Silver, an often overlooked metal commodity, reached yet another milestone in November, breaking a price record set recently.

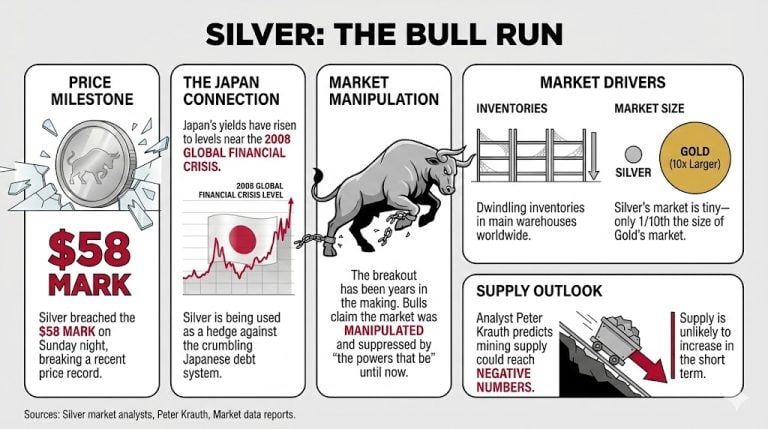

Gold’s sibling breached the $58 mark on Sunday night, taking a step closer to reaching $60 in its relentless rise, as Japan’s yields rose to levels close to those registered during the 2008 global financial crisis.

While many have linked these two events, relating silver’s resurgence as a hedge to the crumbling Japanese debt system, the silver breakout has been years in the making, with bulls declaring that the market had been manipulated and suppressed by the powers that be until now.

Analysts claim that several elements are contributing to silver’s bull moment, including dwindling inventories in main warehouses around the world, and the relatively small size of the market, which reaches a tenth of gold’s numbers.

Silver’s supply is unlikely to increase in the short term, a phenomenon explained by silver market analyst Peter Krauth, who declared that mining supply could even reach negative numbers.

Read more: Analyst Forecasts Silver Shortage, Price Increases As Consumers Tap Dwindling Secondary Inventories

Gold bug Peter Schiff established a relationship between silver’s rise and bitcoin’s price drop, explaining that the latter was the former’s “mirror image.”

“During the month of November while silver surged 16.5%, bitcoin tanked 17.5%. But silver is up 95% so far in 2025, while bitcoin is only down 4%,” he stressed on Friday, concluding that “since silver will likely go much higher, that means its mirror image will likely crash.”

As Schiff predicted, at the same time that silver rose, bitcoin fell under $88K, showing a correlation with risk assets, with traders losing close to $200 million in long positions.

Read more: Bitcoin Falls off a Cliff as $91K Support Vaporizes

- What recent milestone did silver achieve?

Silver broke past the $58 mark, moving closer to $60 amidst rising yields in Japan, leading to renewed interest in the metal. - How has silver’s price movement been linked to Japan’s debt situation?

Analysts suggest that silver’s resurgence is partly a hedge against the crumbling Japanese debt system, with fears driving investment. - What factors are contributing to silver’s current bull market?

Dwindling inventories in major warehouses and the relatively small size of the silver market, which is one-tenth that of gold, are fueling the price increase. - What correlation did Peter Schiff draw between silver and bitcoin?

Schiff noted that as silver surged by 16.5% in November, bitcoin fell by 17.5%, suggesting a mirrored relationship between the two assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。