The monthly closing has arrived, and Bitcoin faced a waterfall drop early in the morning. Zhong Liang had already issued a long article over the weekend reminding everyone that the upward momentum was weak and heavily suppressed. This week, we are looking at a second bottom test, advising everyone to short at 91000 and 3050. If you followed along, you should be happy. On December 1, Arthur Hayes published an article stating that Bitcoin plummeted due to the Bank of Japan hinting at a possible interest rate hike in December. The USD/JPY exchange rate fluctuated between 155-160, indicating a hawkish stance from the Bank of Japan.

In the past 24 hours, over 218,000 people were liquidated across the network, primarily long positions. Long positions were liquidated for $570 million, with $550 million in the past 12 hours, $68.6946 million in the past 4 hours, and $2.7306 million in the past hour. Everyone must follow the trend and not get overly excited; manage your positions well!

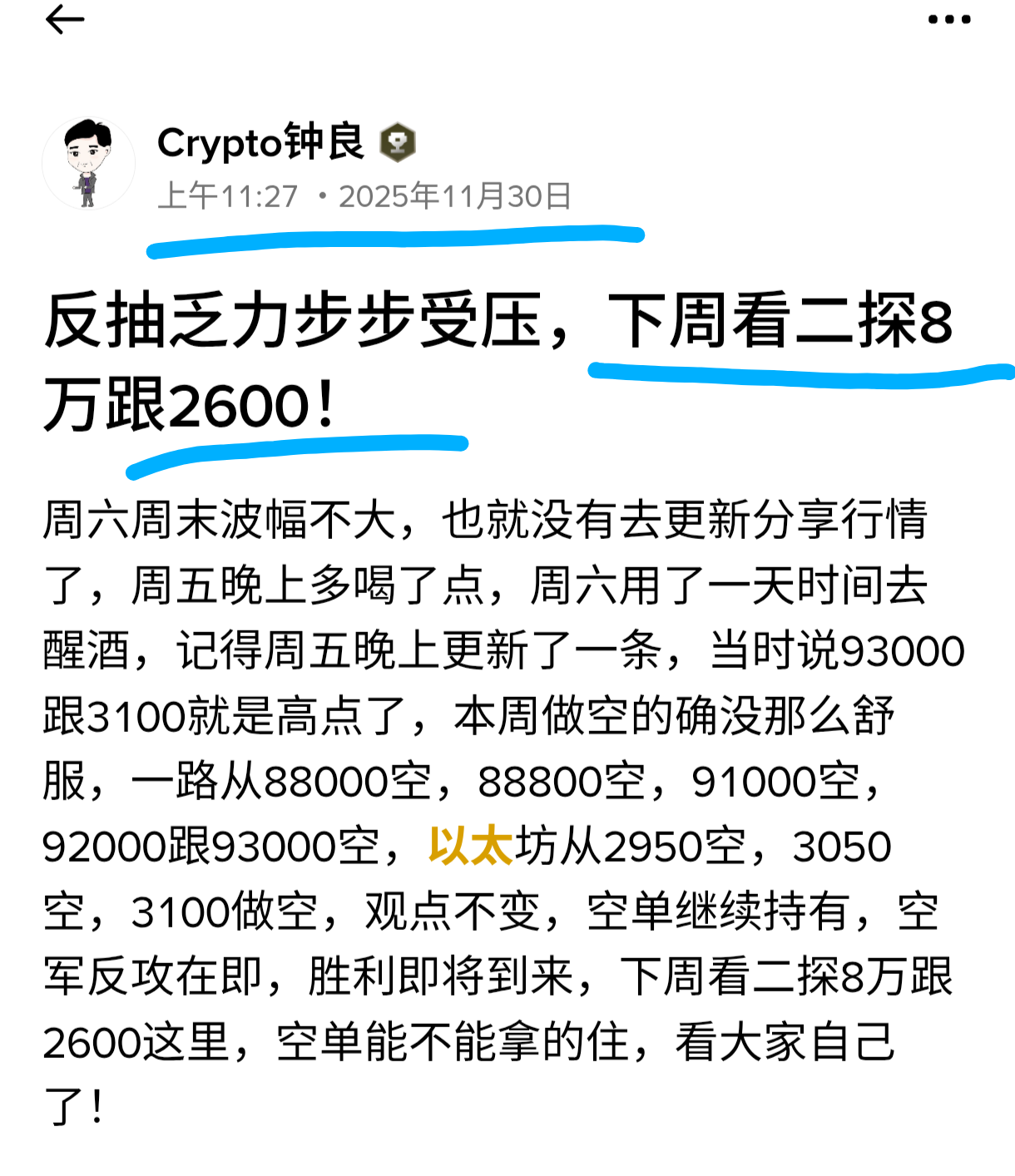

Last week, the short positions at 88000, 90000, 91000, 92000, and 93000 have all been resolved, but resolving positions is never the goal of the bears. This week, the target is to look for a second test at 80000 and 2600. Can everyone hold on and stay steady? Reduce short positions in batches, and definitely keep a base position; do not exit completely! The monthly K-line for Bitcoin closed with a triple top forming around 124000, followed by a pullback. The current price has once again fallen below the middle track support, with two consecutive bearish monthly K-lines, and the MACD bears continue to expand, while KDJ and RSI are turning downwards.

The weekly K-line Bollinger Bands show both the middle and lower bands opening downwards. Although last week closed with a small bullish line with upper and lower shadows, the upper shadow is significantly larger than the lower, indicating stronger selling pressure. The price has once again returned below the lower band, with MACD bearish energy continuing to expand. This week, the bearish outlook remains unchanged, looking forward to a second test of the 80000 mark. The daily K-line has three consecutive bearish lines, consistently pressured by the middle track, with the upper and middle bands of the Bollinger Bands opening downwards. KDJ has formed a dead cross at a high position and is moving downwards.

In the short term, the 4-hour level price has significantly fallen below the lower band, which is currently accelerating downwards to catch the price. MACD bearish energy continues to expand, and KDJ has formed a dead cross at a high position, moving downwards, with RSI also dropping sharply. Although there may be a correction in the market, and gaps need to be filled, entering long positions for short-term rebounds is not recommended; the focus should still be on shorting. The market may also consolidate sideways, using time to fill the gaps and wear down the bullish strength. The upper resistance to watch is at 87600 and 88000, followed by strong resistance at the 90000 mark, which are positions to consider for shorting. The lower support to watch is at 85400, 83300, and 80000.

Ethereum's monthly K-line faced resistance at the high of 4957 and has been oscillating downwards, forming a double top near 4750, followed by three consecutive bearish lines. The current price has fallen below the middle track support. The weekly K-line Bollinger Bands show both the middle and lower bands opening downwards, with the price pressing down on the lower band, and MACD bearish energy continuing to expand. The daily K-line rebound is under pressure from the middle track, starting to decline this morning, with KDJ forming a dead cross at a high position and moving downwards, while RSI is turning down. This week, the strategy is to short on highs, looking for a second test of the 2600 line.

In the short term, the 4-hour level price has fallen below the lower Bollinger Band, with MACD bearish energy continuing to expand, KDJ forming a dead cross downwards, and RSI turning downwards. The market is weak, and any rebound is an opportunity to short. For those without short positions, pay attention to the upper resistance at 2900, 2960, and 3030, and consider entering short positions around these levels. The lower support to watch is at 2780, 2700, and 2620.

It's not that the market is unsuitable or that the trend is weak; it's about being in the wrong position and going in the wrong direction. Change your mindset, and you may find gold bars everywhere. A Mercedes on a muddy road will never outrun a Xiali on the highway! In investing, avoid the mindset of getting rich overnight; what we need to do is survive in the market for the long term. Do not expect to buy at the bottom and sell at the top every time; avoid greed and panic, and aim for achievable profits. View every market fluctuation with a calm mind, avoid greed and panic, and do not seek to become an expert in buying at the bottom and selling at the top. Instead, aim to follow the trend, profit steadily, and secure your gains! For more real-time market insights, follow Zhong Liang's public account: BN Zhong Liang.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。