Author: Liang Yu

Editor: Zhao Yidan

In 2025, China's digital asset industry is in a stage of "crossing the river by feeling the stones." On November 26, China International Airlines (Air China) announced its 31st anniversary membership celebration activities, officially releasing three types of digital assets with transferable segment rights, and announced that these digital assets will be compliant for circulation at the Shanghai Data Exchange. According to Air China's official disclosure, the digital assets released correspond to different membership levels' segment rights, marking the first institutionalization and trading of traditional airline loyalty systems in the form of digital assets. This initiative differs from previous NFT marketing projects launched by brands, emphasizing institutionalization, rights, and transferability, and is seen by the industry as an important signal that China's digital asset applications have entered a stage of institutional development.

During the anniversary celebration, Air China officially launched three types of digital assets with segment retention attributes and clearly announced that these assets will circulate at the Shanghai Data Exchange. From the way information is disclosed to the technical architecture, from the rights structure to the circulation system, almost every link points to one fact: this is not a marketing activity, but a systematic trial of a digital rights asset system.

The airline industry's early entry into this path is not accidental. The aviation sector inherently possesses a mature loyalty system, a clear rights structure, and real redemption needs; its mileage system is itself a quasi-asset model that predates digital assets by decades. When Air China migrated these traditional structures into the digital asset framework, a brand new value system was quietly opened.

This move by Air China not only reconstructs its membership system but also becomes a landmark event marking the entry of China's digital assets into a "systematic development stage." For the entire Chinese digital asset industry, this could be a benchmark case, indicating that China's digital rights circulation market has truly entered a new phase. All enterprises concerned with digital assets and the industrialization of RWA should realize that a watershed has emerged, and the future brand management models, user relationship structures, and digital asset circulation systems are quietly changing.

This is not an isolated event; it is more like a symbol, a precursor, a signal determining the future direction.

I. From NFT Experimentation to Institutionalized Digital Rights

From 2021 to 2025, China's digital asset industry has undergone a gradual evolution from exploration to institutionalization. In 2021, the Chinese market witnessed a boom in digital collectibles (NFTs), with major internet companies, listed firms, and brands in culture, tourism, and fashion attempting to issue NFTs. However, due to a lack of institutional closure, rights not being bound to real value, and limited use cases, most projects gradually receded in 2022. According to a report by China Securities Journal in November 2021, over 500 companies publicly released NFT-type digital assets within a year, many of which were from listed companies.

Subsequently, regulation and technological construction advanced simultaneously. Starting in 2022, the China Internet Association and relevant ministries promoted the establishment of digital copyright confirmation, digital asset registration, and the standardization of data element circulation, with alliance chains, government chains, and digital RMB chains being launched one after another. By 2023, a digital asset and data element circulation system gradually formed in multiple regions, with over 20 provinces and cities nationwide establishing or preparing digital asset, data element, or government chain systems, gradually unifying the technical foundation and converging the regulatory mechanism (Xinhua News Agency, December 2024).

This series of constructions has gradually formed an institutional closure in the domestic digital asset ecosystem: digital assets can be regulated, tracked, and circulated, emphasizing security, asset authenticity, user protection, and value-compliant circulation. This logic sharply contrasts with the overseas Web3 model of "permissionless, public chain first": overseas focuses on asset securitization and financial efficiency improvement, while China emphasizes the path of rights and institutionalized circulation.

It is under this institutional environment that Air China launched transferable segment rights digital assets during its 31st anniversary celebration. According to Air China's official disclosure, the digital assets released correspond to different membership levels' segment rights and will circulate through the Shanghai Data Exchange. This initiative not only realizes the digital assetization of the airline loyalty system but also marks the first institutional landing case of China's digital asset closure in consumer rights scenarios. For the entire Chinese digital asset industry, this could be a benchmark case, indicating that China's digital rights circulation market has truly entered a new phase.

Through this path, we can see the development logic of China's digital assets: from the early experimental exploration of NFTs to regulation, technology, and institutional construction, and then to the institutional landing of specific enterprises (such as Air China), the entire industry has gradually formed a replicable and expandable institutionalized digital rights system. This provides a clear template for the subsequent development of digital assets and offers practical references for various enterprises exploring the assetization of digital rights.

II. Air China's Digital Assets: The Chinese Version of Rights-based RWA

The reason why the three types of digital assets released by Air China have become a milestone event is that it is the first time that "loyalty rights" have been formally pushed into the digital asset framework, granting them transferability and circulation. This is something that all previous digital collectibles could not achieve, and it is also a step that traditional airline points systems have not dared to take.

According to the official website of China International Airlines, the three types of digital assets released correspond to the Brilliant, Golden, and Silver versions, containing 49, 19, and 9 segment retention rights, respectively, matching different membership levels and allowing compliant circulation at the Shanghai Data Exchange. This means that segment retention has been confirmed as a transferable and clearly valued "digital right."

The airline points system inherently possesses semi-financial characteristics. For example, miles can be redeemed for tickets, upgrades, or services, which is an implicit value system. However, points themselves are non-transferable and can only be used within the airline's system. Air China's breakthrough lies in that it is the first time these rights have escaped the "closed account system" and entered the "publicly confirmable digital asset market."

This represents a structural leap from a user operation tool to an assetization carrier.

The airline industry is the first to advance this largely due to its inherent advantages. According to the Civil Aviation Administration's development statistical bulletin, in 2024, China's civil aviation passenger transport volume exceeded 620 million, with Air China holding a significant share, maintaining a high-frequency, high-value user base over the long term. The airline's loyalty system is not only related to passenger retention but is also a crucial part of its revenue structure. Segment retention, mileage acquisition, and level redemption all drive passenger behavior.

When these traditional rights structures appear in the form of digital assets, they not only provide users with more flexible usage methods but also transform previously "non-tradable" airline rights into "tradable quasi-assets." This is a natural extension of RWA (Real World Assets) in rights-based scenarios. Air China has effectively opened the path to the "fifth type of RWA"—rights-based RWA.

III. Shanghai Data Exchange: Institutional-level Infrastructure for Digital Rights Circulation

Air China's choice to complete the confirmation, on-chain, and circulation of digital assets at the Shanghai Data Exchange is not accidental. With the advancement of the data element market construction, the Shanghai Data Exchange is gradually forming a set of infrastructure systems aimed at digital rights, data products, and data derivative assets, enabling enterprises to attempt structured expression and trading mechanisms for digital assets within a visible regulatory framework.

In recent years, the Shanghai Data Exchange has continuously promoted the construction of a "tradable data asset (RDA)" system. According to publicly available information from the Shanghai Data Exchange, RDA aims to establish a unified confirmation, pricing, custody, and auditing mechanism for different types of data and data derivative rights, providing traceable circulation paths, allowing data and rights-based assets to achieve standardized and transparent circulation under regulatory compliance. The core of this system is to ensure that "confirmable, definable, and regulatable" rights have a clear assetization expression.

Within this framework, Air China's segment retention rights possess strong adaptability. Its value structure is mature, usage scenarios are clear, and redemption rules are stable, coupled with years of accumulated membership systems, making it inherently compliant with the characteristics of "quantifiable, verifiable, and possessing clear payment relationships." Air China's pilot project of incorporating segment rights as digital assets into circulation aligns closely with the confirmation and compliant custody mechanisms emphasized by RDA, allowing these loyalty rights to possess conditions for verification, holding, and transfer within the regulatory system for the first time.

From an industry perspective, this practice provides a referable structured path for digital rights assets. It neither escapes the regulatory framework nor is it a simple digitization of traditional points systems, but rather attempts to provide a more transparent and standardized expression for rights-based assets on top of the existing institutional structure. The Shanghai Data Exchange, as the carrier of technology and institutions, provides circulation mechanisms and underlying infrastructure, rather than value judgments or commercial endorsements.

Thus, Air China's case becomes a window for observation. It demonstrates how traditional enterprises explore the assetization expression of digital rights within existing regulatory frameworks and showcases the role of the Shanghai Data Exchange in the reform of data elements: regulating circulation, clarifying rules, and providing traceable circulation paths. As more industries explore similar structured models, the boundaries between digital rights and digital assets may become clearer at the institutional level.

IV. Overseas and Domestic: The Divergence of Two Digital Asset Civilizations

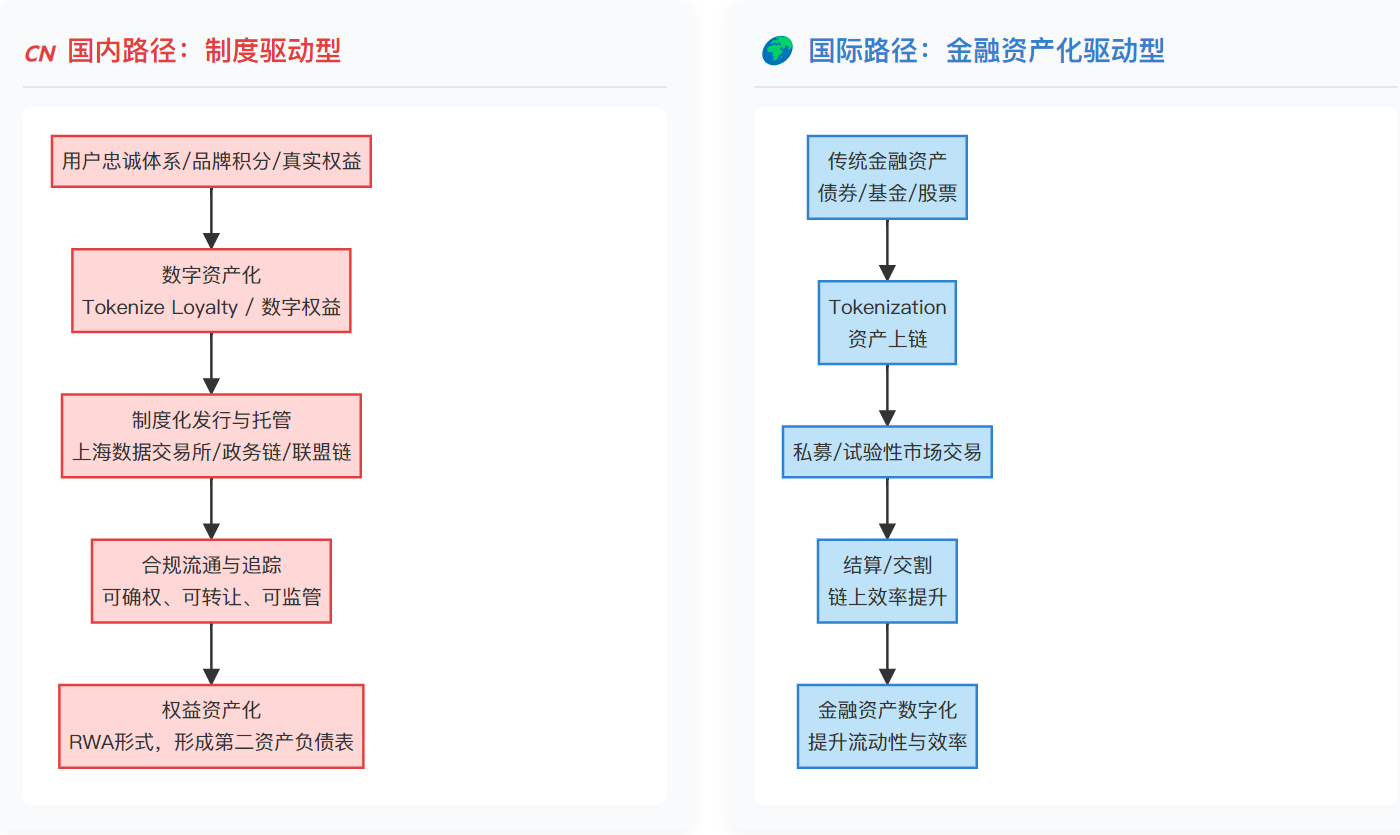

When we turn our attention to the global landscape, we can clearly see that domestic and overseas digital asset fields present two completely different paths. Overseas focuses on financial assets, while China focuses on consumer rights; overseas is market-driven, while China is institution-driven; overseas relies on public chains, while China advances along regulated chain systems.

According to The Wall Street Journal, institutions such as JPMorgan, BlackRock, and Fidelity are rapidly advancing tokenization, putting bonds, funds, stocks, and income certificates on-chain, and conducting settlement and delivery in experimental markets. The main battlefield for overseas digital assets is the efficiency revolution of traditional finance.

In contrast, China has a completely different strategic structure. Domestic financial assets have always been strictly regulated, making it more suitable to enter low-risk scenarios such as user rights, brand points, and cultural tourism assets. At the same time, the strategic position of China's digital RMB dictates that the digital asset system must revolve around the RMB chain, government chain, and alliance chain, ultimately leading to a regulated, traceable, and verifiable system.

Thus, we can see a clear divergence: the core of overseas digital assets is "tokenize finance," while the core of domestic digital assets is "tokenize loyalty."

Overseas focuses on asset attributes, while domestic focuses on rights attributes; overseas emphasizes liquidity efficiency, while domestic emphasizes regulatory robustness.

As the first Chinese brand to push "transferable segment rights" into the digital asset system, Air China thus holds unique historical significance: it stands at the forefront of this uniquely Chinese path and allows this model to be realized for the first time within an institutional framework.

V. After Air China: Which Industries Will Be Reshaped First?

When Air China institutionalizes the assetization of segment retention, it has actually provided a replicable model for the entire Chinese consumer market. The industries most likely to be thoroughly rewritten by digital rights often share two common characteristics: high repurchase rates and strong loyalty dependence.

From the existing trends, the first industries to enter the digital rights system will include retail brands, hotel groups, beverage giants, e-commerce platforms, sports and entertainment industries, and cultural tourism scenic area operators. The membership points systems in any of these industries are essentially "digital rights that have not been assetized."

Once these industries observe Air China reconstructing user relationships with digital assets, it is easy to foresee that more and more enterprises will choose to enter the system. The demonstration effect of Air China will give rise to a batch of "second-generation digital rights brands," marking a new track that is about to explode.

VI. Looking Ahead: Digital Rights Will Become the Brand's Second Balance Sheet

Air China's actions are not just a flashy marketing stunt but the starting point for genuinely reconstructing the value system. If the brand competition in the Web2 era was "traffic competition," then the competition in the next five years will be "digital rights competition." Those who can establish a clear, confirmable, transferable, and accumulable digital rights system will truly master user data sovereignty and possess stronger control over the future digital economy.

This signifies that a new era is approaching: digital rights will become the "second balance sheet" for brands. These rights will no longer be costs but operational, growth-oriented, and transferable value units. They will become recorders of user behavior, mediums of value exchange, and asset carriers for brand management.

As one of the first enterprises to achieve institutional landing, Air China has presented this future to the market ahead of time. It tells all enterprises: digital assets are not a trend but infrastructure; they are not short-term highlights but long-term strategies; they are not attention-seeking gimmicks but the underlying logic of brand management systems.

For brands, this is the best moment to rethink their digital strategies.

Conclusion: A New Chapter Has Begun

When China International Airlines incorporates such serious and critical rights as segment retention into the digital asset system and enters circulation at the Shanghai Data Exchange, the significance of this event far exceeds the aviation industry itself. It is a signal of the times, a symbol of the maturity of China's digital rights system, and a prelude to the changes in commercial competition logic over the next five to ten years.

The development of China's digital assets has undergone four years of iteration, from the noise of 2021 to the order-building of 2025. Today, as Air China takes this step, the entire industry suddenly realizes that this path will lead to a vast, sustainable, and uniquely Chinese digital asset ecosystem, and every enterprise will ultimately face the same question: in the new digital economy era, what kind of digital rights structure does your brand possess, and can you truly turn user loyalty into an asset?

Air China has already provided the answer. The future belongs to those enterprises that can understand the new relationship between rights, value, and assets, and this moment is the starting line for entering this era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。