Vision ecosystem it is building.

For many Asian users, Bitpanda may not yet be familiar; but in Europe, it is almost the default option in the digital asset investment field.

Founded in 2014 in Vienna, Austria, Bitpanda's early development path was relatively conservative. It did not bet on explosive coin listings and ultra-high leverage but instead spent nearly a decade gradually applying for licenses and building local teams across European countries. Long before regulatory frameworks like MiCA were officially implemented, it had already been in long-term contact with various regulatory agencies, developing a compliance gene familiar with "regulatory language."

More critically, Bitpanda has not positioned itself as a purely retail-focused trading site but rather as a digital asset infrastructure company, providing buying, custody, and investment products to the C-end while offering white-label digital asset services to banks and financial institutions on the B-end.

This dual-track positioning has allowed Bitpanda to establish deep cooperative relationships with traditional large banks such as Deutsche Bank, Société Générale, and Raiffeisen Bank in Austria. For these institutions, outsourcing digital asset business to a locally licensed platform that understands regulatory logic is safer, more efficient, and more cost-effective than building systems from scratch.

After the implementation of MiCA, this compliant identity suddenly became a significant first-mover advantage. Under this framework, Bitpanda logically must do one thing: no longer be satisfied with a centralized account system but expand towards chains, protocols, and ecosystems, turning the licenses and asset pools it has obtained into a set of universal underlying capabilities. Vision was launched under this strategy.

Unlike traditional crypto projects that start from a white paper, Vision has been grounded in the solid soil of real finance from day one. Backed by Bitpanda's asset system and compliance moat, it is more like a fusion of centralized and decentralized finance, attempting to build a bridge to a new generation of financial infrastructure between chains and protocols.

The narrative focus of Vision is not on "creating a public chain with high TVL" but on how to allow the banking channels, custody, and compliance interfaces that Bitpanda has already mastered to be reused by more institutions, wallets, and applications; how to extend the trust and compliance that originally existed only in offline legal documents and banking systems into the broader Web3 space.

From this perspective, Vision's role is more about helping Bitpanda transition from a centralized account system to "chain + protocol + ecosystem."

On the other hand, it provides a default technical and asset landing point for institutions in Europe looking to engage in digital assets, RWA, and compliant DeFi. As the European Central Bank and various national regulators emphasize a cautious attitude towards offshore stablecoins and crypto services, an ecosystem rooted in the EU system naturally possesses higher policy affinity and institutional trust.

TOKEN2049 Event Site | Source: Vision

From Platform Points to Universal Tokens: The Design Logic of $VSN

In the Vision ecosystem, the token $VSN is the core axis that runs through the entire system.

Whether enjoying transaction fee discounts in Bitpanda Broker, being used for incentives and usage in Web3 products (such as DeFi Wallet, Vision Protocol), or even participating in future Launchpad qualifications, governance, and resource allocation in Vision Chain, $VSN will permeate the entire ecosystem.

This design concept is based on Bitpanda's systematic thinking about a "compliant Web3 platform."

Vision's path is pragmatic; the platform is not in a hurry to push the token into partner ecosystems but chooses to first build itself as a multi-chain liquidity and routing infrastructure through Vision Protocol, becoming the underlying component that connects different chains and applications. As the protocol's usage grows, the fees generated will flow back to the foundation and $VSN, thus achieving a value closed loop.

This strategy continues the idea of BNB integrating ecological value through a single asset but has a broader scope, no longer limited to the trading platform level but delving into the chain and protocol level. The core logic of Vision is to first reduce the usage costs for partners through infrastructure, and then achieve value binding between external business and the token through a revenue distribution mechanism.

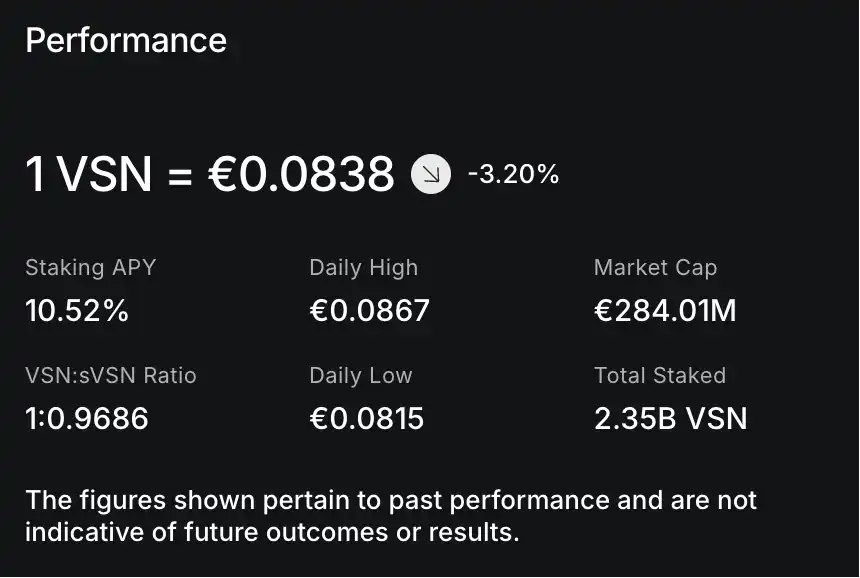

In terms of the revenue model, $VSN adopts a combination mechanism of emissions + protocol fee dividends + buyback and burn. Users can stake $VSN on app.vision.now to earn returns, with the current annualized return rate being about 10.5%, mainly sourced from basic emission rewards and fee dividends from external ecosystems like Bitpanda.

At the same time, during the phase when the foundation's business cash flow has not fully covered the release pressure, it will continue to participate in buybacks and burns through its own treasury to maintain the predictability of the token supply curve.

As the ecosystem construction progresses, the usage rate of fee deductions, the routing trading volume of DeFi Wallet and Vision Protocol, and the on-chain fees of the future Vision Chain will all become key variables driving the growth of the token's value.

On November 27, Binance Alpha announced the launch of Vision (VSN), which means that beyond Bitpanda and the European licensing system, VSN is connecting to a broader global user base and on-chain liquidity through Binance Alpha. The narrative of Vision as a compliant infrastructure in Europe is beginning to be priced and speculated within a larger trading and distribution network.

Vision's Product Architecture and Third Path

Placing Vision back into the larger cryptocurrency and financial landscape, it aims to provide a third path that differs from existing paradigms. This is neither a narrative dominated by American tech giants and offshore trading platforms nor a pseudo-blockchain that remains in the experimental fields of traditional financial private chains, but rather starts from a locally licensed platform in Europe, building a layer of universal infrastructure on a public network that can connect real assets, meet strict compliance, and maintain open composability.

If this route is validated, the coordinate system of RWA and compliant DeFi will be redrawn, allowing assets to be issued and circulated in compliance under EU legal protection, with institutions and users sharing the incremental value of the infrastructure through a unified token, rather than being forced to fight their own battles and make fragmented bets across decentralized platforms and single-point projects.

On the product side, Vision's matrix unfolds in a radiating manner from the inside out, from near to far, and can be understood according to the logic of "entry—routing—issuance—settlement":

· Vision App: The universal staking entry for $VSN, also a globally applicable DeFi front end.

· Bitpanda DeFi Wallet: An important entry point for the Bitpanda ecosystem, allowing participation in staking and XP point activities to earn future airdrops (currently unavailable in regions like China, reflecting the project's caution regarding compliance differences across jurisdictions).

· Vision Protocol: The outward routing layer, continuously connecting more DEXs and wallets, providing liquidity routing services within other applications.

· Bitpanda Launchpad (planned for 2026 launch): To undertake the issuance and participation qualifications of tokenized assets.

· Vision Chain (planned for 2026 launch): To establish compliance interfaces at the chain level, providing a highly trustworthy execution and settlement environment for RWA assets.

This self-consistent layering allows Vision to transform compliance from an external added service into an endogenous capability of the architecture. In other words, it converts compliance costs into trust dividends and transmits the latter to the participants who truly use this infrastructure through the unified value capture mechanism of $VSN.

Conclusion

From a higher dimension, Bitpanda's choice is not isolated but part of the entire CEX industry's rewriting of its strategy.

When leading trading platforms are searching for a "second curve," they have roughly differentiated into three directions. One type is the "speed faction," which continues to bet on high leverage, high-frequency trading, and positions itself as a global liquidity hub. This path requires relatively low regulatory friendliness but demands extremely high risk tolerance from the platform itself.

The second type is the "platform faction," which aims to enhance its compliance image through listing and leveraging its own public chain and account system, positioning itself as an infrastructure entry point for the general public. Coinbase and its extension, Base, are typical representatives of this approach.

The third type is the "infrastructure faction," which chooses to deeply cultivate specific regulatory jurisdictions, building service capabilities around banks, brokerages, and local institutions, striving to become the clearing and custody layer of the digital asset world. Bitpanda is precisely following this route.

Within this framework, without Bitpanda's accumulation of experience over the past decade, it is difficult to truly understand the necessity of Vision's emergence.

The potential upper limit of Vision is highly bound to the depth of Bitpanda's own evolution; it is more like a long-term option regarding "whether Europe can provide its own answer in digital asset infrastructure." Bitpanda is attempting to present its version through Vision. It may not rely on extreme leverage to amplify its narrative during a regulatory vacuum like BNB, but if Europe's compliance narrative ultimately becomes part of a global consensus, then the "slow project" that Bitpanda has built over ten years could potentially be repriced by the market under a new order.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。